Share Sleuth: fully invested, but here’s what I would buy

9th February 2023 10:22

by Richard Beddard from interactive investor

Richard Beddard doesn’t have enough cash on hand to make new trades this month. Here, he names the company he would buy more of, and runs through why his lowest-scoring share is keeping its place in the portfolio.

There are no new trades in the Share Sleuth portfolio to report this month, because it is fully invested. Even after adding dividends from D4t4 Solutions (LSE:D4T4), James Latham (LSE:LTHM), Jet2 (LSE:JET2), and XP Power (LSE:XPP), the cash balance of £3,131 is less than the portfolio’s minimum trade size of about £4,700.

- Invest with ii: Share Dealing with ii | Open a Stocks & Shares ISA | Our Investment Accounts

What I would have invested

The minimum trade size is set at 2.5% of the portfolio’s total value, which is my way of keeping trades meaningful. I do not want to use valuable research time thinking about trades if I do not have at least that much money to commit.

In practice, 2.5% of the portfolio’s total value is also a maximum trade size. It has been a long time since I have put more than 2.5% of the portfolio’s capital at risk in one month, because it is easy to get carried away only to regret it later. These days, I prefer a more gradual approach.

When I was at secondary school, we used to play board games (what can I say? I fell into the right crowd). Often we would go around somebody’s house and spend most of the time disagreeing about what to play. It became such a common event, the argument became a game itself. We called it “what we would have played” because a consensus usually formed when there was no time left to play. I do not think anyone minded, it was entertaining, and sometimes it paved the way for our next meeting.

In the same spirit, here is a game of what I would have invested in. There are two reasons why I might not invest in a share ranked highly by my Decision Engine. The first is if the portfolio already has a sizeable holding in the company, and the second is that its annual report will be published in less than six months’ time.

The ideal size of a holding is determined by its score (you can read how, in the link on implementation at the end of this article). The publication of the annual report is my cue to re-score a share, and if I am soon to re-score it I would rather wait until then before trading.

Of the top eight shares in the Decision Engine, Howden Joinery (LSE:HWDN) and Churchill China (LSE:CHH) are substantial holdings coming up for review. James Latham and Goodwin (LSE:GDWN) are out of contention because they are also substantial holdings, and although I could add more shares to the portfolio’s holdings in Anpario (LSE:ANP) and RWS (LSE:RWS), they are due to be re-scored soon.

That leaves Focusrite (LSE:TUNE) (ranked 1) and Dewhurst (LSE:DWHT) (ranked 3). I have scored both companies recently. Focusrite is the smaller holding, so it would have been a relatively simple decision to put more money in shares of the supplier of music recording interfaces, synthesisers and speakers over the manufacturer of lift components.

Wild ride, but I’m glad it’s not over

The other way to fund a new purchase is to liquidate a holding, something I have been tempted to do because so many of the shares I follow are, according to my Decision Engine, good value (see last week’s Shares for the Future article).

But only one share in the portfolio scores less than 5 out of 9, my yardstick for poor value, and that is Jet2, the leisure airline and package tour operator.

I resolutely refused to sell Jet2 throughout the pandemic, such is my admiration for management, its customer-focused strategy, and its achievement in becoming the UK’s second-biggest package tour operator in less than two decades.

The company made stonking losses and haemorrhaged cash in the years to March 2021 and March 2022, a performance that would normally rule it out of contention for the portfolio. But a trading update earlier this month reminded me why I held on through all the uncertainty.

Jet2 flew into the pandemic at the top of its game. It was expanding its fleet and it had been a contributory factor in the demise of rival Thomas Cook. As expected, it seems to be flying out of the pandemic in an even stronger competitive position.

In the year to March 2023, Jet2 expects to book a record profit. For the summer, it is selling more seats per flight, more flights, and more of them are more profitable package holidays.

The improving statistics will be satisfying for shareholders, but the highlight of the update for me was the company’s admission that profit margins might come under pressure as Jet2 invests to ensure staff “thrive and have a balanced lifestyle”.

As any customer-focused company knows, if staff are unhappy, then customers are not happy. Pilots, cabin crew, ground crew and office staff have had a tough time during the pandemic, although I expect Jet2 has treated them better than many rivals, just like it won plaudits for refunding customers promptly for cancelled flights.

Due to the dramatic rise in share price since I first added the shares in 2009, Share Sleuth’s holding had become uncomfortably large and I reduced it on two occasions. When the pandemic struck, one of the reasons I could hold on to the rump was the notion that losing it, however improbable, would not have been disastrous. Share Sleuth’s Jet2 holding is about 3% of the total value of the portfolio, although it would have been somewhat large on the eve of the pandemic because the shares are lower than they were then, but the portfolio is worth more.

It has been a wild ride, and I am glad it is not over. Running an airline will always be a risky business, but we have been through a pandemic together and I suspect I will find it in me to raise Jet2’s score after I have read its annual report for the year to March 2023.

It should be published in August.

Source: SharePad. “b” marks the date and price when Jet2 joined the portfolio and “s” marks when I reduced the size of the holding.

Share Sleuth performance

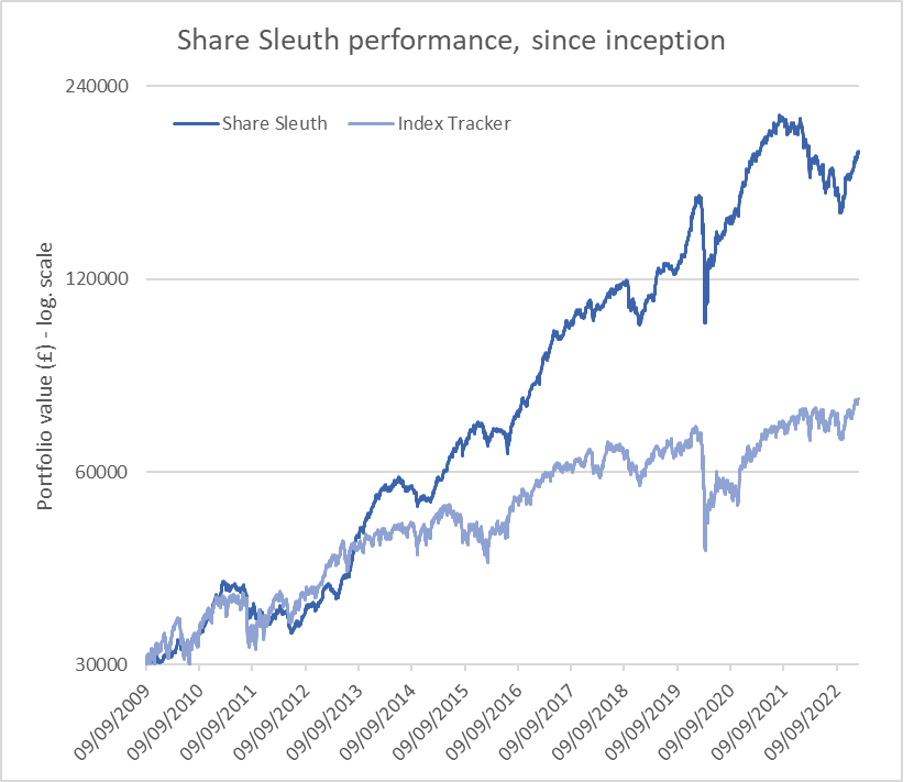

At the close on Monday 6 February 2023, the Share Sleuth portfolio was worth £188,666, 529% more than the £30,000 of pretend money I started with in September 2009.

In comparison, the same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £78,229, an increase of 161%.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 3,131 | ||||

Shares | 185,536 | ||||

Since 9 September 2009 | 30,000 | 188,666 | 529 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 3,934 | -3 |

BMY | Bloomsbury | 1,681 | 5,915 | 7,464 | 26 |

BNZL | Bunzl | 201 | 4,714 | 6,195 | 31 |

BOWL | Hollywood Bowl | 1,615 | 3,628 | 4,223 | 16 |

CHH | Churchill China | 682 | 8,013 | 8,900 | 11 |

CHRT | Cohort | 1,600 | 3,747 | 8,400 | 124 |

D4T4 | D4t4 | 1,528 | 3,509 | 3,667 | 5 |

DWHT | Dewhurst | 532 | 1,754 | 7,102 | 305 |

FOUR | 4Imprint | 190 | 3,688 | 8,740 | 137 |

GAW | Games Workshop | 148 | 4,709 | 13,845 | 194 |

GDWN | Goodwin | 266 | 6,646 | 9,510 | 43 |

GRMN | Garmin | 53 | 4,413 | 4,477 | 1 |

HWDN | Howden Joinery | 2,020 | 12,718 | 14,702 | 16 |

JDG | Judges Scientific | 85 | 2,082 | 7,412 | 256 |

JET2 | Jet2 | 456 | 250 | 5,673 | 2,169 |

LTHM | James Latham | 750 | 9,235 | 9,413 | 2 |

NXT | Next | 106 | 6,071 | 7,208 | 19 |

PRV | Porvair | 906 | 4,999 | 5,835 | 17 |

PZC | PZ Cussons | 1,870 | 3,878 | 4,095 | 6 |

QTX | Quartix | 1,085 | 2,798 | 2,821 | 1 |

RSW | Renishaw | 92 | 1,739 | 3,665 | 111 |

RWS | RWS | 1,000 | 4,696 | 3,852 | -18 |

SOLI | Solid State | 356 | 1,028 | 4,842 | 371 |

TET | Treatt | 763 | 1,082 | 4,776 | 341 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 8,000 | 263 |

TSTL | Tristel | 750 | 268 | 2,306 | 760 |

TUNE | Focusrite | 400 | 4,530 | 3,000 | -34 |

VCT | Victrex | 292 | 6,432 | 5,443 | -15 |

XPP | XP Power | 240 | 4,589 | 6,036 | 32 |

Notes

December: No new trades

Costs include £10 broker fee, and 0.5% stamp duty where appropriate. Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £188,666 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £78,229 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, 6 February 2022.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all of the shares in the Share Sleuth portfolio.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.