Share Sleuth: adding to my No 1 ranked share

6th April 2023 09:35

by Richard Beddard from interactive investor

Richard Beddard has cash to spend having waved goodbye to a portfolio holding in last month’s update. Here, he runs through a shortlist of stocks he considered buying prior to picking his number-one ranked company.

This month’s trade should have been a shoo-in. Ever since I scored Focusrite (LSE:TUNE) for the second time in January, the designer of music and audio equipment has been my top target for new money.

Focusrite is run by enthusiasts who are, I believe, adept at developing and acquiring much loved brands.

- Invest with ii: Share Dealing with ii | Open a Stocks & Shares ISA | Our Investment Accounts

The problem, resolved in last month’s update by the portfolio’s liquidation of Hollywood Bowl, was that I did not have enough money to invest.

But even though Focusrite is still ranked #1 by my Decision Engine and it was a very small holding (1.6% of the portfolio’s total value), there were many other options.

The top 10 shares on 6 March, the date I chose to decide what to trade, were, in order: Focusrite, Howden Joinery (LSE:HWDN), Churchill China (LSE:CHH), Dewhurst (LSE:DWHT), Anpario (LSE:ANP), RWS Holdings (LSE:RWS), Latham (James) (LSE:LTHM), Goodwin (LSE:GDWN), Auto Trader (LSE:AUTO) and Treatt (LSE:TET).

At 7.7% of the portfolio’s total value, Howden Joinery was the portfolio’s biggest holding, and Goodwin was its third-biggest (sandwiched in between was the lower-ranked Games Workshop (LSE:GAW)). James Latham is also a substantial holding.

By dint of their size, these shares were not eligible for further investment, a precaution, determined by a formula, that defines a holding’s size in relation to its score. The higher the score, the bigger a holding can be up to a maximum 11.5% of Share Sleuth’s total value. I cannot add more shares though, if a holding exceeds 9% of the portfolio’s total value. These rules protect us from over-concentration.

I will be re-scoring Anpario and Churchill China in the not too distant future, so I deferred judgement on them.

- Shares for the future: this company’s days in my list might be numbered

- 10 quality UK stocks that are reasonably priced right now

- Stockwatch: could this AIM share be a massive winner?

That left Dewhurst, which manufactures and distributes lift components. Its rank is #4 and it constitutes 3.5% of the portfolio. Also in the frame was translation company RWS, which is ranked 6 and a 1.9% holding, online car market Auto Trader, ranked 9, and not currently a member of the portfolio, and the ingredients business Treatt, ranked 10, and a 2.2% holding.

I eliminated Treatt because it was, by a fraction, the lowest scoring and it is better represented than some of the other candidates. I eliminated Dewhurst because it is the biggest holding of all the candidates.

What followed was an evenly contested battle between Focusrite, RWS and Auto Trader. Even though Auto Trader scores 7 and is ranked 9, it would be a new addition to the portfolio and an opportunity to diversify. Share Sleuth already has 28 members, though, so there is not much pressure to add another one, especially as I think of 30 as a practical maximum.

Auto Trader and RWS remain targets for investment. On Tuesday 7 March, after having slept on the decision, I added 650 more shares in Focusrite at a price, quoted by my broker, of £7.05. After deducting £10.00 in lieu of broker fees the transaction cost just shy of £4,593, which was about the minimum trade size for the portfolio (2.5% of its total value).

That took Share Sleuth’s holding in Focusrite to just over 4% of the portfolio’s total value, though it has slipped to 3.5% over the course of the month!

Averaging down in name only

In practice, this trade is an example of averaging down because the share price was much lower than it was when Focusrite first joined the portfolio in March last year, however that is not the way I think about it.

Source: SharePad. A ‘b’ represents each addition

Buying shares we already own reduces our average purchase price, so the price must rise less to generate us a positive return. This is not something I actively seek to do because my trades are governed by scores, of which price is only one component.

When I score shares, how much a share has gone up or down means nothing to me. Share price movements are an indication of what other traders, with different objectives, think.

The goal of scoring is to find out what I think.

Here we go again

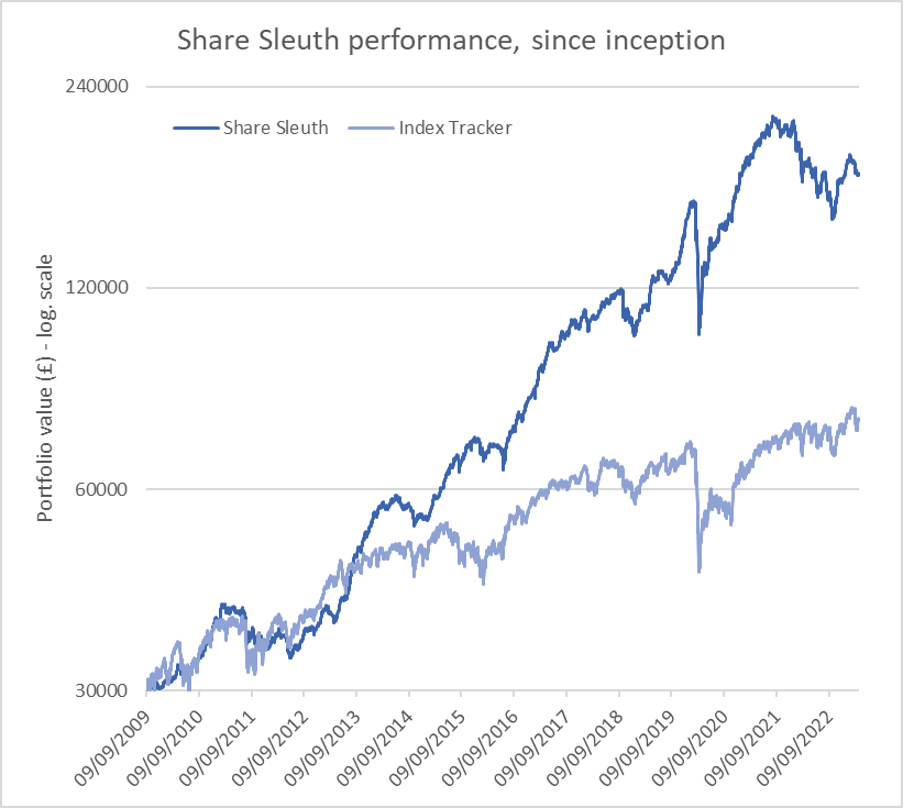

The logarithmic scale of the performance chart puts the performance of the portfolio in perspective. If we compare two periods in which its value changed by the same percentage, the line on the chart will have moved the same distance up or down the vertical scale.

The fact that the portfolio’s value has jumped around a lot more over the last few years than it did previously, I think, is a symptom of the “interesting times” we live in, as traders evaluate and react to unexpected events.

I do not think it has anything to do with the quality of the shares in the portfolio, shares in businesses I trust to navigate a course through these events, so that I do not have to react to them.

After the addition of more Focusrite shares and dividends paid during the month from Treatt and Garmin (NYSE:GRMN), Share Sleuth’s cash pile is £3,313, which is insufficient to fund a new purchase and sends me spinning back into purgatory.

Our focus must return to deciding which share to cast out of the nest next.

The minimum trade size, 2.5% of the portfolio’s value, is £4,450.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 3,313 | ||||

Shares | 173,522 | ||||

Since 9 September 2009 | 30,000 | 176,834 | 489 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 2,136 | -47 |

BMY | Bloomsbury | 1,681 | 5,915 | 7,464 | 26 |

BNZL | Bunzl | 201 | 4,714 | 6,151 | 30 |

CHH | Churchill China | 682 | 8,013 | 8,457 | 6 |

CHRT | Cohort | 1,600 | 3,747 | 7,232 | 93 |

D4T4 | D4t4 | 1,528 | 3,509 | 2,903 | -17 |

DWHT | Dewhurst | 532 | 1,754 | 5,772 | 229 |

FOUR | 4Imprint | 190 | 3,688 | 9,158 | 148 |

GAW | Games Workshop | 148 | 4,709 | 13,927 | 196 |

GDWN | Goodwin | 266 | 6,646 | 10,427 | 57 |

GRMN | Garmin | 53 | 4,413 | 4,271 | -3 |

HWDN | Howden Joinery | 2,020 | 12,718 | 13,926 | 9 |

JDG | Judges Scientific | 85 | 2,082 | 7,361 | 253 |

JET2 | Jet2 | 456 | 250 | 5,855 | 2,242 |

LTHM | James Latham | 750 | 9,235 | 9,075 | -2 |

NXT | Next | 106 | 6,071 | 6,839 | 13 |

PRV | Porvair | 906 | 4,999 | 5,708 | 14 |

PZC | PZ Cussons | 1,870 | 3,878 | 3,460 | -11 |

QTX | Quartix | 1,085 | 2,798 | 2,713 | -3 |

RSW | Renishaw | 92 | 1,739 | 3,717 | 114 |

RWS | RWS | 1,000 | 4,696 | 2,920 | -38 |

SOLI | Solid State | 356 | 1,028 | 3,907 | 280 |

TET | Treatt | 763 | 1,082 | 4,509 | 317 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 7,380 | 234 |

TSTL | Tristel | 750 | 268 | 2,513 | 837 |

TUNE | Focusrite | 1,050 | 9,123 | 6,300 | -31 |

VCT | Victrex | 292 | 6,432 | 4,643 | -28 |

XPP | XP Power | 240 | 4,589 | 4,800 | 5 |

Notes | |||||

March: Added more Focusrite | |||||

Costs include £10 broker fee, and 0.5% stamp duty where appropriate | |||||

Cash earns no interest | |||||

Dividends and sale proceeds are credited to the cash balance | |||||

£30,000 invested on 9 September 2009 would be worth £176,833 today | |||||

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £76,583 today | |||||

Objective: To beat the index tracker handsomely over five-year periods | |||||

Source: SharePad, 3 April 2023 | |||||

At the close on Monday 3 April 2023, Share Sleuth was worth £176,834, 489% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £76,583, an increase of 155%.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all the shares in the Share Sleuth portfolio.

More information about Richard’s investment philosophy and how he implements it with his Decision Engine.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.