Share Sleuth: the 10 trades I made in 2020

Richard Beddard explains why valuations are a cause for concern at the start of 2021.

6th January 2021 10:42

by Richard Beddard from interactive investor

Richard Beddard examines last year’s portfolio activity and explains why valuations are a cause for concern at the start of 2021.

In 2020, I was bamboozled by events. There is nothing unusual about that but the extremity of the events and, therefore, my confusion. As we lurch between despair and hope, I expect 2021 to be similarly extreme.

Coping with the capricious consequences of the Covid-19 pandemic on the rest of life was challenging enough, so I am glad I had outsourced the job of ensuring my investments survived and ultimately prospered to the people who work for them.

Surviving the pandemic as a long-term investor meant resisting the temptation to trade my way through it by out-zigging and out-zagging the virus.

It meant sticking to the blueprint of adding shares in businesses with good long-term prospects at inexpensive prices and disposing of them only when I discover an obviously much better opportunity.

Because I have added no new money to the portfolio since the notional £30,000 that funded it in September 2009, opportunities to add new shares only come about because of disposals or through the gradual accumulation of dividends.

- Shares for the future: how the Decision Engine fared in 2020

- Share Sleuth: the share I am holding off buying

- UK outlook for 2021: FTSE 100 target and events to watch

Trades this year

In 2020, I traded 10 times in the Share Sleuth portfolio.

In January, I added shares in PZ Cussons (LSE:PZC) for the first time. It owns Carex soap, St Tropez fake tan and other famous brands. I described PZ Cussons as a firm in flux, and it still is. The new chief executive is reviewing the strategy of his disgraced predecessor and the outcome may determine whether I commit more funds.

On 28 February, I added shares in tenpin bowling chain Hollywood Bowl Group (LSE:BOWL) for the first time. Even with my limited foresight I could see it might be impacted by the as yet undeclared pandemic and I proceeded knowing the Share Sleuth portfolio was in the midst of a meltdown. The portfolio declined 37% peak to trough over the last two weeks of February and the first two weeks of March.

To fund the purchase of Hollywood Bowl, I reduced the portfolio’s holding in Games Workshop Group (LSE:GAW), which is truly the gift that keeps on giving. The decision was not a verdict on the prospects of Warhammer, Games Workshop’s fantasy model and game universe and profit source, it was because this exemplary growth stock had again become the portfolio’s biggest holding. I acted to maintain diversification.

In June, I said goodbye to Alumasc (LSE:ALU), added to the portfolio over a decade earlier. I had long expected the supplier of building materials to turn its high returns on capital into growth but it had not.

I recycled the money liberated from Alumasc into animal feed supplement manufacturer Anpario (LSE:ANP), by doubling the portfolio’s holding. Anpario was performing well despite the pandemic, and traders had not noticed.

D4t4 Solutions (LSE:D4T4) was the next addition to the portfolio in July. D4t4 develops and sells sophisticated software that captures customer interactions and allows company’s software systems to react in real time. The market should grow but D4t4 is profitable today and, unusually for a software business, the shares were inexpensive.

In September, I lost confidence in Portmeirion Group (LSE:PMP). The manufacturer of tableware and a growing range of other homewares had, I thought, too much on its plate as it sought to follow customers online, tame overseas distributors and make perhaps ill-advised acquisitions pay.

Later that month, I harvested Share Sleuth’s burgeoning holding in Games Workshop for a second time and put the proceeds into 4imprint Group (LSE:FOUR), a new holding. 4Imprint makes promotional products, which are gifts printed with corporate logos.

Long admired, 4Imprint had hitherto been unavailable to the Share Sleuth portfolio because of its high share price. The pandemic changed that.

My final trade of the year was another double in October. First I removed Castings (LSE:CGS). Like Alumasc, I had held it for more than 10 years and could not imagine holding it for another decade.

Then I doubled the portfolio’s holding in retailer Next (LSE:NXT). Strong management, clear communication and a plan to become a platform for other retailers give me confidence.

Performance

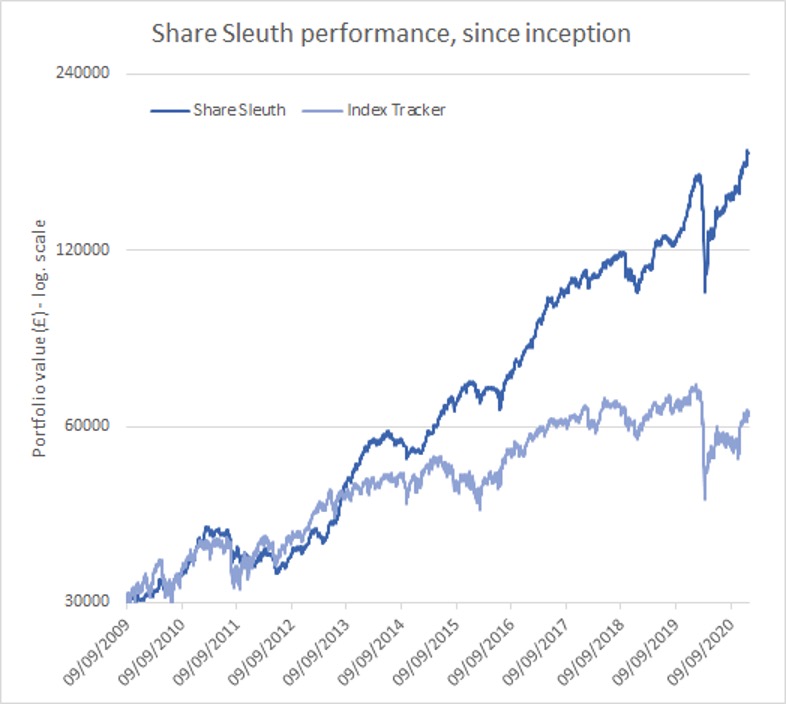

I only entertain a trade if I believe I will be able to stick with it for a decade, so less than 12 months is far too soon to judge these decisions. The portfolio’s performance since 2009, when I started it, demonstrates that, in aggregate, earlier decisions have paid off though.

Source: SharePad (4 Jan 2021)

With £4,232 in cash, Share Sleuth has slightly less than the £4,406 it needs to fund a new trade (2.5% of the portfolio’s total value of £176,976). I could bend the rule and still make a pretty meaningful trade, but there are no obvious trades for me to make.

The prices of the kind of companies I am interested in have more than recovered, and the portfolio already has significant allocations to those that remain undervalued, so I sat on my hands in December.

State of the portfolio

Looking to 2021 and beyond, I feel some trepidation. Anxiety is a natural state of mind for a contrarian investor whose portfolio is hitting all-time highs, but it is also grounded in fundamentals.

Considering Share Sleuth as though it were a single business, the statistics are reasonably reassuring. According to my Decision Engine, the average scores for all the shares in the portfolio are 2 out of 2 for profitability, 1 for risk, 2, for strategy, 2 for fairness and 0 (on a scale from -2 to 2) for price.

The total is 7 out of 10, which suggests the portfolio is fairly valued.

The financial characteristics of this super conglomerate are also reasonably healthy. The weighted average debt to capital ratio is -13% (meaning that Share Sleuth’s holdings had more cash than debt at the end of their respective financial years).

- Most-bought FTSE 100 shares of 2020

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The weighted average return on capital is 38%, weighted average cash conversion is 75% and the weighted average earnings yield is 5% (the enterprise multiple is 21 times adjusted profit).

For the second year running, the area of concern is price. A score of zero for price is dragging the portfolios weighted average score down, which is why it is not obviously undervalued.

As a long-term investor, I expect the majority of the returns Share Sleuth earns to come from the growth of the businesses it holds, but the impact of traders’ changing perceptions on price can help or hinder returns.

Other things being equal, the higher prices are, the lower potential future returns. Finding some equally good businesses at substantially lower prices to add to the portfolio, would make me more comfortable in 2021.

But that will not be easy. Companies with strong finances and good prospects are prized assets in these uncertain times and do not generally come cheaply.

| Share Sleuth Portfolio | Cost (£) | Value (£) | Return (%) | ||

|---|---|---|---|---|---|

| Cash | 4,232 | ||||

| Shares | 171,929 | ||||

| Since 9 September 2009 | 30,000 | 176,161 | 487 | ||

| Companies | Shares | Cost (£) | Value (£) | Return (%) | |

| ANP | Anpario | 1,874 | 6,593 | 8,995 | 36 |

| AVON | Avon Rubber | 192 | 2,510 | 6,077 | 142 |

| BMY | Bloomsbury | 1,256 | 3,274 | 3,592 | 10 |

| BOWL | Hollywood Bowl | 1,615 | 3,628 | 3,246 | -11 |

| CHH | Churchill China | 341 | 3,751 | 4,680 | 25 |

| CHRT | Cohort | 1,600 | 3,747 | 10,144 | 171 |

| D4T4 | D4t4 | 1,528 | 3,509 | 4,431 | 26 |

| DWHT | Dewhurst | 735 | 2,244 | 9,004 | 301 |

| FOUR | 4Imprint | 190 | 3,688 | 4,674 | 27 |

| GAW | Games Workshop | 76 | 218 | 8,710 | 3,896 |

| GDWN | Goodwin | 266 | 6,646 | 8,060 | 21 |

| HWDN | Howden Joinery | 748 | 3,228 | 5,218 | 62 |

| JDG | Judges Scientific | 159 | 3,825 | 9,826 | 157 |

| JET2 | Jet2 | 456 | 250 | 6,001 | 2,300 |

| NXT | Next | 106 | 6,071 | 7,327 | 21 |

| PZC | PZ Cussons | 1,870 | 3,878 | 4,404 | 14 |

| QTX | Quartix | 1,085 | 2,798 | 4,188 | 50 |

| RM. | RM | 1,275 | 3,038 | 2,805 | -8 |

| RSW | Renishaw | 92 | 1,739 | 5,511 | 217 |

| SOLI | Solid State | 1,546 | 4,523 | 11,409 | 152 |

| TET | Treatt | 1,222 | 1,734 | 10,045 | 479 |

| TFW | Thorpe (F W) | 2,000 | 2,207 | 6,900 | 213 |

| TRI | Trifast | 2,261 | 3,357 | 3,505 | 4 |

| TSTL | Tristel | 750 | 268 | 3,998 | 1,390 |

| VCT | Victrex | 323 | 6,254 | 7,636 | 22 |

| XPP | XP Power | 240 | 4,589 | 11,544 | 152 |

Table notes: no new holdings.

Costs include £10 broker fee, and 0.5% stamp duty where appropriate. Cash earns no interest. Dividends and sale proceeds are credited to the cash balance. £30,000 invested on 9 September 2009 would be worth £176,161 today. £30,000 invested in FTSE All-Share index tracker accumulation units would be worth £63,824 today.

Objective: to beat the index tracker handsomely over five-year periods.

Source: SharePad, 4 Jan 2020.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.