Seven things you need to know about recessions

With recession worries cranked up to 11, Deutsche Bank has analysed 170 years of market history to write a lengthy report about what the past might tell us about the present. Here are the seven most important takeaways from that report.

11th October 2023 10:59

by Theodora Lee Joseph from Finimize

Rising interest rates tend to precede recessions. And that’s where we are now. What’s more, recessions are expected to be more common now, because central banks have less flexibility in sidestepping them.

They’re painful, sure, but recessions aren’t altogether a bad thing. Some of the strongest economic growth has happened when downturns occurred more naturally and frequently.

Bonds and defensive sector stocks with high dividend yields tend to outperform the overall market during a downturn.

If you want to understand today, you have to search yesterday – or so the saying goes. And, right now, with uncertainty and recession worries cranked up to 11, searching yesterday seems like a smart idea. Deutsche Bank did just that recently, digging into 170 years of market history and writing a lengthy report about what the past might tell us about the present. Here are the seven most important takeaways from that report...

1. Rate hikes usually precede recessions.

When it comes to igniting a recession, no one has more firepower than central banks, and there’s tons of research to back that up. The interest rate changes they make have a massive influence on whether an economy grows or shrinks – and by how much.

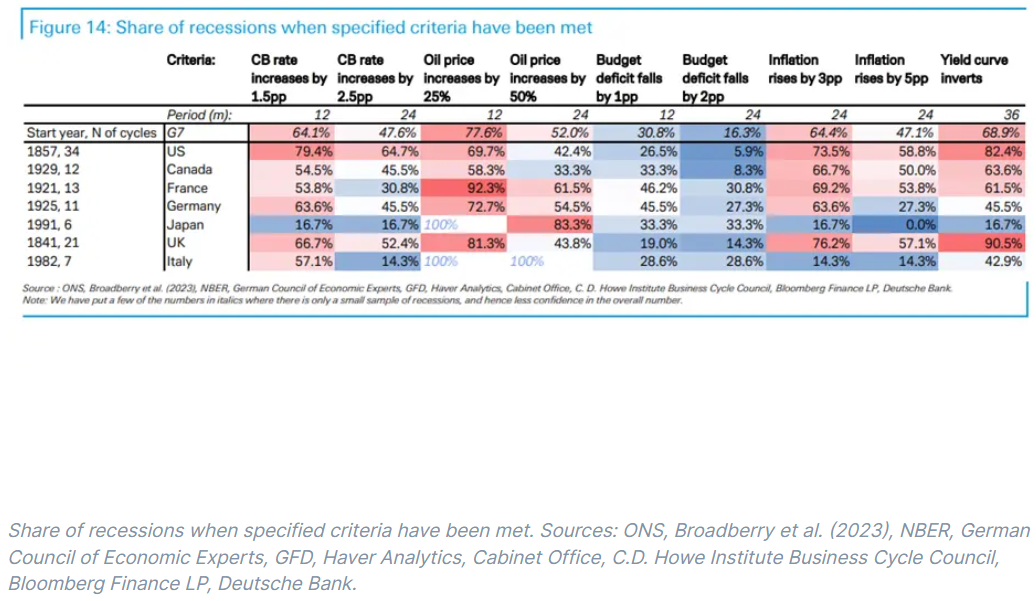

When interest rates in the US rise by either 1.5 percentage points in a single year or by 2.5 percentage points over two years, there's a pretty good chance a recession will happen within the next three years. And the relationship seems to be stronger in the US compared to the UK, Germany, or France. This heatmap shows which variables most consistently occur before a recession. The redder the grid, the hotter the relationship. With interest rates in the US having risen by more than 5 percentage points in less than two years, statistically speaking, you shouldn’t be too surprised if a recession follows.

2. Recessions used to be a lot more frequent.

Now, in the olden days, before World War II, long periods of economic boom were pretty rare worldwide. Back then, economies were mostly based on agriculture, which made them more vulnerable to things like bad weather and tended to lead to ups and downs in production. But even as economies became more industrialized, economic policy wasn't always geared toward making the good times last longer. Money was often tied to gold, and the prevailing wisdom was all about balancing budgets.

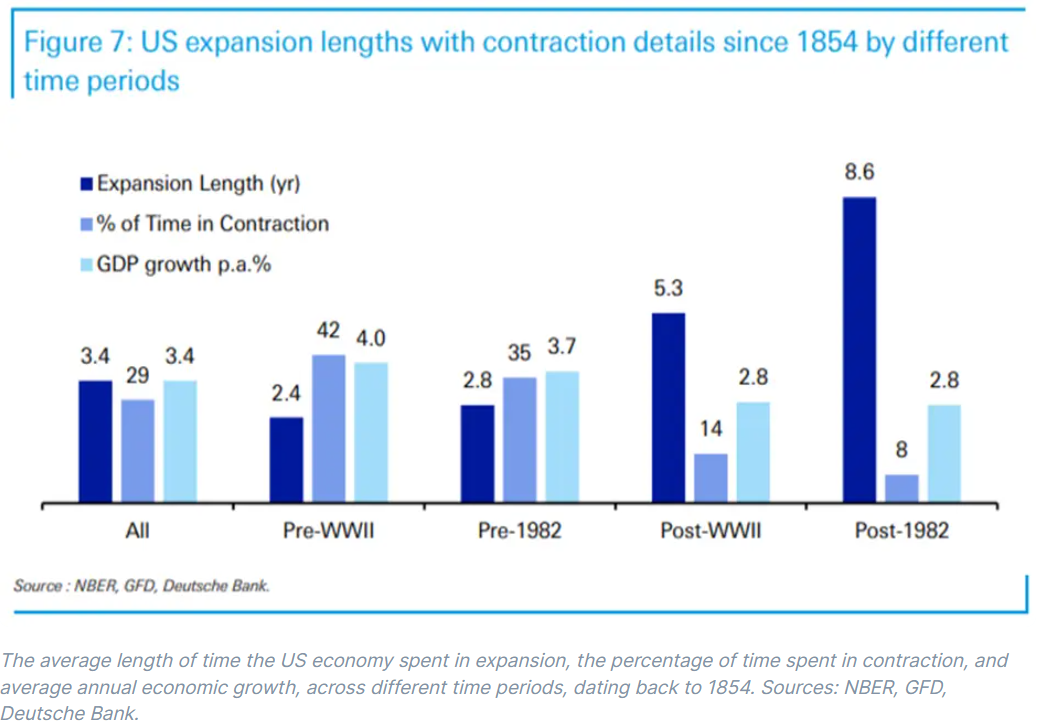

Before 1982, the average economic expansion lasted just 2.8 years, and overall a whopping 35% of time was spent in a recession. Since 1982, however, it’s been a different story: the average time the US has spent in a good economic groove (expansion) has been about 8.6 years, and only a tiny 8% of the time has been spent mired in a recession. So, you could say recessions have become a lot less common. In the past 40 years, the US, Germany, and France have seen only four recessions each, while the UK and Canada have had just three.

3. Recessions generally haven’t lasted very long.

The good news is that recessions typically don’t tend to stick around. Capital Group’s analysis of 11 economic cycles since 1950 shows that recessions have usually lasted anywhere from a quick two months to a longer 18 months, with the average stretching about 10 months.

But there's a twist: before 1982, even though about one-third of the time was spent in recessions, the economy still grew at a solid 3.7%. In the past four decades, developed countries haven’t managed to keep up that pace, despite longer periods of growth.

4. Recessions are not necessarily a bad thing.

Recessions happen for various reasons, usually because the economy gets a bit out of balance and needs a reality check. They are tough to go through, but they're a necessary kind of "clean up" that happens before the next economic boom. Some of the best economic growth has happened alongside more naturally and frequently occurring recessions.

Take the US, for example: it’s had more ups and downs than its buddies in the Group of Seven major advanced economies club over the past century. But, it's also had some of the strongest economic growth. And that’s because recessions can actually help clear out the excesses and bubbles from previous cycles, making room for new, exciting industries to thrive. Without recessions, the risk is that inefficient sectors stick around, dragging the whole system down.

5. Central banks today have less flexibility to manage recessions.

Despite the fact that recessions aren’t all bad, most governments see them as major disasters to be avoided at all costs. That's led to some pretty aggressive actions from policymakers who want to do everything they can to make recessions as short and painless as possible.

But there’s a point where this gets tricky. See, most countries have piled up a ton of debt, both from the government and from private folks. That means no one has much wiggle room to deal with future economic bumps. And, with interest rates on the rise, making borrowing more expensive, and with inflation still acting up, that could bring wild swings in interest rates and the economy in the years to come.

The real test will happen with the next recession. Without additional levers to pull, like slashing interest rates and holding them at super-low levels with the kind of massive bond-buying programs that central banks have used since the global financial crisis, there’s no guarantee that an economy can handle future recessions as deftly as they’ve done since the 1980s.

6. Recessions should become more common again.

With central banks lacking some of the tools to sidestep recessions, it’s probably no surprise that we might have more of them. Historically, government deficits have played an important role in helping to smooth out economic cycles. But with countries’ debts at historic highs, the idea of issuing new bonds to sustain and smooth out business cycles will be a tougher one to swallow. It’s not a coincidence, after all, that the recent, decades-long era of stable and low inflation happened alongside a lengthening of the economic growth cycles. If high inflation persists, central banks will face a dilemma: whether to prioritize achieving their 2% inflation targets, even at the expense of economic growth and maximum employment.

7. Sectors with high dividend yields and bonds perform best during recessions.

Investing isn’t easy during a recession. In fact, bear markets often overlap with them. But here’s an interesting fact: stocks usually start sliding about six to seven months before the economy takes a dive, and they're often back on their feet before the whole picture brightens.

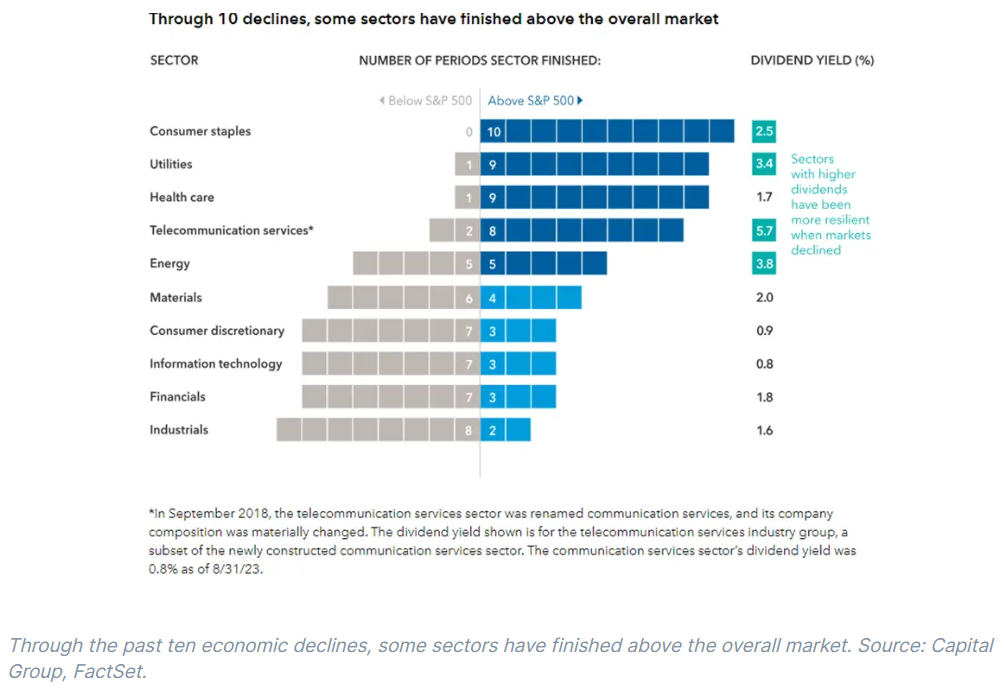

The chart below shows which sectors tend to perform well during recessions. In general, you’ll find that defensive sectors with high dividend yields – like consumer staples and utilities – tend to outperform the overall market. Some of the best returns happen when the economy is on the upswing after a market dip. So rather than sit out a recession, you’d be wise to remain invested and consider dollar cost averaging. The strategy, which involves investing a fixed amount of money at regular intervals regardless of market conditions, can help you nab more of the shares you want at some optimal prices. And it assures that, when the market bounces back, you're in a sweet spot to make gains.

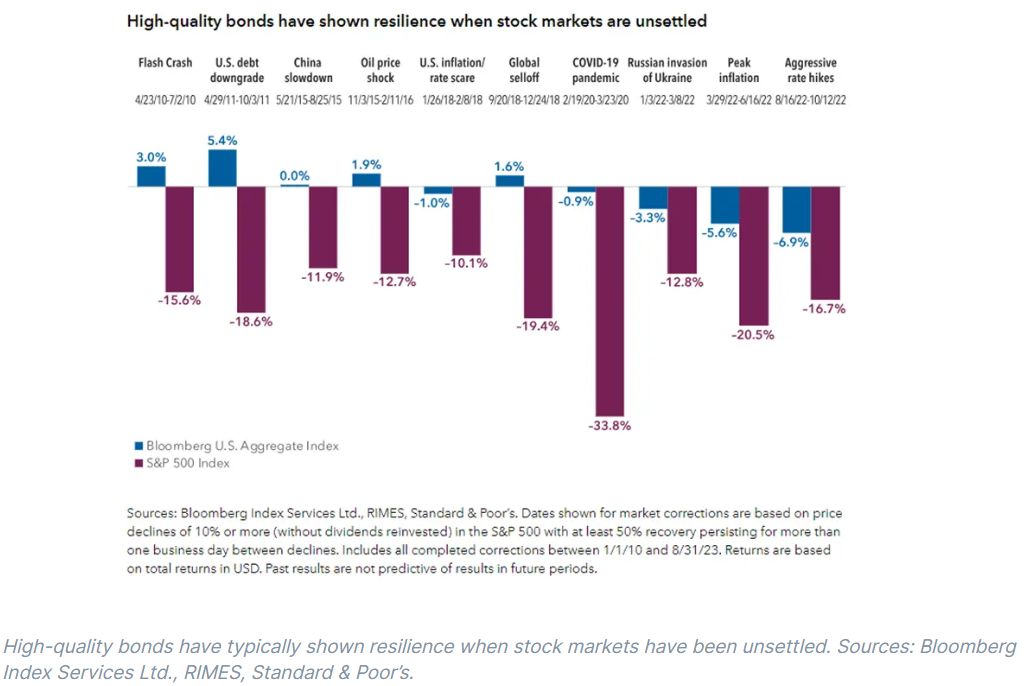

And when things get rocky in the economy, bonds can also be your secret weapon. They bring some stability and can help preserve your money, especially when stocks are all over the place.

Sure, in 2022, things were a bit unusual: bonds didn't play their usual safe-haven role during the market chaos. But across the past seven market hiccups, bonds, as measured by the Bloomberg US Aggregate Index, rose four times and never dropped by more than 1%.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.