Seven investing pitfalls to avoid

You win some and lose some on your financial journey: even the most seasoned investors do. But avoiding the most common portfolio perils will give you a better shot at long-term success. Here are the seven big pitfalls I’m always on the lookout for.

25th September 2023 13:44

by Theodora Lee Joseph from Finimize

Having a clear exit strategy for your investments, even before you buy, is a smart move. It helps keep your feelings from messing up your investment goals.

Investing is about taking smart risks, accepting that you can't know it all. Needing to know everything before you take the plunge could mean you losing out on an investment opportunity. This is also what hinders new investors from actually getting started.

Bad news never stops; so if you try to time the market, and wait until it has passed, you’ll end up waiting on the sidelines and missing out on the market.

Investing can seem like hard work at times – cutting through the jargon, doing your research, and keeping to your budget. And you can expect to win some and lose some along your financial journey: even the most seasoned investors do. But to give yourself a better shot at long-term success, you’ll want to avoid the most common portfolio perils. Here are the seven big pitfalls I’m always on the lookout for:

1. Not knowing when to walk away

Buying stuff is easy. Knowing when to sell is hard. So it’s a good idea to have a clear exit strategy for your investments, even before you buy. It helps prevent your emotions from standing in the way of your investment goals. When you “panic sell” during a market downturn or hold onto assets after you should have sold them, it can lead to the worst outcomes. Pros have five golden "sell" rules: they regularly evaluate the company's health and its price, set stop-loss points, examine if the original reason for buying still holds, and have a back-up list of other potential investments.

2. Falling for confirmation bias

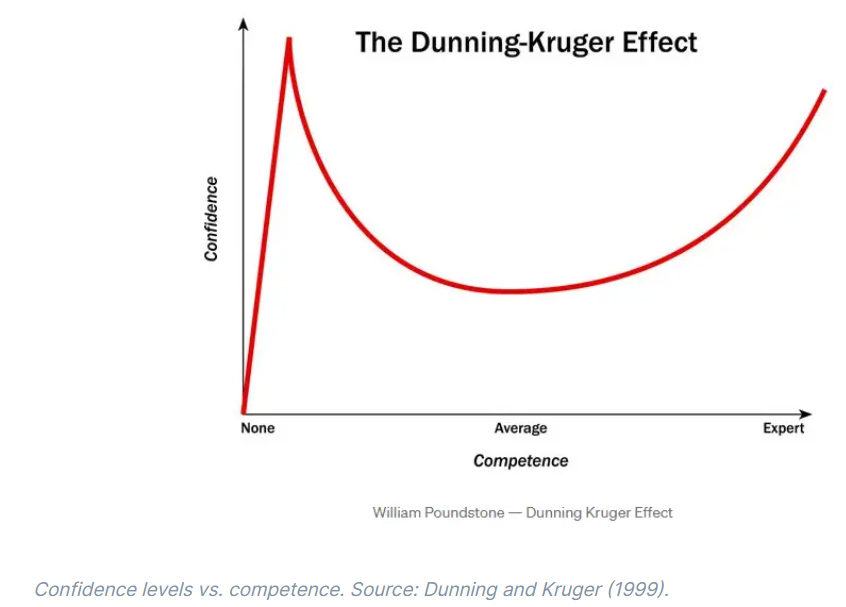

Believe it or not, we like others to agree with us. No surprise, then, that we tend to seek out information that aligns with our investment choices and ignore the stuff that doesn't. That’s what confirmation bias is all about. And it can be disastrous when paired with the Dunning-Kruger effect – that’s where folks who don't know much about something start to think they're actually experts. It’s a real headache during market bubbles: people ignore red flags and keep buying stuff that's way too expensive, because they feel they must be right. The best way to avoid this bias is to actively seek out opinions that contradict yours, to understand both sides of the argument.

3. Being trapped in analysis paralysis

On the other end of the spectrum, some people feel they need to know everything before they make a decision. In fact, that’s what keeps some people from getting started investing in the first place. But, look, there will always be unknowns in investing – and that’s OK. Investing is about taking smart risks, accepting that you can't know it all. It’s a mix of science and art. You collect data, crunch numbers, but also have to trust your gut sometimes. . Needing to know everything before you take the plunge could mean losing out on an investment opportunity. To win, you’ve got to know when to take the leap with the info you've got. Sometimes, the best move is realizing that it's OK to make mistakes as long as you're careful, and learn as you go. It's all part of the journey.

4. Performance chasing

I hate to admit it, but I’m guilty of this one. I love checking out a stock's price chart and seeing how it compares to its history and the market. It’s reassuring to know when a stock I like has recently outperformed the market – and with a strong price performance to boot. And I’m not alone in this camp. Most regular investors tend to pick funds based on how well they’ve done recently, compared to their benchmarks. They think these funds will keep doing great. But, look, the best-performing funds don’t tend to stay on top for long. Of the 549 funds that rocked the charts in June 2017, fewer than 3% were still up there four years later, according to BlackRock. Finding funds that can keep outperforming is like trying to spot a rainbow before it appears. Just because a stock or fund killed it in the past doesn't mean it'll keep doing the same. When you focus too much on the short-term, it feeds the urge to chase performance, which can hurt your long-term gains. Rather, take time to understand what’s driven a stock’s past performance and evaluate whether that can continue.

5. Believing in star fund managers

We've all heard about investing legends like Howard Marks, Warren Buffett, or Bill Ackman who seem to always beat the market. But let's keep it real: these are the rare unicorns of the investing world. Time is the best judge of investment skill, and a lot of so-called star fund managers are eventually judged to have just been in the right place at the right time. In other words, their stars light up and quickly fade. So rather than committing your money to “star” fund managers, whose higher fees might more than consume any outperformance, you could buy a broad market index instead – and likely do just as well. It may not sound sexy, but the S&P 500 ETF is one investment that has stood out over the past three decades and you’d have done quite nicely investing in it. Since 1992, it’s outperformed 90% of actively managed funds. Sometimes in investing, you have to keep it simple.

6. Obsessing about the negative

Loss aversion is real. The pain of losing absolutely can be psychologically twice as powerful as the pleasure of gaining. This is why we fixate on bad news and worry that the markets will fall. The thing is, there will always be bad news, and things to fret about like pandemics, political upheavals, and disruptions of all kinds. But if you try to time the market or and wait until the bad news has passed, you’ll end up missing out. Markets tend to bounce back more quickly than we expect. So it's usually best to chill and wait out whatever’s happening. After all, it’s time in the market that counts, not timing the market.

7. Thinking that more investing equals more diversification

Diversifying your investments is like having a safety net for your money – it lowers the risks of a catastrophic fall. But you won’t achieve it simply by having a bunch of different stocks. What really matters is the kind of stocks you've got. A portfolio with 15 different US tech stocks won’t have as safe a net as one with 15 stocks from several different sectors – or one spread across different countries and asset classes. To be truly diversified, you’ll want to hold assets that aren’t tightly correlated to each other, meaning they don’t respond the same way to varying market environments.

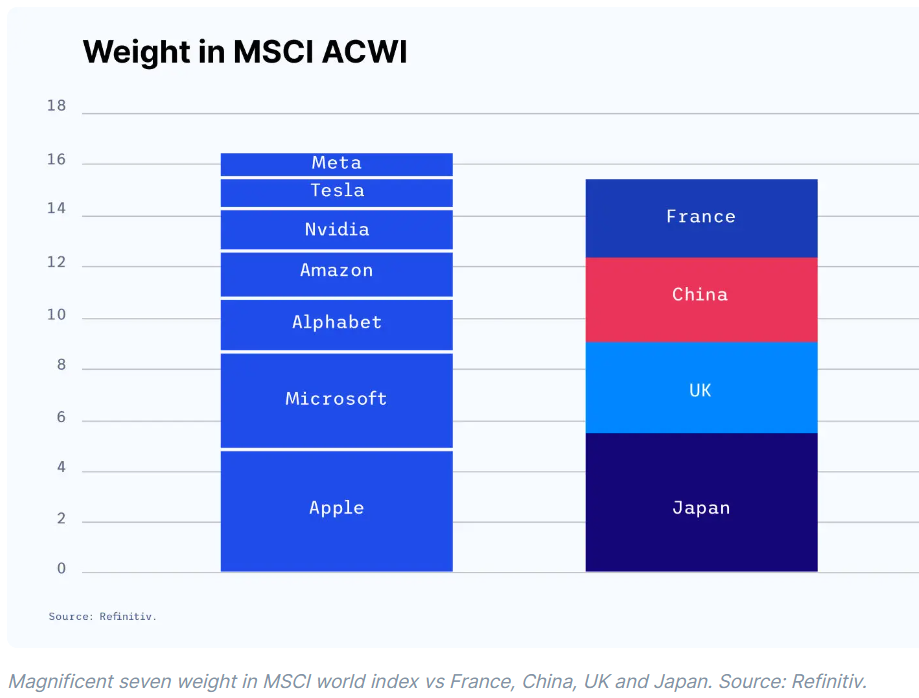

Be careful with your ETFs too. The stock market’s “Magnificent Seven” – Apple Inc (NASDAQ:AAPL), Microsoft Corp (NASDAQ:MSFT), Alphabet Inc Class A (NASDAQ:GOOGL), Amazon.com Inc (NASDAQ:AMZN), NVIDIA Corp (NASDAQ:NVDA), Tesla Inc (NASDAQ:TSLA), and Meta Platforms Inc Class A (NASDAQ:META) – now make up more of the global stock market (MSCI All-Country World Index) than the countries of Japan, France, China, and the UK combined. So if you have any ETFs that track the global market, you probably have a lot more of your eggs in the tech basket than you might like. Before you choose a market to invest in, you’ll do well to understand the market’s concentration risk, and its breakdown, both in terms of individual stocks and sectors. If your research reveals a risk you’re not happy to take, consider investing in an equal-weighted market index ETF instead.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.