The secret rally that everyone is missing

21st July 2023 13:47

by Reda Farran from Finimize

With all the excitement this year about Big Tech’s AI darlings, another noteworthy opportunity might have slipped from your view. Fortunately, the rally is only getting started.

EM stocks are cheap and would, along with EM bonds, benefit from the rate cuts that are expected later this year. On top of that, EM currencies are strengthening, boosting the returns for international investors when converted back into their home currency.

What’s more, EM governments are adopting investor-pleasing economic policies, and are seeing their economies grow faster than advanced ones. And emerging economies that aren’t China are benefiting from the West’s pivot away from the country.

There are multiple ways to turn this into an investment opportunity, including EM stocks (excluding China), EM bonds denominated in local currencies or in US dollars, and EM currencies via carry trades. But note that EM stocks, bonds, and currencies are volatile and come with more risk.

With all the excitement this year about Big Tech’s AI darlings (looking at you, Nvidia and Microsoft), another noteworthy opportunity might have slipped from your view. Fortunately, the rally in emerging market (EM) assets is only getting started. So let’s take a look at why now’s a good time to invest in EMs – and how you could do just that.

Why are EM assets rallying?

1. EM stocks are cheaper.

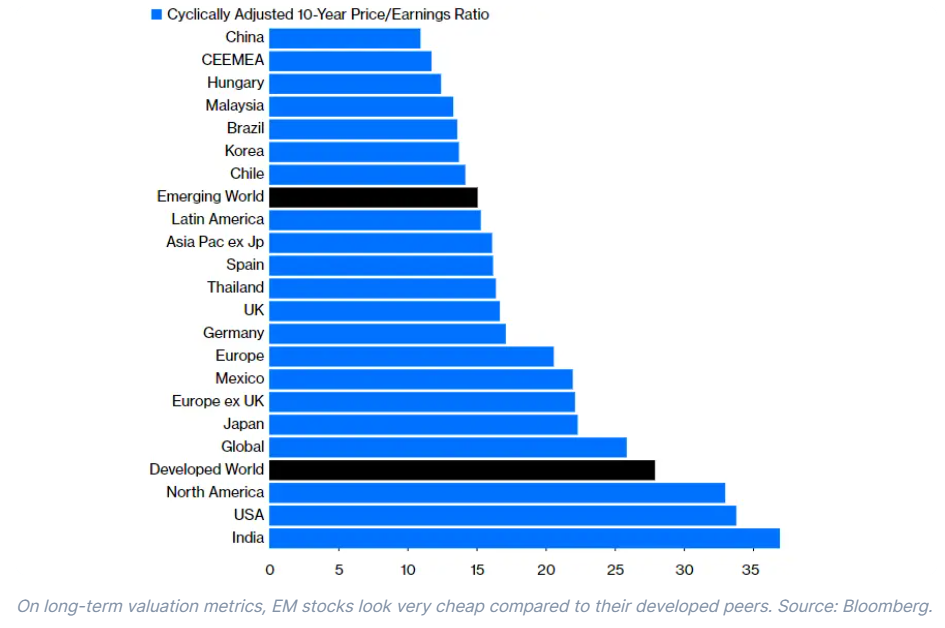

Valuation is important wherever and whenever you buy stocks. The cyclically adjusted price-to-earnings (CAPE) ratio is a valuation measure that divides the share price by the average inflation-adjusted earnings over the past ten years. By smoothing out fluctuations in corporate profits caused by business cycles, the CAPE ratio paints a pretty good picture of long-term valuation levels. And based on that metric, the emerging world as a whole is barely half as pricey as the developed world, with EM stocks trading at a CAPE ratio of 15.1x versus 27.9x for their developed peers.

This owes largely to the dominance of China (very cheap, with a CAPE ratio of 10.9x) and the US (very expensive, with a CAPE ratio of 33.8x) in emerging- and developed-market stock indexes, respectively. But it's worth noting that sector composition often holds more sway than geography, and high valuations in the US are partly because of all the fast-growing companies in sectors that warrant higher multiples (think: Big Tech). Having said that, during previous major EM bull markets, investors were arguing that EM stocks deserved higher valuation multiples than the developed world, thanks to their superior growth prospects.

2. EM economies are growing faster.

To put that faster growth in context, the International Monetary Fund (IMF) forecasts that emerging economies will grow by an average of 4.2% in 2024, compared to 1.4% for advanced economies, in what would be the widest growth differential in a decade. Looking further ahead, the IMF forecasts that China and India will be the top contributors to global growth over the next five years, together becoming responsible for 35.5% of total world growth – more than three times what’s expected from the US.

3. EM currencies are strengthening.

The US dollar’s worst slump since November has analysts and investors anticipating a turning point for the world's No. 1 reserve currency. With signs of cooling inflation, bets are growing that the Federal Reserve (the Fed) will stop hiking interest rates, sending the greenback to its lowest level in over a year. Dollar bears are looking even further ahead to inevitable rate cuts, something traders see happening at some point next year. (Remember: lower interest rates make a currency less attractive to international savers and investors.)

There’s also another dynamic that could further weaken the greenback: the ole “dollar smile”. That’s the US dollar’s tendency to rise in value when the American economy is performing particularly well – or particularly badly. Right now, the US economy is in the middle of these two extremities – neither too strong nor too weak. Here, investors tend to chase the higher returns available in EMs, shunning US investments – and the US dollar – in the process. So if the Fed’s recent interest rate hikes do manage to rein in inflation without triggering a recession, the dollar’s likely to weaken.

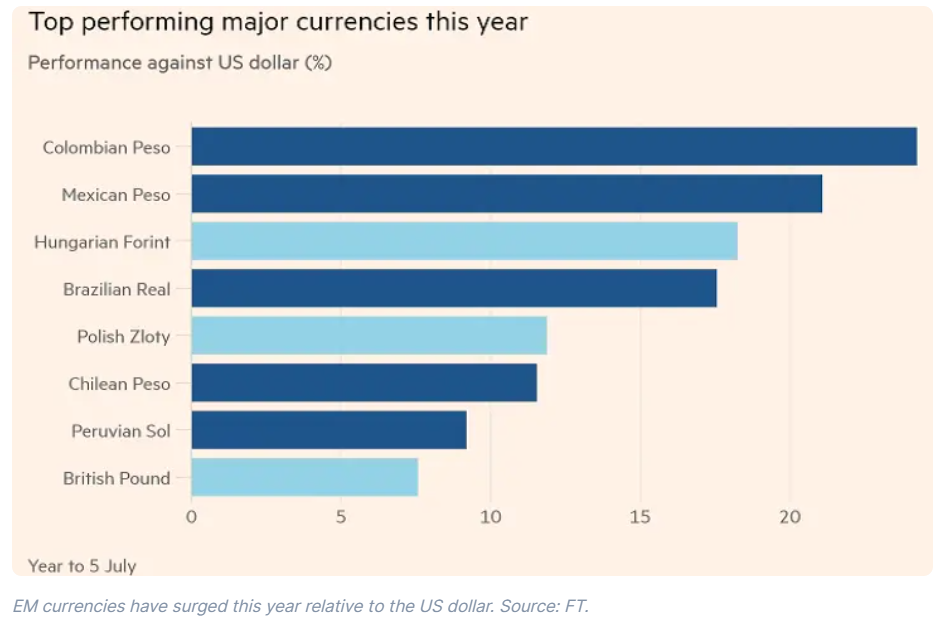

You can already see signs of that happening: EM currencies have staged a remarkable rally against the dollar this year, but without capturing as much attention as the AI craze. And that’s an awfully big deal: when EM currencies strengthen relative to the dollar, that increases the returns for international investors, since their gains become even more valuable when converted back into their home currency.

4. EM stocks and bonds would likely benefit from rate cuts.

Emerging economies did a better job than developed ones at navigating last year’s inflation shock. Central banks in Latin America and Eastern Europe acted more quickly to raise rates in response to inflationary pressures.

Economists expect inflation in EMs to continue falling in the coming months. And the falling dollar is likely to help matters by reducing the price of imports. All in all, cooling inflation creates scope for interest rate cuts – potentially before the end of the year. Those cuts would, in turn, lower bond yields and push up bond prices. And at the same time, they’d shrink the discount rate used to value stocks, pushing up their prices too.

5. EM economies stand to benefit from the West’s pivot away from China.

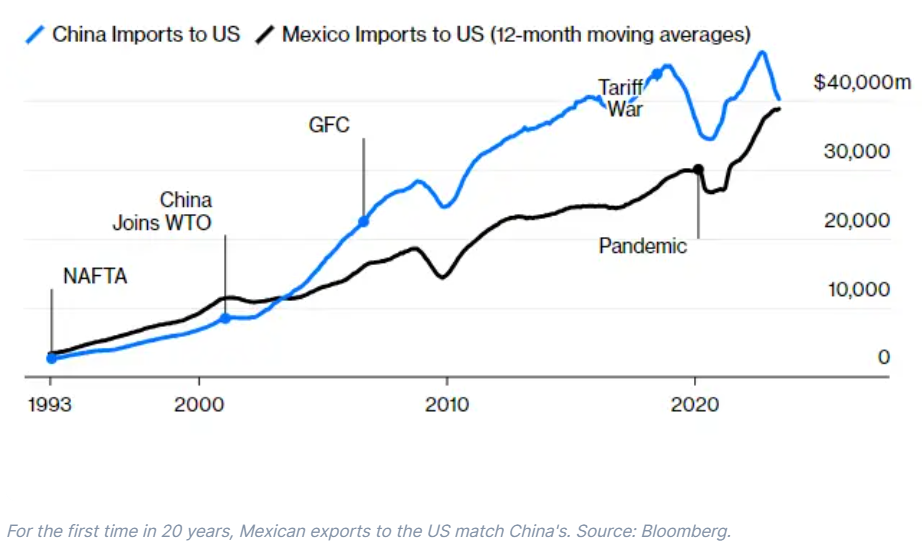

Growth prospects in Latin America, specifically in Brazil and Mexico, have greatly improved on the back of “friendshoring” trends, which have led to an increase in foreign direct investment as companies pivot their global supply chain strategies away from China. Just look at how imports to the US from Mexico (blue line) and China (black line) have changed over the past three decades.

Trade agreements have had a significant impact on both countries, with Mexico experiencing hefty losses after China joined the World Trade Organization in 2001. However, Mexico now seems to be reaping benefits from the retreat from China, with imports from the far smaller Mexico almost on par with China’s on a 12-month average basis (used to eliminate distortions arising from the Chinese Lunar New Year holiday).

What’s more, as the two hyperpowers (the US and China) try to disentangle themselves, there will be other winners in the EM world. Countries in emerging Asia stand to do more trade with China, for example, while other major EM nations might start to trade more with each other.

6. EM governments are returning to conventional economic policies.

In Colombia, Egypt, and even in Argentina (a perennial bond market pariah), governments are pivoting away from unconventional economic policies. See, when investors can make 5% or more by parking their cash in ultra-safe US Treasury bills, policymakers in EM nations have to work a lot harder to entice investors into providing the financing needed to power economic growth. That means either offering exceptionally high yields – an approach that's unsustainable in the long run – or adopting basic policies traditionally advocated by EM bond investors: fiscal austerity, minimal government interference, and simple rules for moving money into and out of the country.

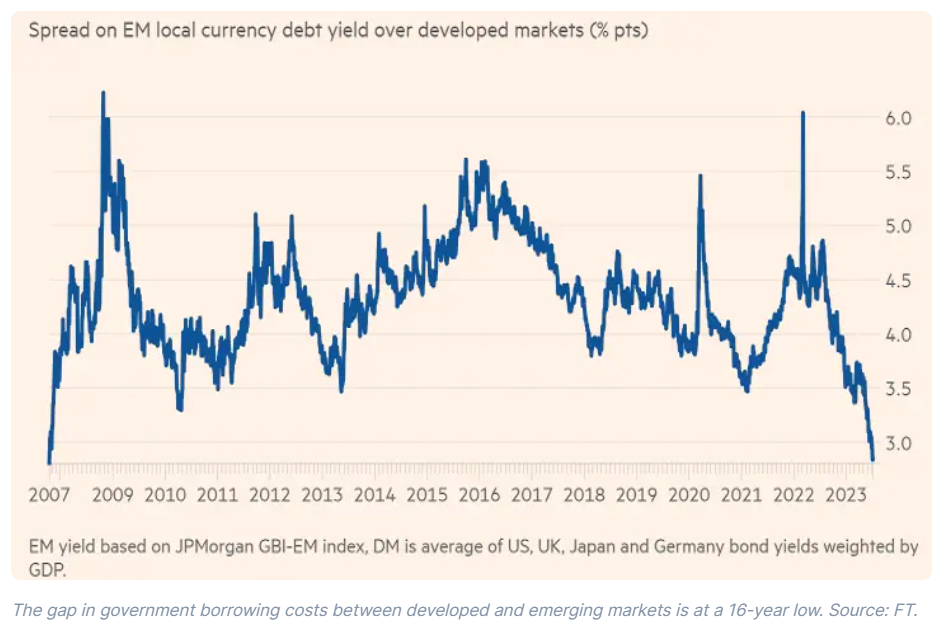

Fortunately, EM countries have been choosing the second approach recently, and are being rewarded for it. You can see proof of that in the gap in government borrowing costs between emerging and developed markets, now at its lowest level since 2007. The spread last week hit 2.9 percentage points – down from 4.8 points just a year ago.

What’s the opportunity, then?

EM stocks, excluding China.

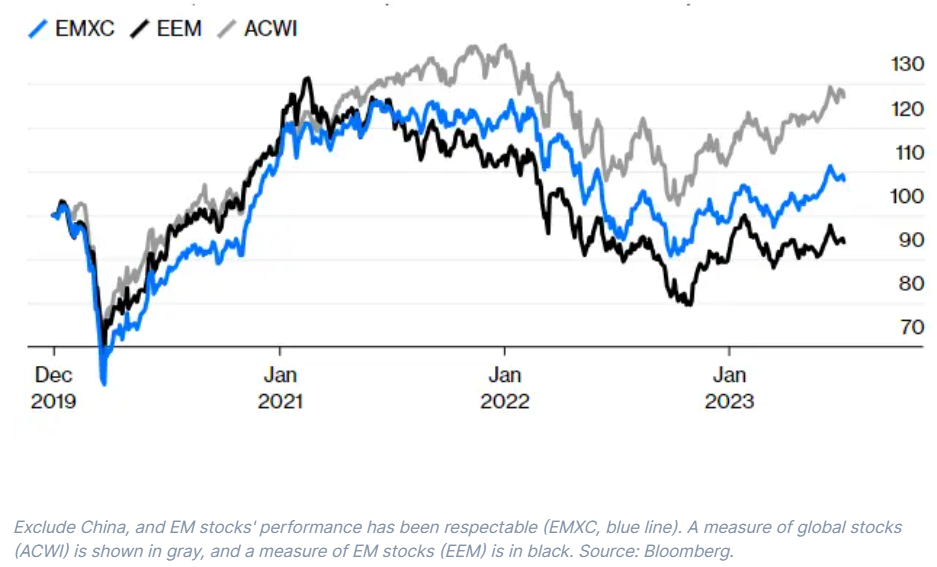

EM's bad performance in the last few years can be attributed mostly to the oversized impact of China, which has been dealing with a whole host of issues, ranging from a tech sector crackdown and property crisis to slowing economic growth and the prospect of deflation. This gauge of EM stocks excluding China (blue line) shows how much better the group of shares would have performed, if not for China’s stocks. The index still lagged global equities (gray line) over the pandemic era, sure, but by a much thinner margin.

Keep in mind, this EM rally has been achieved without the fuel that propelled the last one: rising commodity prices. Notice how the blue line started trending higher from late 2022 onward – a period that coincided with falling commodity prices. It suggests that investors believe that EM economies are no longer reliant on digging stuff out of the ground and selling it to richer countries.

EM bonds.

Given the still-high real yields on offer from emerging economies, declining inflation, and the prospect of rate cuts, many investors are positioning for further gains in EM bonds – even after a remarkable (and mostly under-the-radar) rally this year. This chart shows the total year-to-date return, in dollar terms, of some of the best-performing EM government bonds issued in local currencies. Some of the returns are attributed to the bonds’ “rates” – the coupon payments and changes in the bond price. The rest is attributed to changes in the local currency’s value, relative to the dollar.

EM currencies.

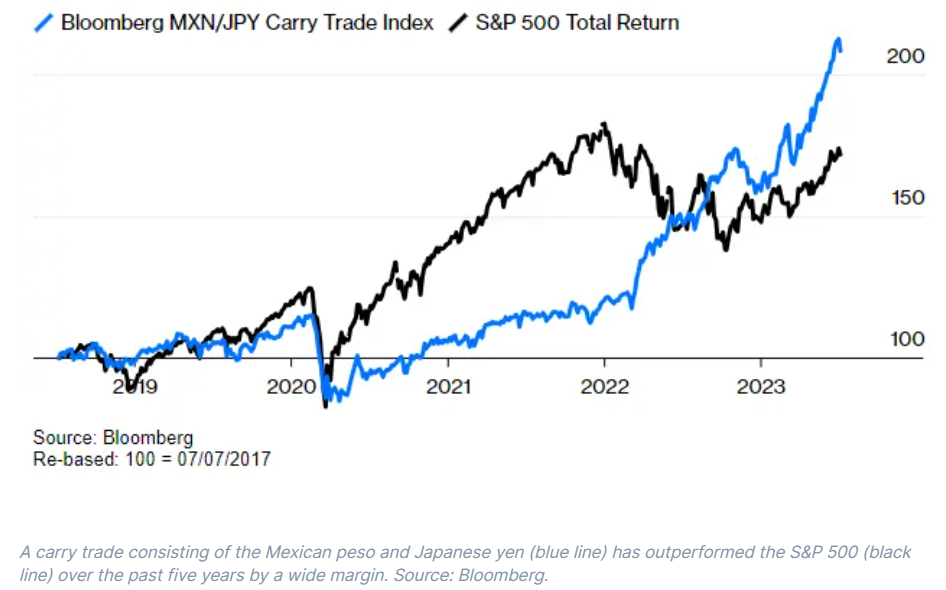

A carry trade involves buying higher-yielding currencies – that is, ones from countries with higher interest rates – using funds borrowed in lower-yielding ones. In the currency, or FX, market, trades are done in pairs, buying one country’s currency and selling another’s. So, mechanically, this is done by simply buying, or “going long”, the currencies with high interest rates and selling, or “going short”, the ones with low interest rates. The rationale behind this strategy is that over the medium term, returns from higher-yielding currencies tend to outperform lower-yielding ones when you factor in both currency price moves and income (from the difference in interest rates).

EM currencies tend to offer higher yields, making them a popular choice for the long side of carry trades. In fact, over the past five years, a carry trade between the Japanese yen and the Mexican peso (in which money is borrowed cheaply in yen and then parked in pesos, where it can accumulate at higher Mexican interest rates), has – quite amazingly – managed to beat the S&P 500.

If you want to construct a carry trade, this website can give you a look at the interest rates set by the world’s central banks. You can see that rates are highest in Turkey, Brazil, and Hungary, and lowest in Japan, Switzerland, and Denmark. So to construct the trade, you might buy the Turkish lira (TRY), Brazilian real (BRL), and Hungarian forint (HUF), and short the Japanese yen (JPY), Swiss franc (CHF), and Danish krone (DKK).

Every day you hold the trade, your FX broker will deposit you the difference in interest rates between the currencies. And as an added bonus, the higher-yielding currencies usually tend to go up in value relative to the lower-yielding ones, as more investors flock to them to benefit from the higher interest rates. It’s worth noting that this crowding of investors is also what makes the trade risky: it tends to get hit pretty hard during times of market stress, as investors rush to the exit at once.

And what are the risks?

Any investment promising higher returns will come with higher risk, and EMs are no different. EM stocks, bonds, and currencies tend to be more volatile than their developed peers, because of political instability, economic uncertainty, and less mature regulatory environments. And it’s worth keeping that in mind when determining how much to invest. FX risks are particularly important because currency fluctuations can significantly impact returns. There are also some broader macroeconomic risks to be aware of: a major slowdown in the developed world, for example, would test just how much EM economies have managed to diversify and decouple from their more developed peers. China’s faltering economic recovery, meanwhile, could seriously dent growth in EMs that are heavily reliant on the world’s second-biggest economy. As always, proceed with caution and do your own research before investing.

Reda Farran is a senior analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.