Safe dividends: UK Equity Income trusts for a rainy day

Investment trust revenue reserves could make a vital stronghold for investors facing UK dividend cuts.

17th April 2020 15:46

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Investment trust revenue reserves could make them a vital stronghold for investors facing UK dividend cuts of as much as 47%.

Hold fast

Callum Stokeld, investment trust research analyst at Kepler Trust Intelligence.

A long, long time ago, I can still remember how, that election had us all talking about sterling (well, some of us).

Instead now we are hard put not to talk about mass dividend cuts, with Link Group estimating dividend cuts of 47% or more in the UK equity market.

Way back in those distant epochs of early December 2019, we appeared to be approaching a greater degree of certainty about the shape of the future in the UK: an election was in the offing which promised to help resolve the outlook for our relationship with the EU and the rest of the world, and to clarify what kind of environment businesses would face going forward.

At the time, GBP looked undervalued on the basis of the Economist’s ‘Big Mac’ index. With signs that global investors’ positions in UK assets were starting to move towards normality from their previous large underweights, it seemed prudent to highlight that a rising currency could prove a headwind for dividend streams.

With UK payout ratios very elevated, and in general terms a roughly inverse relationship between UK corporate earnings and the strength of the currency, dividends funded by overseas earnings logically seemed somewhat vulnerable.

Sure enough, following the general election we saw the GBPUSD rate move up to c. 1.35 in fairly rapid fashion (having traded below 1.30 since May 2019). Even so GBPUSD remained short of the ‘fair value’ level of c. 1.42 suggested by the ‘Big Mac’ index at the time, but there were certainly positive signals in sentiment surveys that suggested sterling was setting up for a more durable rally.

Duct tape for Icarus

Against this possible headwind to index-level dividends, in December we highlighted the benefits of investment trusts having revenue reserves to fall back on.

Trusts are required to pay out a minimum of 85% of distributable income generated from their holdings, unlike their open-ended counterparts who are required to distribute all income.

This allows investment trusts the option of using strong years to build a ‘revenue reserve’, giving boards the option in leaner years of paying income from balance sheet reserves.

Investors evidently remain cognisant of this distinction, with UK Equity Income sector discounts proving resilient in the difficult market conditions (as we recently discussed here).

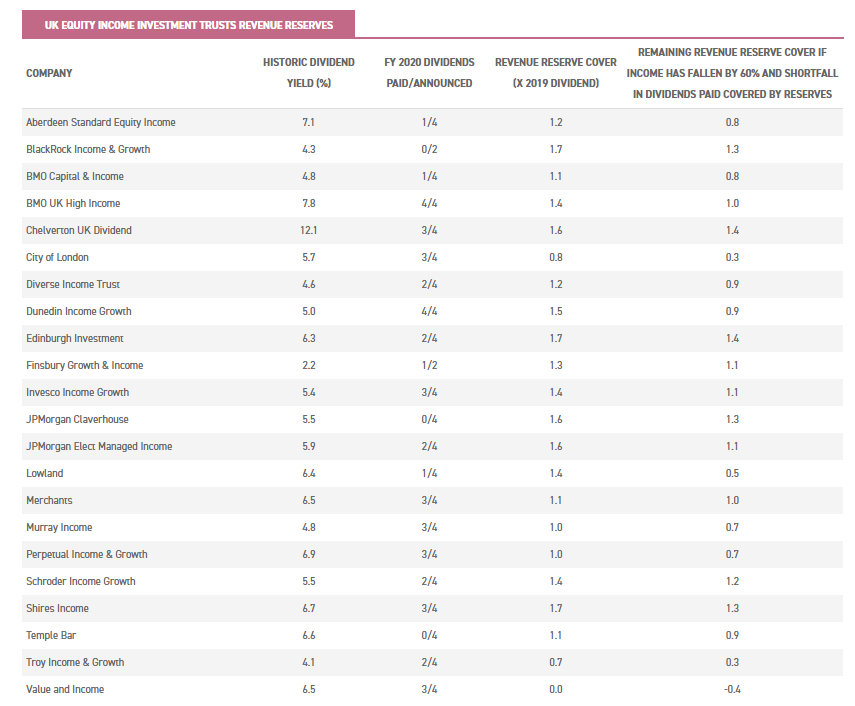

Below we look at how trusts’ revenue reserves compare to their 2019 full year dividend (based on the most recent annual or interim report for each trust).

We would caveat that some of these reserves will have been reduced in the intervening period, in order to pay subsequent dividends; as such the data in the table below is a guide and not a hard data point.

However, whilst reserves may be slightly lower than reported here, most distributions in this period will have come against a backdrop of robust dividend distributions, with UK company aggregate dividends reaching record levels in 2019.

Thus, we would expect most dividends paid so far to have been covered by income, and we do not anticipate that any serious deterioration in revenue reserves will have occurred since the last publicly available accounts.

Still, FTSE 100 Dividend futures currently suggest a likely fall in dividends of c. 59%. For context, this is worse than that seen in the Great Depression.

For an extreme stress-test, we have attempted to look at what revenue reserves would be for each trust if they had seen income subsequent to the reporting period fall by 60% and they paid the shortfall in their dividends from revenue reserves. [Note: this is an extremely unlikely scenario, with many companies having reported prior to H2 2019.]

Even in this scenario, many trusts would retain revenue reserves in excess of their 2019 dividend, whilst others would retain ample reserves to cover a shortfall from income. We discuss this further below.

Source: AIC, annual or interim report for each trust

When we last highlighted revenue reserves in December 2019, we had highlighted how the managers and boards of trusts such as Aberdeen Standard Equity Income (LSE:ASEI) had been able to grow their dividend at significant rates whilst still increasing their revenue reserve against a sudden stop; indeed, ASEI has, since this time, been able to maintain its level of revenue reserve relative to a growing dividend.

JPMorgan Claverhouse (LSE:JCH) has even managed to expand its revenue reserve, with the board keen to ensure that the trust’s track record of 47 consecutive years of dividend increases remains intact.

Headline revenue reserve figures are only a guide, of course. As we have noted above, there will be some variability in these figures depending on reporting periods and dividends in the intervening period.

Similarly, some trusts, such as Troy Income & Growth (LSE:TIGT) will deliberately target within their portfolio companies which pay ‘safer’ dividends.

In essence, the board of TIGT will be comfortable operating with a lower level of revenue reserve cover in the expectation that the underlying companies should offer resilient dividend streams which are unlikely to require much support.

So, on the basis of the above data we can estimate that the UK Equity Income sector had a weighted average revenue reserve of c. 1.1x their 2019 dividend, and a median revenue reserve of c. 1.4x.

Coming into 2020, UK equities looked well set and the AIC UK Equity Income sector well placed to deal with any potential currency headwinds to income streams.

Legend of the Wu-Han Clan

Unfortunately, somebody persuaded an adventurous epicurean in Wuhan to eat a bat. After some bureaucratic buck-passing, officialdom denial, and the passage of several weeks, financial markets started to wake up to the potential of a global pandemic, a fear that only accelerated as the rest of the world started to realise the Covid-19 virus could not be easily contained, nor its economic impact easily constrained.

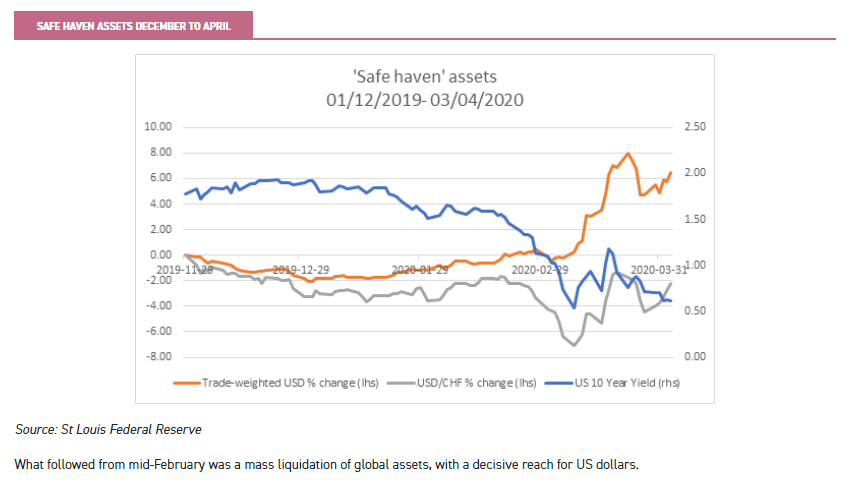

Financial markets are forward looking and discounting. As news started to leak out of Wuhan province about the intractable nature of the virus, many ‘risk-off’ moves to ‘safe haven’ assets started to occur in FX and bond markets, even as equities in general ground higher.

The US dollar started to appreciate against other major currencies (such as GBP) with the exception of the Swiss franc, as buyers across the world tried to ensure they had a ready supply of USD for any eventuality.

Source: St Louis Federal Reserve

What followed from mid-February was a mass liquidation of global assets, with a decisive reach for US dollars.

A fistful of dollars

The US dollar has remained the global reserve currency. Essentially, companies and countries need ready supplies of US dollars to function.

And when there was a sudden communalistic (but not communal or coordinated) reach for US dollars, the global financial system started to creak.

Bond yields and yield curves collapsed: bad news for banks (a significant dividend constituent in the UK, contributing around 14% of the FTSE All-Share dividend).

Even worse for UK equity income investors, we also saw a sudden, fairly calamitous crash in the spot price of oil, throwing in doubt the ongoing commitment of oil majors to their dividends.

For now, the US Federal Reserve appears to have essentially accepted its role as the globe’s central banker with the mass extension of US dollar liquidity (whether the methods used ultimately prove ephemeral or otherwise remains to be seen).

And the US, Russian and Saudi governments appear to be edging towards some sort of concord on oil production levels; devil may cry indeed.

Possibly, then, this will prove to be no more than a passing liquidity crisis, with the Fed pouring sufficient dollars into the world to sate the globe’s demand; in this instance, a USD devaluation would seem likely, and sterling may well strengthen once more (having fallen to 22% undervalued on the ‘Big Mac’ index in January 2020).

In these circumstances, our original point remains. Conversely, if the Fed’s actions prove insufficient, we could see credit pressures building, and some of the worst-case dividend scenarios may come to pass.

There's something about dividends

Governments across the developed world are stepping in with gargantuan stimulus packages (many are still to be agreed, but the one thing all agree on is they will be huge. Some estimates of Japan’s stimulus, for example, suggest it will amount to c. 20% of GDP).

Much of this spending will be used to provide lifelines to businesses, and some of it no doubt will represent essentially unnecessary corporate giveaways courtesy of the taxpayer.

However, what we are already seeing is that governments will not be amused if their largesse is used to fund dividends: UK banks have already abandoned dividends in the face of political pressure and stern warnings from the Bank of England.

This also has implications going forward, of course, with HSBC already threatening to move their primary listing to Hong Kong in protest.

[We’re sure they will find the Communist Party of China, which requires party interests to be written into every company’s articles of association, much more respectful of corporate autonomy….]

According to Link Group, 45% of the largest UK public companies have now either cancelled or are due to cancel their scheduled dividends. Furthermore, as at 6 April 2020, 15% of the FTSE All-Share by weight (24% by number) had already confirmed their intention to cut their dividends.

According to Link, more than £52 billion of dividends are now allegedly at risk under worst-case scenarios; with c. £110 billion of dividends having been paid out in 2019, this would represent a fall in dividends of c. 47% (by way of comparison, during the Great Depression dividend payments fell by c. 55%, whilst during World War I and the Spanish flu they fell by c. 33%).

Yet some companies such as Tesco (LSE:TSCO) remain committed to paying out dividends, and Royal Dutch Shell (LSE:RDSB) seems likely to do so: understandably, Shell is reluctant to forfeit its track record of not having cut its dividend since World War II.

Still, if you are an investor reliant on income and are invested through an open-ended UK passive product, we’re afraid we must warn you that you are most likely – in the short-term – scunnered (to use a technical term).

For closed-ended investors, research from JPMorgan Cazenove suggests that UK Equity Income trusts have exposure to dividend suspensions declared to date ranging from 1% to 47%.

A cement mixer for the little Dutch boy with his finger in the dam Still, it’s not all bad; not all dividends will be cancelled, Eurovision has been cancelled, and UK Equity Income trusts retain healthy reserves on the whole.

Investment trusts are companies, and as such follow a corporate financial year particular to themselves. Thus, many have already paid out some or most of their financial year (FY) 2020 dividends. In the case of BMO UK High Income (LSE:BHI) and Dunedin Income Growth (LSE:DIG), both have in fact paid all four of their FY 2020 dividends already.

Many of these trusts have exemplary records of growing dividends consistently over many years, such as City of London (LSE:CTY) (53 years going on 54), JPMorgan Claverhouse (LSE:JCH) (47 years), Schroder Income Growth (LSE:SCF) (23 years), and Invesco Income Growth (LSE:IVI) (23 years).

IVI will, in any event, be benefiting from a cautious approach and from its overweight exposure to sectors such as utilities; whilst SCF has large positions in stocks that should prove resilient, such as GlaxoSmithKline (LSE:GSK) and Legal & General (LSE:LGEN) (which announced it would proceed with its dividend despite pressure in some quarters).

Trusts such as these will not lightly sacrifice their track records, while many others will be continuing to work hard to establish a track record of exactly this kind.

The crisis in dividends will likely prove ephemeral; much of the impairment of corporate operations, cashflows and incomes is a political decision that the scale of the economic drawdown that a lockdown entails will be justified on medical grounds.

Economic costs ultimately have medical costs too, though, and the more protracted the lockdown the greater these will become; and the more the calculus will change.

In our view, revenue reserves will be justifiably drawn upon at this time, in the expectation that income streams will be expected to improve once again in the not-too-distant future.

Already the board of City of London (LSE:CTY) has made clear that intends to continue its track record of dividend growth for a 54th consecutive year.

The manager of CTY, Job Curtis, recently cautioned that the travel, retail and leisure sectors would be particularly hard hit by the lockdown, but said he was identifying resilience in other spaces such as consumer staples and utilities.

Even if the UK listed companies it held were to cut dividends by a weighted average of over 75% (a far worse outcome than that seen in the Great Depression, as noted above), CTY should remain in a position to maintain its own dividend.

As we have noted above, dividends will undoubtedly be under pressure. Governments may look to pressure companies to cut dividends, to better ensure that staff can be retained; and any company paying a dividend now will find future financial support subject to far more stringent conditions.

Even if the constraints prove more durable and lasting than expected, managers will have an opportunity to reposition.

In the table below, we can see:

1. How many dividends each trust has paid or announced thus far in their financial year 2020

2. The level of 2019 dividends per share (DPS)

3. The level of DPS paid thus far in 2020

4. The ratio of reported revenues per share (RRPS) to the remaining DPS still to be paid IF the trust were to leave dividends flat for the year (i.e. 0% dividend growth). If this metric is above 100, the trust in question will, if its board so chooses, be able to maintain its FY 2020 dividend solely through revenue reserves even if it receives no further dividend income.

This analysis is based off the numbers we have used above, where we have assumed that each trust’s revenue reserves have been depleted to meet a 60% shortfall in income from its underlying holdings. Again, it is worth stressing that this stress scenario is extremely unlikely.

As noted with regard to the table above, these figures are estimates. Accordingly, they should be considered a guide within reasonable parameters as opposed to ‘hard’ figures.

Two trusts have already announced their full FY 2020 dividends, BMO UK High Income and Dunedin Income Growth (DIG) (both are highlighted below). For these trusts, we have instead calculated RRPS relative to the full FY 2020 dividend.

Source: AIC and trust annual & interim reports

We can see above, then, that most UK Equity Income trusts are well set to at the very least maintain their FY 2020 dividends, and should be able to do this even if we see unprecedented drops in incoming dividends.

BlackRock Income and Growth (LSE:BRIG), as an example, has yet to distribute a FY 2020 dividend; however, even if it were to literally have received no income so far in FY 2020, and were to receive none for the rest of the year, it would be able to meet and indeed grow its dividend from reserves.

Conclusion

The future is, by definition, uncertain. We have some precedent for pandemics but none for the current governmental response; and the timeframe and shape of exit strategies from ongoing lockdowns remain, as yet, unknown to the public.

Whilst many companies have been able to continue to operate more or less normally, for many others the crisis represents an existential threat.

It is for precisely such a rainy day that investment trusts accrue revenue reserves. We have looked above at the worst possible income scenario for trusts (literally zero income over a reporting period, which for many includes the second half of 2019 when dividends were relatively plentiful), and still we find a strong degree of resilience.

Income remains important for many investors, but it has also been made clear that many investment trust boards similarly place a great deal of importance on their ability to maintain and grow dividends consistently.

The accumulated reserves at many trusts should, even in implausibly extreme scenarios, mean they can cope with an unprecedented shortfall in income on a temporary basis.

This is true outside the UK Equity Income sector too. This note has focused primarily on trusts in the UK Equity Income sector, but these are by no means the only trusts to offer revenue reserve protection. Aberforth Smaller Companies (LSE:ASL), for example, retains revenue reserve cover of c. 2.8x on a historic dividend yield of c. 3.5%.

Revenue reserves are not a new or novel concept, and have received much coverage in recent weeks.

However, an investor can know something while still not being in a position to do anything substantial about it.

This will likely represent the main difficulty for open-ended equity income funds under all but the most optimistic scenarios; they may know they face a Sisyphean task to match their previous year’s payout solely from dividend income received, but they have no reserve to call upon.

Like the Duke of Wellington at Waterloo, embattled investors in UK Equity Income trusts know reserves are out there, but they will truly appreciate them when they arrive to carry the day.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.