Richard Beddard: why I own shares in this 265-year-old company

It’s one of the largest companies of its kind in the country, and our columnist likes the business so much he rates it a good long-term investment. Using his unique scoring method, he makes sense of an extraordinary couple of years.

22nd September 2023 14:06

by Richard Beddard from interactive investor

On the first page of its annual report, Latham (James) (LSE:LTHM) credits relationships with suppliers for the extraordinary revenue and profit of 2022, and the only slightly less extraordinary performance in 2023, a result of shortages as economies emerged from pandemic lockdowns.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

Steady supplier

The company imports timber (solid wood), wood-based panel products (such as fibreboard, chipboard, and plywood), engineered timbers, door blanks, decking, mouldings and decorative surfaces. It distributes them throughout the UK from 16 depots, three of them at the major ports of Tilbury, Liverpool, and Grangemouth.

The strategic significance of Lathams’ supply network may be illustrated by two connected facts. It says pretty much nothing about this network in the annual report except for the fact that it is important; so important that despite, or perhaps, because it proved decisive during the pandemic, Latham’s first major post-Covid strategic initiative is a “comprehensive review” of its supply chain.

Lathams is 265 years old and one of the UK and Ireland’s largest importers and distributors of timber. Most likely scale gives it bargaining power with a broad network of suppliers. As a cash buyer it secures discounts, and alternative sources of supply served it well as the economy normalised after the pandemic.

- Share Sleuth: spoilt for choice, but here’s why I’ve added to this holding

- Stockwatch: I rate these three stocks at inflection point a ‘buy’

Being a good customer enables Lathams to be a good supplier to joiners, builders merchants and kitchen, door, and furniture manufacturers. These customers need to be confident that products will be in stock and delivered when they need them, even if that is the day after they order.

It supplies trade customers and large projects such as Morpeth Leisure Centre, showcased in this year’s annual report. Dresser Mouldings, part of Lathams, supplied the facade made from Accoya, modified pine that is highly resistant to wind-driven salt and sand typical of the North East coast of England.

Often, the timber will be specified by an architect or designer, so Lathams stays on their radar by offering presentations that can form part of their professional development, and by operating specification showrooms, two physical showrooms in London and Manchester, and one online.

Growth by range expansion

Lathams is expanding depots in areas of the UK and Ireland where it believes it can grow market share, such as Yate in Somerset, Belfast in Northern Ireland, and Abbey Woods in Dublin. In Belfast, for example, it intends to move IJK Timber, acquired in 2021, to a modern depot that can supply the company’s full range of products.

Typically, distributors grow by opening new depots, but it does not look like Lathams’ growth strategy is a conventional roll-out.

By operating seven of the depots 24 hours a day during the week, and transferring product between depots overnight, it can already serve the whole of the UK and Ireland, offering a next-day delivery service where “customers require it”.

The company’s stated objective is to expand the product range, rather than its geographic range, so that it can be a one-stop shop that already stocks non-timber products such as natural acrylic stone, melamines (like formica), laminates and other decorative panels made from minerals, resin, and plastic.

Natural acrylic stone is a blend of minerals and pigments in an acrylic matrix that can be cut and shaped like wood but can also be thermoformed into shape. It is often used to make worktops.

- Stockwatch: investors bag big profits after company lands the big one

- Portfolio diversification in action: see how it really works

The acquisition of Dresser Mouldings in 2019 might also have been a strategic move. Dresser Mouldings is a small manufacturer based in Rochdale that specialises in cladding and decorative mouldings.

If the company is planning to get into manufacturing timber products in a big way, it has only just started. Revenue from Dresser Mouldings is not deemed significant enough to report.

Expanding the range into non-timber and manufactured products are logical steps to take. They make good use of Lathams’ nationwide distribution network, and mean the company sells higher margin products that may fluctuate less in price. But the strategy will bring new challenges, and competitors.

There is also the opportunity for Lathams to grow with the market. Almost all the timber Lathams supplies is sourced sustainably. Growing timber takes carbon out of the atmosphere, unlike the manufacture of rival materials such as concrete and steel, which are big polluters.

If the popularity of timber as a building material increases in future, Lathams is in a position to help customers seeking to reduce their emissions. It collates information from published sources and suppliers to calculate a carbon score for each of its products.

Fathoming an extraordinary couple of years

As anticipated, there was a decline in profit in 2023 as supply problems eased, but were replaced by spiralling energy and labour costs. Lathams sold more volume, and at a 6.5% higher average price, but unlike the previous year when it lifted prices 36%, this was not enough to maintain profit margins, let alone increase them.

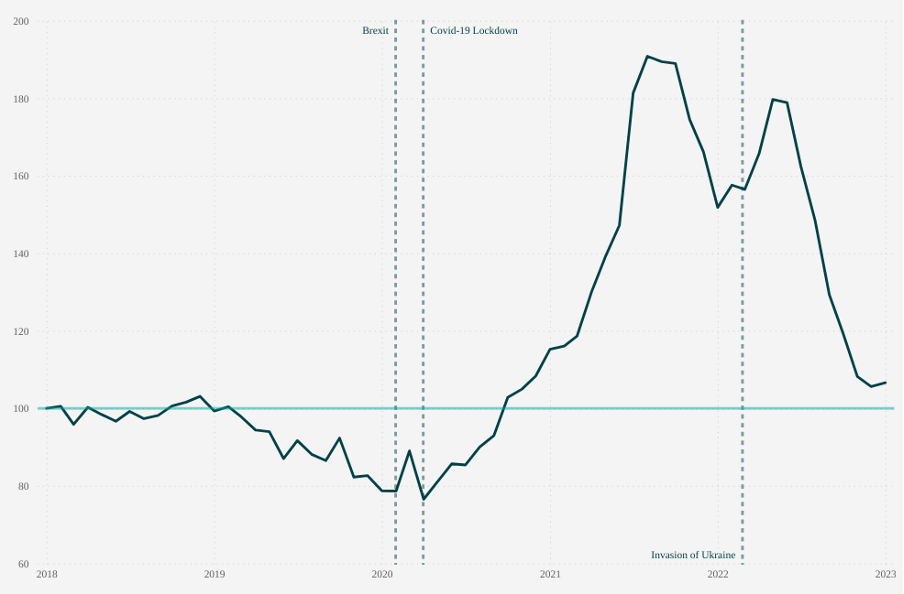

Structural Timber Price Index (Timber Development UK)

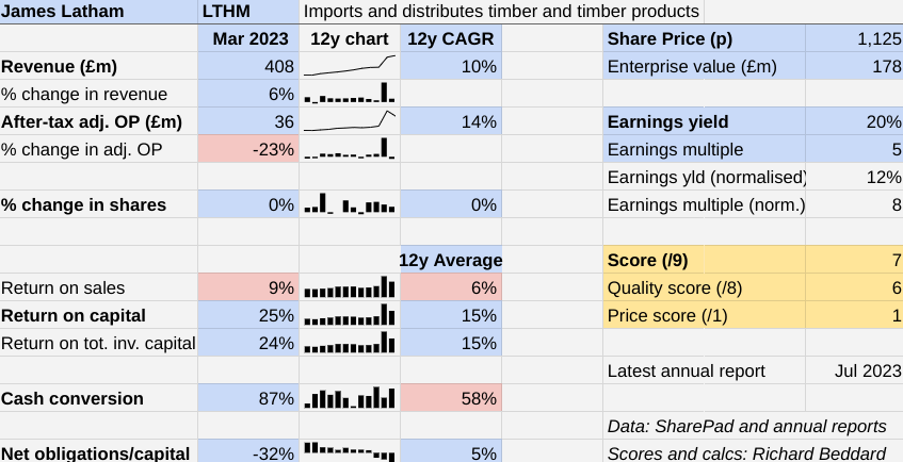

To put this year’s 23% fall in profit into perspective, profit was still nearly three times its pre-pandemic peak at £36 million.

Adjusted profit in March 2022 was over £47 million. The biggest year previously was 2021, the first year of the pandemic, when James Latham earned just over £15 million. The last pre-pandemic year to March 2020, profit was £13 million, also a record.

One final perspective. In the last three years, James Latham has earned over £80 million in cash, much more than it did in the previous decade.

Clearly the last two years have been extraordinary. The difficult bit is what happens next.

Since the year end, Lathams’ gross margin has returned to normal due to cost increases and some price weakness in a more competitive market. So we can probably expect the company’s 9% operating profit margin in 2023 to fall close to the long-term average of 6%, and return on capital from 25% to the 15% average.

Profit will fall too, though not as low as pre-Covid unless demand declines significantly. There is no sign of that, but it could happen in a recession, or if, as the company fears, European suppliers might flood the UK economy with cheap timber because the market is weak there.

- Stockwatch: a small-cap share defying the gloom

- Richard Beddard: why I give this company my maximum score

The issue of which Lathams is the James Latham of the future, pre-Covid James Latham or the one we have witnessed over the last couple of years, is befuddling, but I believe it is one my price score is well suited to arbitrate.

Instead of basing the price multiple on 2023’s profit, which is definitely atypical, it calculates the profit James Latham would have earned in 2023 if it had earned its average return on capital over the last 12 years, which may be typical.

James Latham has earned an average return on capital of 15%. In 2023 average operating capital was £150 million, so my normalised profit figure is about £22.5 million instead of the extraordinary £36 million reported.

That £22.5 million figure means the company’s enterprise value (market capitalisation less net cash) of £176 million is about 8 times normalised profit.

That is a higher multiple than 5 times 2023 profit, but by no means expensive.

Scoring James Latham

I like Lathams. The board is tremendously experienced, but in the latest annual report the company indicates how it might one day be refreshed. Nick Widlinski, an employee of 14 years, is congratulated on his promotion to associate director giving him a seat but not a vote in the boardroom.

The report also lauds a depot director who retired after 40 years with James Latham. The autonomy Lathams gives its site directors, chair Nick Latham believes, is a major factor in the company’s successes.

This is also true at Howdens, a kitchen supplier and many other businesses that operate regionally, like Lathams, or locally.

Does the business make good money? [1]

+ Decent return on capital

? Modest profit margin

? Modest cash conversion

What could stop it growing profitably? [2]

+ Very strong finances

+ Low competitive threat (it even says so in the risk report!)

? Runs out of new product types to sell profitably

How does its strategy address the risks? [1]

+ Range expansion

? Vertical integration

? Limits to growth

Will we all benefit? [2]

+ Very experienced management

+ Remuneration not excessive

+ Long-term ethos

Is the share price low relative to profit? [1]

+ Yes. A share price of £11.25 values the enterprise at about £178 million, 8 times normalised profit.

A score of 7 out of 9 indicates James Latham is a good long-term investment.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

It is ranked 17 out of 40 stocks in my Decision Engine.

Richard owns shares in James Latham.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.