Richard Beddard: this small-cap gem may well be worth some of your money

17th September 2021 16:00

by Richard Beddard from interactive investor

Our columnist closely examines the prospects of a firm that has reason to be optimistic.

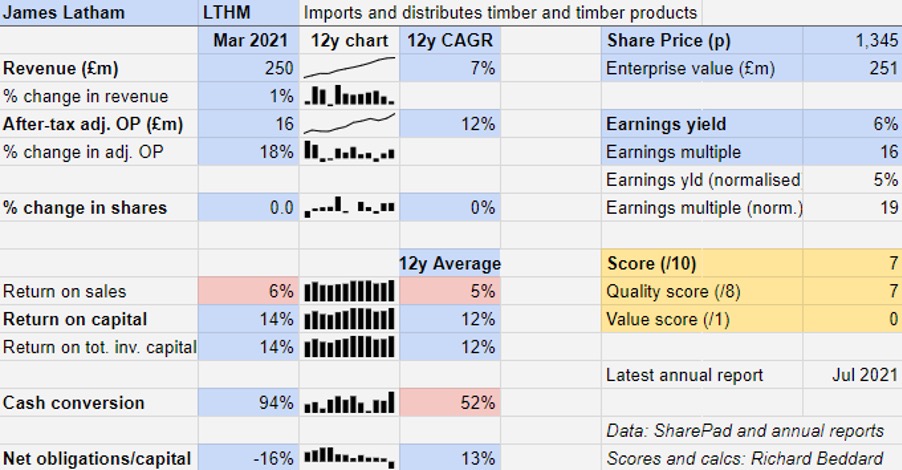

James Latham (LSE:LTHM)’s end of year scorecard, reporting on performance through the first year of the pandemic, shows that though the importer and distributor of timber was affected by lockdowns, the bounceback more than compensated.

Timber demand soared, global supply constricted, and shipping costs rose, but James Latham passed the cost on to customers and earned higher profit margins than usual.

The company generated 18% more profit from 1% more revenue in the year to March 2021 than the previous year:

Past performance is no guide to future performance

At 14%, return on capital (RoC) was a bit higher than usual, and cash conversion was way above its typical level of just 50%.

If that sounds impressive, the company reported last month that it had made as much pre-tax profit in the first four months of the new financial year as it did in the whole of 2020.

James Latham expects demand to remain strong for the rest of the year, but costs to rise, and it doubts these conditions will ever be repeated again.

The fact that James Latham managed to source more timber (volumes per working day were 11% higher than the three preceding months) and earn higher profit margins when the mismatch between demand and supply has never been greater, speaks well of the company’s relationships with its suppliers, and customers.

James Latham’s reputation as the supplier of choice is the essence of the argument for investing in the company, and the answer to a conundrum about one aspect of its performance.

The price of a good reputation

Weak cash conversion is the most off putting thing about James Latham’s numbers.

There can be two reasons for cash flow to be low relative to profit. The first is the most concerning, that the profit figure is doubtful. The second could actually be a strength. It is that the company needs to consume a lot of capital (i.e. invest) to grow.

The first scenario is unlikely. James Latham’s accounts are conservative. Adjustments are vanishingly rare, and it is a pretty straightforward business that does not require lots of accounting judgement to determine profit.

Over the last 10 years, capital expenditure has exceeded depreciation, the rough cost of replacing capital, handsomely. This estimation could be wrong and flatter profit, but it is much more likely that it is the result of heavy investment.

We would only expect capital expenditure to match depreciation if the company were not growing and the prices of property and equipment were not rising.

The former is certainly not true. Over the last 12 years, James Latham has increased revenue at a Compound Annual Growth Rate (CAGR) of 7% and profit at a CAGR of 12%.

The biggest single expense item in the company’s cash flow is capital expenditure which gobbled up a third of its operating cash flow.

In the year 2018, capital expenditure was especially high at nearly £11 million (30% of the 10-year total). That year the company completed the development of two new sites at Yate and Leicester, re-racked another site in Hemel Hempstead, invested in technology to manage its warehouses, and bought new lorries and fork-lifts.

In 2021, the company set up a new warehouse in the Republic of Ireland and redeveloped its Gateshead site.

The heavy cost of investment reflects James Latham’s policy, which is to own, rather than lease, almost everything it needs to make a profit, from warehouses to delivery vehicles.

The next biggest operational expense was the cumulative total of the annual increases in stock, which used up 22% of operating cash flow over the last decade.

A growing business needs to buy more stock each year than it did the prior year.

High levels of growth capital expenditure would be a concern if timber distribution was a particularly cyclical industry because James Latham might suddenly find itself with vastly too much wood on its hands.

It could also be problematic if the company were trying to outspend larger stronger businesses, because James Latham might not have the means to fund itself to parity and beyond.

The company’s steady and self-funded performance over the years assuages my doubts about cyclicality and market position, although the risk of oversupply merits disclosure in the annual report.

As well as monitoring prices and stock levels closely, James Latham believes it owes some of its stable growth to increasing sales of higher margin and less price-sensitive products (such as engineered wood). This has made it less reliant on high volume price sensitive items like panel products (plywood, etc).

James Latham describes itself as the UK’s biggest independent timber supplier. The company is probably defending its market leadership rather than playing catch up, and in that context its investment and commitment to supply orders within 24 to 48 hours would be a powerful competitive advantage.

Bearing the cost of capital expenditure and high stock levels, therefore, is the price the company pays for stable growth. It is why customers and suppliers like James Latham, and what makes it such a successful business.

Strategy developments

James Latham continues to emphasise investment in its warehouses. In 2021, three of them moved to 24-hour operation during the week. Thurrock and Purfleet will join them, and the company also continues to increase their capacity.

It is increasing the range of products it supplies to joiners, door and kitchen manufacturers, shopfitters and builders merchants, principally in the UK and Ireland in pursuit of more revenue and profit margins.

As well as timber, doors and panel products, engineered wood, cladding, decking and mouldings it supplies laminates (such as melamine) and natural acrylic stone, a blend of natural minerals and pigments in an acrylic matrix that is as easy to cut, shape and join as wood.

- Shortlist of AIM’s best companies in 2021 revealed

- Take control of your retirement planning with our award-winning, low-cost Personal Pension

In common with other successful businesses that supply the construction industry, like lighting company FW Thorpe (LSE:TFW) and vinyl flooring manufacturer James Halstead (LSE:JHD), James Latham courts ‘specifiers’, architects and designers that specify materials for building and refurbishment projects.

It has a showroom at the Building and Design Centre in Islington, and presents to architects during their Continual Professional Development.

The company talks about acquisitions, but so far its softly-spoken words are louder than its actions, which I find reassuring.

Scoring James Latham

While the numbers do not hit all the highest notes, I like James Latham.

Site directors have the autonomy to set their own sales and purchasing strategies, which, along with policies to maintain high levels of stock and turn orders around rapidly, ensures it satisfies local customers and makes a good profit.

Meanwhile, the company’s commitment to owning its own property reflects the long-term ethos we might expect from a family business that traces its origins back to 1757 and is still run by members of the founding family.

Does the business make good money? [1]

+ Average Return on Capital is good but unexceptional

? Profit margins are modest

? Cash conversion is modest too

What could stop it growing profitably? [2]

+ Very strong finances

+ Competitors must invest even more to catch up

? Severe recession in construction industry

How does its strategy address the risks? [2]

+ Continual investment in warehouses and stock

+ Addition of new products may be improving profit margins

? Acquisitions

Will we all benefit? [2]

+ Directors are owner managers

+ Executives not extravagantly paid

+ Staff and customer focused

Is the share price low relative to profit? [0]

? A share price of £13.45 values the enterprise at just over £250 million, about 16 times adjusted profit in 2021, a good year.

James Latham scores 7 out of 9. It probably is a good long-term investment.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.