Richard Beddard: A profit machine of rare quality

A great business on the inside, but what about the outside? We get the analyst's view on this company.

28th June 2019 16:01

by Richard Beddard from interactive investor

A great business on the inside, but what about the outside? We get the analyst's view on this company.

The more a business is master of its own destiny, the more likely it is to be a good long-term investment. In many ways, IntegraFin (LSE:IHP), which supplies a "wrap" platform called Transact to financial advisers and their clients, is in the driving seat. The company says it does not outsource "any material component" of its service or technology, giving it control of cost, quality and how the system develops.

The growth train departs from the wrap platform

A wrap platform makes it easier for financial advisers and their clients to manage investments by consolidating them in a single system, simplifying and reducing the cost of trading, record-keeping, reporting and planning.

Transact claims to be the first platform, launched in 2000. In 2007, the Financial Times described it as one of two small independent full-service investment platforms duking it out with platforms provided by large insurance companies and pension providers.

Transact charges a commission based on the value of the assets in its system (Funds Under Direction), which have grown in recent years as existing clients have invested more and new advisors have come on board, bringing Transact new clients.

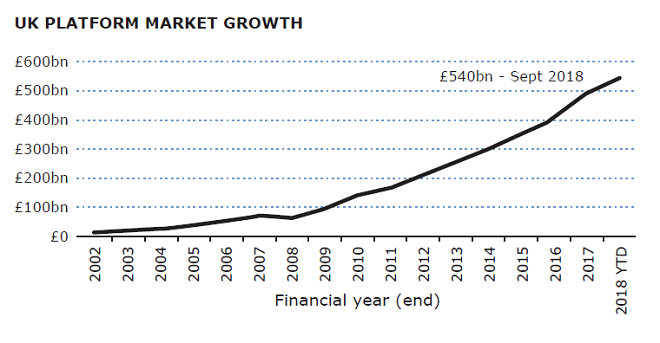

The industry including Do-It-Yourself platforms has grown to manage £540 billion of assets. The biggest name in adviser platforms is now Aegon, which recently acquired and "replatformed" Cofunds. The combined entity has perhaps £120 billion of assets in its system compared to Transact, which had £33 billion FUD at the end of 2018.

Source: IntegraFin annual report 2018, Platforum

Strategy of restraint

There is much to like about IntegraFin. The board eschews big incentives for executives, limiting them to 100% of basic pay in exceptional circumstances and 65% normally. While that may seem generous, it is restrained in comparison to other firms. These days, medium-sized listed firms typically award executives bonuses of up to 100% in cash and an additional 100% of basic pay in so-called long-term incentives (shares) at least.

IntegraFin's modesty, if that is the right word, means the company has more money to invest in the business, pay staff lower down the pecking order, or pay out to shareholders. All of these outcomes are good for shareholders, although in the long-term it is the company's ability to invest, and attract and retain good staff that will drive most of our returns.

IntegraFin's annual report makes reassuring reading on this front too. Over 25% of employees, who receive shares as part of their generous annual bonuses, have been with the firm for more than 10 years.

This enlightened approach may well be because the executives, including one of IntegraFin's co-founders, are major shareholders and have much to gain from the firm's enduring prosperity.

IntegraFin's restraint is not just directed at executive bonuses. The company also reduces the fee it charges clients, once it has achieved the required profit and service level. In this respect it is like Next (LSE:NXT), the clothing retailer that is turning itself into an online retail platform and returning profit in excess of its 16% margin to customers and partner brands. The strategy means customers stay loyal. In 2018, IntegraFin retained 96% of clients.

The whole annual report oozes restraint. It says any new platform developments should improve financial planning processes for all customers, and not risk the company's capital "beyond reasonable levels". Neither should new developments bring the company into commercial conflict or make it difficult for it to meet regulatory responsibilities. This is rather obvious, but it is also very important because finance is complicated, and financial firms all too often take ill-advised risks in pursuit of profit that puts the whole enterprise in danger (here's looking at you Woodford).

Perhaps restraint is the reason Transact is the most-loved of the adviser platforms, gaining a Net Promoter Score of 59% in a survey that measured how likely advisers were to recommend platforms to other advisers. The next best platform achieved 31%.

Perhaps lack of restraint is the reason why Cofunds shipped customers in 2018. They were unhappy at being shifted onto the Aegon platform.

A profit machine chugging away in the basement of a financial fortress

IntegraFin floated in March last year, so it does not have a track record as a listed firm. Its results for the year to December 2018, though, are of rare quality. Revenue and profit grew by 13% and 12%, respectively, and IntegraFin earned even more in cash terms. Return on capital was 59%. It has over £100 million in cash sitting on the balance sheet, nearly three times annual profit and more than the company earned in revenue.

The company looks like a profit machine chugging away in the basement of a financial fortress. IntegraFin is a great business on the inside. On the outside I am not so sure...

Battle of the platforms

Over the last decade investment platforms have been expanding into empty territory because they provide a useful service that did not previously exist. We have seen this in the growth of do-it-yourself investment platforms. IntegraFin is joined on the stock exchange by Nucleus, the other independent adviser platform identified by the FT in 2007, which floated in 2018.

The sudden bout of flotations make me nervous. We do not have a precedent for how the industry will perform in a bear market. If the value of people's assets falls, platforms that charge clients percentage-based fees will earn less. I also wonder how long it will be before industry-wide growth slows.

Having managed my own finances for two decades, and written almost exclusively for platforms, magazines, and services for DIY investors, it feels perverse to be advocating a company servicing the dark side. However, there will always be a section of the population that seeks to outsource investment. The question is, as the battle of the platforms unfolds, how big will that population be?

This is how I score IntegraFin, provisionally because of its short track record and because this is the first time I have investigated it:

Does IntegraFin make good money?

Phenomenally so in 2018, but fees are dependent on the value of clients assets, which will fall in bear markets.

Score: 2

What could prevent it from growing?

Investment platforms have grown strongly to meet an unfulfilled need, but that growth will slow as platforms become ubiquitous. DIY platforms could prove more successful in the long run.

Score: 1

How will it overcome these challenges?

IntegraFin's strategy of restraint should enable it to grow market share even if market growth slows, because it is good for customers.

Score: 2

Will we all benefit?

The company explains itself very well and looks after its employees and customers.

Score: 2

Are the shares cheap?

No. The shares cost 29 times adjusted profit on a debt-adjusted basis.

Score: -1.3