Richard Beddard: lots to like about this mid-table FTSE 250 company

24th February 2023 14:04

by Richard Beddard from interactive investor

Its job remains a difficult one, but there’s plenty to like about this distinctive company. Our columnist explains why it’s probably a good long-term investment.

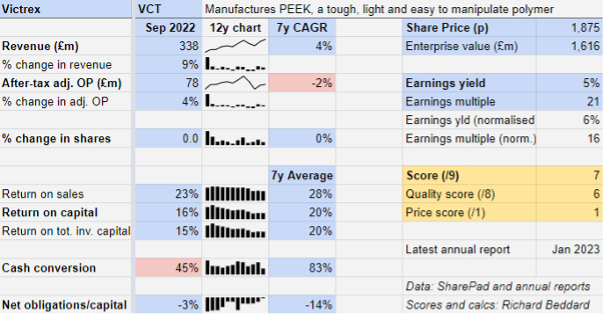

Take a look at the tiny charts in my summary of Victrex (LSE:VCT)’s financial performance over the past 12 years and you will detect largely declining trends in the company’s profitability and net cash balance. Happily, there are signs that the trends may be reversed.

- Invest with ii: Share Dealing with ii | Top UK Shares| Cashback Offers

From great to good

Although cash flow was sub par due to investment in a new manufacturing facility and a build up in working capital, the year to September 2022 does not look bad in isolation. Revenue and profit increased modestly, 23% profit margins are healthy in comparison to many other businesses, and so too is a 16% return on capital.

While most of the company’s markets were in recovery mode, revenue from the automotive industry declined due to the semiconductor shortage. Cost inflation, particularly energy costs, ate into profit margins.

Much of the decline in profitability in recent years has been due to the pandemic. Victrex makes PEEK, a plastic material used in high performance components for planes, cars, smartphones, and medical implants. Many of these markets were impacted by the pandemic, which may now be largely behind us.

Judging by a sharp rise in average selling price since the year end due to price rises and more sales of higher priced PEEK grades and products, the effects of cost inflation may also prove temporary.

But the decline started before 2020. In terms of the numbers, the company has gone from being great to being good, and in terms of profit, it has gone from growing to not growing. Revenue has grown at a compound annual growth rate (CAGR) of 4% over the last seven years, but profit has declined at a CAGR of about 2%.

The number rot started maybe a decade or so ago, when Victrex decided it needed to stimulate demand for PEEK by working with parts manufacturers to break into new markets by proving the superiority of PEEK components.

PEEK sits on top of a polymer pyramid as the strongest, lightest, most hardwearing of semi-crystalline thermoplastics, capable of withstanding high temperatures. It is used to replace weaker, heavier, more corrosive metals. Lighter cars and planes use less fuel. Cars with PEEK gears also vibrate less. Victrex says PEEK implants produce better outcomes for patients.

The material was invented by ICI in the 1970’s and Victrex spun out of ICI as a specialist PEEK manufacturer in the 1990s. Although the original PEEK patent expired in 2000, Victrex has sought to stay ahead of competitors by improving its chemistry and processes (it holds over 200 patents), and by developing or collaborating with manufacturers to develop new variants of PEEK and PEEK products, a strategy dubbed “Polymer and Parts”.

The parts strategy is epitomised by the so-called mega-programmes, parts made from PEEK with the potential to earn more than $50 million a year.

No doubt, Victrex was encouraged by the success of its PEEK spinal implants, hitherto the mainstay of its medical programme, when in 2014 it launched the mega-programmes, five programmes that would reach meaningful revenue of more than £1 million by 2019.

Today there are seven mega programmes, but only three have achieved £1 million revenue, which is a fraction of 1% of Victrex’s total revenue. One, automotive gears, has surpassed £4 million, but that remains a long way from $50 million.

Hidden progress

Nine years later, Victrex earns only 20% of revenue from parts and forms of PEEK (pipes, films, coatings and composites) that are pre-formed from raw pellets or powder and easier to manufacture into parts. Only 6% of revenue comes from products invented since 2014, although that is a 2% improvement on recent years.

The parts and polymer strategy requires Victrex to develop new relationships and capabilities in unfamiliar markets. Proving new products requires trials, documentation and sometimes regulatory approval, which can take many years. Then the new product must be commercialised.

This costly strategy is often a risk too far for executives at leading parts manufacturers, so Victrex must work with challengers to develop better products in the expectation that competition will nudge bigger rivals to adopt PEEK too.

It is a laborious process that racks up costs but shows little financial return until the market shifts.

For any given mega programme, we do not know when or even if that moment will come, but when it does the increase in demand could be sudden and substantial. Victrex builds capacity in anticipation of this demand. This too is a drain on the company’s resources.

Alternative materials

There may also be an element of commodification in Victrex’s dwindling performance. Chemical companies selling lower grades of PEEK may be chewing away at some of Victrex’s business.

But Victrex is selling PEEK in greater volumes than it ever has, and before the recent increase in average selling price to £83 per tonne, prices were fairly stable at around £70 per tonne.

Victrex tells me no competitors have added nameplate capacity, the maximum theoretical output of their plants in continuous operation, since 2017, and they have not announced plans to. This financial year, Victrex is adding 1,500 tonnes of nameplate capacity in China and removing bottlenecks in its UK plant, raising its total nameplate capacity to over 9,500 tonnes. I think that is about 70% of global nameplate capacity.

- Stockwatch: an opportune moment to buy hard-hit cyclical shares?

- Insider: two FTSE 100 winners tipped to keep rising

As the dominant supplier, Victrex invests between 5 and 6% in Research and Development (R&D) to increase its lead in differentiated grades and parts made from PEEK.

Other materials may pose a bigger risk. One of the selling points of PEEK is it is easily moulded into parts without much waste, but the development of 3D printing has made manufacturing with metal more efficient too. Victrex’s spinal implants, the mainstay of its highly profitable medical division is facing stiff competition from 3D printed titanium spinal cages. Victrex hopes to turn the tide with a new generation of PEEK cages.

Doing business with China has a risky feel these days due to our fragile geopolitical relationship with the manufacturing superpower. Victrex’s Chinese investment is in part a response to the Chinese government's Made in China 2025 plan, which seeks to raise the domestic content of components manufactured in China. Politics aside, the bulk buying of highly profitable medical products in China is also putting pressure on profit margins.

It is somewhat reassuring, therefore, that China is Victrex’s third biggest national market, responsible for 14% of revenue in 2022. Germany is a much bigger market (32% of revenue), and so is the USA (31%). Perhaps China is more of an opportunity than a threat.

Medical shimmy

Despite the dog-fight with titanium spinal cages, Victrex has sharpened up its strategic focus by picking its favourite mega programmes, and they are from its medical division.

Medical products are produced in low volumes and sold at high profit margins, and demand is more constant than for say, aircraft or car components, so the attraction is obvious. Currently, though, they only account for 20% of revenue.

Victrex is focusing on knee replacements, where it has developed an alternative to cobalt chrome implants, a $1 billion market. Trauma plates, which help repair broken bones, is its other priority. Both programmes are in clinical trials, with, the company says, many successful implants and no interventions yet required.

Success is not guaranteed. The spinal programme is showing that competitors do not just give up when Victrex successfully commercialises a product. They improve their products too.

Polymer and Parts has made slow progress, but the really difficult scenario for me would be if Victrex lost confidence in the strategy. Directors at last year’s Annual General Meeting were adamant that they would not move down the polymer pyramid in search of growth.

Perhaps I am too invested in the story, but I find it reassuring that Victrex is sticking to its knitting.

Scoring Victrex

Last year, I wrote: “It [Victrex] is trying to do a difficult job, and the pandemic has delayed progress. Maybe that is all there is to it.”

I am writing a similar story this year, but revenue from new products is higher, there is a sharper strategic focus in this year’s annual report, and I wonder if, after five somewhat disrupted years, chief executive Jakob Sigurdsson has got his feet firmly under the table.

I like Victrex. It is a distinctive business. Voluntary staff turnover was 8% in 2022, which still seems modest given a lot of people are changing jobs. The company has a new finance director, Ian Melling, who previously worked for Smith & Nephew, and his experience may help the company achieve its medical aspirations.

The executives are paid well, but employees are too.

Victrex aspires to carbon neutral operations by 2030 and says 89% of its research and development is directed to sustainable products, although the definition is quite broad. Aerospace products are sustainable because of the fuel savings, and the company’s medical programmes qualify because they improve people’s health.

Victrex’s new chair’s CV is chock full of sustainability credentials, and it is probably serious about its intentions.

Doing the right thing is an aspiration for the company, and a decent one.

Does the business make good money? [2]

+ Good return on capital

+ Decent profit margin

+ High average cash conversion

What could stop it growing profitably? [1]

+ Strong balance sheet

+ Limited competition from other polymer companies

? Other materials?

How does its strategy address the risks? [1]

+ Investment in polymer, parts, and capacity

? Mega programmes

? Focus on medical

Will we all benefit? [2]

? Executives yet to prove themselves

+ Employees are well paid and loyal

+ Focus on sustainable applications. Net zero plans do not rely on offsetting

Is the share price low relative to profit? [1]

+ Yes. A share price of £18.75 values the enterprise at about £1.6 billion, about 16 times normalised profit.

A score of 7 out of 9 indicates Victrex probably is a good long-term investment.

It is ranked 21 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Victrex.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.