Richard Beddard: gettin’ on down, movin’ on up

21st January 2022 15:04

by Richard Beddard from interactive investor

This electronic music business appears to be operating in more or less perfect harmony; only the share price jars with our columnist.

At the dawn of electronic music in the 1980s and 1990s, Focusrite (LSE:TUNE) manufactured mixing desks for recording studios. Today, recording is computerised and everybody is doing it.

Focusrite sells Scarlett, the most popular hardware interface connecting musicians to their computers via their instruments. It has a more upmarket sibling, Clarett. Studio monitors from Focusrite’s ADAM Audio brand, acquired in 2019, enable musicians to hear the music they are recording and perfect it.

In 2004, Focusrite moved into the creation of electronic music when it acquired Novation, a synthesiser brand that also makes grooveboxes and created Ampify, a music creation app. It diversified again in 2019, this time into playing music, when it acquired Martin Audio. Martin Audio makes speaker systems for festivals, theatres and large nightclubs.

In 2021, the company launched another commercial audio brand, Optimal Audio, which supplies speaker systems to smaller concerns – restaurants and gyms for example – that do not have the money or expertise for high-end equipment.

Customer-friendly policies

Optimal Audio’s systems work out of the box, an innovation that echoes Focusrite’s strategy since those early years. It has broadened the market by simplifying its products so that they appeal to hobbyists and novices as well as professionals.

Other customer-friendly policies, frequent software updates, the development of innovative products and the provision of 24/7 follow-the-sun support for the lifetime of the product have all contributed to its considerable reputation among hobbyists and indie bands.

- Five AIM share tips for 2022

- From AIM to Main: does moving markets make sense?

- Like AIM and small-company shares? Check out ii’s Super 60 recommended funds

- Share Sleuth: here’s how the portfolio could change in 2022

Focusrite has not given up on the professionals, though. In 2017, it established Focusrite Pro, which delivered the audio for the presidential inauguration in 2021. That year it also acquired Sequential, an American brand that makes the famous Prophet synthesisers heard in many of the hits of recent decades. Like all of Focusrite’s brands, its professional brands are highly profitable, but their smaller customer bases mean they are smaller businesses.

No red flags

There are no red flags in the numbers. Focusrite earns great returns, inflated because people had more time to make music during the pandemic, but before the virus struck the company was earning good profits, and it reckons it is maintaining its swollen customer base post-lockdown.

The obvious concern for a company that has recently stepped up acquisition activity is diworsification – the risk that Focusrite might be blowing its prodigious cash flow on less profitable businesses. This is a particular worry in the case of Martin Audio, which supplies a completely different market – venues as opposed to musicians.

But despite the fact that the pandemic closed down festivals and stopped bands touring, Martin Audio made good profits in 2021 by focusing on venues that stayed open longer, like clubs and places of worship.

The rest of Focusrite’s subsidiaries earn comparably high profit margins, and the company’s overall Return on Total Invested Capital (ROTIC), including the money spent on acquisitions at cost value, is 38%.

2021 | Revenue (£’000) | Profit (£’000) | Profit margin | % of total revenue |

Focusrite | 97,218 | 47,798 | 49% | 55% |

ADAM Audio | 23,865 | 14,040 | 59% | 14% |

Novation | 22,262 | 7,965 | 36% | 13% |

Martin Audio* | 20,398 | 9,471 | 46% | 12% |

Sequential** | 5,299 | 2,341 | 44% | 3% |

Focusrite Pro | 4,877 | 2,540 | 52% | 3% |

Distribution | 16 | -25 | -156% | 0% |

*Martin Audio acquired 30 Dec 2019, contributed to 8 months of year to August 2020

**Sequential acquired 26 April 2021, contributed to 4 months of year to August 2021

Profit excludes central costs. Source: Focusrite annual report 2021

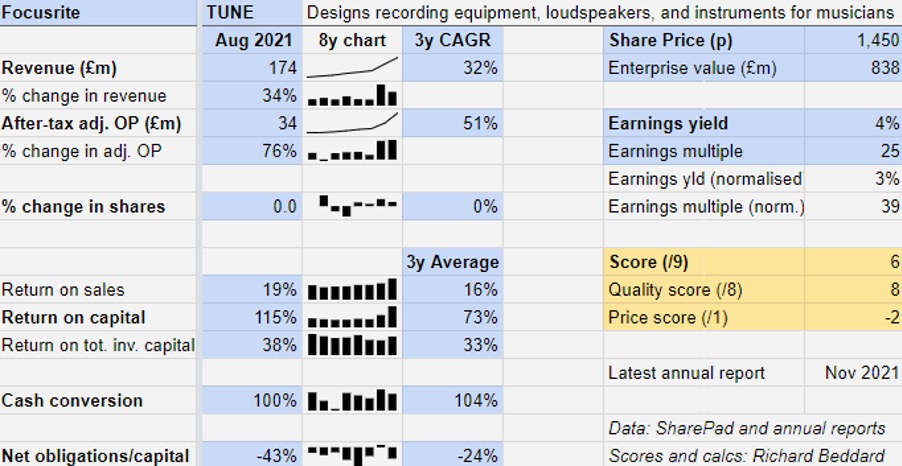

Valuation is a bit more tricky. An enterprise multiple of 25 times adjusted profit might be justifiable for such a high-quality business, but Focusrite was way more profitable in 2022 than it was even in the recent past.

The questions I cannot answer are to what extent Focusrite is a better business than it was a few years ago, how far increasing demand for digital audio as society has permanently improved Focusrite’s prospects, and the extent to which the boom in profitability is a lockdown-related flash in the pan.

I have hedged my debts in assessing the company’s share price by using the profit Focusrite would have earned had it had achieved its average Return on Capital (RoC) over the last three years. That puts the enterprise on a heady multiple of 39 times adjusted profit.

Enthusiast culture

Apart from the price, I like Focusrite. It helps musicians make and record music more easily, and now it is helping venues play it more easily too.

Its heritage is as long as the history of electronic music. Focusrite was founded by an electronic music visionary, Phil Dudderidge, who remains chairperson and a majority shareholder. Dudderidge was Led Zeppelin’s sound engineer and the mixing desks he worked on have a legendary status. In acquiring Sequential it has acquired the services of another music industry visionary in Dave Smith, that company’s founder. Smith invented perhaps the most fetishised synthesiser of them all, the Prophet-5.

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

- Watch our new year share tips here and subscribe to the ii YouTube channel for free

Dudderidge’s legacy is a business populated by enthusiasts, and the company has recognised that strength by making ‘creating a great place to work’ the fourth element to its strategy after innovation, focusing on lifetime value for customers and expanding into new markets. One of those enthusiasts is Tim Carroll, 20 years a professional keyboard player before he joined Avid, developer of the industry standard software often used with Focusrite’s hardware interfaces, and then became Focusrite’s chief executive in 2017.

The market is still growing. Focusrite has products that address podcasting and gaming, for example, and the company thinks there may be 14 times as many musicians who do not yet use technology to create, perform or capture sound as do use it.

It is restlessly creating and acquiring brands to help them.

Scoring Focusrite

Does the business make good money? [2]

+ High RoC and ROTIC

+ High profit margins

+ Strong cash flow

What could stop it growing profitably? [2]

+ Hobbyist market is probably resilient to recession

+ Strong brands resistant to competition

? Early days for acquisitions, they may be more risky

How does its strategy address the risks? [2]

+ Customer-friendly policies increase loyalty

+ New products and updates develop brands

+ Acquisitions appear to be good-quality businesses

Will we all benefit? [2]

+ Founder and chairperson is majority shareholder

+ Liked by customers and staff (Net Promoter Scores are +74 and +43)

+ Executive pay does not look especially greedy

Is the share price low relative to profit? [-2]

+ A share price of £14.50 values the enterprise at about 39 times normalised profit.

There is nothing I can find to dislike about Focusrite except the share price, which is of course determined by investors, not the company.

A score of 6 out of 9 means Focusrite probably is a good long-term investment. It is ranked 16 out of the 40 good businesses in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.