Richard Beddard: can this small UK firm make it big in America?

These shares have performed well over the long term and they’re recovering well from losses suffered in 2021. Here’s what our columnist thinks of them now as they try to crack the US market.

19th January 2024 15:12

by Richard Beddard from interactive investor

Last June, Tristel (LSE:TSTL) received the news shareholders had been waiting for, for more than five years.

It had achieved De Novo clearance from the United States Food and Drug Administration (FDA) for Tristel ULT, a disinfectant used on ultrasound probes.

The protracted approval process was, in part, a result of Tristel’s novelty in the US.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

De Novo means “anew”, and the fact that the FDA had never before approved the sale of a similar product, hints at the company’s competitive advantage.

Its disinfectants clean medical devices and surfaces in hospitals. It has two brands, the eponymous Tristel brand, and Cache.

Tristel disinfectants clean small heat-sensitive medical instruments like endoscopes and ultrasound probes, principally used by hospital outpatient departments.

Tristel’s biggest revenue earner is Trio, a three-step wipes system for cleaning, disinfecting, and rinsing instruments. The next biggest is Duo, a foam disinfectant applied with a dry wipe.

The more comprehensive Trio system is favoured in cardiology and Ear Nose and Throat (ENT) departments, where the instruments are more complex. Duo is sufficient for ultrasound and ophthalmology.

This is the business that made the company what it is today, and it was the source of 86% of revenue in the year to June 2023.

Tristel is also establishing Cache for the disinfection of medical surfaces. Cache brought in 9% of revenue, but at a lower gross margin.

The remaining 5% of revenue comes from sales to pharmaceutical companies and vets, which are no longer a strategic focus.

Different kind of disinfectant

Tristel’s success has been built on its proprietary chlorine dioxide chemistry, which the company invented 20 years ago.

It is safe enough to be applied by hand but as effective as the hazardous chemicals used in washing machines. This makes it quicker and easier to clean small instruments and also cheaper, because no machine is required.

Surfaces can be cleaned more effectively because unlike competing disinfectants, Cache is sporicidal. It does not just kill germs, it also kills their spores, which can lay dormant and later germinate.

Tristel and Cache are the only chlorine-dioxide based hospital disinfectants.

- Share Sleuth: this share trebled, but now it’s time to sell

- Stockwatch: I’m still happy to buy both these rival companies

Chlorine dioxide is not patentable, but Tristel’s products, the packaging, their delivery and the way the disinfection process is audited, are protected by 142 patents in 32 countries.

Twenty years of know-how, customer relationships, regulatory approvals, device certifications, and endorsements in the scientific literature present a considerable barrier to would-be new entrants.

This uniqueness combined with the fact that disinfectants are vital consumables that are routinely replenished, has delivered profitable growth for many years now.

Tristel says it is the market leader in manual high-level disinfection, in Europe, the Middle East, and the Asia-Pacific region.

Now the FDA has cleared the way for a tilt at the world’s biggest healthcare market, the USA.

How things could pan out in the US

Tristel’s biggest market remains the UK, where it earns 35% of revenue.

But I wonder if it will be harder to penetrate the bigger and more fragmented US market, where Tristel is relying on distributor Parker Laboratories.

That said, Tristel has been growing strongly in international markets for many years, and it entered most of these markets using distributors too. As a seller of ultrasound gels, Parker Laboratories is very familiar with the market Tristel is targeting first.

Once Tristel has become established in a market, it often takes control by acquiring subsidiaries. In 2023, it acquired a Middle Eastern distributor, for example. Of the 65% of revenue earned abroad in 2023, 58% was earned through direct sales by Tristel’s own subsidiaries.

I think this vertically integrated approach is wise. Tristel’s products are special, and nobody knows them better than Tristel itself.

It would be no surprise if, once the product has become established in North America, Tristel establishes a direct sales channel there.

The catch with Cache

Cache builds on Tristel’s strengths, it uses the same chlorine dioxide chemistry, and in a more infection conscious world post-Covid, Tristel believes a sporicidal disinfectant will catch on. Securing approval for new Cache products is taking longer than expected, though.

The certification process in the UK post-Brexit has changed, and in Europe surface disinfectants used around the patient require a high level of regulatory scrutiny.

Delays in securing approvals will be familiar to shareholders, and the company says it is confident most of the approvals backed up in the pipeline will be achieved this year.

Tristel says it has invested heavily in its regulatory compliance team, and while this has dragged on profit in recent years, it may in itself prove to be a competitive advantage.

- 27 favourite small-cap shares for 2024

- 2024 Investment outlook: share tips, forecasts, tax, pensions and savings

Success is not guaranteed though. Tristel previously failed to convince vets to adopt its more efficacious products, so it is possible it may not persuade hospitals about the benefits for surfaces.

There is one more risk nagging away at me. Trio wipes are pre-wetted with disinfectant. To maintain their integrity, these wipes contain plastic, which is bad for the environment.

Tristel’s newer products, like Duo and Cache, are applied with dry wipes (Tristel supplies them), but as Tristel seeks to meet its environmental targets, and customers do too, sales of Trio, the more comprehensive and highly priced cleaning product may come under pressure.

Tristel tells me Trio makes twice the revenue Duo does from half the disinfection events and it keenly monitors the migration flows between the two products.

“There is not a clear one-way direction of travel,” the company says. Perhaps that could change.

Back to business as usual

Profitability has been below par for a few years, disrupted by the cancellation of routine procedures during the pandemic, by stockpiling and destocking due to the pandemic and Brexit, and five years funding the approvals process in the US.

During the year to June 2023, the number of procedures returned to normal, and the stockpiling issues reduced.

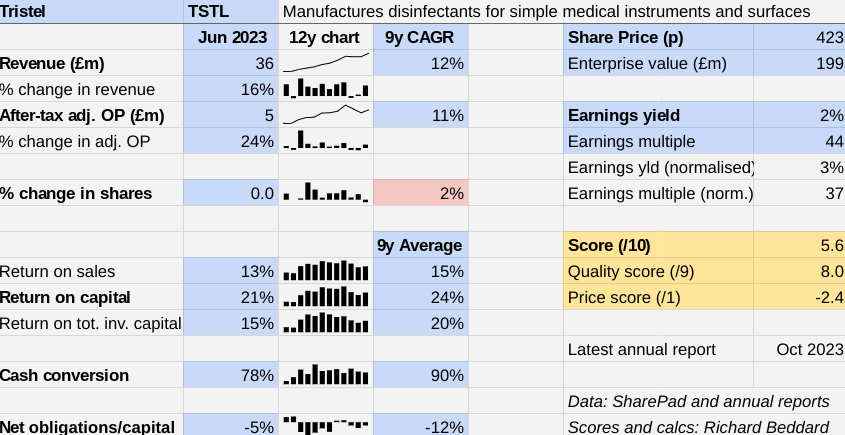

Despite the ructions, profitability has remained high, and Tristel’s financial performance over the last nine years is excellent. It has achieved double-digit growth in revenue and profit and earned a return on capital of more than 20% nearly every year.

Parker Laboratories is manufacturing Tristel ULT and has started supplying “beta sites”. If revenue ramps up in the US, these numbers could improve.

- 28 recovery stocks to watch in 2024

- Stockwatch: my response to results season so far plus tip updates

The one blot in the figures is the increase in the share count, which takes 2% off Tristel’s growth rate on a per share basis. These shares have fed the directors’ remuneration, primarily.

Scoring Tristel

Tristel’s products do good. The company says it has the simplest, quickest, and most affordable high-performance disinfection method available.

The company’s strategic pillars are to empower its people, push the boundaries of innovation, and protect the health of our planet (including reducing carbon emissions).

The annual report is both concise and mostly illuminating.

I have always been doubtful about executive pay, though, which is high and tied to the share price rather than the underlying performance of the business.

In the past, I have also been concerned that the board might be too chummy. The chief executive and chief financial officer are married, and non-executive director David Orr is a director of a supplier. These issues may be resolving themselves in an unexpected (by me) way.

I started this article with big news, and as it draws to a conclusion, there is more big news!

Mr Tristel, aka Paul Swinney, the company’s founder and chief executive, is to retire this year. The company will lose an excellent communicator who surely understands the manual high-level disinfection business better than anyone else. Mr Orr is standing down too.

We do not know who will succeed Mr Swinney yet, but the two other executive directors are experienced. Liz Dixon, the CFO, has been a director for 15 years. Bart Leemans’ association with the company goes back way beyond his appointment in 2018. That year, Tristel acquired Ecomed, its distributor in Benelux and France. Mr Leemans was CEO and founder.

Tristel does not disclose the median pay of employees, or employee satisfaction and staff turnover statistics, although it does say its minimum wage policy exceeds the UK Living Wage.

Although I suspect it is a happy company, it would be good to read statistics that verify it. Perhaps they will follow.

Tristel’s inaugural Environmental Social and Governance (ESG) report is laden with target Key Performance Indicators (KPIs).

The Past (dependable) [3]

● Profitable growth: Yes [1]

● Strong finances: Yes [1]

● Through thick and thin: Yes [1]

The Present (distinctive) [3]

● Discernible business: Unique and vital consumable [1]

● With experienced people: Yes, even after Mr Swinney leaves [1]

● That creates value for customers: Cheap, quick, safe, effective [1]

The Future (directed) [2]

● Addressing challenges: Unsure about threat to Trio [0.5]

● With coherent actions: New products with same chemistry, overseas registrations [1]

● That reward all stakeholders fairly: Executive pay restraint, more stats on employees would be good [0.5]

The price (discounted?) [-2.4]

● No. A share price of 423p values the enterprise at £199 million, about 37 times normalised profit.

A score of 5.6 out of 10 indicates Tristel is fair value.

It is ranked 36 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Tristel

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.