Richard Beddard: can this share overcome alarming change of fortune?

Holding this stock has been a good decision in the past, our companies analyst thinks it can be again.

25th September 2020 15:25

by Richard Beddard from interactive investor

Holding this stock has been a good decision in the past, and our companies analyst thinks it can overcome obstacles to be so again.

Engineering company Renishaw (LSE:RSW) had me on the opening page of its annual report, where it declares:

“Our purpose is to design, develop and deliver solutions and systems that provide unparalleled precision, control and reliability. By pursuing our purpose, we can continue to be a worldwide leader in precision technology: an insatiable innovator, a trusted partner, an inspiring employer and a responsible business.”

Restless innovation, whizz-bang technology, made by a good company to work with, or for. Renishaw makes machines that are automating manufacturing and healthcare, making us better at making things and repairing ourselves.

However, in the year to June 2020, Renishaw shed 578 jobs, perhaps 11% of its workforce. Some of them were due to a redundancy programme, so let’s not get carried away.

Renishaw manufactures tools incorporating sensors and probes that control machines and check the products they make meet the specifications. It also manufactures metal additive manufacturing (AM) machines, a process that may become a means of mass production. It is working with BAE Systems to develop AM machines for aerospace and defence.

Although not representative of Renishaw’s volume AM ambitions, this 3D printed replica of the 12th century Gloucester Candlestick demonstrates its sophistication. It was built up layer by layer from aluminum powder using a RenAM 500Q machine. Source: Renishaw.

A second division, Healthcare, manufactures AM systems configured for medical and dental applications, medical and dental implants, surgical robots and other complex medical devices.

- Richard Beddard: this engineering stock has promise, but can it inspire confidence?

- ii view: Babcock scuttles the dividend

For many years Healthcare was unprofitable due to the high cost of developing complex equipment for highly regulated medical applications, but 2020 was the third year running it achieved an operating profit. It was modest, though, in comparison to the rest of the business, and there was a big decline in profit across the board.

48% drop in profit

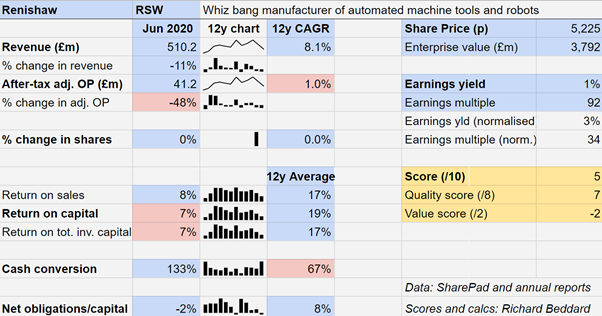

Group revenue declined 11% and profit declined 48% in the year to June 2020 and Renishaw achieved its lowest return on capital (ROC) since the financial crisis of 2009.

Then, Renishaw achieved a ROC of 5%, and in 2020 it achieved 7%. Usually, Renishaw is much more profitable than that. Average ROC over the twelve-year period is a much more prosperous 19%.

This was the second year of decline following a 33.5% fall in adjusted profit in 2019. Comparing a low point to a high point is perhaps a little unfair, given the oodles of profit Renishaw has made in between, but the company has only achieved compound annual growth in adjusted profit of 1% since its pre-crisis high of 2008.

The perilous economics of the machine tool business

Renishaw’s fortunes are tied to those of its industrial markets, which include aerospace, automotive, electronic devices and household appliances.

Pledges by various governments to phase out diesel and petrol cars before the infrastructure for electric vehicles (EVs) is fully developed have depressed sales in the car industry. The pandemic has also stymied the supply chains of aircraft manufacturers, and trade frictions and the maturation of the smartphone market has been weighing on semiconductor manufacturers.

- Share Sleuth: why valuation alone is not enough to trigger a ‘sale’

- ii view: BAE reinstates the dividend payment

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Even healthcare was knocked by the pandemic, due to cancelled surgical operations and delayed orders.

Some of these industries are prone to periods of low demand and over-capacity, so collapses in profit are a feature of Renishaw’s business model and not a bug.

The company makes the tools it designs, and sells them directly to manufacturers, which is a strength most of the time. It gives the company insight into what customers want and control of cost and quality.

But the high fixed costs of manufacturing and running 79 offices around the world mean modest falls in revenue lead to big falls in profit. The upside, of course, is modest rises in revenue can lead to big rises in profit.

During the 2009 crisis, and again in 2020, Renishaw made redundancies and shut down less profitable activities to reduce costs. This time it is the AM business taking the biggest hit, with the closure of one site and the rationalisation of the product range.

The costs, £17.5 million of written-off investments, and £6.3 million in redundancy costs group-wide, have been treated as exceptional items and not been deducted from profit in my figures.

The good news is that because Renishaw’s financial year ended at the end of June, 2020 bore the brunt of lockdown. Although the company is working at reduced capacity, the current financial year may be more prosperous.

And Research and Development (R&D), the source of long-term growth, remained high at 13% of revenue.

Reassuring strengths

As long as Renishaw’s business model has not been holed, judging its merits as an investment based on its performance in its worst year in over a decade would be perilous.

The company has many patents, fifty years of know-how, strong relationships with manufacturers around the world, and invests heavily to invent new products.

This year’s performance is testing my theory that by working more closely with manufacturers of things rather than supplying manufacturers of machines, it will become more resilient.

Machines are a tough sell in recessions because manufacturers experiencing lower demand will often be reducing investment to shore up their financial positions. The cost of buying a new machine may be greater than the benefit of keeping an old one going longer, even if the old one is less efficient.

By supplying tools that can be retrofitted to machines made by any manufacturer, Renishaw has developed alternative sources of income like upgrades and maintenance contracts. It can also help customers automate at lower cost, something that might be attractive to some at least, in a recession.

In the distant future, the Healthcare division could stabilise profit, but that is probably a long way off.

As you would expect of a prudently managed business in a capricious industry, Renishaw maintains strong finances. At the year end it had marginally more cash than it did financial obligations, which include borrowings, a pension deficit and lease obligations.

Valuing Renishaw

I think it is reasonable to predict that Renishaw will survive and ultimately prosper again, and its valuation is better calculated from average profitability over the last twelve years than from 2020’s result.

Sadly, it does not help the investment case much. In 2020, Renishaw used operating capital of £594 million. If the company had earned its average return on capital of 19%, profit would have been £113 million before interest but after tax at the basic rate.

Although that is a lot more than the £41 million Renishaw reported (on an adjusted basis), Renishaw’s Enterprise Value (EV) is £3.6 billion, still 32 times my normalised profit figure.

It’s still quite a pricey looking multiple.

Scoring Renishaw

I like Renishaw despite the alarming changes in its fortunes. Its co-founders still sit on the board, to the chagrin of a substantial minority of investors who vote against their re-election at the firm’s annual general meeting. Executive chairman David McMurtry owns 36% of the shares and non-executive deputy chairman John Deer owns 16%.

They have overseen the growth of a culture of innovation and integrity, and their wealth is evidence that in the past, holding Renishaw shares for the long-term has been a good decision.

Does the business make good money? [1]

+ Average return on capital and profit margins are high

− But can collapse in downturns

? Cash conversion is weakened by investment

What could stop it growing profitably? [2]

? Capricious end markets

+ High fixed costs

+ Competition

How does its strategy address the risks? [2]

+ Strong balance sheet

+ High spending on R&D

+ Vertical integration and focus on end-users

Will we all benefit? [2]

+ Founders still involved as directors and shareholders

+ Enlightened attitude to staff

+ Communicates well with shareholders

Are the shares cheap [-2]

− No

A share price of £48.94 values the enterprise at £3.6 billion, about 86 times adjusted profit. A normalised earnings multiple of 32 times is not cheap by any means.

A score of six out of 10 means Renishaw is ranked 30th out of 34 companies I follow. It probably is a good long-term investment but the company’s performance is volatile and holding for the long term requires faith in the business.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.