Regime change: How manager changes impact performance

After some dramatic manager changes recently, the experts see if this might improve trust performance.

13th December 2019 15:50

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

After some dramatic manager changes recently, the experts see if this might improve trust performance.

Regime change: how manager changes impact performance

William Sobczak is an analyst at Kepler Trust Intelligence.

All leaderships come to an end at some point. With investment trusts, however, it is rarely the electorate (aka shareholders) who initiate the change in manager. In some cases it is the board. In others, it is the management company itself recognising the need for a new manager, and replacing them before the board feels the need for more decisive action.

A change instigated by the board will often result in a transformative outcome for a trust, perhaps with a change in management house as well as personnel. Changes proposed by the management company itself can be just as transformative, but can also be subtler. The aims are always the same: to improve performance for shareholders, and to stimulate demand to bring in the discount, or grow the trust through share issuance.

The last few weeks have seen some of the most dramatic changes of manager we have witnessed in recent years. Yesterday (10 December), the board of Edinburgh Investment (LSE:EDIN) announced they had dismissed Mark Barnett as manager and appointed James de Uphaugh, of Majedie.

EDIN has underperformed for the last four calendar years, with its exposure to UK domestics and other value sectors being major detractors. On 29 November, Baillie Gifford effectively took control of the portfolio of European Investment Trust, one of the last remaining value trusts in the AIC Europe sector.

The mandate being awarded to Baillie Gifford (the pre-eminent growth investment house) represents a significant change of direction, and comes after several years of a growth bull run. However, James de Uphaugh's approach is more balanced, and his portfolios currently are tilted towards similar areas as Mark Barnett's, including UK domestics, so this change to us seems more about process and personnel than a shift in strategy.

Time only will tell which of these decisive (and dramatic) switching of horses will prove successful. In the meantime, below we reveal the results of a detailed analysis on how effective past manager changes have been for investment trust.

Methodology

We reviewed all equity investment trusts which have had a change of manager over the past ten years. From this list we discounted any managers who have been running their new mandates for less than three years to date (not a sufficiently long period to determine whether the change has been a success). We also discounted those manager changes which represent no real change (for example having been co-manager for years prior). Overall this means we included 31 different trusts in our analysis, with the average tenure of the current manager being close to five and a half years.

We next took alpha and correlation statistics for the new managers since they assumed their mandates, and compared those with the previous incumbents’ track record for the five years before handover.

Performance

Being able to assess the returns of a manager, relative to the broader market and peers, is an important tool for investors. In order to do so, we use ‘alpha’. This measures a manager’s outperformance on a risk-adjusted basis, incorporating how much market risk they are taking on; this measures volatility relative to the market, but does not penalise a more differentiated strategy.

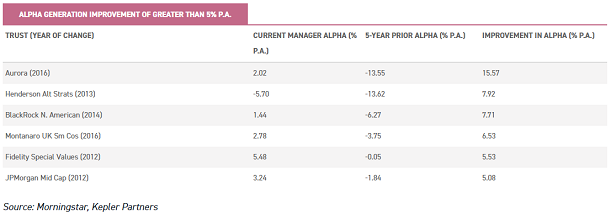

Using alpha, we found that, on average, a change of manager led to a significant improvement. Comparing the current manager’s alpha (on average 1.59% p.a.) to that of the five years prior to the change (on average -0.14%), investors benefited from an average improvement in annualised alpha of 1.74%. A new manager brought improved results for a significant majority of trusts, with 22 out of the 31 trusts in our sample experiencing an increase in alpha compared to the previous regime. Below we highlight all trusts that increased by more than 5% in annualised alpha generation.

Aurora (LSE:ARR) changed manager in January 2016, at the same time changing its management company to Phoenix Management. This resulted in a dramatic increase in the concentration of the portfolio, to just 15-20 holdings, although it maintained the same investment objective.

The current manager has generated an alpha of 2.02% in comparison to the FTSE All Share benchmark, while the previous manager’s alpha was negative over the 5-year period. We published a full note on the trust in May.

The effect has been transformational for the previously sub-scale trust, which is now issuing shares and growing.

BlackRock North American Income (LSE:BRNA) has been one of the great turnaround stories in the investment trust universe. Since 2014 the trust has been led by Tony DeSpirito, and the impact of the new manager has been stark. Since appointment, the team has generated both high levels of alpha and low levels of volatility, illustrated through the trust’s Sharpe ratio of 1.11.

The overall sample, in comparison, had a Sharpe ratio of 0.94. In an attempt to entice new investors, 2018 also saw the board shift its income policy, increasing the dividend by 61.6% and allowing a proportion of the payout to be funded from capital.

This new policy has had a dramatic impact on the discount, which first narrowed and then switched to a premium, currently 2.2%, which has allowed the board to issue shares throughout 2019.

Correlation

The reasons for a change in manager are many and varied. Anecdotally we believe that as part of the change many boards have pressed for a more active investment approach. We believe this different emphasis is very much in the interest of investors, given that the academic research suggests more active managers tend to demonstrate greater outperformance.

It is possible that there is a link between the new cohort of managers following their benchmarks less closely and generating greater excess returns for investors. Statistically, however, our study is not conclusive on this hypothesis.

We analysed the correlation of NAVs to their respective benchmarks – both before and after a change of manager – to evaluate the degree to which a trust’s manager is more active after a change in personnel. Our analysis shows that, in comparison to the five years prior to the change, NAV correlations to (sometimes new) benchmarks under new managers are not very different to those observed previously.

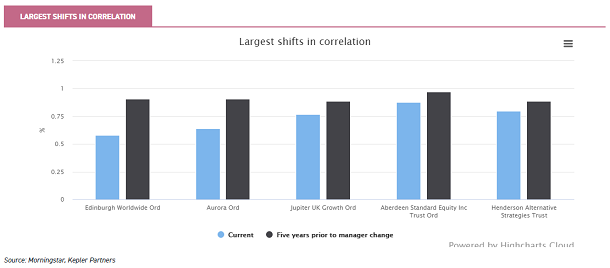

On average, our analysis shows a reduction in correlation of just 0.01%, with the current managers having a correlation of 0.86% relative to their respective benchmarks. This shows evidence of only a very small move towards a trust being more active on a change of manager. However, within the averages, some individual managers and trusts have seen decent reductions in correlation, as highlighted in the graph below.

At Edinburgh Worldwide (LSE:EWI), management of the portfolio moved from Mark Urquhart to Douglas Brodie and the rest of the Baillie Gifford Global Discovery team in 2014.

This trust saw the largest move away from the benchmark of any of the 31 companies we looked at. EWI has an active share of 99%, and despite joining at a tricky time for the trust, Douglas has delivered returns far exceeding Global and Global Smaller Companies peers.

This performance has further supported the narrowing of the discount, and the board has been issuing shares over 2019, with the trust normally trading at a premium between zero and 5%.

In the case of Fidelity Asian Values (LSE:FAS), the manager Nitin Bajaj took over in 2015. Alongside this change, the board also decided that the company was insufficiently differentiated from its peers.

As such it moved to a value strategy with a smaller-cap focus, aiming to make use of the closed-ended structure of the trust. The trust has struggled in performance terms relative to the peer group over most time periods, but continues to trade at a premium (currently 3.1%), with the board issuing shares throughout the year.

In the same way, Aberdeen Standard Equity Income (LSE:ASEI), has also seen the portfolio shift significantly away from the benchmark since the appointment of a new manager. Thomas Moore took the helm in 2011, and although he has recently been ‘scolded’ by the chairman of the trust for poor performance over the past year, since taking over he has actually increased the trust’s annualised alpha by more than 2%, from -1.2%. This illustrates the importance of the board judging the manager’s performance over a longer time scale.

Manager, management or mandate?

Within our sample of 31 trusts, there have probably been 31 (or more!) different motivations for changing the manager. We divided the changes into those which involved a change in the sign over the door (management house) and those which represented a significant change in personnel.

Of the 31 companies assessed, just nine (29%) saw the board initiate a change in management house at the same time. In the majority of cases, the change was in personnel only, though it may or may not have also involved a new direction in the investment approach or mandate.

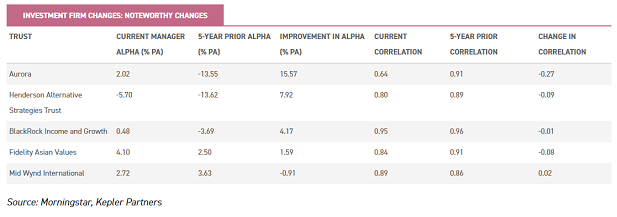

Rather contrary to what we expected, our analysis showed that trusts who appointed new management firms have generally struggled in terms of delivering significantly improved alpha.

On average, these trusts have generated an alpha of -0.80% p.a. since the new managers took over, relative to alpha of 1.84% p.a. from trusts that appointed new personnel only.

However, in terms of correlation, hiring a new firm did result in a more active approach. In comparison to the prior three years, new management companies reduced the correlation of their trusts to their respective benchmarks by 0.06%.

The overall sample saw a correlation reduction of just 0.02%. This is in line with what one might expect, with a more active approach being one of the attractions of hiring an entirely new management firm. It is interesting, though, that hiring a new firm has not necessarily paid off for boards in terms of alpha generation.

In the table below we highlight examples of pay-offs for boards hiring a new manager in a different management firm.

BlackRock took over the mandate of BlackRock Income and Growth (LSE:BRIG), previously run by RCM, in 2012. As the table above shows, this move has seen the manager’s alpha transformed. The new management team, led by Adam Avigdori and David Goldman, has also more than halved the trust’s standard deviation (relative to the prior five years).

The team has achieved a very strong track record for its open-ended fund, which holds the impressive record of being the only UK OEIC that has increased its distribution each year for 30 years. The solid performance is yet to be truly recognised in this relatively small trust (£50 million), which for most of 2019 has traded on a discount of between zero and 5%. Currently the discount is 5.5%.

For Mid Wynd (LSE:MWY), the Artemis Global Select team, Simon Edelsten, Alex Illingworth and Rosana Burcheri, won the mandate and started managing the trust on 1 May 2014. They replaced Baillie Gifford’s Michael MacPhee, who had run the trust since 1998. Although the five-year numbers have seen a marginal reduction in alpha (due to the strong performance in 2009 and 2010), relative to the three years prior, the manager has actually seen a whopping alpha increase of 4.81%. The new managers set out to outperform over the long term by profiting during rising markets, and then protecting capital where possible when markets fell. They use an unconstrained approach to stock-picking, and are highly active. We view the trust as a core holding for investors, offering smoother equity returns than Global peers. Since 2014 the trust has successfully grown the number of shares in issue by over 70%, representing something of a vote of confidence in the board’s original decision to award the mandate to Artemis.

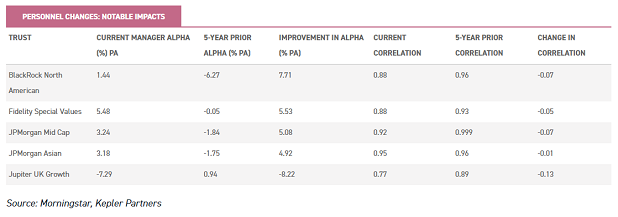

In contrast to situations where the board has appointed a new firm as manager, many of the trusts within our analysis (22 out of 31) have changed or evolved the management personnel, but kept the existing firm. In some cases, this approach has resulted in a quite remarkable change in the fortunes of the trust – mostly good, but sometimes terrible. In the table below we highlight those trusts in this category which we believe particularly stand out.

Aside from those we have already mentioned above, two trusts that stand out from this analysis are Fidelity Special Values (LSE:FSV) and Jupiter UK Growth.

Fidelity Special Values has seen a huge improvement in alpha generation. The manager, Alex Wright, took over the portfolio in September 2012 and, although the mandate did not change, the board announced they were keen to take greater advantage of dynamic smaller and mid-cap companies. The difference in alpha generation is clear, with Alex generating an annualised alpha of 5.48%, compared to negative 5-year numbers under the previous incumbent. Impressively, this turnaround has also been achieved with significantly lower levels of volatility. Again the strong performance of the new manager has helped the trust narrow its discount, allowing the board to issue shares in recent times.

Jupiter UK Growth (LSE:JUKG) on the other hand, is a situation where a new manager (and in this case, strategy) has unfortunately had the opposite effect. Steve Davies took over the former Jupiter Primadona investment trust in April 2016. The move held good promise, with the new manager adopting a concentrated stock-picking approach to UK equities.

The impact of the Brexit vote meant Steve got off to a poor start, but after a moderate performance the board has been in no mood to forgive the recent impact of large positions in Thomas Cook (LSE:TCG) and Sirius Minerals (LSE:SXX). In October, then, the board announced that it will be making changes to the trust’s strategy or its management group, or possibly both. We expect an announcement soon.

Conclusion

Having an independent board is one of the key advantages for investors in closed-ended funds over open-ended funds. With independent oversight, managers are truly answerable to investors’ long-term goals, as opposed to the best interests of a management firm.

Our analysis shows that changing a poorly performing manager can have a significantly beneficial impact on a trust which is struggling. In particular, we have shown that new managers often deliver improved alpha generation. However, in contrast to what we expected, on average it has been personnel changes without a change to the management company that have had the most beneficial impact.

An example of how well this approach can work came in 2015 when Gerald Smith was replaced as manager of the Monks trust by the Global Alpha Growth team; but without the trust leaving the Baillie Gifford stable.

The resulting improvement in performance saw the discount narrow from the mid-teens – once investors had developed confidence in the new approach – before switching to the current premium rating.

Baillie Gifford has recently won two trust mandates from other managers in the UK (from Schroders) and in Europe (from Edinburgh Partners). Whether the history of Monks will repeat itself for these latest trusts – with a narrowing discount accompanying a significant improvement in performance – only time will tell.

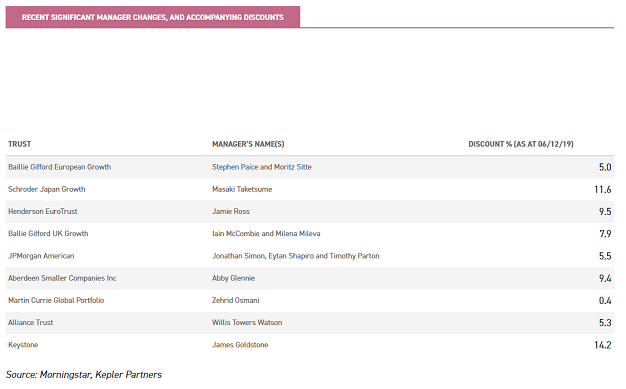

In the table below we highlight a number of trusts that have seen more recent management changes. The performance track records of these managers was too short to be included in our analysis. If performance is strong, and remains so, the discounts that they currently trade on could – in time – be a thing of the past.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.