The reasons why out of all the shares I bought this one

Share Sleuth’s intention is to hold the shares for at least a decade. Here’s his newest acquisition.

5th August 2020 10:16

by Richard Beddard from interactive investor

Share Sleuth’s intention is to hold the shares for at least a decade. Here’s his newest acquisition.

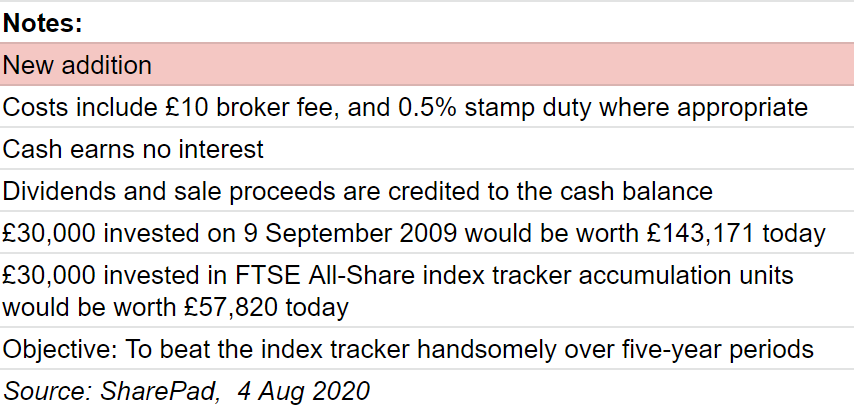

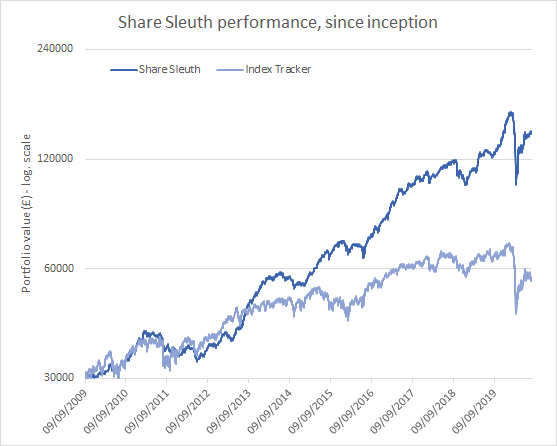

Although interactive investor has published the Share Sleuth portfolio for many years, it has always waited for Money Observer magazine to publish it first.

One of the delights of reading the magazine was the clatter of the letterbox, the opening of the biodegradable packaging, and the appreciation of the work of many contributors packaged tightly within.

The penalty was the time it took to produce the package, which means the Share Sleuth update was always a few weeks old by the time readers performed our monthly ritual.

Money Observer has closed and from now on Share Sleuth will be published directly on interactive investor and bang up to date - as long as you remember to come and read it in the first week of the month.

Share Sleuth has always had a second home at interactive investor. Most of my research is published here, and this research informs the trades in the model portfolio.

Happily I can demonstrate, because I traded in July.

New addition: D4t4

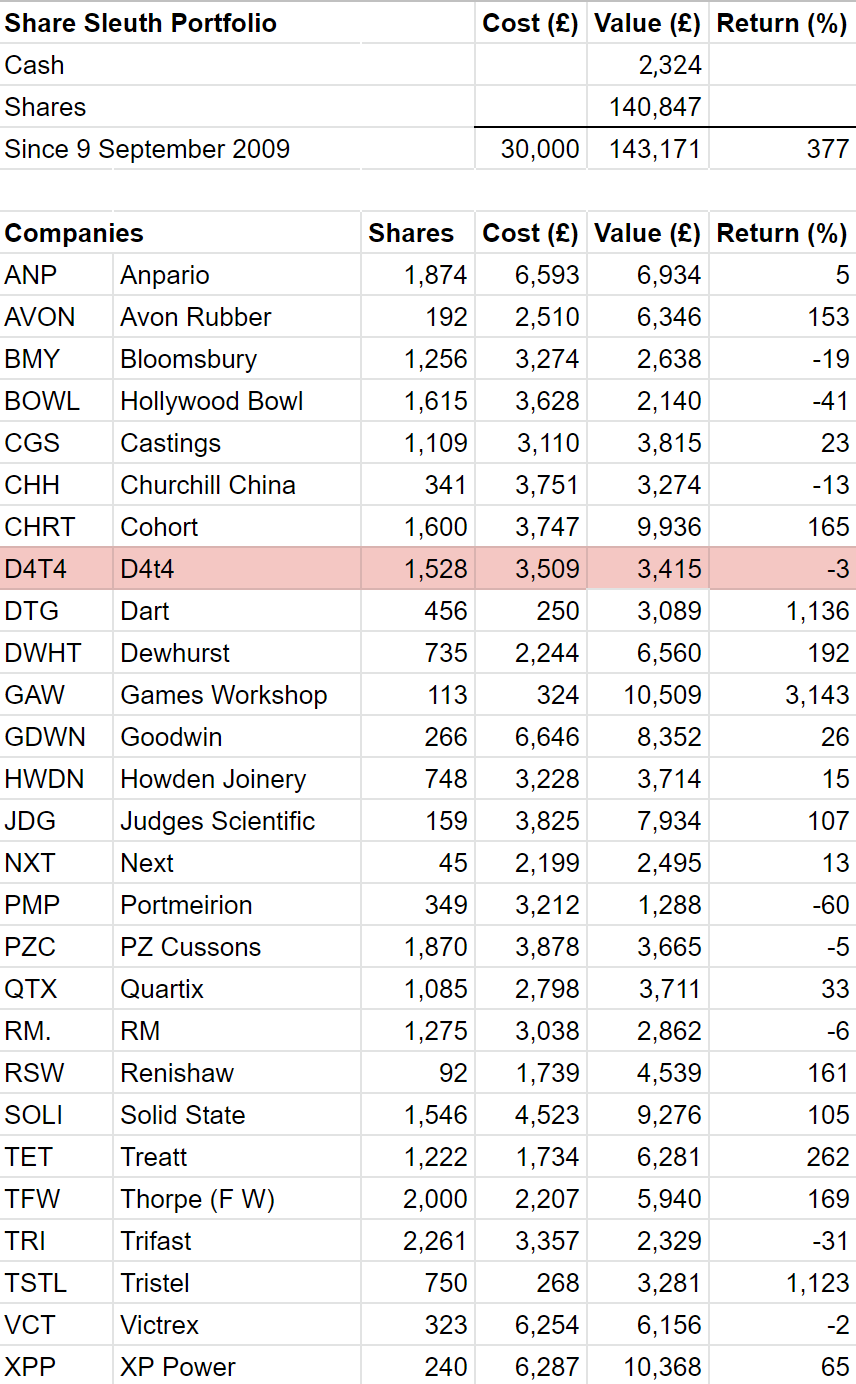

On 27 July, I added 1,528 shares in D4t4 (LSE:D4T4) to the Share Sleuth portfolio at a share price of 229p, the actual share price quoted by a broker. The total cost of the transaction was £3,509 including £10 in lieu of broker fees. D4t4 is a company that sells software that captures data about our behaviour as we use websites.

As usual, I only committed 2.5% of the portfolio’s total value, which was about £140,000 on the day. Trading in relatively small amounts gives me scope to add more shares in future as I get to know D4t4 better, or indeed back out relatively gracefully. Backing out is not my intention though. My intention is to hold the shares for a decade at least.

Following the trade, Share Sleuth has about £2,000 in cash, which can only be augmented by dividends and sales. Dividends are hard to come by during the pandemic and in July the portfolio received them from just two companies, Judges Scientific (LSE:JDG) and Anpario (LSE:ANP).

Since the level of cash is well below 2.5% of the value of the portfolio, my trade size, it is highly likely the next trade will reduce a holding or remove it entirely from the portfolio.

The portfolio now has 27 members, high by past standards, although I have never had the courage to reduce it to below 20.

Why D4t4, out of all the shares available?

When we invest in a company, we are choosing it above all the others available to us, which is essentially an act of comparison. This is how I chose D4t4:

First, I scored the company, measuring it up against the same five criteria I measure all shares: profitability, risk, strategy, fairness and value.

Then I shuffled D4t4 into the pack, all the shares I follow closely enough to score, and sorted it so I could see how it compared to all of the others I follow. Companies with the highest scores are, in my mind, probably the best long-term investments.

Stage three follows the scoring and the sorting. It is, of course, the trade, which you are reading about today.

On 27 July, D4t4 was the third most attractive share but the two higher ranked shares (Dewhurst (LSE:DWHT)and Victrex (LSE:VCT)) were not available to the Share Sleuth portfolio. Both are stalwarts already worth about 5% of the portfolio’s total value.

According to the formula that tells me how much to invest in each company I could invest more in these shares, but not as much as 2.5% of the portfolio’s value, my trade size. Any trade smaller than this would not have much impact. It would be frittering away at the edges of the portfolio.

The maths is relatively straightforward and coded into a spreadsheet.

Dewhurst, the highest ranked share, has a score of 9 (out of 10). I use the score to determine the ideal size of a holding as a percentage of the total value of the portfolio. The ideal size as a percentage is 75% of the score, so 6.75% in the case of Dewhurst (9*0.75).

The higher the score, the bigger the holding. 6.75% of £140,000, the portfolio’s value on 27 July when I chose D4t4 over Dewhurst, is £9,450, greater than the value of Share Sleuth’s Dewhurst holding (£6,500) but the difference, £2,950, is less than my trade size, £3,500, so I did not add more shares.

Dewhurst’s share price would not have to fall much for it to become available to me, but it is not currently in the "buy zone".

I would not normally trade a share when it exceeds its ideal size either, unless it exceeds it by more than the minimum 2.5% trade size. That means holdings can grow to a maximum of 10% of the portfolio’s value in the unlikely event they score 10/10.

That is the ideal size (7.5%) plus the trade size (2.5%).

Occasionally I let them grow even bigger, but not much.

Richard owns shares in all of the companies in the Share Sleuth portfolio.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.