Raspberry Pi shares surge on UK stock market debut

Pricing the microcomputer maker at the top of the indicative range valued the UK business at over half a billion pounds. It’s worth much more than that now amid huge demand. City writer Graeme Evans reports.

11th June 2024 13:35

by Graeme Evans from interactive investor

Retail investors who took the maximum slice of Raspberry Pi Holdings (LSE:RPI) in the UK’s biggest IPO of the year were today sitting on a £300 paper profit in the first hours of conditional dealings.

Allocations were capped at 365 shares per applicant, equivalent to £1,022, as demand for the offer via interactive investor and other intermediaries far outstripped supply.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Top UK Shares

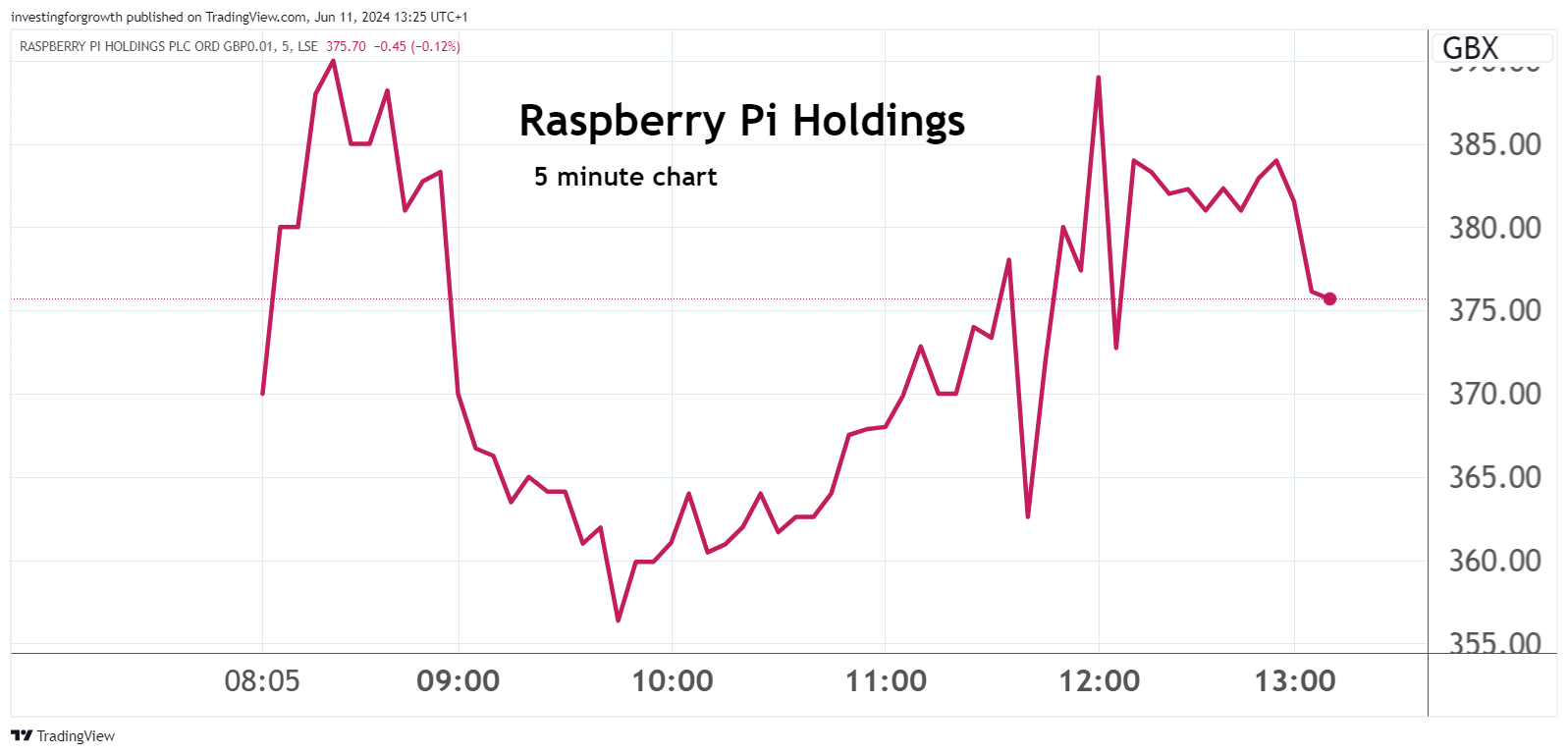

Shares were priced at the top end of their 260-280p indicative range for an opening valuation of £541.6 million. They then jumped by 40% to a high of 392p before settling at 370p by lunchtime, up a third on the issue price.

Source: TradingView. Past performance is not a guide to future performance.

Trading is under way on what’s called a conditional basis, with unconditional dealings getting under way at 8am on Friday, when the stock will be admitted to the premium segment of the London market.

In contrast to some of the new issues during 2021’s boom year for IPOs, retail investors have been able to capture the upside of today’s opening day bounce after the offer was made available to intermediaries through Peel Hunt’s REX portal.

This element of the IPO was materially oversubscribed, with orders received exceeding the eight million euros (£6.75 million) threshold. The enthusiasm was shared by institutional buyers in a sign that the London market can be the home for more technology-focused listings.

The strength in demand also reinforces confidence that the wider IPO market is finally picking up speed after a barren couple of years for stock market debuts.

- Top picks in UK tech sector named

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Peel Hunt said yesterday it expects an increasing number of flotations in the second half of the year before a broader re-opening in 2025.

The second edition of its IPO speedometer, which gives a score between 0 and 60 based on more than 30 qualitative and quantitative inputs, puts the new listings market in second gear with a reading of 27 mph. That compares with 24 mph in April.

The City bank added: “What has so far been a European-led IPO recovery has started to spread to the UK. Although the number of announced or priced UK IPOs remains small, it is positive to see the activity levels gradually increasing.

“Broader market indicators continue to improve and the market remains open for select issuers.”

Recent IPO speculation has focused on the potential London listing of Chinese-founded fast fashion chain Shein, which is reportedly set for a record-breaking $66 billion (£52.3 billion) flotation later in the summer.

However, the Sunday Times said this week that the number of shares being sold is likely to fall short of the minimum required for inclusion in the FTSE 100.

- Stockwatch: Aviva shares remain a priority for income investors

- Insider: directors spend £1.4m on two FTSE 100 stocks

London’s blue-chip index is also unlikely to see the return of Boots after Bloomberg reported that its US-based owner Walgreens Boots Alliance Inc (NASDAQ:WBA) is in talks over selling the retail chain to private equity firms or other potential buyers.

Private equity firm CVC Capital Partners (EURONEXT:CVC) listed in Amsterdam in April, while the owner of Cambridge-based ARM Holdings ADR (NASDAQ:ARM) chose New York for last year’s $55 billion listing.

The stock market listing by Raspberry Pi comes at the second attempt after a previous move in 2021 was scuppered by the impact of the global semiconductor shortage.

Its valuation now stands at £700 million, which means the Cambridge-based business will be large enough to enter the FTSE 250 index.

The maker of high-performance, low-cost general-purpose computing platforms began trading in 2012 and has sold over 60 million units for industrial internet-of-things purposes, as well as to enthusiasts and educators in markets worldwide.

The 7.4 million sold in 2023 led to revenues of $265.8 million (£210.5 million) with gross profit of $66.million (£52.3 million).

The company is a subsidiary of the Raspberry Pi Foundation, a UK charity founded in 2008, with the goal of promoting interest in computer science among young people. It has distributed approximately $50 million in dividends to the charity since 2013. Other strategic shareholders include Sony and Arm.

Chief executive Eben Upton said: “Welcoming new shareholders alongside our existing ones brings with it a great responsibility, and one that we accept willingly, as we continue on our mission to make high-performance, low-cost computing accessible to everyone.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.