‘Protective diversifiers’ remain on the defensive

Despite the rally this year, a handful of investment trusts appear well placed to offer protection if equity markets suffer another dip and inflation remains higher for longer.

15th September 2023 14:53

Within the flexible investment sector, we consider four investment trusts to be ‘protective diversifiers’: Ruffer Investment Company Ord (LSE:RICA), Capital Gearing Ord (LSE:CGT), Personal Assets Ord (LSE:PNL)and RIT Capital Partners (LSE:RCP).

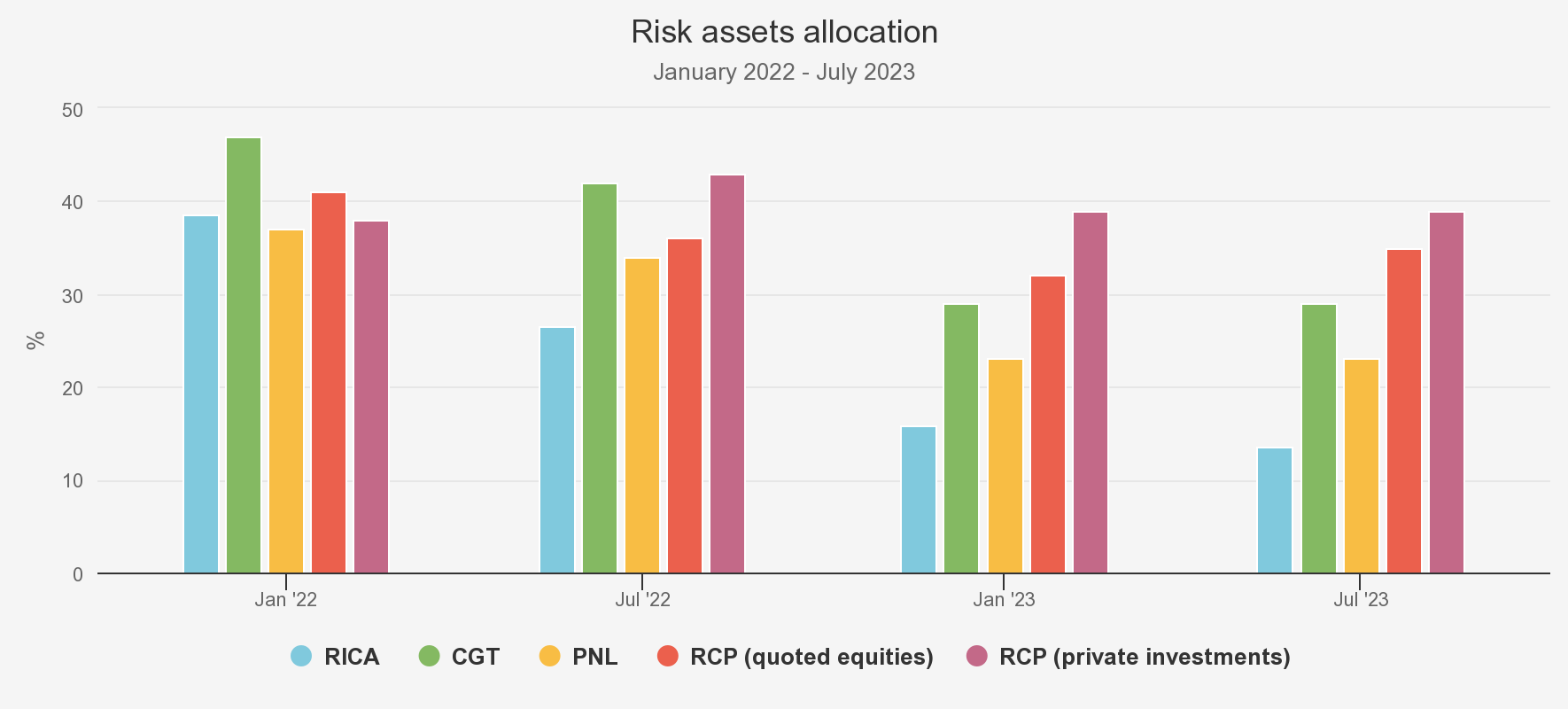

Their long-term absolute-return focus means the managers invest in an unconstrained manner across multiple asset classes. The chart below illustrates how significantly reduced their equity exposure is since the start of 2022. RICA managers Duncan MacInnes and Jasmine Yeo have made the most notable reduction in equities, which have fallen from 38.6% to 13.5% of their portfolio. However, this was an allocation decision shared by Sebastian Lyon at PNL and Peter Spiller and the team at CGT. Sebastian has reduced PNL’s equity exposure from 37% to 23% and Peter has maintained a low equity allocation of circa 15% and reduced overall exposure to risk assets, largely equities and funds, from 47% to 29% over this period.

- Invest with ii: Top Investment Trusts | Sustainable Funds List | Transfer an Investment Account

EVOLUTION OF EQUITY ALLOCATIONS

Source: RICA, CGT, PNL and RCP

We would argue that the foundation for the decisions to reduce their allocation to equities is the same across these three trusts. The managers of the three trusts all believe that we are now in a period of structurally higher inflation and hold significant allocations to index-linked bonds, in part to protect against the inflationary environment they anticipate. Additionally, all three managers are bearish on the outlook for equity markets.

Sebastian Lyon argues that high interest rates mean an end to the ‘there is no alternative’ (TINA) era, meaning investors now have an attractive alternative to equities, resulting in a reduction in his trust’s equity allocation to a level equal to its historical lows at 24%. Like the managers of RICA and CGT, he is concerned that a hard landing – i.e. a serious recession – will result from the rapid increase in interest rates.

The chart above highlights an obvious exception to this reduction in risk assets, namely RCP. RCP has seen little movement in its quoted equity allocation over this period, although we note it remains at its lowest exposure for more than a decade. RCP has built up substantial holdings in private equity over recent years, which we would argue have to be considered alongside the public equity exposure as ‘risk assets’, even if their valuations may remain more stable than public equities from day to day.

Below, we show how the four trusts have fared since markets began a significant sell-off at the start of last year. RICA performed particularly well during 2022, thanks to the tactical management of duration and the use of protective derivatives. PNL benefitted in a falling market from a historically high allocation to highly liquid short-dated UK and US government bonds, while the gold allocation was protective too. CGT struggled, thanks largely to high duration, particularly during the market disruption following the Truss/Kwarteng mini-budget. RCP saw the worst performance in 2022, reflecting the higher allocation to public equities and losses taken in the private book, which are exposed to China and technology, two themes which were particularly under pressure last year.

NAV PERFORMANCE STATISTICS

| INVESTMENT | 01/01/2022 - 31/08/2023 (%) | 01/01/2022 - 31/12/2022 (%) | 01/01/2023 - 31/08/2023 (%) |

| Ruffer Investment Company (RICA) | -0.9 | 7.6 | -7.9 |

| Capital Gearing Trust (CGT) | -5.6 | -3.5 | -2.2 |

| Personal Assets (PNL) | -2.3 | -3.6 | 1.3 |

| RIT Capital Partners (RCP) | -12.1 | -13.3 | 1.4 |

| iShares MSCI ACWI ETF | 0.5 | -8.1 | 9.1 |

Source: Morningstar, as at 31/08/2023. Past performance is not a reliable indicator of future results.

These exposures are more sensitive to interest-rate movements. The sharp correction over 2022 meant RCP’s managers had to write down a portion of the significant gains attributed to the tech-focussed private markets allocation, detracting 6% from NAV. However, we feel it is important to note that over a three-year period up to the end of 2022, this allocation contributed 26% to NAV. Additionally, this year-to-date, RCP has performed the strongest against its peers; in fact, in simple terms, the higher the allocation to growth equities, the better the performance has been in 2023. While RCP therefore doesn’t have the same defensive profile as the other trusts, it does arguably look likely to protect better against one outcome in markets: a rapid rate-cutting cycle.

2023 has seen global equity market gains be driven by US large-cap tech and euphoria around artificial intelligence, making it more challenging for protective strategies, whose managers have maintained a very low level of risk assets. The view of the managers of RICA, PNL and CGT is that they are positioned for a lower-growth environment, with structurally higher inflation and interest rates. Therefore, RICA has a low equity allocation of 13.5%, as at 31/07/2023, and very low exposure to large-cap tech. Instead, the risk-on exposure has been focussed in the commodity and energy space and the China reopening trade. Neither has played out as expected, with China’s reopening disappointing so far, leading to a pull-back in performance of 7.9%.

PNL’s equity exposure has been more helpful. Sebastian avoids capital-intensive, cyclical businesses, such as banks, oil majors and minors, which performed well over 2022. However, the focus on high-quality sustainable businesses, that have competitive advantages to enhance the pricing power and the sustainability of cash flows over the long term, provided some ballast. Furthermore, Sebastian was also positioned to capture some of the rally in 2023, through holdings in Microsoft Corp (NASDAQ:MSFT) and Apple Inc (NASDAQ:AAPL), which have generated year-to-date returns of 38% and 42% respectively, as at 31/08/2023. One detractor from CGT’s returns has been the holdings in closed-ended funds, which have largely seen discounts widen, even if NAVs have performed well.

Duncan, Jasmin and the team at Ruffer believe there is a strong possibility of a liquidation event and are positioned for a further sell-off in equity markets as a result of the rapid rate hikes across western economies, which could lead to capital being pulled out of the banking system and invested into safer, higher-yielding short-dated assets (see recent note). They believe that if such an event were to occur, the higher levels of liquidity in the portfolio would mean that they would be positioned to lean back into risk assets should the opportunity present itself, either through cheaper valuations or if a more optimistic macroeconomic outlook developed – a similar view held by the managers of PNL and CGT. In fact, CGT’s team have started to see value in the investment trust universe and are looking to increase buying activity, not just due to wider discounts on equity trusts, but also opportunities in infrastructure assets, such as Greencoat UK Wind (LSE:UKW) and HICL Infrastructure (LSE:HICL), which they judge to be offering prospective nominal returns of circa 10% per annum. However, they are aware of the idiosyncratic regulatory risk, power-price risk and their higher interest-rate sensitivity compared to the equity market. Despite this, they argue that the rates on short-duration government bonds, Treasury bills and corporate credit continue to offer shelter against what are expensive markets, alongside a 2% real (ahead of inflation) yield - in CGT’s case, driven by their allocation to TIPS.

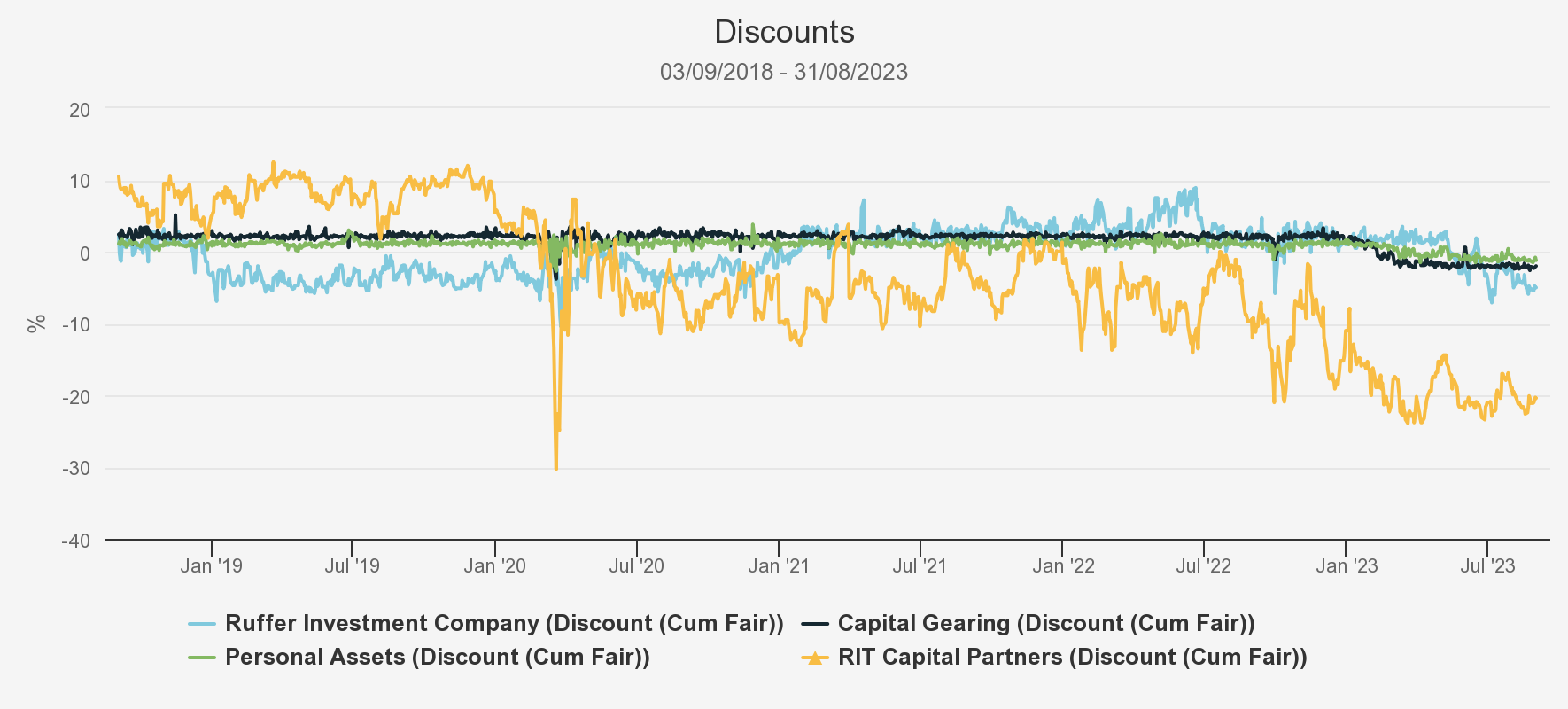

All these protective trusts have struggled in at least one of the past two years and, perhaps as a result, discounts have widened out significantly from their longer-term averages. For RCP, this has been more significant since the start of 2022, which we believe reflects investor sentiment on the exposure to private markets (we note that listed private equity trusts currently trade at historically wide levels in discount terms). However, this has occurred more recently over 2023 for RICA, PNL and CGT, as illustrated in the chart below. Taking a long-term view, we think the wider discounts could be an attractive entry point. All have attractive long-term track records of delivering good returns with low volatility.

FIVE-YEAR DISCOUNTS

Source: Morningstar

Conclusion

While returns have been mixed since the markets began to sell off in early 2022, we think these defensive trusts still have a useful role to play in a portfolio. If inflation does remain higher and more volatile for longer, RICA, PNL and CGT look placed to offer protection if equity markets react with another leg down. RCP looks better set up to perform well if rates were to be cut sharply, while CGT also has arguably greater duration in its portfolio, not least through the investment trust holdings. Arguably, given the subtleties of some of the underlying positioning, a combination of these strategies may provide an optimal solution.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.