Percentage-based investment charges: an indecent proposal?

22nd March 2023 15:04

by Myron Jobson from interactive investor

Your choice of investment platform can be just as important as your choice of ISA investment, says interactive investor's Myron Jobson.

As the end of the tax year on 5 April draws closer, it’s important to remember that your choice of investment platform can be just as important as your choice of ISA investments.

We recently wrote a paper demonstrating that ‘value for money’ is a hugely important consideration for many investors.

That included investment platform costs and charges. In particular, our paper highlighted that many private investors would prefer a fixed subscription-like fee rather than a percentage fee.

Percentage fees rely on cross subsidies, where one group of customer pays a higher price than another for exactly the same service.

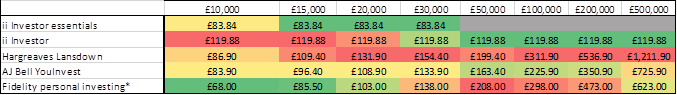

If you struggle to work out how much you are paying in charges on your ISA, it might be because the investment firm don’t want you to know! And you don’t need to take our word for that. Just look at the comparison table below calculated by independent consultancy The Lang Cat.

*Based on charges applying from 1 February 2023. Source: the lang cat

Notes on calculations: we look at the cost of investing on platform for one year. Calculations include ongoing platform fess, any additional wrapper charges, opening fees and trading where applicable. This table assumes investment in an ISA making four trades (buys or sells) in the year – two funds, two equities.

It also includes regular monthly investing into one fund and one equity.

Data is based on publicly available charging structure information with some details verified via conversations with platforms January 2023

An indecent proposal? You decide.

Cross-subsidisation occurs when a firm charges one group of customers more (astronomically more in some cases, in order to subsidise the provision of the same or similar service to another group of its customers. In the case of investment platforms, this will inevitably mean that customers who have more money invested will effectively be paying for the services provided to other customers who have less invested.

But let me tell you a secret: it doesn’t cost us much more to administer a large portfolio or place a larger trade. And yet if you look at our largest competitor, the difference in charges between a £500,000 ISA account and a £50,000 account is over £1,000 in just one year, with the £500,000 account paying a massive wealth tax. How can that possibly be the case?

Is that you? Are you one of those customers paying well over the odds to subsidise others?

As you’ll see from the table above comparing costs, ii now have a product – Investor Essentials – specifically tailored for those customers with investment amounts up to £30,000. Historically, flat fees were expensive at smaller investment amounts compared to percentage charges, however, that price difference is no longer material.

Because we now have two distinct propositions tailored for different investment amounts, there are no unfair cross-subsidies at play: people who want lower fees of £4.99 versus £9.99 don’t get a free Junior ISA, and they don’t get a fee monthly trade. This means that our other customers are not inadvertently cross-subsidising these lower monthly fees. But they do get free regular monthly investing, so it is really good for regular investors.

In other words, no smoke and mirrors.

Many of the firms that charge percentage fees actually realise their structures and core product costs are inherently unfair and therefore cap their fees when pot sizes get very high. Some people call these caps ‘decency limits’, however in many cases they are far from decent as the limits only come into play when investments reach into the high hundreds of thousands, and millions in some cases.

We would urge people to carefully review the fee structure of any firm they are considering and if they choose to go with that firm, make sure they are happy to be subsiding other customers over time as their investment grows. And if that sounds ridiculous, we agree!

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.