Pension ‘trump cards’ launched by interactive investor

14th December 2021 10:18

by Rebecca O'Connor from interactive investor

More than 25 ways to describe a pension, research finds.

What’s in a name? If you are talking about a pension, it turns out, quite a lot.

Research from Opinium on behalf of interactive investor, the pension platform, reveals that when asked what term people would use to describe their pension, respondents came up with more than 25 alternative ways to describe the type of pension they currently have.

25 ways ii survey respondents described their pension type (most common):

Final salary | Private | Self-invested personal pension/SIPP | Workplace | Career average |

Civil service | Company | Default | Defined benefit | Defined contribution |

Money purchase | Salary related | Disability | Employer | Railway |

Government | Armed services | Local government | NHS | Occupational |

Personal | Public sector | Stakeholder | Teachers | Work |

Some used other words to describe their pension when asked, such as:

Insufficient | Excellent | Expensive | Fair | Modest |

Monthly | Manageable | Safe | Traditional | Worthwhile |

A few came up with some fairly creative language to describe their pensions, too:

- “defined contribution – pay and pray”

- “stock market Ponzi scheme”

- “I pay 5%, my employer pays 8%: it’s rubbish”

Pension ‘trump cards’

To make sense of the many types of pension and how they vary, interactive investor has produced a ‘pension trumps’ pack (see below) – an educational tool designed to inspire a conversation about the value of pensions and the variety of arrangements.

Retirement income potential, investment growth potential, investment choice (including sustainable options), inheritability and access & control are the features we have chosen to compare. Some variables, such as charges and service level, are more dependent on the provider rather than the type of pension, so we have excluded them. The pack is designed to give a rough idea of what to expect from different pension arrangements, rather than be a definitive guide.

The scores are general and accept some degree of variability within each type. Retirement income and investment growth potential are to some extent linked, so where there is a higher score for investment growth potential there will probably also be a higher score for retirement income.

Becky O’Connor, Head of Pensions and Savings, interactive investor, said: “What people hear when you say the word ‘pension’ can be subjective and based on their own experience of saving for retirement to date.

“For some, a pension is ‘excellent’; for others, it is ‘insufficient’. The type of pension someone has; the generosity of their employer or past employers and also, perhaps, their age, contribute to the different perceptions as well as eventual outcomes. An older person who has only ever had defined benefit schemes is perhaps more likely to have a favourable view and experience of pensions than a younger person who has always been self-employed.

“We’ve designed the pension trumps game as a bit of fun but hopefully with genuine educational benefit. We also hope it will spark a bit of discussion around what is the best type of pension arrangement and prompt action among some who may be feeling a bit disconnected from their pension.

“The classic ‘trump’ pension is a defined benefit, final salary scheme. Sadly, few such schemes are open to new members anymore. But even this type has a disadvantage when it comes to inheritability, as these pensions might only be inherited at a reduced rate by a spouse, but not by surviving children when the spouse dies.

“Defined contribution schemes, despite the general inferiority of the retirement income you can expect when compared with defined benefit schemes, do come with the advantage of the ability to pass them down to future generations, inheritance tax-free.”

“While there may be many permutations and perceptions of a pension, the ability to move to different types of scheme can be limited by certain guarantees and requirements to take advice, as well as employment status and how much you have in your pots. So there’s an element of ‘what you get is what you get’ about workplace schemes, while there is more freedom with personal pensions, including SIPPs.”

Play Pension ‘trumps’

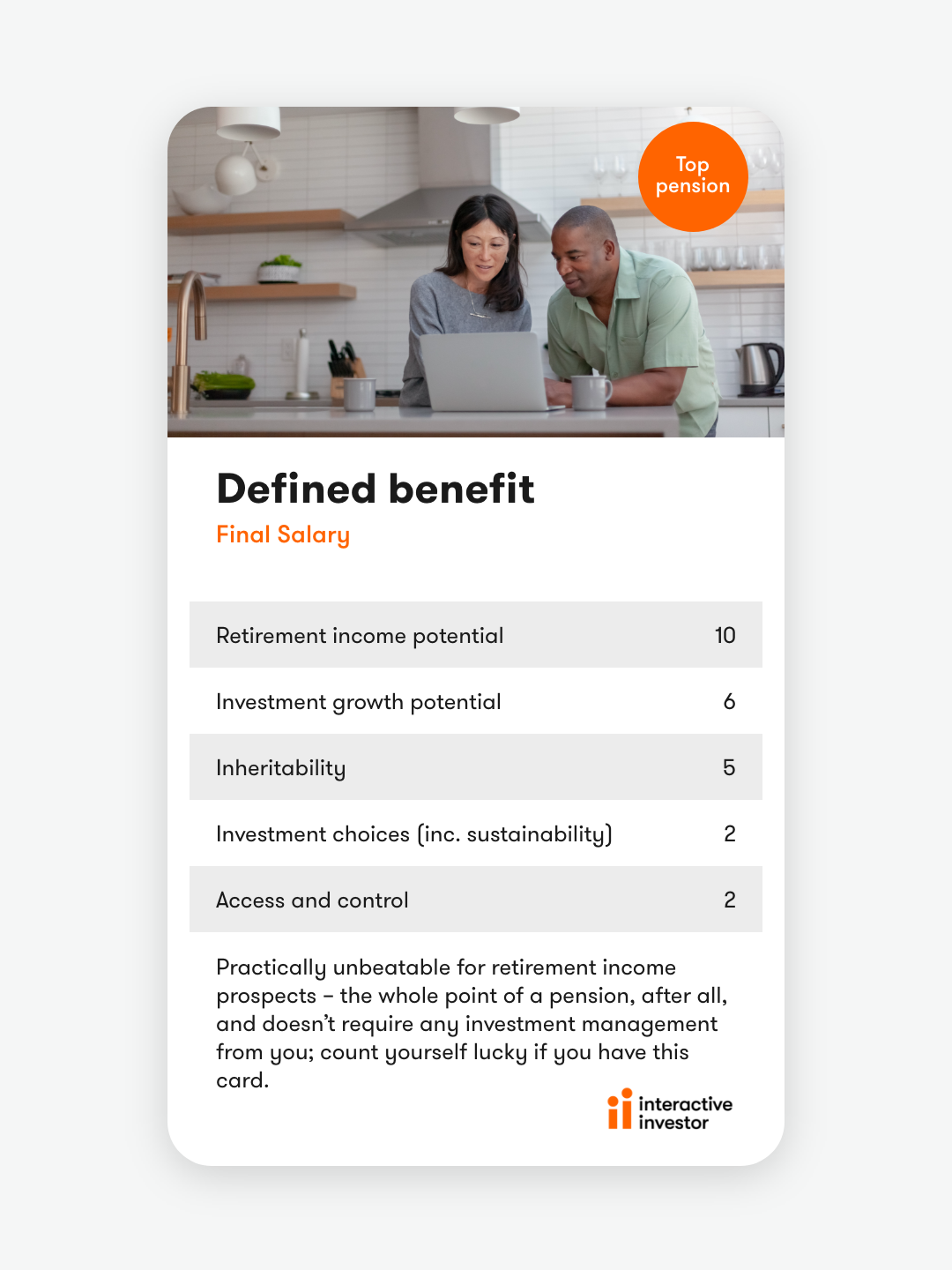

Defined benefit, final salary

(TRUMP CARD)

Retirement income potential: 10

Investment growth potential: 6

Inheritability: 5

Investment choices (inc. sustainable): 2

Access and control: 2

Practically unbeatable for retirement income prospects – the whole point of a pension, after all, and doesn’t require any investment management from you; count yourself lucky if you have this card. A spouse might be able to inherit your pension when you die, but at a reduced rate. It couldn’t be passed on to adult children afterwards.

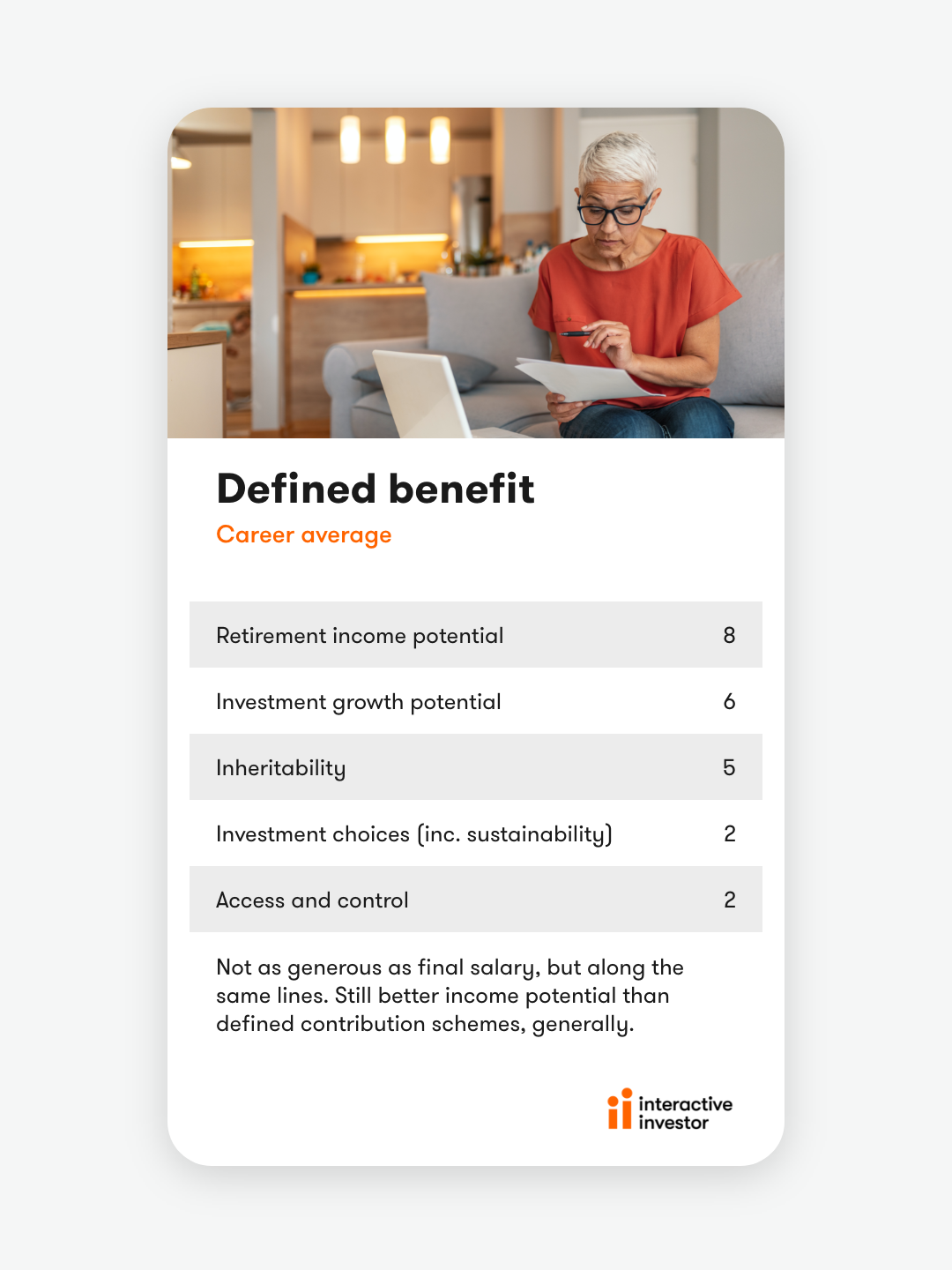

Defined benefit, career average

Retirement income potential: 8

Investment growth potential: 6

Inheritability: 5

Investment choices (inc. sustainable): 2

Access and control: 2

Not as generous as final salary, but along the same lines. Still better income potential than defined contribution schemes, generally.

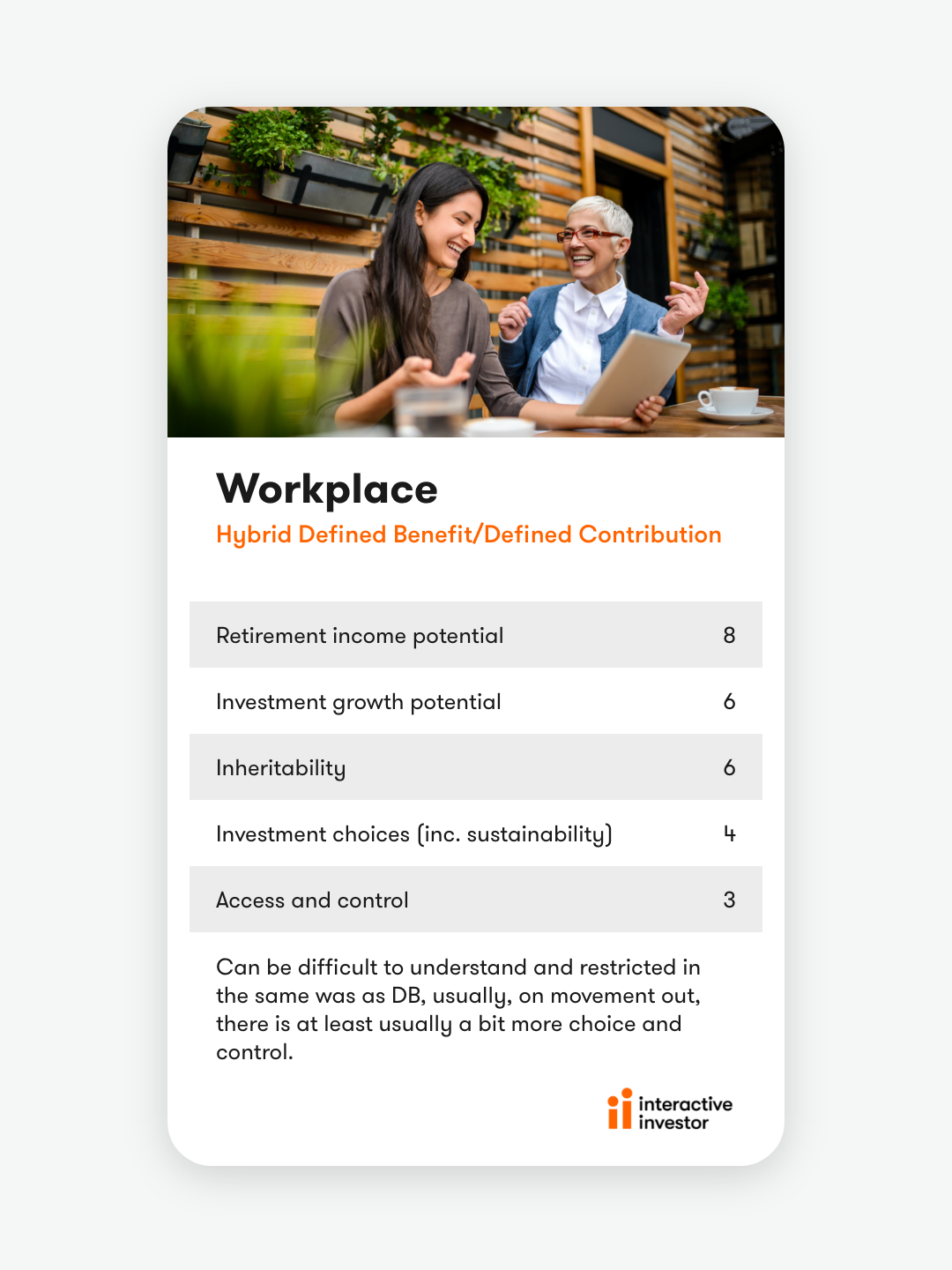

Workplace: ‘hybrid’ DB/ DC

Retirement income potential: 8

Investment growth potential: 6

Inheritability: 6

Investment choices (inc. sustainable): 4

Access and control: 3

Can be difficult to understand and restricted in the same waY as DB, usually, on movement out, there is at least usually a bit more choice and control.

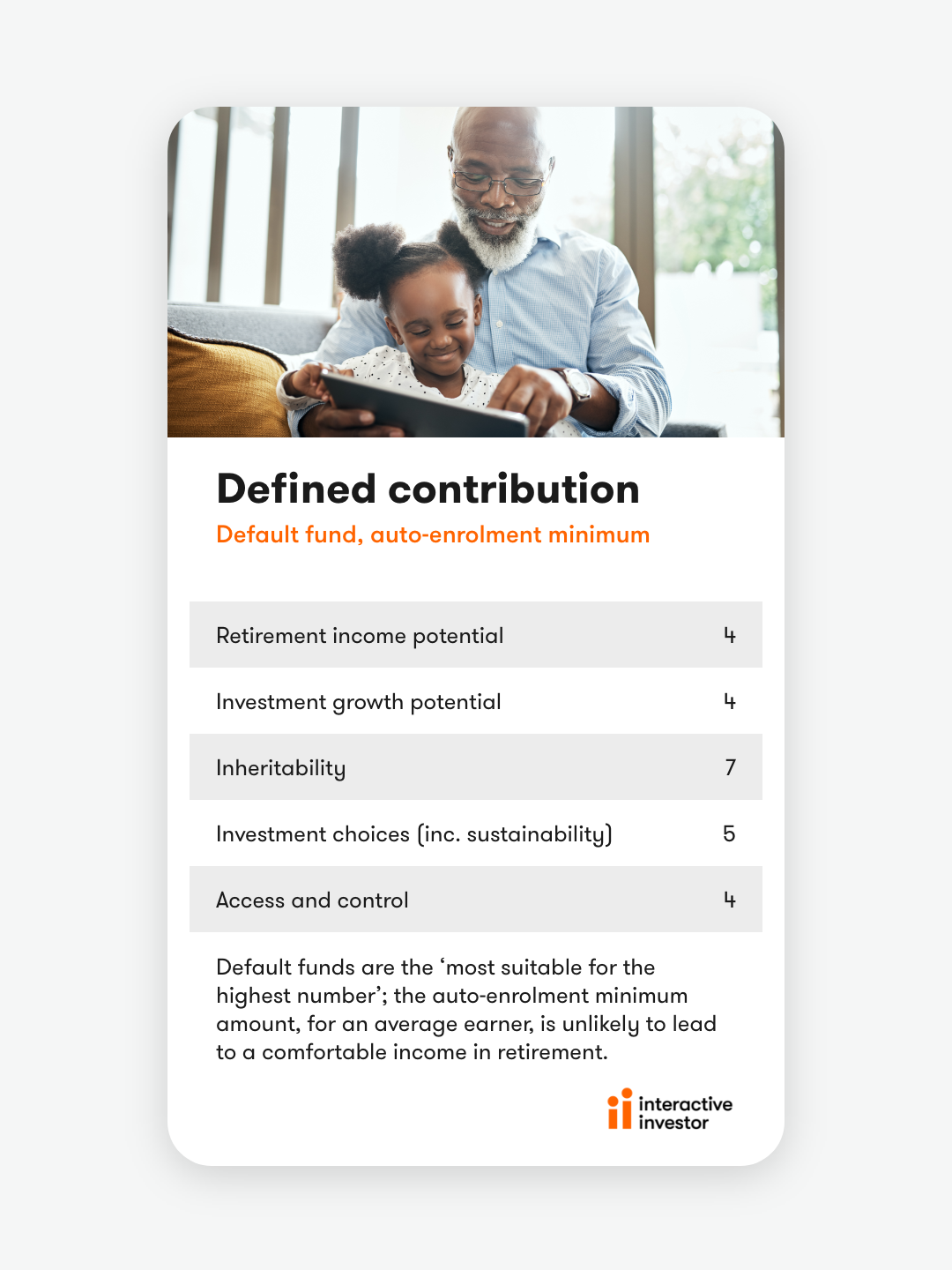

Defined contribution, default fund, auto-enrolment minimum

Retirement income potential: 4

Investment growth potential: 4

Inheritability: 7

Investment choices (inc. sustainable): 5

Access and control: 4

Default funds are the ‘most suitable for the highest number’; the auto-enrolment minimum amount, for an average earner, is unlikely to lead to a comfortable income in retirement. Something is better than nothing. Marked down for inheritability as although they usually can be passed on, there’s not likely to be much left in the pot for relatives. You can usually switch out of default funds to others even with the same provider, so there is some choice, even if you don’t especially want it.

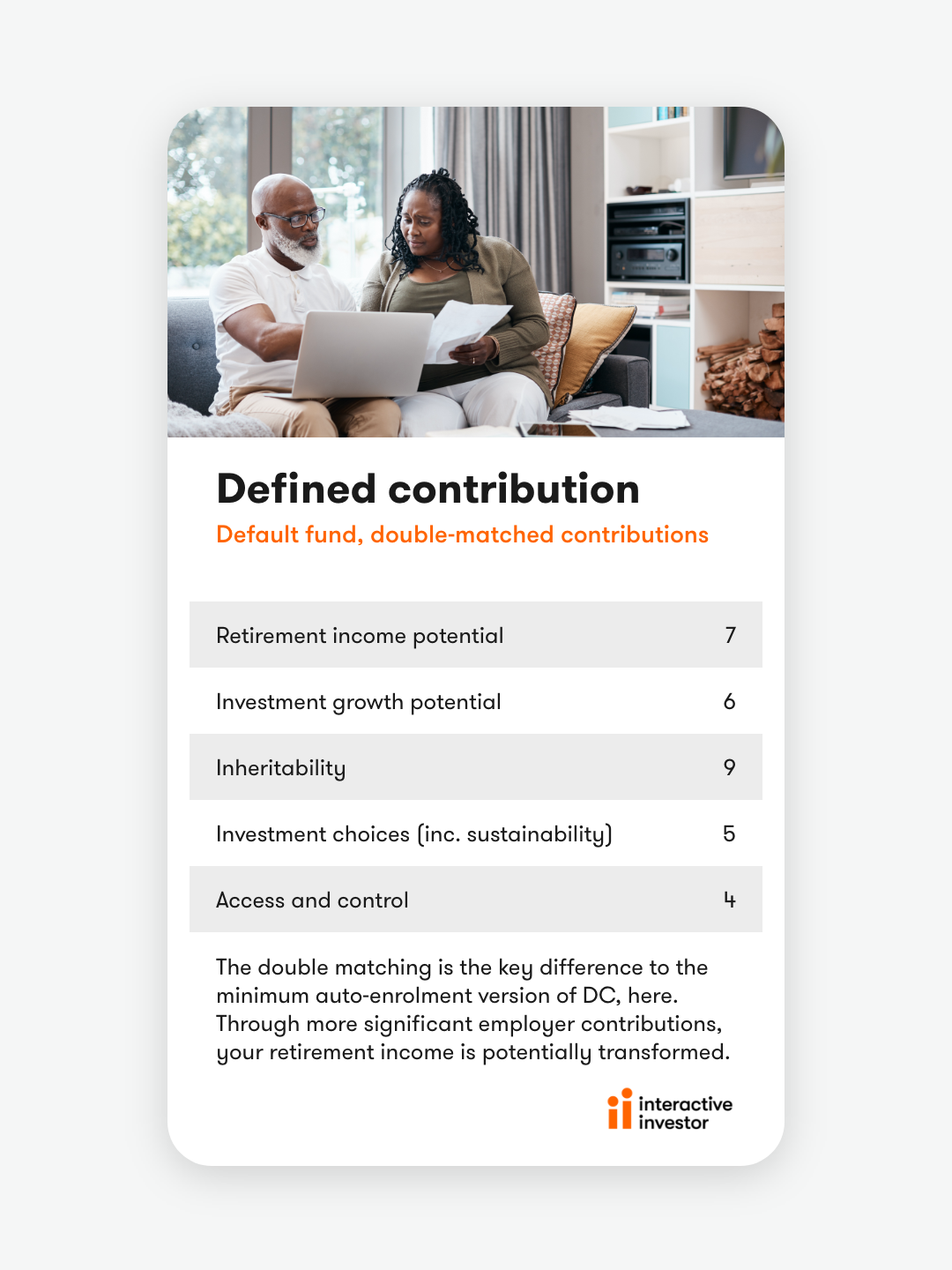

Defined contribution, default fund, double-matched contributions

Retirement income potential: 7

Investment growth potential: 6

Inheritability: 9

Investment choices (inc. sustainable): 5

Access and control: 4

The double matching is the key difference to the minimum auto-enrolment version of DC, here. Through more significant employer contributions, your retirement income is potentially transformed and so is the investment growth, as more is going in for the returns to work on. With a bigger pot, there’s more likely to be a bit left for relatives to inherit.

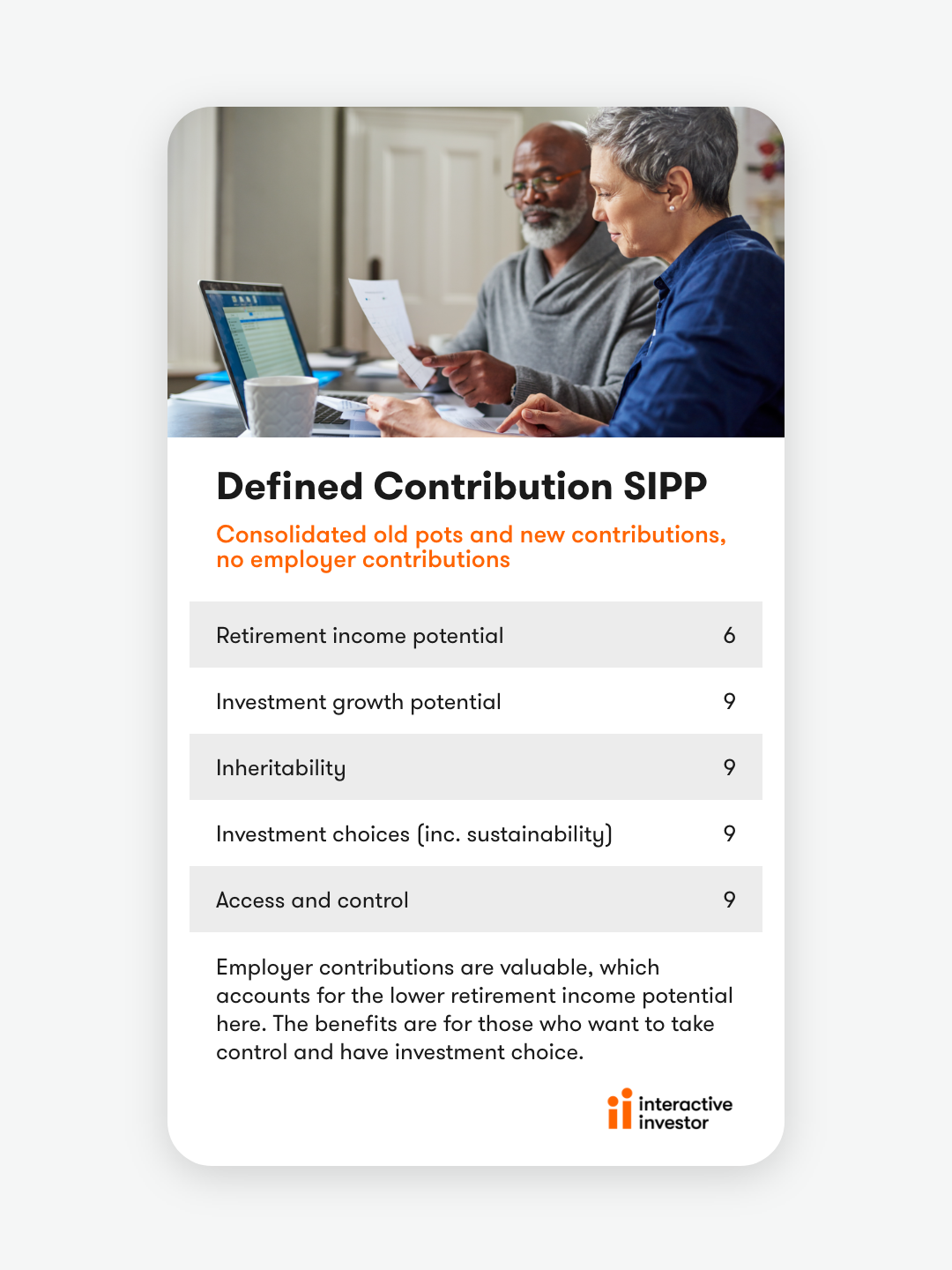

DC, Self-invested personal pension (consolidated old pots and new contributions, no employer contribs)

Retirement income potential: 6

Investment growth potential: 9

Inheritability: 9

Investment choices (inc. sustainable): 9

Access and control: 9

Employer contributions are valuable, which accounts for the lower retirement income potential here. But some of what you may lose in employer contributions (although you can ask your employer to pay into a Sipp instead), you could gain through access to higher growth investment opportunities. These are benefits for those who want to take control and have some choice. If you aren’t up for this, these features won’t be on your personal score card. If you are consolidating old pots and making new contributions, these scores assume a healthy pot on which to build bigger returns. One for the self-employed as well as consolidators and keen investors.

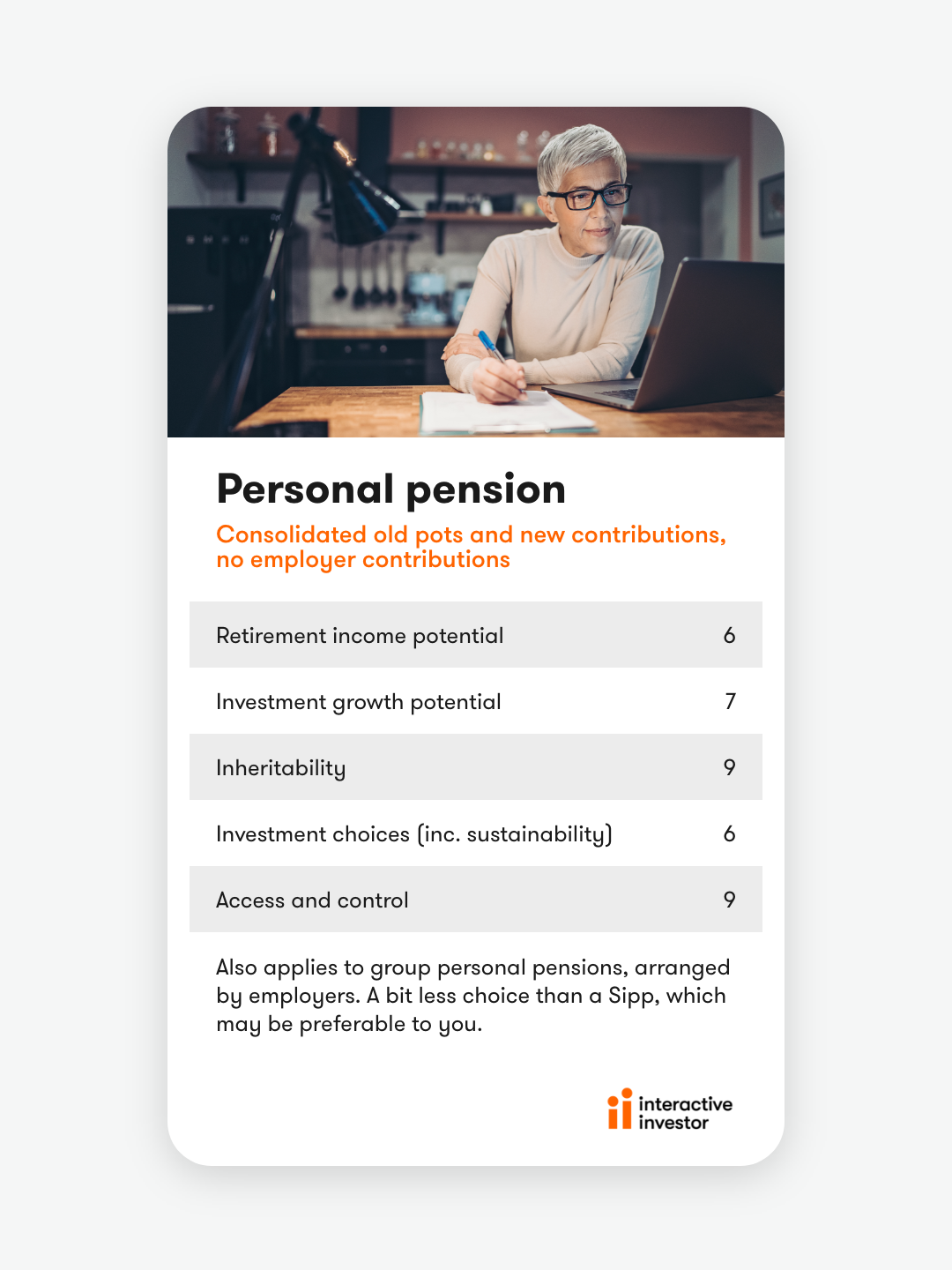

Personal pension (consolidated old pots and new contributions, no employer contribs):

Retirement income potential: 6

Investment growth potential: 7

Inheritability: 9

Investment choices (inc. sustainable): 6

Access and control: 9

Also applies to group personal pensions, arranged by employers. A bit less choice than a Sipp, which may be what you would prefer. Otherwise similar. If you are consolidating old pots and making new contributions, these scores assume a healthy pot on which to build bigger returns. One for the self-employed who don’t want to manage their own investments, as well as consolidators. A shame not to have an employer contributing, but again, something is always better than nothing.

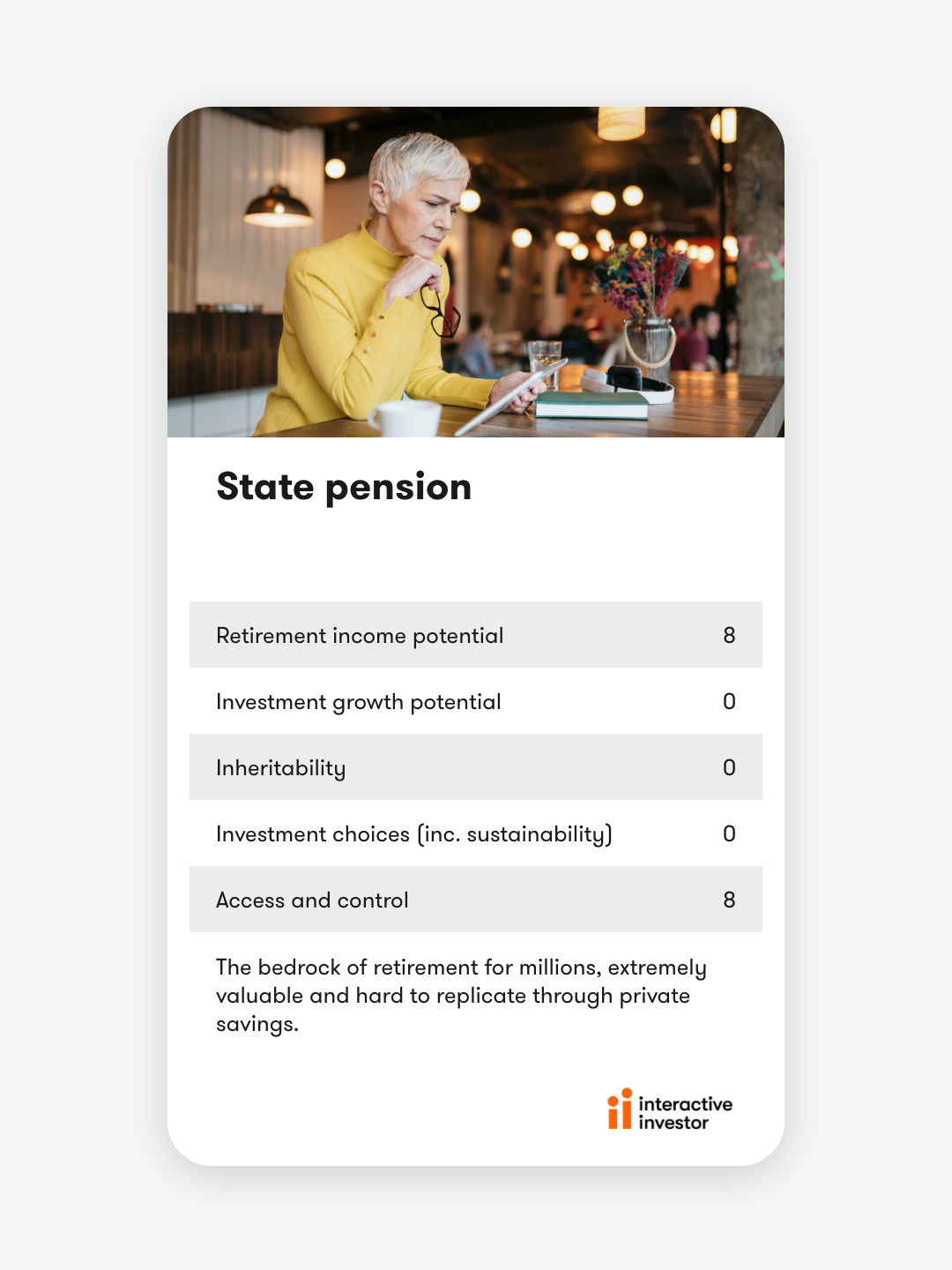

State pension:

Retirement income potential: 8

Investment growth potential: 0

Inheritability: 0

Investment choices (inc. sustainable): 0

Access and control: 8

Just for comparison, the state pension, which is actually pretty good for retirement income compared to other options if you have worked your whole life and would take a lot to replicate through private saving. It’s the bedrock of retirement for millions. It’s easy to access, although you do need to claim it and slightly marked down because the age you get it is later than other forms of workplace pension. No one can inherit it and it’s not an investment, so it can’t score at all for these factors.

‘Pensions Unpacked’ vodcast

Interactive investor recently launched a ‘Pensions Unpacked’ vodcast with Barnett Waddingham, the pensions consultancy, to unravel some of the tricky terminology and demystify pensions for people at all stages, whether working or in retirement.

You can watch the first three episodes here.

Notes to editors:

- Opinium interviewed 2,000 UK adults between November 26 and 29.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.