Nvidia share crash: second bite of the cherry or red flag?

A market-wide sell-off that saw shares in this AI leader plunge as much as 25% in just a few days, has grabbed the attention of Rodney Hobson. Here’s what the overseas investing expert thinks of the stock now.

7th August 2024 08:46

by Rodney Hobson from interactive investor

One of the most popular stocks on the interactive investor platform has been, for many months now, tech giant NVIDIA Corp (NASDAQ:NVDA). Recently it has been, for them, the most traded stock in the world. Nvidia certainly provides plenty of excitement, with moves of 5% or more in the share price quite commonplace. Its recent heavy fall could be the chance for latecomers to buy.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Nvidia, which makes chips for artificial intelligence (AI) products, had seen its market capitalisation leap from $2 trillion to $3 trillion in only 30 trading days, overtaking Microsoft Corp (NASDAQ:MSFT) as the world’s most valuable publicly-listed company. When the shares topped $1,300, the company split them into 10 new shares for each one held to make them more acceptable for small investors, many of whom in the UK would baulk at putting up £10,000 and getting only 10 shares in return.

Share splits normally occur when the company involved is confident that the share price will continue to edge higher. Alas, timing is everything. The hardly surprising decision by the Federal Reserve to keep US interest rates steady for another month was followed by the more unexpected news that fewer jobs were being created and unemployment was rising, raising fears that the American economy was heading into recession.

Throw in concerns about quarterly results from Google owner Alphabet Inc Class A (NASDAQ:GOOGL) and electric vehicle maker Tesla Inc (NASDAQ:TSLA) and the perfect storm hit US tech stocks, wiping more value off the shares of the seven biggest companies than on any day since 2012. Nvidia promptly slipped back to third-most valuable company.

However, Nvidia has not gone away. It has an 80% share of the market for AI chips, a market that will continue to expand rapidly despite concerns that it will destroy traditional jobs, spread misinformation and attract the attentions of regulators around the globe.

Whether Nvidia has done better than other tech stocks will become clearer with figures due later this month, but the last announcement, issued towards the end of May, was highly encouraging. In the three months to 28 April, its first financial quarter, net income multiplied sevenfold to $15.9 billion on revenue 262% higher at $26 billion compared with the same quarter last year.

Both figures were clearly higher than analysts had expected. Revenue forecasts for the second quarter are for around $28 billion.

- Morgan Stanley says this industry should win when rates fall

- Top tech investor: ‘Big Five’ stock concentration risk is justified

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Founder and chief executive Jensen Huang believes he is spearheading a new industrial revolution that will transform traditional data centres into artificial intelligence factories. Nvidia makes units that help personal computers to process graphics. These units are also suitable for the gigantic number of calculations needed for AI programmes to create text, music, images or video.

Already data centre revenue is by far the major part of Nvidia’s business, generating record revenue of $22.6 billion in the first quarter, up 427% on a year earlier.

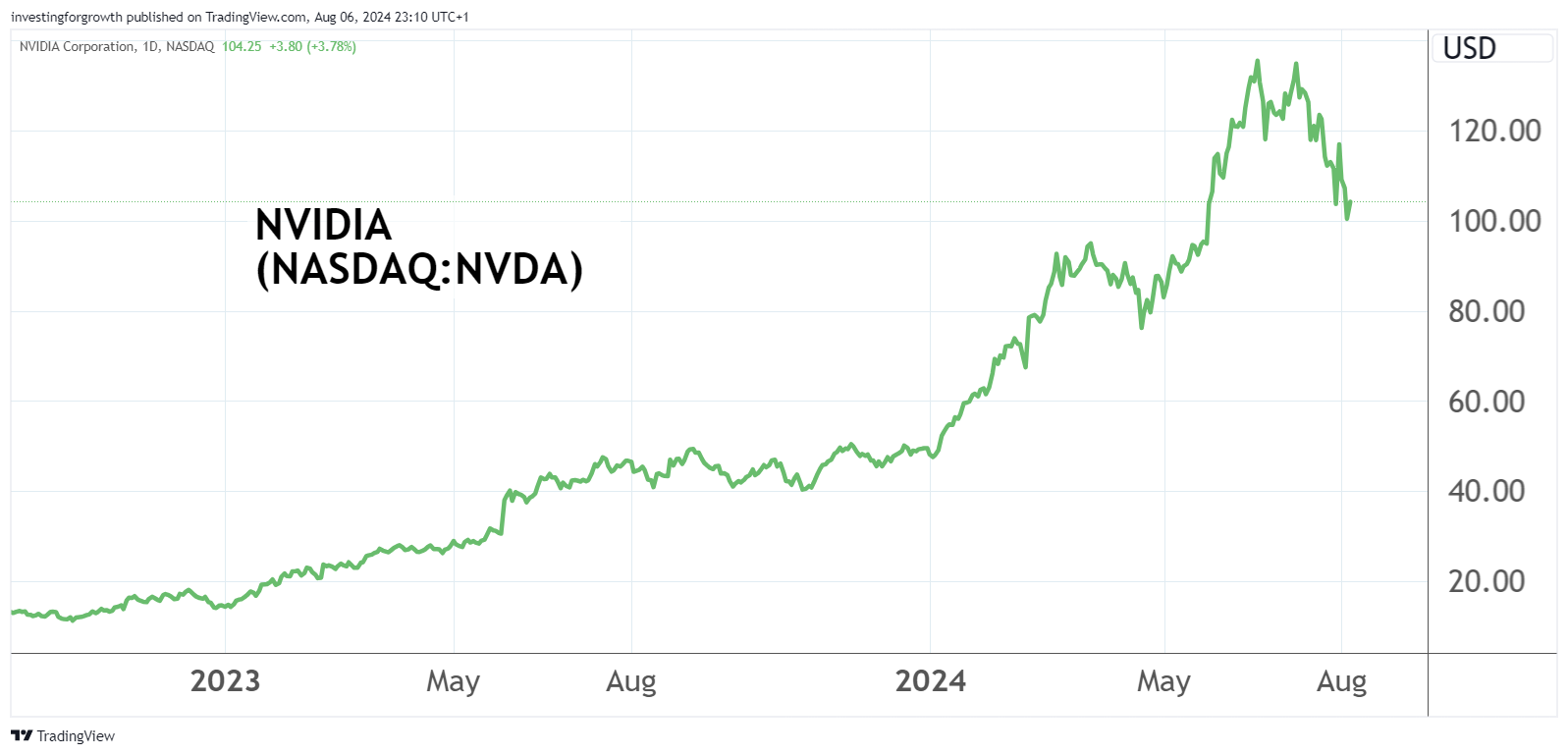

Nvidia shares, restated to allow for the share split, started motoring in October 2022 when they were only $11 to a peak of $140 in June and $136 in July this year. They have since slumped to $100, having been as low as $91 in intra-day trading, but have come off the bottom to stand at $104.

Source: TradingView. Past performance is not a guide to future performance.

- ii view: economic bellwether Caterpillar reports record profit

- ii view: Berkshire Hathaway cash bolstered by Apple sale

Hobson’s choice: Like it or loathe it, artificial intelligence is not only here to stay, it is here to grow exponentially. While Microsoft has led the way, Alphabet is splashing out nearly $50 billion on capital expenditure this year, mostly on playing AI catch-up.

The historic fundamentals for Nvidia are, on the surface, not great, with a price/earnings ratio of nearly 60 and a yield of 0.02% despite a 150% boost to the dividend three months ago. However, the rating is based on a potentially dazzling future. While it is always risky to buy just ahead of results, the chance to get in at just above $100 may not last beyond the next couple of weeks. I was too cautious about the stock in July last year when the fundamentals were far worse, but the future looks much clearer now. Buy.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.