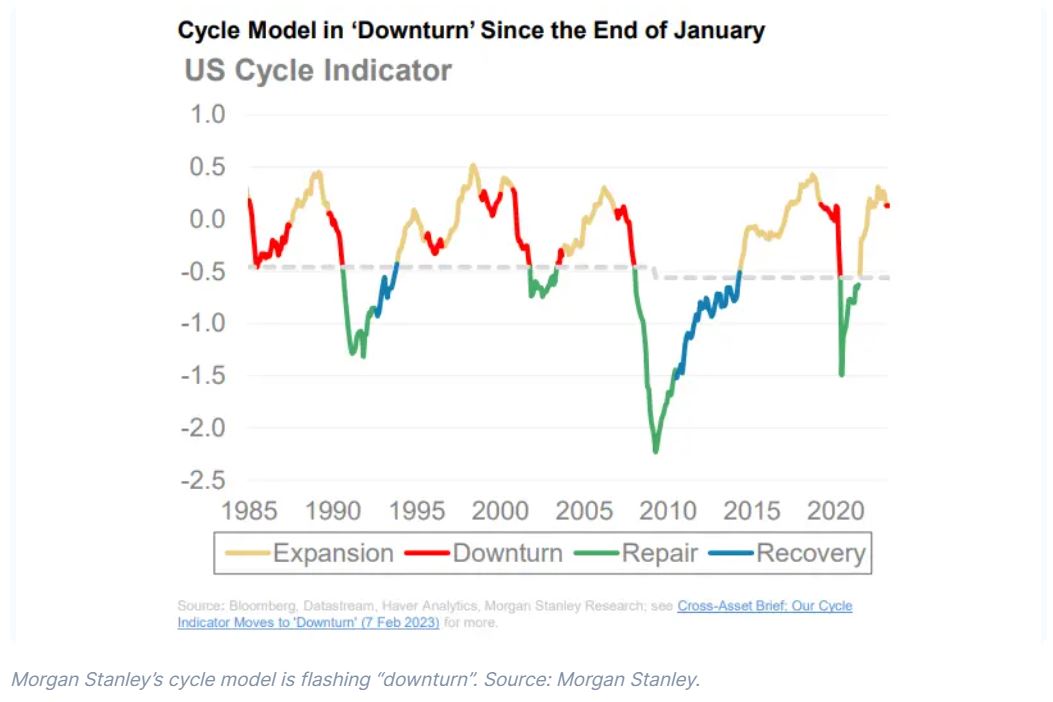

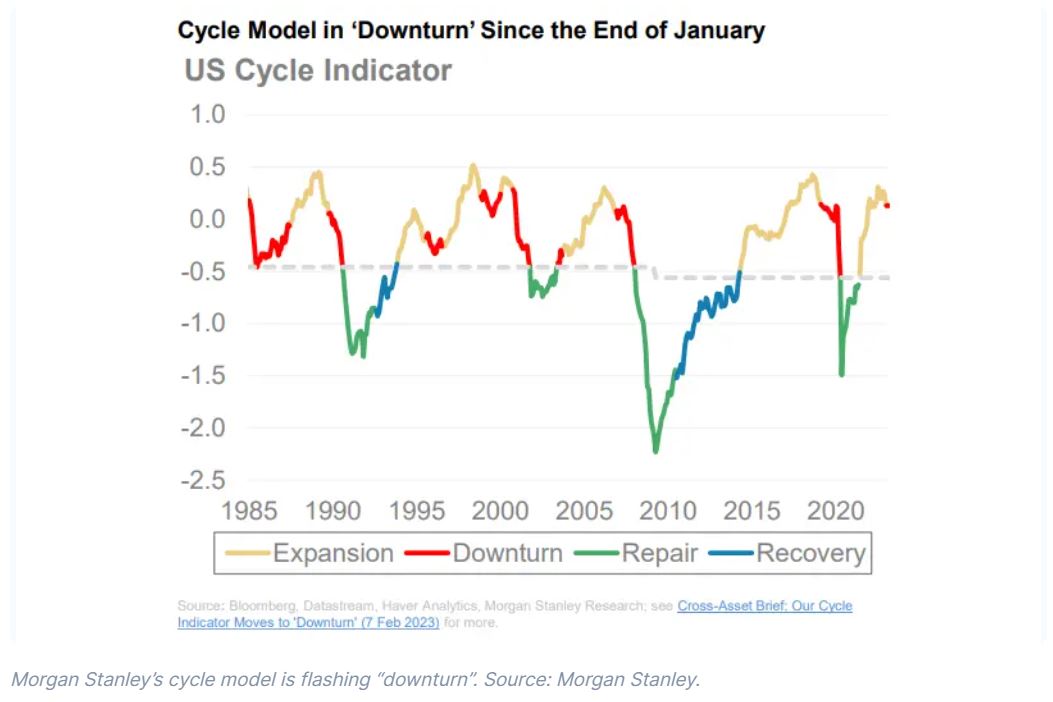

Morgan Stanley’s cycle model is flashing ‘downturn’

24th February 2023 09:50

by Stéphane Renevier from Finimize

The economy tends to fluctuate in a cyclical pattern, with alternating periods of expansion and contraction. Morgan Stanley’s business cycle model has sent a clear message that the economy has just entered the “downturn” phase.

Morgan Stanley developed a model that analyzes the breadth of changes across the economy to estimate which phase of the business cycle we’re in.

The model recently switched to “downturn” from "expansion", indicating that the economy has likely entered the last stage of the business cycle and will probably slow further.

During the downturn phase, investors may want to play defense by reducing their allocation to stocks and increasing their allocation to cash and Treasury bonds.

The economy tends to fluctuate in a cyclical pattern, with alternating periods of expansion and contraction. So, you’d think it’d be easy to figure out where we are in the cycle and when it’s truly changing. But sometimes the economy sends conflicting signals. Luckily, Morgan Stanley’s got a business cycle model for this. But, unluckily, it’s sending a clear message: the economy’s just entered the “downturn” phase…

Wait, how does it know?

Morgan Stanley’s model tracks more than just hard economic data like jobs and manufacturing production. It factors in soft data like consumer confidence, market data like the yield curve, credit data like loans, and even corporate aggression data like mergers and acquisitions (M&A) and bond issuance.

The model analyzes all that data, paying attention to how the different economic indicators are changing over time, not just whether they’re high or low. And by combining the data, it tracks how many different indicators are moving in the same direction, and for how long.

See, for the cycle to be at a turning point, more than 60% of the model’s indicators have to be getting stronger or weaker for three months in a row, compared to their levels six months prior. This creates a small lag in its signaling, but it ensures that the cycle indicator doesn’t jump around constantly between phases and improves its reliability.

This method has a lot of advantages: it’s both theoretically sound and empirically proven, it’s rule-based (meaning it’s less subject to biases), it's comprehensive, and it summarizes the economy into one easy-to-understand indicator. That makes it a great tool for keeping an eye on the big picture and separating the signal from the noise.

So, what’s it saying now?

Well, after 19 months of pointing toward “expansion”, the cycle indicator just switched to “downturn”. This phase is characterized by economic data that’s generally still strong, but deteriorating or stalling. That’s exactly what we’re seeing now: consumer loans and the housing sector have been slowing, M&A activity and bond issuance have been weak, and manufacturing activity has been collapsing. And while some sectors, like the labor market, remain relatively robust, there are signs of a slowdown there too.

All in all, this framework is giving us a clear signal: economic growth is sputtering, and weaknesses are becoming more broad-based.

Now, a switch to “downturn” doesn’t mean a recession is imminent, or that stocks will crash. It also doesn’t mean that the economy couldn’t switch back to “expansion” again soon – although because of its methodology, that’s unlikely. What it does mean is that the economy has likely entered the last stage of the business cycle and is likely to slow further from here.

And that should set off some alarm bells for you, especially since it contradicts some popular narratives – for example, that the economy’s already past the slowdown, or that there won’t actually be a slowdown.

What’s it mean for your portfolio?

Different assets will perform very differently in different stages of the cycle. As you’ve probably guessed, the downturn phase has historically been the worst for stocks and high-yielding corporate debt, and the best for cash and US Treasuries. That’s because as the economy slows, companies’ earnings generally take a hit and more companies default on their debt. What’s more, as sentiment sours, investors tend to require a higher risk premium for holding risky assets, and that pushes stock valuations lower and credit spreads higher. So, at the same time, cash and Treasury bonds benefit from investors flying to safer assets.

Now, for your portfolio, Morgan Stanley’s got some ideas of what to do when the indicator switches from expansion to downturn:

First, play it safe across asset classes: reduce your allocation to stocks, and increase your allocation to US Treasury bonds and cash.

Second, play it safe within asset classes: rotate your US stocks into international ones, and your riskier high-yield corporate bonds into more defensive, investment-grade ones.

Of course, every cycle is unique and looking at historical averages can sometimes be misleading. Plus, the framework doesn’t say much about how bad the slowdown might be. But if we’ve indeed moved to the last stage of the cycle, things are likely to get a lot bumpier than the recent optimism suggests.

Stéphane Renevier is a global markets analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.