Morgan Stanley says this industry should win when rates fall

Interest rate cuts will be a boon for some and a bust for others. Morgan Stanley identified one sector that should turn a trim into a grin.

2nd August 2024 09:33

by Stéphane Renevier from Finimize

- Biotech stocks tend to outperform the market when rates are high and falling: their far-out cash flows make them more sensitive to changing rates, they majorly benefit from cheaper financing costs, and they’re more likely to be acquisition targets when rates are calmer.

- Morgan Stanley identified four specific areas that could see the most benefit: biotechs with a clinical catalyst in the near term, a strong “platform”, and existing solid businesses with a catalyst for additional value, as well as acquisition targets.

- Biotech stocks match high potential rewards with high risk, so if you want to try your hand at making scientific discoveries, diversify your investment across different companies to manage your downside.

The Federal Reserve (Fed) looks poised to cut rates later this year – and while the stock market as a whole will likely breathe a sigh of relief, some sectors will feel the effect more than others. Investors are on the lookout for those that should steal a march when rates are cut, and Morgan Stanley is pushing biotech companies into the conversation.

Why now might be a good time for biotech stocks?

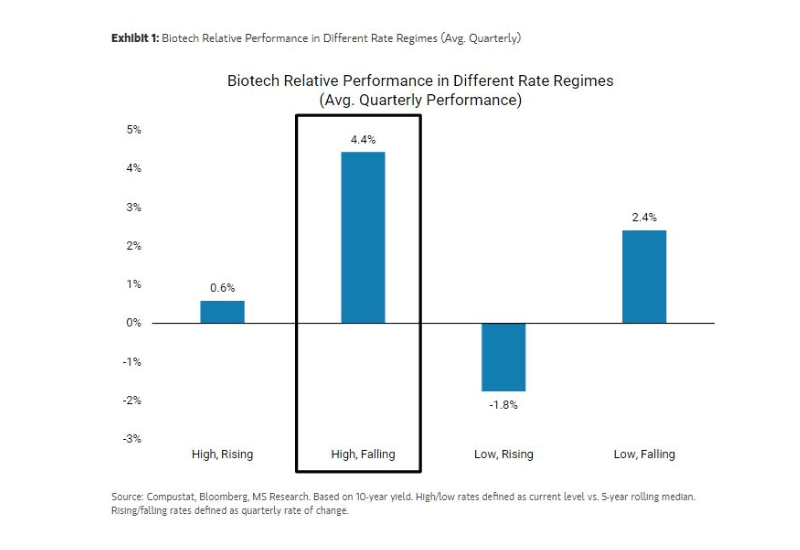

Biotech stocks tend to outperform the rest of the market when interest rates are falling, especially when they’re still high but starting to fall. And that’s the scenario we’re looking at today.

Biotech stocks do best when interest rates are high and falling. Source: Morgan Stanley.

There are a few reasons why that’s the case. First, because biotech companies often work on complex concepts and products that bring in revenue over the long haul, their cash flows are far out in the future. Remember, you discount those future earnings over time – using interest rates as the discount rate – to find their present value. The further out they are, the more the impact of the discount rate is magnified. So when interest rates drop, the present value of those cash flows could increase significantly.

Second, falling interest rates make it cheaper for companies to borrow money. In the biotech industry, that makes it easier to fund new product development. For the bigger firms on the lookout for acquisitions, that means they’re more likely to be able to afford smaller biotechs, even at premium prices.

Lastly, biotechs tend to be focused on developing unique, high-value treatments and therapies over the long term, rather than boosting short-term sales or margins. That means they’re not so affected by the typical reasons behind rate cuts, like slowing pricing power.

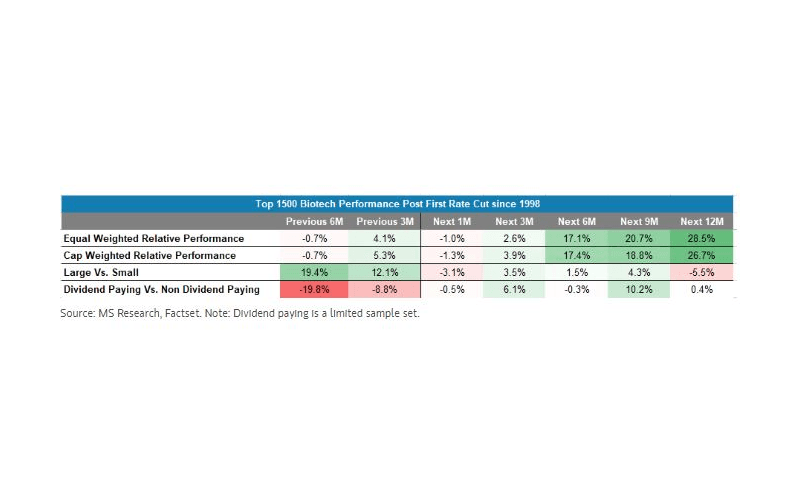

That all explains why historically, biotech stocks have outpaced the market by about 17% in the six months following a rate cut, and by about 27% over a year. Interestingly, biotech also tends to come up trumps in the quarter leading up to the first rate cut, though it might underperform immediately after as the cut gets priced in.

Biotech stocks tend to do well around the time when rates are cut. Source: Morgan Stanley

What are the specific plays that Morgan Stanley is watching?

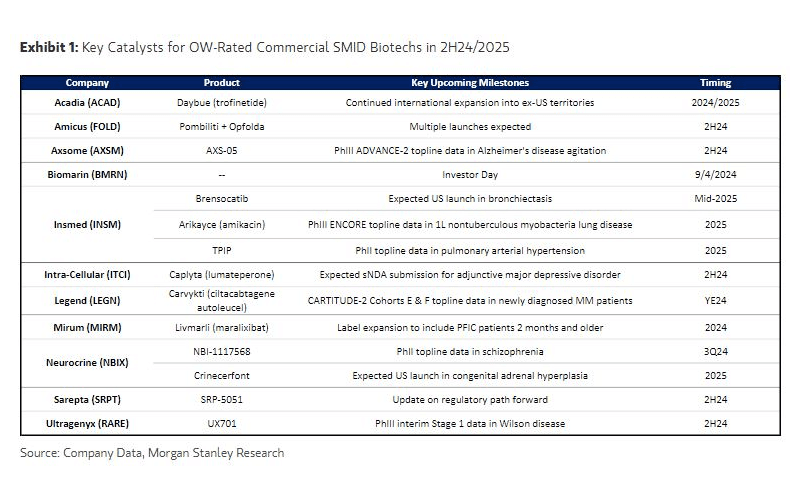

Clinical catalysts: Morgan Stanley is keen on biotech firms that are poised for pivotal clinical trial results. With rates falling in the background, positive outcomes from these trials could be rewarded with a stronger-than-usual market reaction. Dubbed “clinical catalyst” plays, these stocks are high risk but come with the lure of potentially even higher rewards.

Commercial small and mid-cap biotech stocks rated “overweight” by Morgan Stanley analysts, and their positive catalysts. Source: Morgan Stanley

Acquisition targets: Plenty of Big Pharma’s patents will expire around the end of the decade, so cash-heavy firms will be on the hunt for fresh prospects to bolster their drug pipelines. Smaller biotech firms, especially those in hot sectors like oncology, neuroscience, and immunology, would fit the bill. Companies in these fields, particularly those with late-stage therapies, could fetch handsome premiums in takeover deals. Morgan Stanley didn’t mention specific stock picks for this play, though.

Platform plays: Biotech firms have struggled during the tough financing landscape of the last couple of years, besides the exceptions with major product launches. But now that the environment could become kinder, Morgan Stanley is looking into stocks that are known for “platform plays”. That phrase refers to innovative drug platforms or technologies – think drug discovery methods or manufacturing systems. The big bank believes biotechs with these under their belt may now have the potential to catch up with the rest of the sector, even if they don’t have any short-term catalysts to boast about. Morgan Stanley identified Akero Therapeutics Inc (NASDAQ:AKRO), Arcutis Biotherapeutics Inc Ordinary Shares (NASDAQ:ARQT), Intellia Therapeutics Inc (NASDAQ:NTLA), Rocket, and Rhythm Pharmaceuticals Inc (NASDAQ:RYTM) as top picks there.

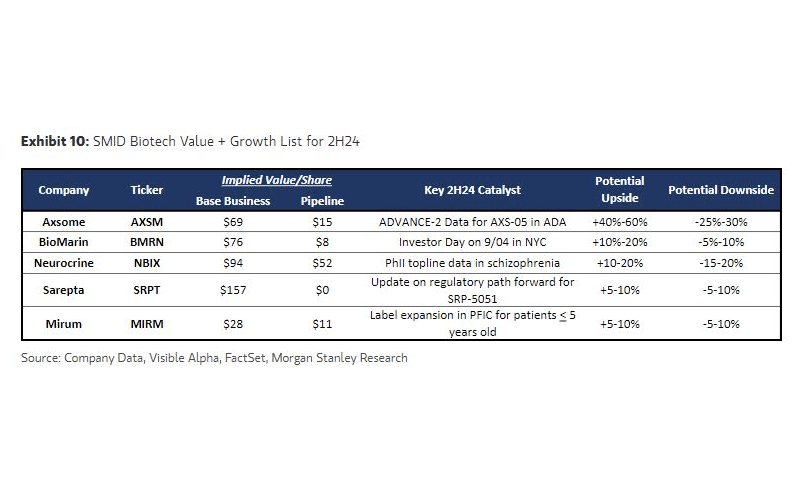

Stocks with both value and growth characteristics: Morgan Stanley identified stocks with both stable, established commercial products and imminent catalysts. That way, they can offer a safety net through their established business base, limiting risks in tougher times, while also harbouring high-risk, high-reward projects. This play is more defensive than the others, making it a better option if the environment sours.

Companies with a solid existing business and catalysts in the near future. Source: Morgan Stanley.

What’s the opportunity here?

Biotech stocks can make for a unique addition to your portfolio, since they’re influenced by very distant factors. Plus, they're somewhat defensive because demand for healthcare products and services is always present, no matter the economy. (That’s one of the reasons why they fared better than the S&P 500 during the 2008 global financial crisis.) And because any successful products are patent-protected for some time, while high barriers to entry keep competition tight, finding a successful biotech company can lead to huge rewards.

But remember, they’re still risky tech companies at heart, thriving on bullish investor sentiment and a decent macro environment. In fact, the thesis for Morgan Stanley’s first three plays relies on a solid macro backdrop. Should interest rate cuts come out of recessionary fears, the big bank’s ideas might not work as well as expected.

What’s more, the success of biotech firms hinges on unpredictable factors like clinical trial outcomes, regulatory approvals, and scientific breakthroughs. A serious hiccup, and there's a real possibility of losing your entire investment.

So if you're considering individual biotech stocks, you should consider playing "mini VC" by spreading your investments across at least five companies. You can hope that one will make it big, just prepare yourself for the fact that the others might lose money.

Or, considering Morgan Stanley’s optimistic outlook on biotech, a broader and more diversified approach might be to invest in the entire sector. You can do this via cost-effective exchange-traded funds that hold a wide range of small and mid-cap biotech stocks, positioning them to potentially benefit from the trends Morgan Stanley highlighted.

Stéphane Renevier is a global markets analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.