Market volatility – looking beyond the noise

Market volatility can be unsettling but it’s key to think long term and accept that ups and downs are a normal part of investing.

9th August 2024 11:09

Markets were rocked at the beginning of the week with the FTSE®100 plunging after Japan's Nikkei 225 index suffered its most severe single-day decline since 1987.

We saw a sharp fall in equity prices and significant appreciation in the Japanese yen. This market turbulence followed disappointing US jobs data, triggering a worldwide stock sell-off as investor worries continue to grow over the possibility of a US recession.

There was mixed sentiment as some investors feared the Federal Reserve (Fed) made a mistake by holding interest rates steady. However, the Fed has paved the way for a September rate cut – a weaker economy should mean they’ll need to cut quicker and deeper than previously expected.

As a result, volatility reached its highest level since the beginning of the coronavirus pandemic. And while markets have recovered ground over the course of the week – the Nikkei up 12% in two days – it’s important to recognise that global market fluctuations of this size can be unsettling. Nobody wants to watch their investments fall in value.

The key is to remain calm and accept that ups and downs in markets are a normal part of investing. History gives us some much-needed reassurance that markets can recover from periods of instability like we’re currently seeing.

Markets often mirror human emotions

The thing to remember about financial markets is that they’ve been created by humans. And just like us, they’re vulnerable to a range of human emotions. Fear and greed are the main two drivers – but the instinct to follow the herd is also key.

That means there’ll be times when markets are excessively optimistic and others when they’re excessively pessimistic. This is illustrated by market bubbles – when markets rise rapidly – and market crashes.

Slow and steady wins the race

As told in Aesop’s Fable, The Hare and the Tortoise, you can be more successful by being slow and steady than quick and careless. When it comes to investing, slow and steady is usually more likely to win the race. In other words, the longer you’re invested for, the more likely you are to reap the rewards.

Fraser Kerr, Regional Director at abrdn explains how during periods of market volatility, emotions like fear and anxiety can cloud judgement:

‘When you’re in the eye of the storm, investing can undoubtedly be emotional and can lead to irrational or knee jerk reactions.

‘Engaging a financial adviser can offer an emotional buffer, provide a rational perspective and can prevent impulsive decisions that could be detrimental in the long term. Advisers encourage clients to stay the course, reminding them that market fluctuations are normal and temporary.’

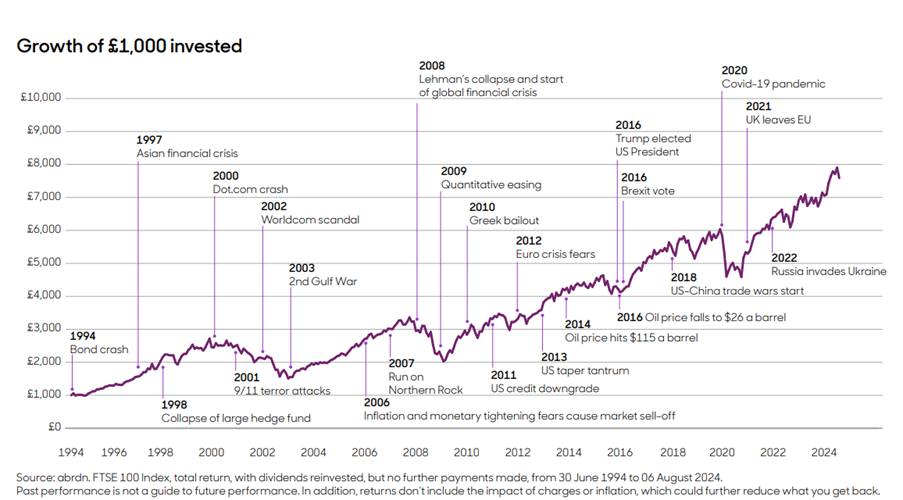

The graph below shows how £1,000 invested in the FTSE® 100 Index, which represents one of the UK’s main stock markets, would have grown if you’d left it for 30 years.

Over those 30 years, there have been plenty of market falls and crashes, as well as rises and bubbles. But the main takeaway here is that, over the long term, investments have the potential to grow in value significantly.

Hold your nerve

Market volatility has undoubtedly caught out some investors over the years. If you give way to panic and sell, you’re likely to be selling after markets have already fallen and, importantly, before they rise again. That means you’re locking in losses. Fraser Kerr highlights the importance of staying invested as it also ‘allows for the continued benefit of compounding on your returns. And if you miss just a few days of market recovery it can significantly impact long-term returns.’

Those who’ve been able to stay the course and hold on to their investments patiently are more likely to have prospered.

Trying to time the markets – in other words selling investments when markets are at a high level and buying when they’re at a low level – is extremely hard. Even investment professionals can’t always spot falls coming.

Try to remain calm, do some research on how markets have recovered in the past, and allow those previous ups and downs to show the longer-term returns your investments have the potential to give.

Remember though that investment growth isn’t guaranteed – investments can fail to recover their value too. And it’s possible that you could get back less than you paid in.

Concentrate on what you can control

You can’t control how markets perform, but you can control where you’re invested. Periods of market volatility highlight the importance of spreading your money across different types of investments, known as diversification.

If you’re only investing in one or two types of investments then you’re potentially exposing yourself to quite a degree of risk. But diversifying your investments can help reduce the amount of risk you take, and potentially give more consistent returns, with fewer and less severe ups and downs.

Invest regularly

And rather than fixating on the best possible time to invest, it can be a better idea to make smaller investments on a regular basis, for a longer period of time.

Making regular monthly payments into your chosen investment account or portfolio means you don’t have to worry too much about when you should invest. Instead, your money will go into the market every month, regardless of highs and lows. This consistent and measured investing approach, even if it is somewhat slow, can achieve better results than trying to time the market in an attempt to gain quicker pay-offs.

There’s support if you need it

If you’re not sure how the latest market movements or other economic events may affect your investments, or are concerned about the impact, you could consider getting financial advice. A financial adviser provides tailored advice that considers your unique financial situation, risk tolerance, and investment horizon.

According to Fraser Kerr, ‘an adviser can prove invaluable during times of market volatility like we’re currently witnessing – providing emotional support, reinforcing long-term goals as well as offering evidence-based strategies, and educating clients.

‘Encouraging clients to take no action during these uncertain periods is often a crucial part of their advice, helping clients avoid costly mistakes and making sure they stay on track to meet their financial objectives. This guidance ensures clients remain confident, focused and able to navigate market turbulence with a steady hand.’

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.