Make your pension last a lifetime

24th September 2018 15:34

by Jeff Salway from interactive investor

More and more people are reaching retirement and choosing to keep at least some of their pension invested to carry on growing their savings and to keep their options open, writes Jeff Salway.

By entering into a drawdown arrangement with a pension provider, retirees are able to keep their funds invested and take a regular income from them without committing to a lifetime annuity.

For many investors – particularly those with savings worth £100,000 or more – there are compelling reasons for going down this route. But the price of that greater flexibility is much greater complexity and risk. So if you're among the growing number of people keeping some or all of their pension invested, how can you go about making sure that you can get the income you need from it while preventing it from running dry?

Here are a few steps you can take to get yourself on the right track – and stay there.

Think about the amount of income you can afford to take

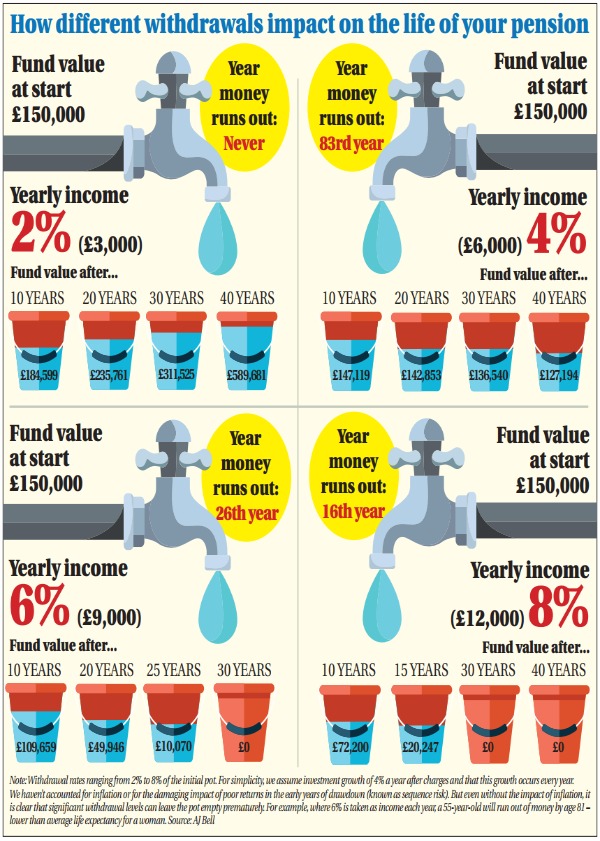

The biggest challenge for drawdown investors is taking the amount of income they need without risking the sustainability of their fund. If you want your pension savings to last, you need to be realistic about the level of income you can draw.

Ultimately, working out how much income you can safely take is largely dictated by individual circumstances and by the level of savings held elsewhere.

If you have £75,000 in pension drawdown and £75,000 stashed away in non-pension savings (such as ISAs) or you have guaranteed income from a final salary pension, you have more flexibility in the risk you can take with your drawdown pot. However, if that £75,000 in drawdown represents all your savings, with just a state pension to fall back on, the picture will look a little different.

"The risk someone can afford to take with their drawdown, and the rate of income taken, will depend on these other pots and other factors," according to Craig Palfrey, certified financial planner at Penguin, a Cardiff-based wealth management firm.

That's why cash flow planning – analysing income and expenditure in different scenarios – can be so useful.

"This usually involves a detailed look at post-retirement fixed costs and lifestyle requirements," says Tom Munro, owner of Tom Munro Financial Solutions, in Falkirk.

"This is crucial as it forms the foundations of the financial plan and, more importantly, the income levels required to sustain it for as long as required."

Take extra care in the early years of retirement

Good returns early in retirement can boost the amount of income you take, but volatility early on tends to have the opposite effect. This is exacerbated by what is called pound-cost ravaging, which refers to the effect of taking income from a fund even as its value is eroded by stockmarket falls.

"The sequence of returns can have a serious impact on the capital value when you are drawing down funds, due to the compounding effect," explains Derek Stewart, managing partner at Sam Wealth in Glasgow. "The lower the fund, the higher percentage required to provide the same level of income. This creates a downward spiral."

One way to mitigate against this is to leave the first two or three years of pension income in cash, so it is insulated from market volatility. The rest of the fund can then be divided into two pots – one to provide income for the next five years and the other to cover income for after that, allowing you to take different levels of risk due to the different time horizons when the money will be needed.

Managing volatility

There is no silver bullet for dealing with the impact of volatility, other than to opt for the guaranteed income offered by annuities.

"To reduce risk to levels which can be tolerated requires careful analysis of what would happen to the investor if they run out of money. If it is a disaster and would ruin their life, then the risk should not be tolerated," says Mr Palfrey.

If you're comfortable with the risks associated with investing, there is one very important concept that will help keep you on track: diversification.

This is about making sure you don't have all your eggs in one basket. By spreading your investments across different asset classes, geographical areas, sectors and funds, you reduce the risk of suffering heavy losses or poor returns in the event of a downturn.

"Appropriate and carefully crafted diversification of the investments within a drawdown plan will reduce risk and in turn will reduce volatility," says Mr Palfrey.

It can also help to limit your withdrawals to the 'natural yield' of your investments, such as that supplied by dividends, rather than drawing income directly from the capital invested or from selling units.

Keep tabs on your portfolio

Casting your eye over your pension investments at least once a year will help ensure that they still reflect your risk appetite and objectives and that your portfolio is sufficiently diversified.

A regular review will also help you make adjustments when your circumstances change, as they almost certainly will at some point in retirement.

Factors including investment returns, inflation, income needs and personal and household circumstances should all be taken into consideration when looking over your retirement portfolio.

Don't forget about annuities

Pensions drawdown has become the most popular retirement income option under the pension freedoms, yet for many people the guaranteed income provided by annuities will make them more suitable.

If you've got a modest pension pot and/or you're uncomfortable with the investment risk that drawdown entails, annuities are probably a better option. You don't have to use all your pot to buy one – you could initially split it between drawdown and annuities, then buy an annuity with your drawdown fund at a later stage. This is the beauty of the pension freedoms: you don’t have to make a decision on day one of your retirement and stick with it.

If you decide to buy an annuity, make sure you shop around as there is a big difference between the best and worst deals on the market. If you suffer from ill health or there is a lifestyle factor that could affect your mortality (if you're a smoker, for instance), you may qualify for an enhanced annuity, which will pay out more on the assumption of lower life expectancy.

Get help if you need it

Investing in retirement can be a complex business and one paved with pitfalls. Anthony Gillham, manager of the Old Mutual Generation portfolios, says:

"Retirees not only need a regular, lasting income, they also need to focus on capital preservation, protect against the ravages of inflation and mitigate against the impact of market falls – which can have a dramatic impact on how long their funds last, particularly if these occur towards the beginning of their retirement."

For this reason professional financial advice can be invaluable. Yet recent research by the Financial Conduct Authority (FCA) found that almost 30% of drawdown plans are entered into without advice.

The price paid for getting it wrong can be a hefty one, especially when you've saved all your life to build a decent pension pot. Paying for advice might well be the best investment of the lot. If you're unable or unwilling to pay for advice, at least seek the guidance of free, impartial services such as Pension Wise (Pensionwise.gov.uk) and the Money Advice Service (Moneyadviceservice.org.uk).

"The biggest danger of entering drawdown without taking advice is the significant increase in probability of running out of money in a lifetime," says Mr Palfrey. "This danger (or avoiding it) on its own warrants why financial advice must be taken."

Mr Gillham agrees:

"Building a genuinely diversified portfolio that seeks to manage all of these risks would probably be a deeply challenging task for DIY investors. In our view, it’s crucial for investors who desire to make the most of the opportunities presented by this stage of their financial journey – and tackle the risks involved – to seek professional advice."

When Jeff and Julie Parr came to decision point with their pension savings they knew exactly what to do.

As Jeff prepared to retire from his job as a microbiologist in the chemicals industry, they had no doubt that they would be mapping out the way forward with the help of a financial adviser.

They had used Craig Palfrey, of Cardiff-based wealth manager Penguin, when Julie wanted to invest an inheritance several years earlier, so the relationship and the trust was already there.

"Craig had taken the time to find out about us, our family and our finances," says Julie. "He started from the beginning, so that he could look at the bigger picture."

The Pontypridd couple, who have two sons, decided when it came to taking their pension that they would go into drawdown, as they wanted both the flexibility and the knowledge that whatever was left on death would go to their children. They were aware of the risks associated with drawdown, however.

"Anyone who has been through a stock market crash has it in the back of their mind. So having advice on drawdown was extremely reassuring, knowing that someone would ensure we were still in good shape whatever happened," says Julie.

Entering a drawdown plan without advice is not something Julie would ever have considered.

"In this day and age, the person who tries to be a specialist in financial affairs is a brave one. If you've got the knowledge and the confidence needed to do all this properly – and understand all the different factors such as tax – you're probably in that field already," says Julie.

"Advice means you can relax in the knowledge that someone has got your back."

Don't drift into drawdown

Large numbers of people are going into drawdown ill-informed and risk suffering lasting consequences as a result.

That was the warning from the City regulator, the Financial Conduct Authority (FCA), in July 2017. Its Retirement Outcomes Review (interim report) claimed that people often make drawdown decisions without understanding the full implications such as the potential for large tax bills if they take too much money from their pension in one go.

The vast majority (94%) of people entering drawdown without taking advice are staying with their existing pension provider, according to FCA analysis of Association of British Insurers' data. In other words, they are much less likely to shop around and find the most suitable drawdown arrangement for them. That may mean many are stuck in poor products with limited options and high charges that could eat significantly into the income they can get from their pension.

From choosing the right drawdown plan or self-invested personal pension (SIPP) to working out how much income you can take, there is a lot to think about when entering drawdown – and a lot of potentially expensive mistakes to be made.

"There is a wide range of financial products and funds in the market and getting "under the bonnet" and past the marketing hype and jargon isn't easy," Derek Stewart of Sam Wealth warns. "The decision to retire is one of the biggest you will make and your lifestyle will be determined by the performance of your assets."

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Moneywise, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.