The low-volatility bond funds we’re buying

Saltydog Investor has been bolstering bond fund exposure, targeting strategies that have offered investors a smooth ride.

3rd September 2024 10:44

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Equity markets around the world struggled at the beginning of last month. Poor economic data in the US, and interest rates rising in Japan led to a significant sell-off. After the first couple of days trading, the FTSE 100 was down 4% and the FTSE 250 had lost 6%. Other European indices fell by similar amounts.

- Invest with ii: Top Investment Funds | What is a Managed ISA? | Buy Global Funds

In the US, the Dow Jones Industrial average had gone down by 5%, the S&P 500 was down 6%, and the Nasdaq was showing a loss of 8%. However, the Japanese Nikkei 225 suffered the most, falling by 20%.

Fortunately, markets rallied and by the end of the month most indices were either showing gains or had significantly reduced their losses.

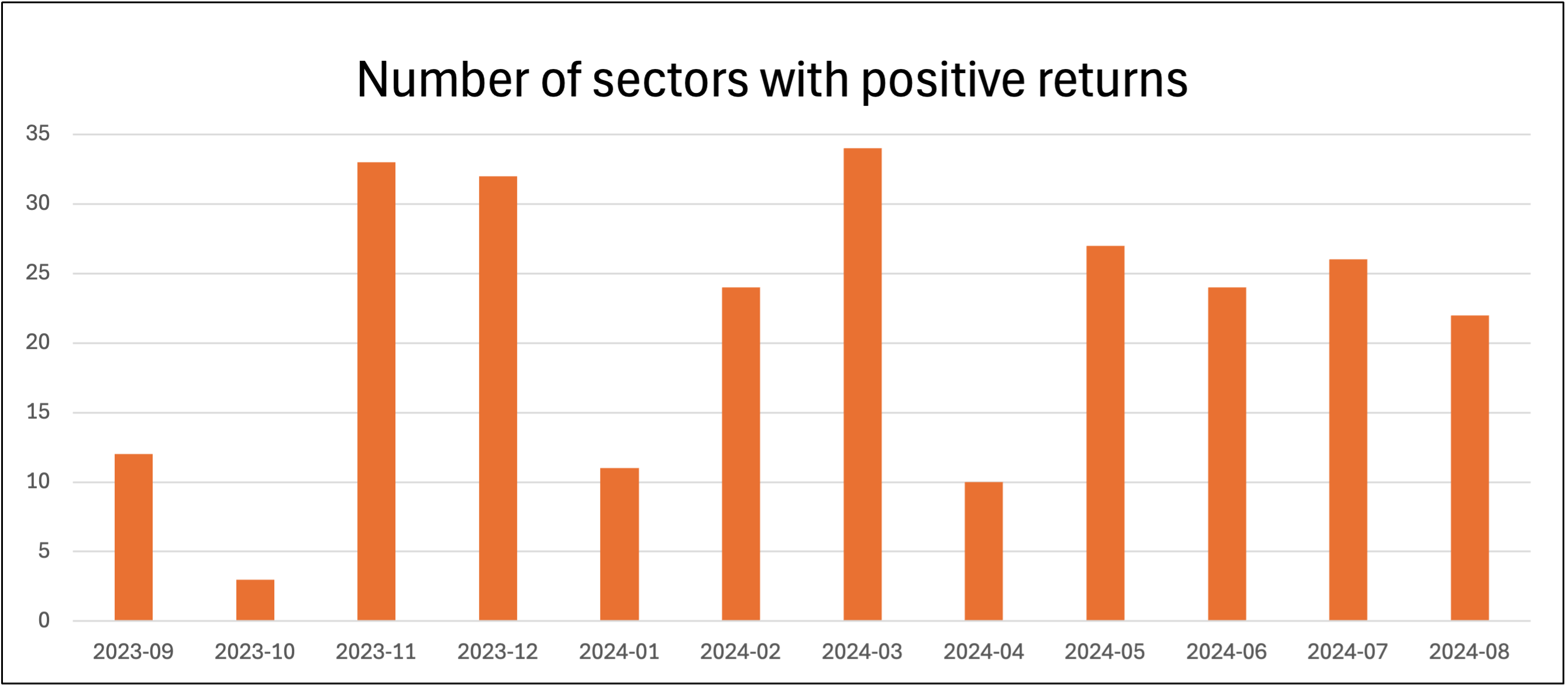

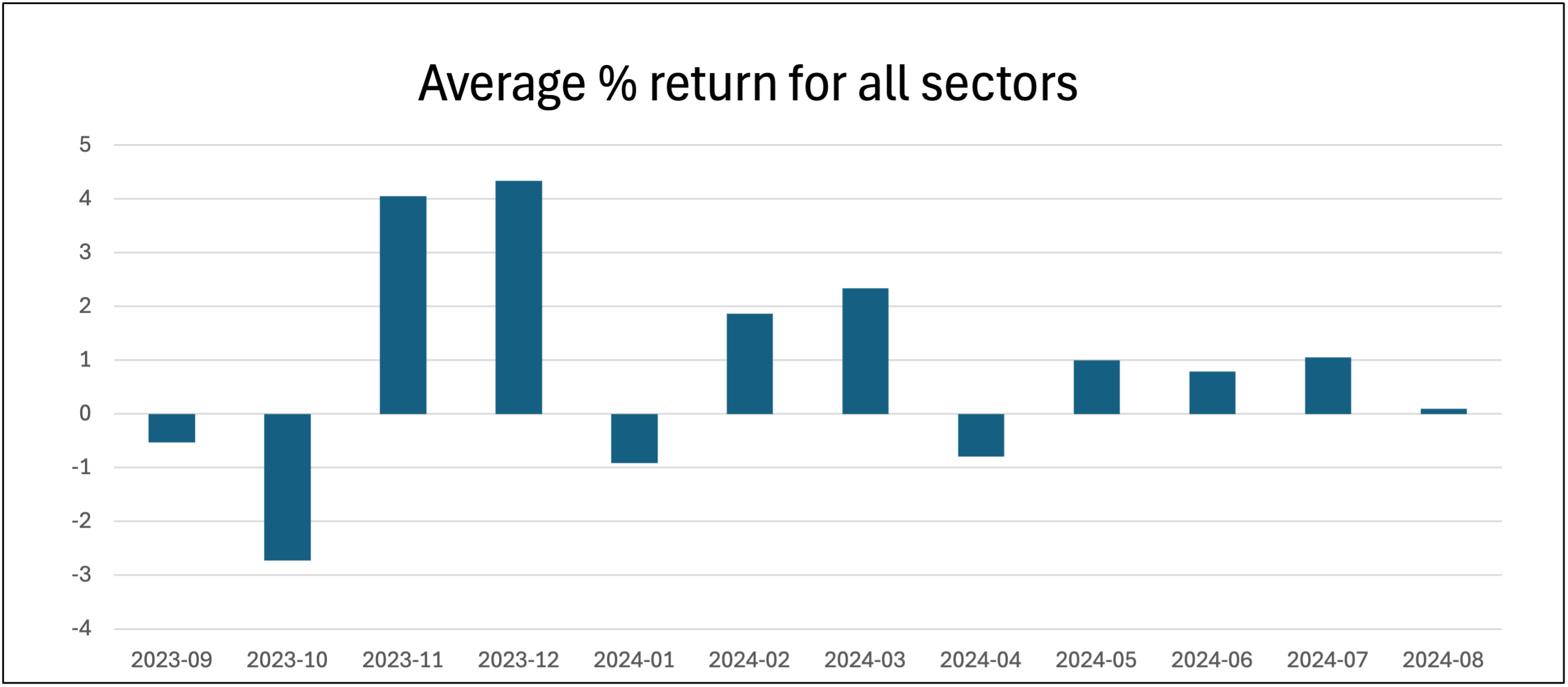

Most of the Investment Association (IA) sectors we track also made gains.

Data source: Morningstar. Past performance is not a guide to future performance.

Of the 34 sectors that we regularly monitor, 22 went up. However, that was down from 26 in July. The average sector return was also quite a lot lower.

Data source: Morningstar. Past performance is not a guide to future performance.

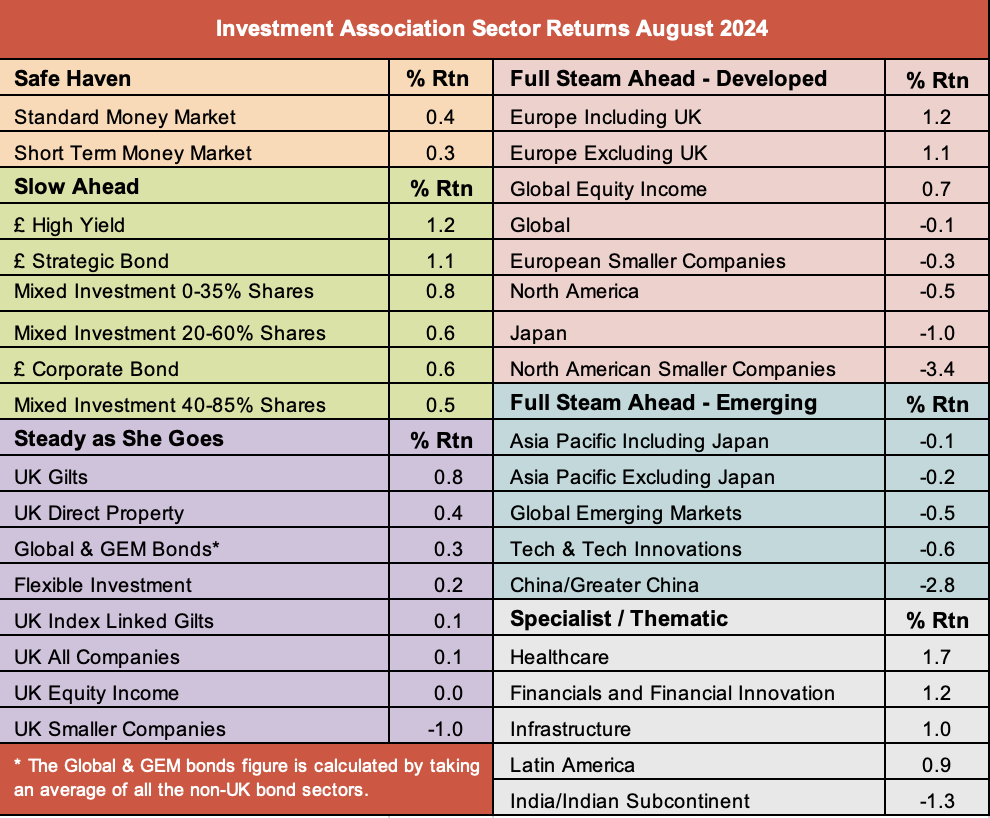

In our analysis we group the sectors based on their historic volatility.

The least-volatile sectors, the money market sectors, are in our “Safe Haven” group.

Then the “Slow Ahead” group is made up of UK Bond and Mixed Investment sectors.

The “Steady as She Goes” group is home to UK Gilts, Global Bonds, Property, Flexible Investment, and the UK equity sectors.

Finally, the most-volatile sectors are in our two “Full Steam Ahead” groups and the Specialist/Thematic sectors.

When stock markets are performing well, we would expect the more volatile groups to be generating greater returns.

That was not the case last month.

Data source: Morningstar. Past performance is not a guide to future performance.

All the sectors in the “Full Steam Ahead Emerging” group went down, and more than half the sectors in the “Full Steam Ahead Developed” group are also showing one-month losses.

Only one sector in the “Steady as She Goes” group went down. The UK Equity Income sector was flat over the month and UK Smaller Companies fell by 1.0%. The best-performing sector in this group was UK Gilts with a one-month return of 0.8%.

The less-volatile sectors, in the “Slow Ahead” group, all went up last month. The leading sector, £ High Yield, made 1.2%, which was better than all the sectors in the “Steady as She Goes” and “Full Steam Ahead Emerging” groups, and on a par with the best-performing sector in the “Full Steam Ahead Developed” group. Only one sector, Healthcare, did significantly better, ending the month up 1.7%.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Bond Watch: interest in ‘cash-like’ bonds keeps rising

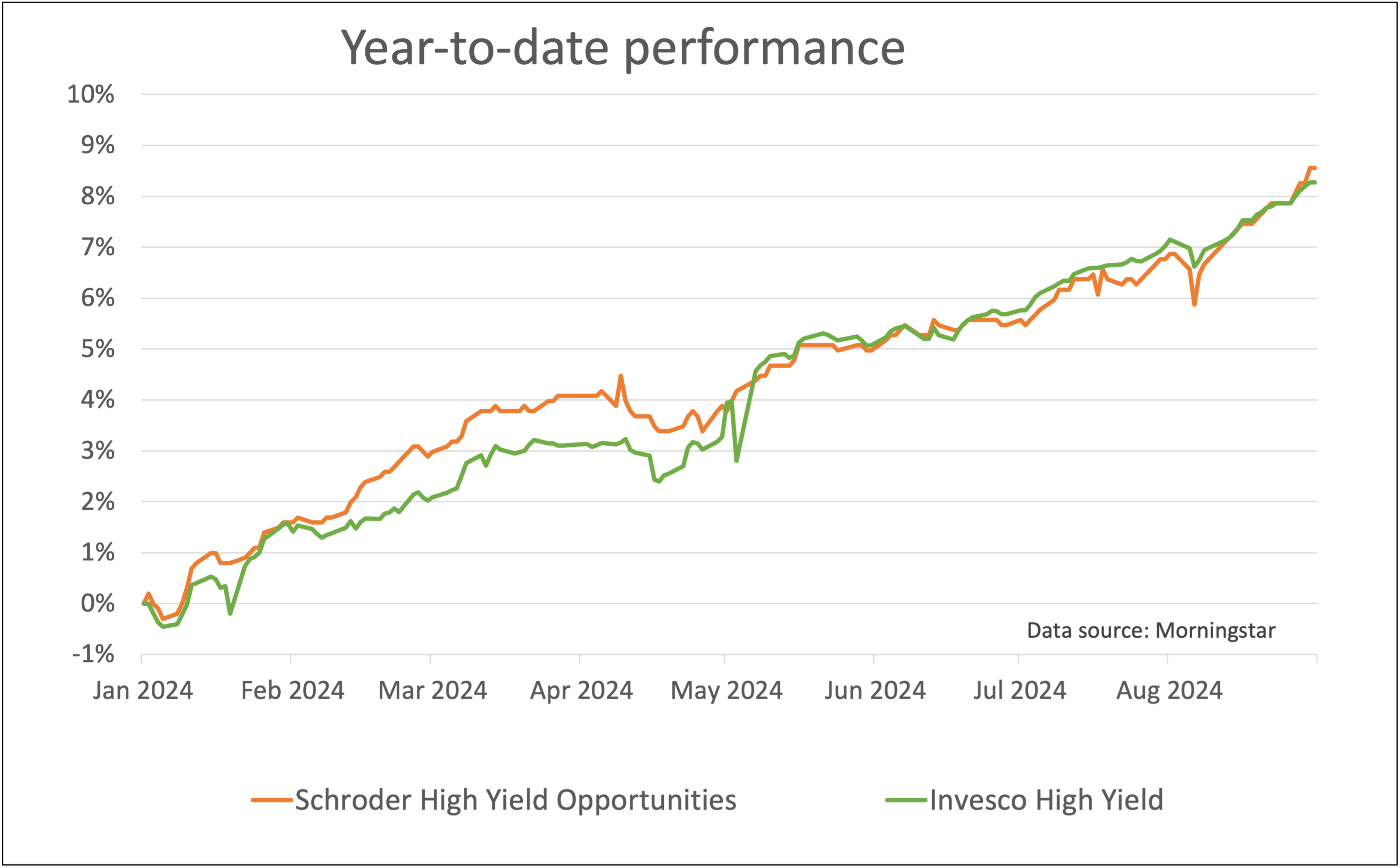

In our demonstration portfolios we have been holding two funds from the £ High Yield sector since last September. They are the Invesco High Yield UK and Schroder High Yield Opportunities funds.

So far this year they have both gone up by over 8%, which is not bad when you take into account the fact that they are two of the least volatile funds that we track. We calculate a Vindex rating for all funds based on their volatility over the past 12 weeks. Funds with a Vindex of 1 are the least volatile, while those with a Vindex of 10 are the most volatile. These funds are both in Vindex 1.

Past performance is not a guide to future performance.

They did fall at the beginning of August, but by much less than most funds, and they quickly recovered. They are now back on an upwards trajectory.

Last month we added a couple more funds from the “Slow Ahead” group to our portfolios. Man GLG Sterling Corporate Bond, from the £ Corporate Bond sector, and L&G Strategic Bond, from the £ Strategic Bond sector. They both had a Vindex ranking of 1. It is early days, but they have started well and are currently showing modest gains.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.