‘Investing more’ is top financial priority for 2023

9th January 2023 14:53

by Jemma Jackson from interactive investor

interactive investor survey reveals desire to spend less and save more.

The start of 2023 offers a chance for many of us to stop and catch our breath after what has been an incredibly uncertain and difficult time for so many of us, with red-hot inflation continuing to bite and a cost-of-living crisis squeeze.

interactive investor, the UK’s second-largest platform for private investors, investigated the key financial priorities being made in preparation for the year ahead among private investors.

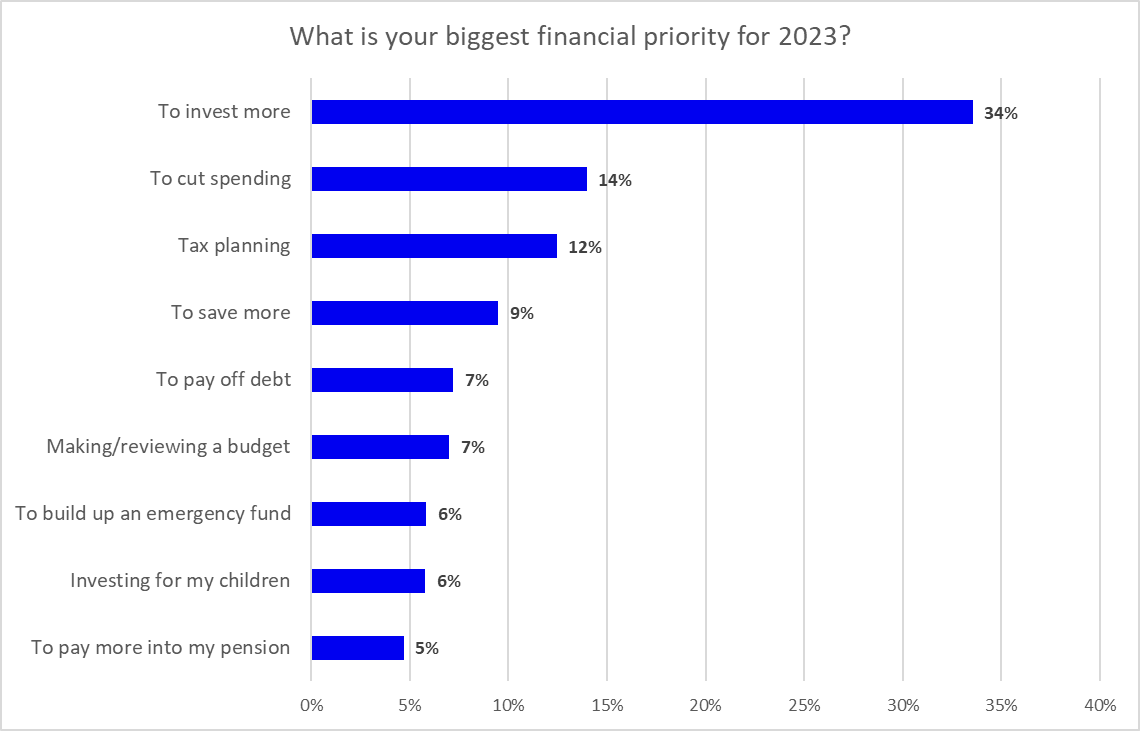

In a poll conducted on ii’s website from the 3-6 January with more than 1,917 responses, ‘investing more’ was the biggest financial priority for 2023 – with 34% of the vote.

- Invest with ii: How to Buy Shares| Free Regular Investing | Super 60 Investment Ideas

This was closely followed by reducing spending (14%) and a focus on tax planning (12%), as the cost-of-living crisis bites and tax changes focus minds. The annual tax-free dividend allowance will half from £2,000 to £1,000 from April 2023, while the capital gains tax allowance will also be halved from £12,300 to £6,000 from April 2023.

The huge financial burden the current cost-of-living crisis is putting on households, and individual, budgets across the UK, and tax planning taking centre stage ahead of changes to capital gains tax, for example, which are due after tax year-end.

Source: interactive investor

Myron Jobson, Senior Personal Finance Analyst, interactive investor says: “For many investors, tax planning will move centre stage this year as income and capital gains tax allowances shrink. Whatever the economic backdrop, tax planning is always good common sense – otherwise even the most carefully constructed portfolio could end up being hit by tax unnecessarily. So don’t forget those ISA and pension wrappers.

“For investors with unused ISA allowance, shifting investments into an ISA protects future dividends and gains from tax. It also means that you will no longer have to declare them on your self-assessment tax return.

“Known as Bed and ISA, a customer’s chosen investments from their trading account are sold free of charge and then the proceeds are used to immediately repurchase the same holdings within the ISA. There might be capital gains tax implications, depending on your circumstances as Bed & ISA action is treated as a sale for capital gains tax purposes. interactive investor only charges trading fees on the repurchase.”

Alice Guy, Personal Finance Editor, interactive investor, says: “It’s great to see that so many of us are prioritising investing in 2023. Investing is one of the best ways to build long-term wealth. Of course, some of these respondents may well be seasoned investors already, but they may also be people about to start their investment journey. In both instances, it is encouraging to see that the choppy markets are not putting people off. The survey results suggest that existing investors are keeping calm and carrying on despite volatility, and that new investors recognise the long-term value of starting to invest, despite the potential for short-term pain.

“For those without a defined benefit pension, investing regularly throughout our working life in a workplace pension or a SIPP is essential to help us achieve a comfortable retirement.

“Other financial priorities for ii website customers include cutting spending (14%), tax planning, (12%), saving more (9%) and paying off debt (7%), and so the results reveal a wide range of financial priorities which vary depending on our circumstances, time of life and existing financial security.”

Source: interactive investor

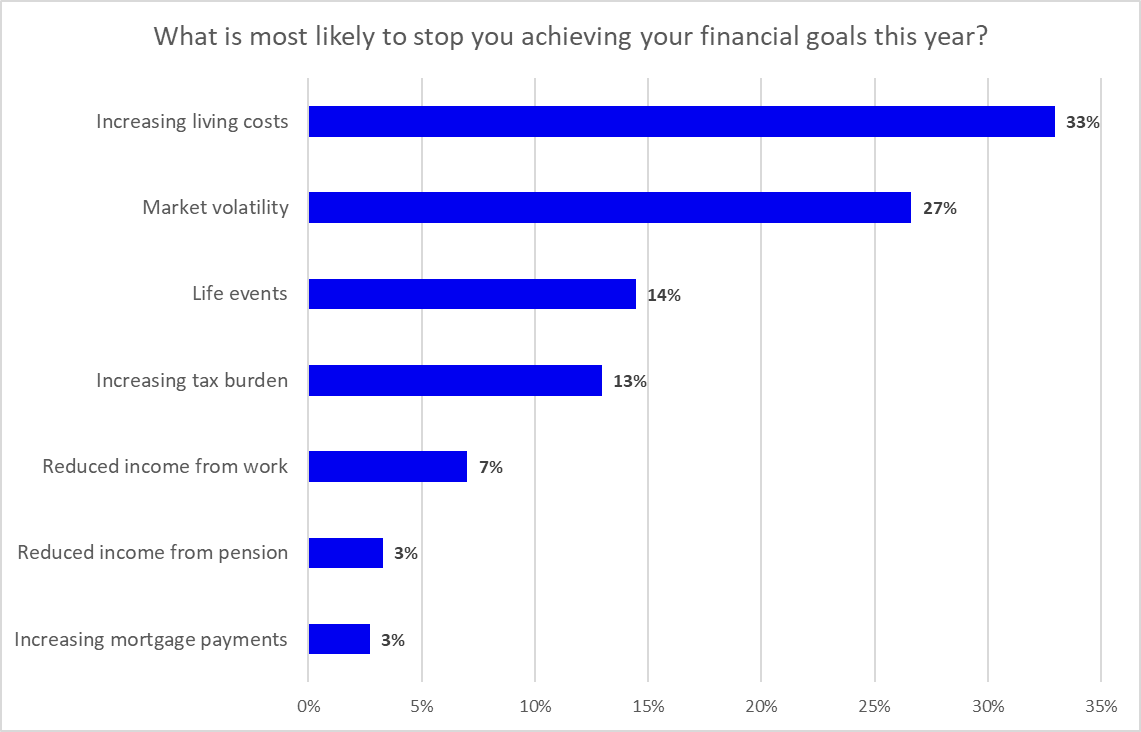

Survey respondents were also asked to choose what factor is most likely to hinder their progress on their chosen financial goal, and the results were varied and thought-provoking –with the cost-of-living pressures, and stock market volatility leading.

Guy adds: “Many of us will have more immediate, and perhaps sudden, payments due to rising costs. If this means you have to put other financial goals on hold, then it’s important not to give up. It’s sometimes possible to revise our goals and keep moving forward even if it’s more slowly than we hoped. Paying off debt more slowly, for example, or contributing a bit less than we hoped to our pension is still a step in the right direction.

“It is no surprise that 27% of those asked said that market volatility was a key concern, but it is important to remember that stock market volatility is, and always will be, a key feature of investing. That’s why it’s a good idea to drip money into your pension or stocks and shares ISA through regular investing. Regular investing is a good way avoid buying at a stock market peak."

Starting your investment journey; the golden rules

Many of the poll’s respondents may well already be seasoned investors, but for those who are keen to kick-start their investments in 2023 – there are some key things to bear in mind.

As Kyle Caldwell, Collectives Specialist, interactive investor, says: “It is important to ensure that each fund you hold in your portfolio is bringing something unique to the party in terms of how it invests and what it is investing in. Diversification, considered one of the golden rules of investing, can be achieved by spreading your money across different asset classes, regions, and investment styles – such as growth and income. It also makes sense to diversify by fund firms, as some follow a particular investment style that could go out of fashion.

“In addition, investors need to weigh up how much time they are prepared to dedicate. The more funds bought, the harder it is to keep on top of how they are performing and whether changes need to be made. Therefore, it makes sense to invest in a manageable number of different fund types to reduce risk, while at the same time avoiding diversifying too much. If you have more than 20 funds, it would be a good idea to look at them all and ensure each one is pulling its weight in terms of performance and are sufficiently different from one another.

“For those dipping their toes into the stock market for the first time – a multi-asset fund is a sensible starting point. They split your money across a mix of different assets, but mainly invest in shares and bonds. Different types of investments are unlikely to all outperform or underperform at the same time, which over the long term typically gives investors a smoother ride. Multi-asset funds give your money ample opportunity to grow, while also guarding against severe short-term losses.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.