Insider: director spends £100k on shares at 15-year low

These shares might have just dropped sharply, but the management team and City analysts believe better days lie ahead. Graeme Evans explains why.

23rd September 2024 08:06

by Graeme Evans from interactive investor

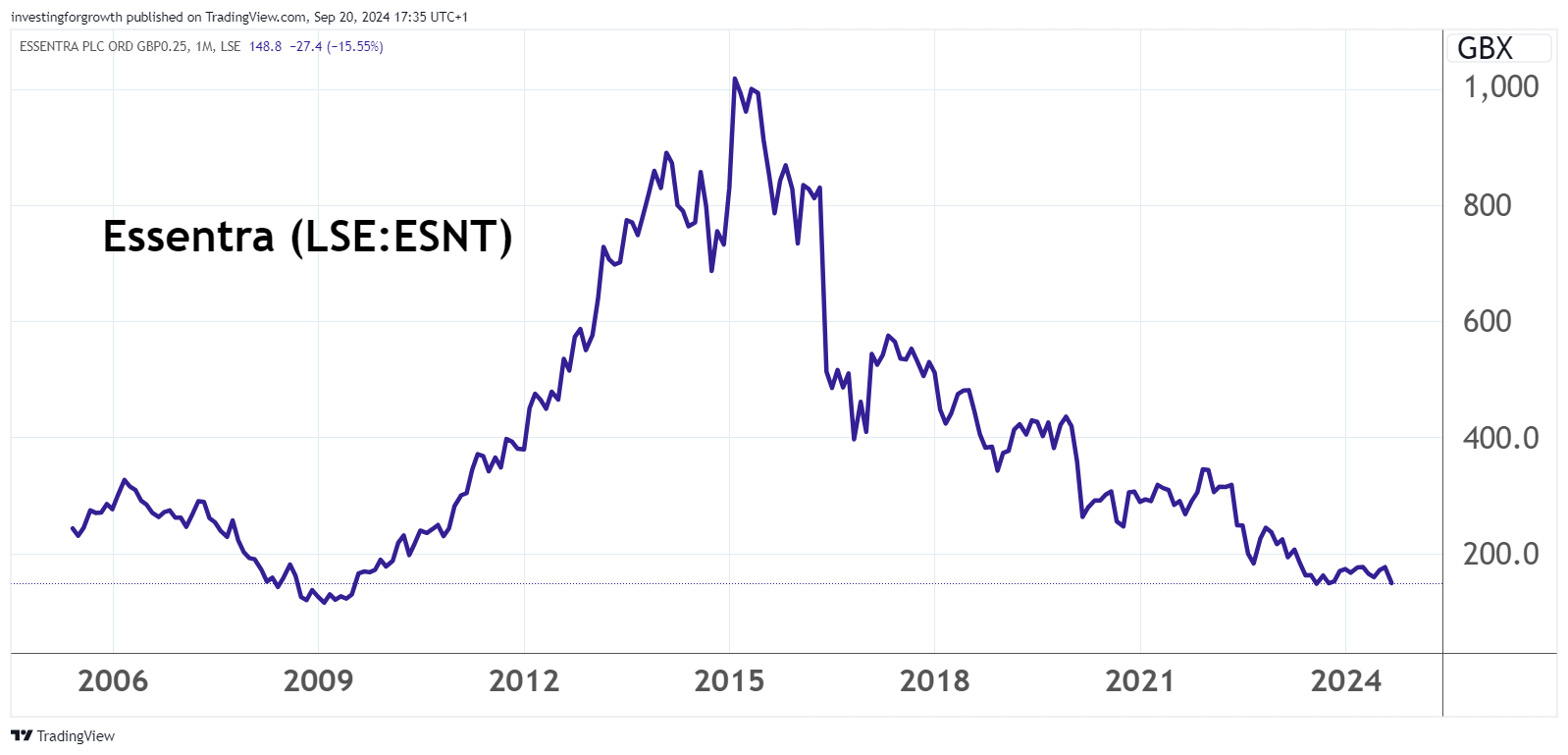

The cheapest Essentra (LSE:ESNT) shares in 15 years were bought by the FTSE 250 firm’s top team last week as they backed the components maker in the wake of a profit warning.

Chair designate Steve Good led the buying with a purchase of £100,000, while chief executive Scott Fawcett spent £15,000 and finance boss Jack Clarke £12,400.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

Their investments took place on Wednesday, the day after Essentra said trading in August and September had not lived up to earlier hopes for a modest upturn in volumes.

It said conditions in Europe were softer and that the recovery in the Americas region has been slower than anticipated, meaning that annual operating profits will be £40-42 million rather than City forecasts nearer £49 million.

The company, which was known as Filtrona until 2013 and demerged from FTSE 100-listed Bunzl in 2005, is now a pure play components business after selling its filters division in 2022.

It employs 3,000 people at 14 manufacturing facilities, producing 60 million parts a week for customers in sectors including automotive, electronics and renewable energy. These are small but critical components that go into other items.

Last week’s trading setback sent shares down by as much as 19% towards 140p, which compared with 350p at the start of 2022 and 190p in May. They closed last week at 145.2p.

Source: TradingView. Past performance is not a guide to future performance.

The sharp reverse came even though the company stressed that it stands to benefit from high levels of operational leverage when normalised growth returns.

The support of directors, who bought their shares at 142p, was echoed in the City after analysts at three firms downgraded their price targets but still forecast a decent recovery.

Peel Hunt lowered its estimate from 300p to 230p and said its focus remains on the potential for accelerated returns as volumes improve: It added: “Service levels are high. The challenges are market volume related rather than pricing.”

Deutsche Bank cut from 240p to 200p, while Panmure Liberum left its price target unchanged at 315p although it conceded that this will now take longer to achieve.

Panmure Liberum added: “Whilst it is disappointing to see lower than expected volumes, we see the situation as cyclical rather than structural in nature.”

It continues to believe the group is capable of delivering on its medium-term ambitions, which were disclosed in November 2022 when Essentra told investors that it intended to double its revenue and triple its operating profits.

- Listen here: 100th episode special: the Terry Smith interview

- Buffett stashes cash: should investors follow?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The growth plan included the opening of a new site in Monterrey, Mexico, reflecting the significant contribution the Americas region will make to its long-term performance.

Efforts to deliver results throughout the cycle saw an improvement in last year’s operating margin to 13.7% from 7.4% the year before, while the balance sheet remains robust at a ratio of 1.1 times net debt to adjusted earnings.

It is due to pay an interim dividend of 1.25p a share on 25 October, with the full year award three times covered by earnings. In 2023, Essentra shareholders received a special dividend of 29.8p a share following the disposal of its filters and packaging businesses.

The group has been led by Fawcett since January 2023, having joined Essentra in 2010. Chair Paul Lester is due to step down later this year after a handover period to Good, who is the former chief executive of Low & Bonar and joined the Essentra board in July.

Building a big stake

At the upper end of the FTSE 250 index, a director of Balfour Beatty (LSE:BBY) has disclosed a £75,000 purchase of the infrastructure company’s shares at a price close to a record high.

The move involving Robert MacLeod, the former Johnson Matthey chief executive who joined the Balfour board as a non-executive director in March, took place on Tuesday at 422.1p.

The shares are up by nearly a third this year and continued their upward momentum after the purchase to close the week at 428.6p.

Bank of America recently raised its price target to 520p after results in August revealed a 6% rise in half-year underlying profit to £101 million, driven by the margins in UK construction and in support services.

Highlighting Balfour’s position in attractive growth markets in the UK and US, the bank upgraded from 440p after making a 3% upgrade to its 2024-2026 earnings estimates.

- Shares for the future: a milestone year for this outperformer

- Stockwatch: stake-building hints at recovery upside here

- The Week Ahead: Diageo, Smiths Group, DFS, Halma

Chief executive Leo Quinn told investors in August that the group’s chosen markets delivering complex projects remain encouraging, including in the UK after the new Government reinforced commitments to critical national infrastructure.

He added: “Balfour Beatty’s prospects across these markets provide the board with confidence that the group will continue to deliver significant and attractive shareholder returns in the coming years.”

Balfour is due pay an interim dividend of 3.8p a share on 6 December, an increase of 9% on the year before and part of plans to distribute £60 million in 2024.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.