How will Rolls-Royce shares navigate market turbulence?

Global financial markets are a bit chaotic right now, so independent analyst Alistair Strang looks at one of the UK's most popular stocks to assess the possible impact.

9th April 2025 07:43

by Alistair Strang from Trends and Targets

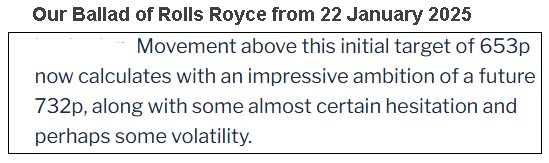

We reviewed the Rolls-Royce Holdings (LSE:RR.) share price in January, giving an upper target of 732p and warning we anticipated some volatility at such a level. Events proved us right, and on 27 February it achieved target, closing the day at 731.6p, impressively alongside our expected level.

Unfortunately, there was a massive fly in the ointment.

- Invest with ii:Open a Stocks & Shares ISA | Top ISA Funds | Transfer your ISA to ii

The share price had been gapped up to our target level.

Source: Trends and Targets. Past performance is not a guide to future performance.

The problem with the price movement came from the fact the market opted to “gap” the share up to our target level. An unspoken implication with such a massive step was a strong argument against any volatility above the target level, this proving to be the case as the share powered onward toward an eventual 818p before becoming entrenched in the overall intransigent behaviour of the wider market.

Of course, Trump's tariffs are expected to potentially affect Rolls-Royce's share price, and developments in the coming weeks and months could indeed create volatility. But let’s face it, no-one ever bought anything from Rolls due to price concerns.

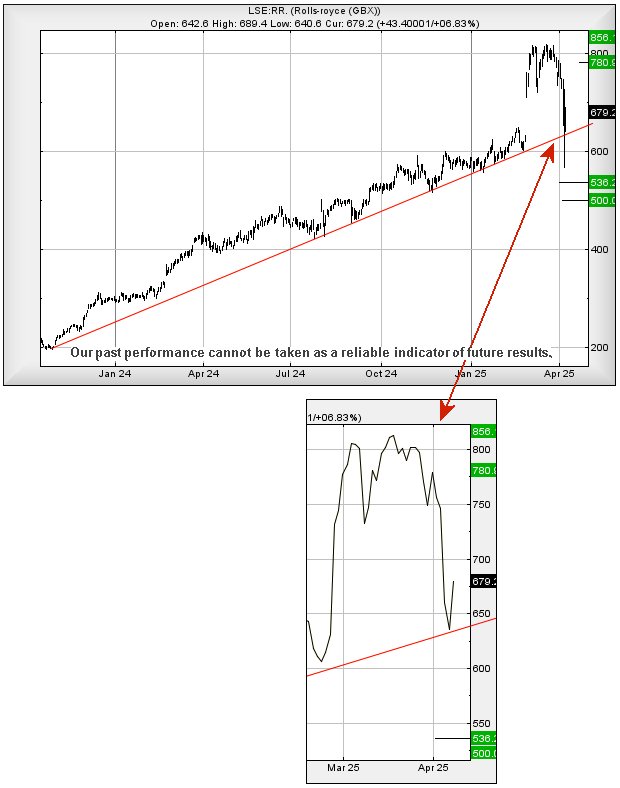

We suspect the market has come to a similar conclusion, the company share price conspicuously failing to close below the Red uptrend on the chart below. As a result, it now seems movement above just 690p should enter a cycle to an initial 780p with our secondary, if bettered, at 856p and a somewhat grudging all-time high.

If things intend to go wrong, below 566p risks a cycle down to the 500p level.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.