How to trade FAANG stocks this earnings season

16th January 2019 11:53

by Rodney Hobson from interactive investor

Leading industry commentator, accomplished author and new interactive investor columnist Rodney Hobson tells us what he'd do with these tech titans at results time.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stockmarket. He is qualified as a representative under the Financial Services Act.

Remember Blackberries? Not so long ago, wannabes loved to ping over texts and emails with “Sent from my Blackberry” on the bottom. It was a sign of climbing the social and business ladder, that you were tech savvy and had the latest gizmo. Now blackberries have gone back to being a pie filling.

It's a warning how fast technology moves and how quickly today's must-have items can disappear, taking whole companies that fail to constantly innovate down the pan. Millennials can be forgiven if they have never heard of Nokia, once the mightiest mobile phone manufacturer.

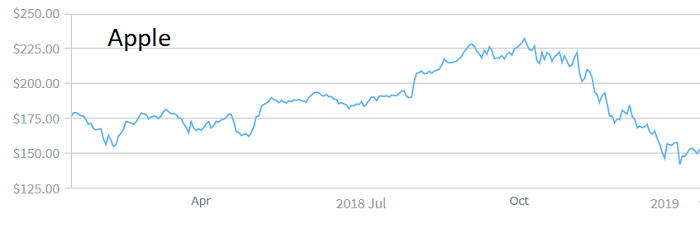

So if you think, quite reasonably, that the FAANGs are the future, it is worth considering what sort of year 2019 is likely to bring for Facebook (NASDAQ:FB), Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX) and Google (NASDAQ: GOOGL) (Renamed Alphabet). All finished 2018 with shares well below the year’s high so there could be scope for recovery over the next 12 months.

It's easy for investors, like companies, to become complacent, which is why the profit warning from Apple was such a shock. After a "challenging" quarter, California-based Apple reduced estimates of its first-quarter revenue from $89-93 billion to $84 billion, with gross margins at the lower end of its guide range.

Apple was quick to blame its downturn on the slowdown in the Chinese economy, and there is no doubt that the US-China trade war has had a serious adverse impact. Much more worrying, though, is criticism of the latest iPhone6, which is prone to bending – a fault that Apple apparently knew about before they launched it as it affected earlier models to a lesser extent.

Source: interactive investor Past performance is not a guide to future performance

Unfortunately, Apple thinks the fault is acceptable, showing a perilous contempt for customers who feel otherwise, and has tried to blame resultant problems with the touchscreen on buyers dropping the phone onto a hard surface. This is a dangerous attitude, as there are other phone manufacturers around. Customers can switch allegiance easily.

Microsoft showed similar disregard for customers when it launched the ill-functioning Vista version of Windows some 20 years ago but has shown signs of learning its lesson. It did at least rush out the much better Windows 7 and has since launched further improvements. The big difference, though, is that Microsoft has a virtual monopoly and it would be massively expensive, with little guarantee of success, for a rival to muscle in on its territory.

Google is one rival that has taken on Microsoft and won. Its Google Chrome has, with a little help from the regulators, held its own against Microsoft's Outlook and Google is the default choice as a search engine. It is hard to see that changing.

Source: interactive investor Past performance is not a guide to future performance

Netflix does have plenty of rivals. TV is a highly competitive market where it is easy to fall from a pinnacle, as ITV has done in the UK.

However, it is producing highly acclaimed content such as Game of Thrones and The Crown so the outlook is pretty good at this stage. Investors should be wary, though, as fortunes can change rapidly.

Source: interactive investor Past performance is not a guide to future performance

Facebook is also in a highly competitive market, one where followers switch allegiance almost on a whim. This is an area where young people predominate so it is vital to keep attracting new adherents.

It is hard to see what Facebook offers that cannot be provided elsewhere in social media, so it is always going to be vulnerable.

Source: interactive investor Past performance is not a guide to future performance

Amazon, like Microsoft, has spent several decades building up an impregnable position in its own field.

Similarly, setting up an alternative delivery service would be excessively expensive with little prospect of success. Even if it is forced to pay a fair share of tax in various parts of the world it will continue to be highly profitable.

Source: interactive investor Past performance is not a guide to future performance

Investors seeking income should note that only Apple currently pays a dividend and the yield is under 2%.

Hobson's choice: Buy Alphabet (Google) with a price/earnings (PE) ratio of 24 and possibly Netflix and Amazon despite PEs in three figures. Avoid Facebook and Apple.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.