How to play markets now, according to BlackRock, and others

The global big picture is beginning to change. So Russell Burns’ broken down the view from Wall Street’s pros to find out where the risks and opportunities are now.

19th July 2024 08:46

by Russell Burns from Finimize

- Interest rate cuts look set to happen in the US later this year, and with slowing (but still positive) growth and the pace of inflation coming closer to target, the outlook for the S&P 500 looks pretty rosy.

- Actively managed funds have been underperforming the big US stock index lately – more than they usually do, in fact – and their managers have been blaming the high concentration of the largest companies for their lacklustre returns.

- Stocks, bonds, cash, and alternative assets all have attractive investment appeal in the current climate, but the big risk to stock and bond markets is a surprise pickup in inflation.

When you’re making big decisions, it’s nice to get a second opinion. And when those decisions involve your hard-earned money and a changing economic climate, a third and a fourth (and maybe even a fifth) from the world’s top investment houses couldn’t hurt either. Lucky for you, I keep pretty close tabs on the big-picture views from Goldman Sachs, Morgan Stanley, BlackRock, and Bank of America. Here’s what they say now.

On interest rates and inflation.

The rapid run of interest rate hikes aimed at bringing some ultra-hot inflation back to low and stable levels is widely assumed to have ended, with consumer price increases having dropped fairly convincingly toward the 2% target.

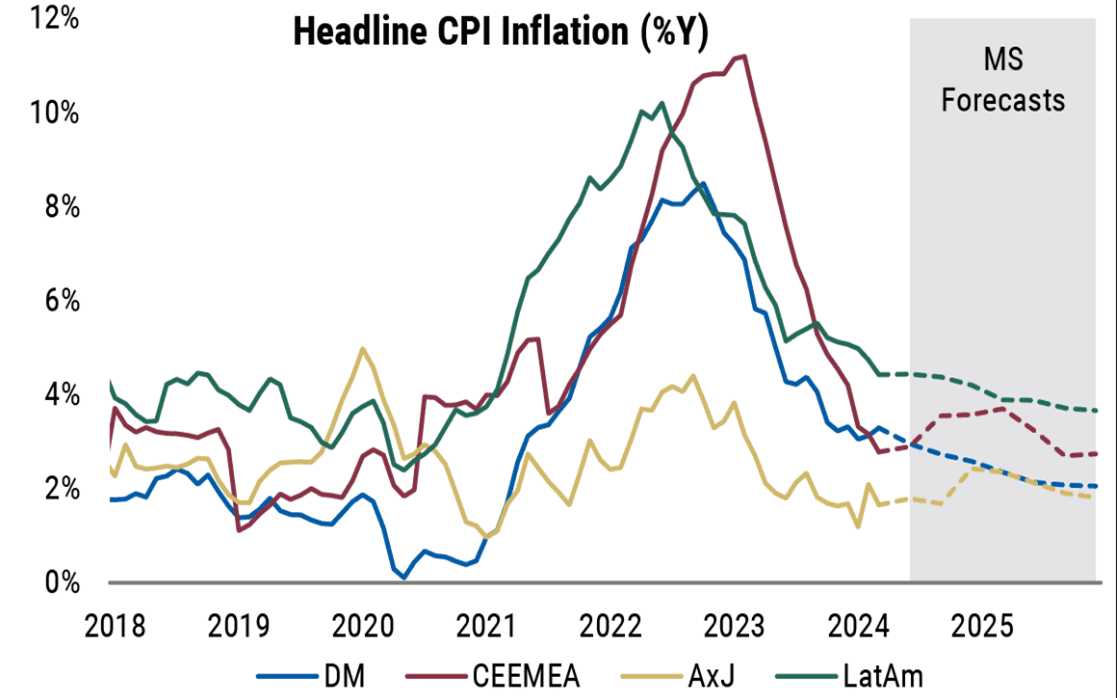

The consumer price index’s overall annual inflation rates, actual and forecasted, from 2018 to 2025. Source: Morgan Stanley.

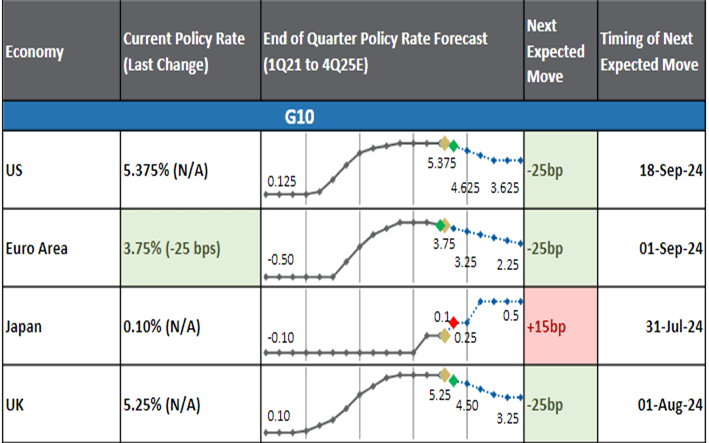

Markets are now fully expecting, or “pricing in”, a series of interest rate cuts from the Federal Reserve (Fed), European Central Bank (ECB), and the Bank of England (BoE). The ECB has already lowered its key rate, to 3.75%, from 4%. The BoE is expected to follow suit in August, the Fed in September.

Central bank policy views: historical, current, and forecasts for interest rates from the first quarter of 2021 to the fourth quarter of 2025. Source: Morgan Stanley.

The chart shows the expected timing of interest rate changes planned through the end of 2025. The Bank of Japan is the exception here, with small rate hikes expected, instead of cuts.

Lower interest rates are known to give a gentle boost to the economy and are generally good for riskier assets like stocks and crypto. But there’s a lingering concern about the potential damage that’s been inflicted on the consumer, with prices rising roughly 20% in total over the past two years and eating away at folks’ spending power. Across the US, UK, and Europe, essentials like food are now much less affordable.

On global growth and the Magnificent Seven.

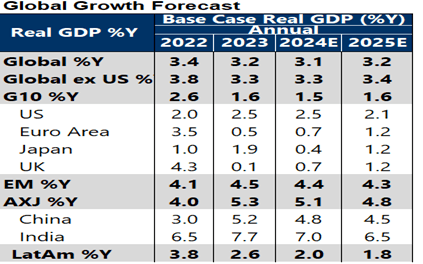

Global economic growth is expected to remain on an even keel, just above 3%. Among the world’s developed markets, the US is going to flex the most muscle, with a slower tempo of expansion this year and next that will nonetheless outpace what’s seen in the EU, UK, and Japan. And that forecast means the world’s biggest economy is likely to avoid the recession that had been predicted by some at the turn of the year.

Far zippier growth is expected in emerging market economies, with China and India near the top of the pack.

It’s worthy of a sigh of relief from investors, because slower but still positive growth, lower inflation, and cuts in interest rates are typically a good cocktail mix for a stock market rally.

Global economic growth, both actual and forecasted, for 2024 and 2025. Source: Morgan Stanley.

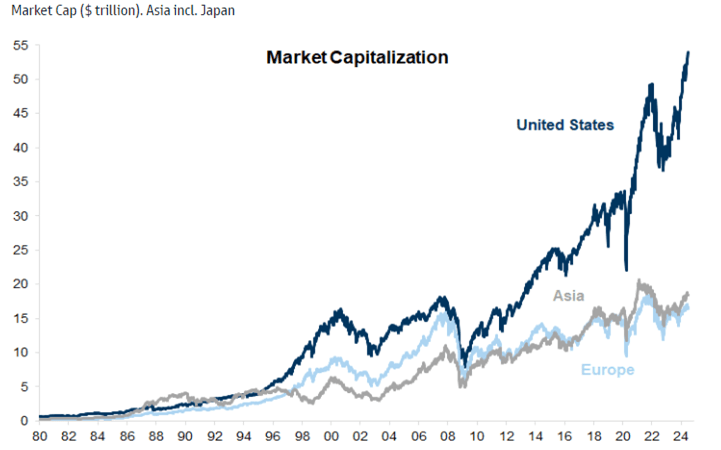

The US stock market has outperformed its overseas peers in dollar terms since the global financial crisis. And, look, that’s partly thanks to the strength of the greenback. But it’s also because America’s got a dynamic economy that’s helped produce many of the world’s leading tech companies.

The market capitalization, or total market value, of US stocks (dark blue), Asian stocks (gray), and European stocks (light blue), measured in trillions of US dollars. Source: Goldman Sachs.

In the past couple of years, earnings at the so-called Magnificent Seven group of US companies have shot the lights out. These giants – Microsoft, Meta, Apple, Amazon, Alphabet, Tesla, and Nvidia – have left the rest of the companies in the S&P 500 (i.e., the other 493) in their dust.

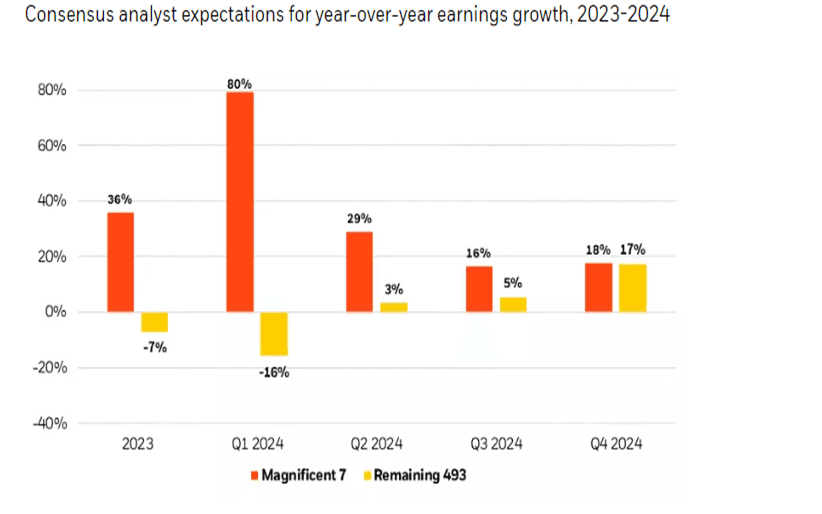

Actual and forecasted yearly profit growth in 2023 and 2024 for the Magnificent Seven and the “other 493” companies in the S&P 500. Source: BlackRock.

The “Mag 7” are expected to continue to post strong growth for the second and third quarters, but at milder levels. The “other 493” are expected to post minimal profit growth in the same period, but by the fourth quarter, analysts expect their growth will match those glittery behemoths.

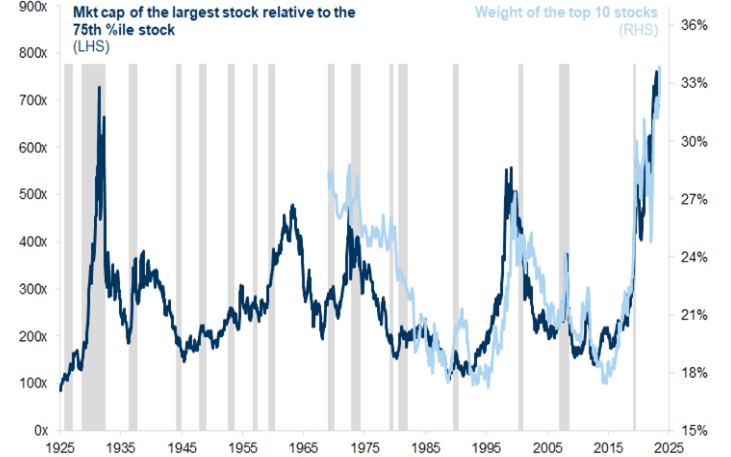

Overall, the Magnificent Seven’s disproportionate strength in recent years has pushed their collective weighting in the S&P 500 index to extreme levels – the kind not seen since 1929.

The weight of the top ten stocks (light blue) in the S&P 500 and the total market value of the biggest stock to the 75th percentile stock (dark blue line) from 1925 to 2024. Source: Goldman Sachs.

Now, comparisons to the stock market era that preceded the Wall Street Crash of 1929 and the start of the Great Depression are never comfortable ones – I’ll give you that. But this high concentration isn’t necessarily a problem, and that’s because the earnings from these seven companies largely justify their share price gains. Still, in a healthier market, you’d expect to see wider contributions from far more companies and sectors.

Less of an issue here is the fact that the high concentration makes it tough for active fund managers to do well in their jobs, since it's hard to outperform an index that’s dominated by just a handful of companies. In the first half of 2024, only 18% of active fund managers who benchmark their work against the S&P 500 Index managed to come out ahead. By the same token, it’s been tougher for retail investors to stock-pick their way to better-than-index gains. Really, it’s no wonder everyday folks have been opting out of higher-fee actively managed funds and into dirt-cheap index ETFs.

What’s the opportunity here?

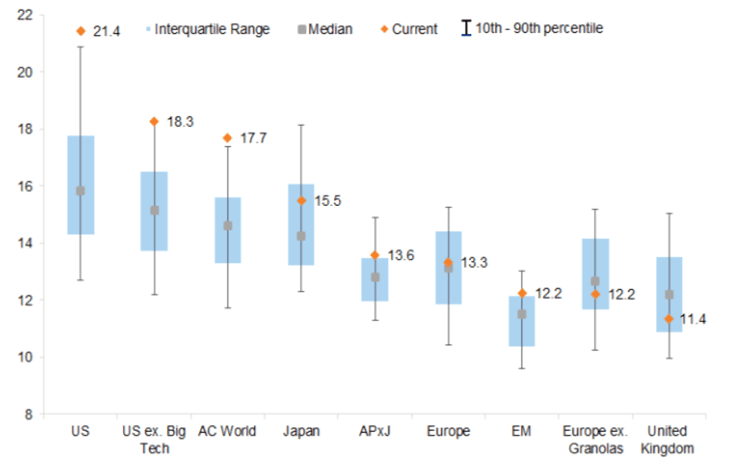

A lot of assets look attractive just now, including shares, bonds, cash, and alternatives (think: commodities, real estate, private credit). And though stock valuations look stretched in the US, it’s hard not to want to be invested in AI as it drives game-changing innovations. And, besides, if you exclude Big Tech, those stock valuations look expensive, but not massively so.

MSCI region stock valuations, 12-month forward price-to-earnings ratio. Source: Goldman Sachs.

If traders’ predictions prove correct with one or two interest rate cuts in the US this year – and fourth-quarter earnings growth broadens out to the so-called other 493, as the consensus of experts expects, then an S&P 500 Equal Weight ETF could also prove to be a timely bet.

Elsewhere, Indian stocks look attractive for investors who favor growth stocks – i.e. the kind that may come with a bit more risk now, but that are seen as having the potential to outperform the overall market over time.

For investors who favor value stocks – i.e. those that appear to be trading at a lower price, relative to the company’s books – the UK stock market is worth a look. It appears to be the cheapest on a 12-month forward price-to-earnings ratio, and with a new, stable government in place and promising to implement a growth agenda, the risk and reward balance looks pretty attractive.

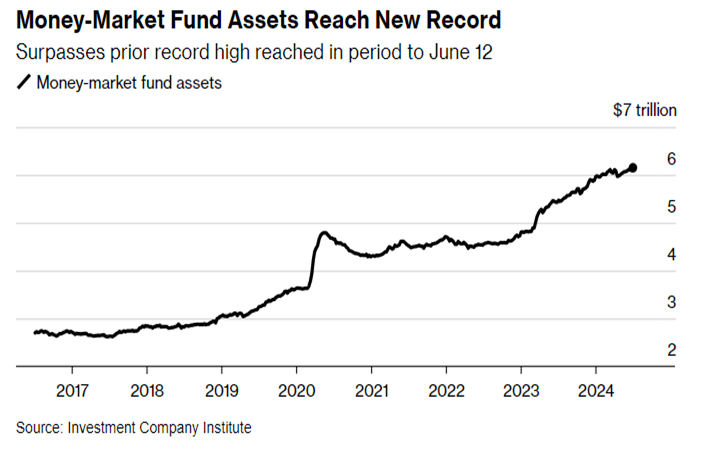

Cash accounts and bonds also look good. Earning a risk-free return of more than 5% on your cash when consumer price increases are fluttering around 2% or 3% means you’ll easily make more than inflation. It’s no surprise, then, that there’s been massive inflows into money market funds over the past two years.

Money market fund inflows from 2017 to 2024. Sources: Bloomberg, Investment Company Institute.

And then there are bonds: right now, they come with pretty decent returns. What’s more, if the economy slows more than expected, and more interest rate cuts follow, bonds would get an added boost higher.

And, finally, what’s the risk here?

Some finance folks are always whispering about the potential for a “black swan”, or totally unforeseen, event. And, sure, those things happen. But right now, I’d say the main threat to the otherwise generally rosy outlook is a brand-new jump in inflation. That’s one reason why the Fed is taking a go-slow approach to that first interest rate cut. It’s been using higher interest rates to bring inflation back to its low-and-stable target, so the last thing it wants to do is drop them too far, too fast, and undo all that hard work.

But the reality is: loftier bond yields would likely result from a new pop-up in inflation. What’s more, recent research from Bank of America shows that the S&P 500 now tends to fall when bond yields rise.

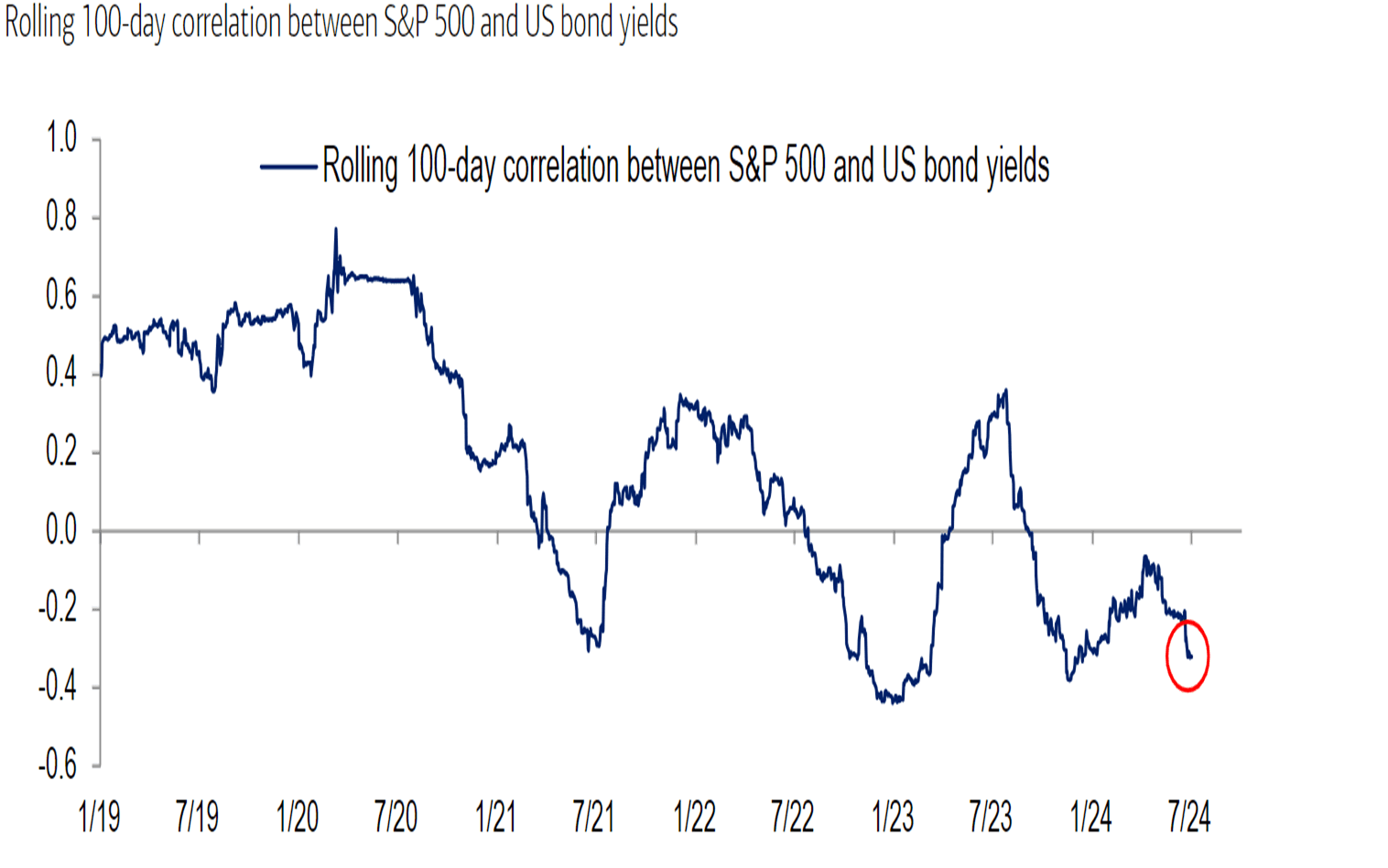

The S&P 500 and US bond yields used to move in the same direction, but that correlation has been turned on its head recently, as you can see here from the rolling 100-day correlation. Source: Bank of America.

Now, that’s a switch from how things used to be. For much of the past two decades, bond yields and stocks have almost always travelled in the same direction. The assets were “positively correlated”, meaning when one was gaining, the other often was too. But that relationship’s been turned on its head in recent years. These days, it’s more often the case that if one is gaining, the other is losing. And because of that, bonds are no longer a super-great counterbalance to the stocks you hold in your portfolio. Nowadays, if your stocks are tumbling, your bonds probably are too. To protect against that situation, you may want to consider adding some commodities and real assets to your mix. They’ve been great hedges against inflation, after all.

Russell Burns is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.