How not to get left in the dust in the EV boom

The electric vehicle market is about to shift into overdrive, but there's more to this megatrend than Elon Musk’s sleek line of cars. Here’s my look at the whole EV roadmap and the pit stops where I see investment opportunities.

8th September 2023 14:10

by Reda Farran from Finimize

Electric vehicles (EVs) reach an inflection point once 5% of new car sales in a country go fully electric. That's usually the threshold at which the key challenges of EV costs, charger availability, and driver skepticism are overcome by the few, causing the masses to follow.

Today, 23 countries have passed that critical 5% mark, including China, the US, and most of Western Europe. So when it comes to EVs, the fast part of the S adoption curve is happening now in most of the world’s biggest auto markets.

Each part of the value chain offers interesting opportunities, but by investing in lithium producers, battery manufacturers, electric utilities, battery recyclers, and EV charging station operators, you could benefit no matter which automaker comes out on top.

The EV market is about to shift into overdrive. But before you go thinking that means you should hurry up and snag shares in Tesla, let me just tell you this: there’s a whole lot more to this megatrend than Elon Musk’s sleek line of cars. So here’s my look at the whole EV roadmap and the pit stops where I see investment opportunities.

How fast are EVs gaining ground?

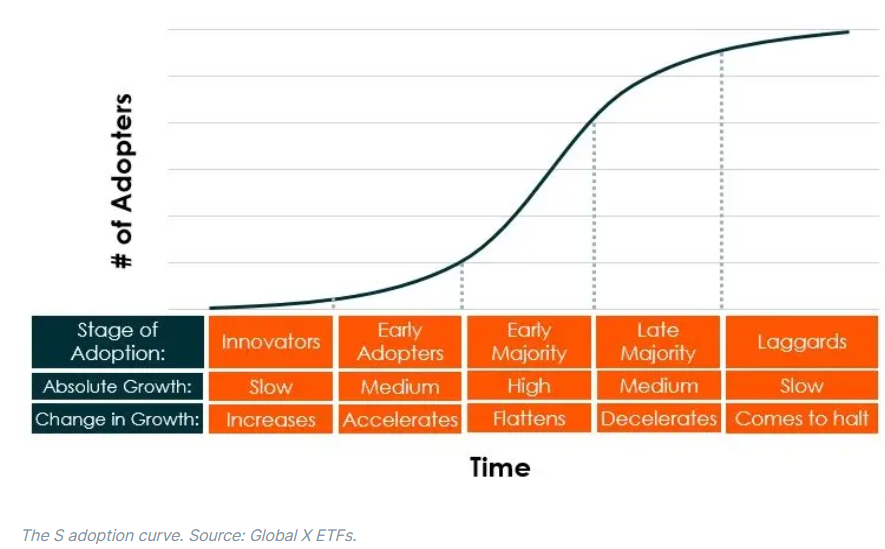

To answer that, let’s use a popular concept called the “S adoption curve”, which illustrates the pace at which people adopt a new technology. These curves rise slowly at first as early adopters try out the new technology. The rise then steepens as broader adoption takes place, before finally levelling off when the market is saturated and only late adopters are left. For investors, identifying that first inflection point, where adoption starts to accelerate, is crucial because it often marks the technology’s shift from niche product to mainstream acceptance – and booming sales.

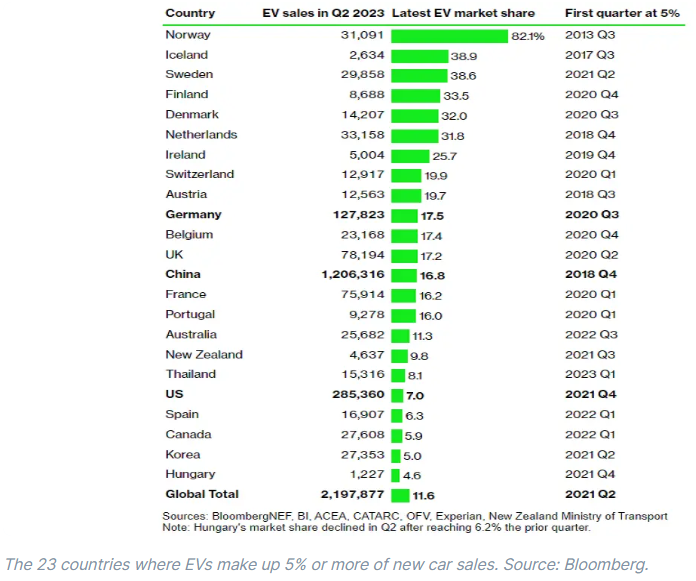

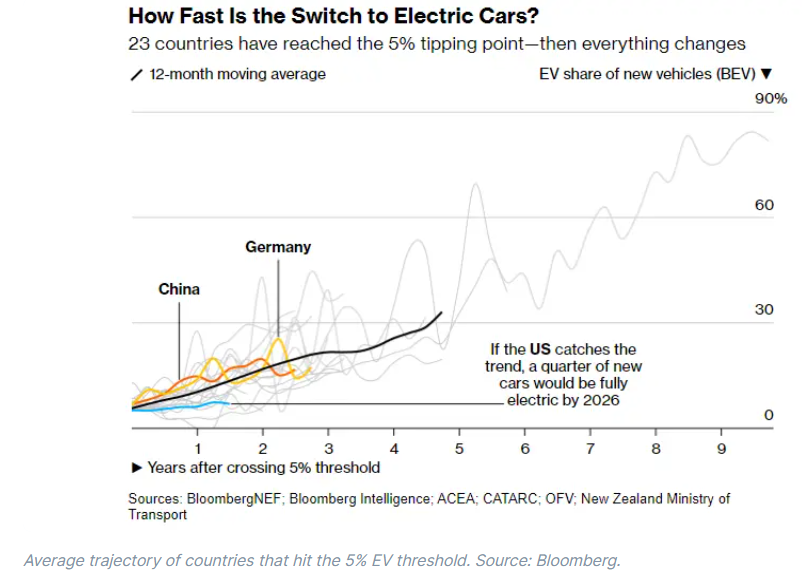

According to an analysis by Bloomberg Green, EVs reach their inflection point once 5% of new car sales in a country go fully electric. The time it takes to hit that threshold varies widely by country, but once the big challenges of EV costs, charger availability, and driver skepticism are overcome by the few, the masses soon follow. Today, 23 countries have passed that critical 5% level, including China, the US, and most of Western Europe. In other words, when it comes to EVs, the fast part of the S adoption curve is happening now in most of the world’s biggest auto markets.

The average trajectory laid out by countries that hit the 5% level a while ago – Norway, China, and the Netherlands, to name a few – suggests that EV market share can surge from 5% to 25% in just four years. That’s big: if the US catches the trend, for example, a quarter of new car sales in the nation would be fully electric by 2026.

What’s more, a tipping point appears to be near for India – the third-biggest auto market after China and the US. EVs made up 3% of new car sales in the country last quarter, after doubling in just six months as domestic automakers made huge investments in electrification. Tesla is also planning to enter the market very soon.

Applying the framework to the entire car-buying world, the EV tipping point was passed in 2021. In fact, global sales of new internal-combustion engines peaked in 2017, and net growth for car sales is now driven entirely by EVs. So if the trends hold true, the rest of the decade will be remembered as the period when EVs went mainstream.

What’s the opportunity here?

The drive toward EVs is a megatrend – one of the biggest of our time. But there’s a lot more to the phenomenon than just a handful of much-hyped manufacturers’ stocks. To make the most of the investing opportunity afforded by this seismic shift, consider buying into a basket of shares from across the value chain, instead of just one or two companies.

When it comes to EVs, the supply chain begins with lithium miners – as well as extractors and processors of the other key metals used in lithium batteries, like cobalt, nickel, and aluminium. Battery manufacturers use the metals to build EV battery packs. These are, in turn, a key input for EV manufacturers, who build the rest of the vehicles and sell them on – either to auto dealers or directly to consumers and businesses.

But the ecosystem doesn’t end there. More EVs on the road means more charging stations, as well as more “fuel” to fill ‘em up – that is, more electricity supplied by utilities. And, preferably, that’s electricity generated from renewable sources: there’s no point in pushing EVs as a green future only to power them with “dirty” electricity generated from gas or coal. There’s also one underappreciated area that closes the loop of EVs’ lifecycle: battery recycling. Here’s a snapshot of some of the stocks across the EV ecosystem…

Battery producers and their suppliers

Unlike some other commodities, it’s virtually impossible to invest in lithium directly. However, you can invest in lithium miners. Global lithium production is dominated by five firms: Albemarle, SQM, Ganfeng Lithium, Tianqi, and Livent. Just be aware that investing in any of them comes with risk exposure to the price of lithium, which is quite volatile. If you want to invest in battery producers, CATL, Panasonic, and LG Chem control around 60% of the market – the other 40% is shared among smaller firms.

EV manufacturers

We can separate EV manufacturing stocks into two main categories. You’ve got pure-play EV makers like Tesla, BYD, NIO, Xpeng, Fisker, Rivian, and so on. And then you have legacy automakers that are investing heavily to electrify their fleets – like Volkswagen, Hyundai, GM, Ford, Nissan, Honda, and so on.

These firms give you the most direct way to invest in EVs. A word of caution though: competition is increasing among all EV makers and there’s a lot of capital being ploughed into the sector. That could drive down future returns for all players involved, especially since they’re all currently engaged in a price war (initiated by Tesla, which has slashed its prices multiple times this year).

Powering the EVs

Fully electrifying almost all road transport will increase global electricity demand by 12% to 14% by 2050, according to Bloomberg New Energy Finance. But as well as selling electricity, utilities make money from infrastructure projects – since all those charging stations need to be hooked up to the grid. You can turn this into an investment opportunity through utility ETFs or individual utility stocks (look for those generating most of their electricity from renewable sources and operating in areas with increasing EV penetration). Profitable companies building and/or operating EV charging stations include Kempower, Alfen, and ABB.

Battery recycling firms

It’s worth thinking about what happens to EV batteries when they reach the end of their life. Safely disposing of the chemicals they contain is tough, and that all-important lithium is really too useful to go to waste – so battery recycling firms have sprung up, looking to recover the metal and sell it back to producers. There’s currently only one publicly listed, pure-play battery recycling firm: Li-Cycle. Another firm to keep an eye on is Redwood Materials, which is run by a Tesla co-founder. The firm, which just closed a fundraising round at a valuation of over $5 billion, could be gearing up for an initial public offering in the near future.

As that adoption slope rises exponentially, each part of the EV value chain offers an opportunity to invest. It’s up to you to decide where to put your money. But by adding lithium producers, battery manufacturers, electric utilities, battery recyclers, and EV charging station operators to your portfolio, you should benefit, no matter which automaker comes out on top.

Reda Farran is a senior analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.