How ISA millionaires are behaving as Covid-19 harms investment growth

Research by ii has uncovered the full impact of coronavirus for long-term ISA investors.

8th April 2020 10:18

by Myron Jobson from interactive investor

Research by ii has uncovered the full impact of coronavirus for long-term ISA investors.

New research by interactive investor, the UK’s second-biggest investment platform, found that while early-bird ISA investors are still ahead of their last-minute rivals, the impact of the last year has caused carnage for long-term investors.

Someone who invested the full ISA allowance into the FTSE All Share index at the start of each year over the past 10 tax years (to 5 April 2020) would have seen their investment of £149,160 grow to £151,105 – very little in investing terms.

Just a year ago, after their £20,000 ISA contribution on 6 April 2019, their investment would have looked very healthy, at a robust £199,721. However, the 24% fall in total return on the FTSE All Share over the past 12 months has wiped out almost an entire decade’s worth of growth on the portfolio.

These numbers highlight the impact of market falls in a long-term portfolio. Market falls when you are starting out can put you off investing, but the amount you have lost is relatively small. Market falls on a larger portfolio hurt a lot more – especially if you are starting to take an income from your portfolio.

Source: interactive investor using Morningstar Data

The good news is that most of us have a longer time horizon than 10 years. Looking at the returns on your portfolio since ISAs began, 21 years ago, the numbers look healthier, with total available subscriptions over the 21 years of £226,560 growing to £308,405 for early-bird investors - although the last year of market falls has wiped nearly £100,000 from the portfolio.

Moira O’Neill, Head of Personal Finance, interactive investor, says: “There is no getting away from the impact Covid-19 has had on investments – regardless of the approach. At uncertain times, investors can take solace in the fact that markets have a knack of bouncing back from sharp market downturns. The current coronavirus-fuelled markets could present an opportunity for brave investors to buy on the dip - although markets could fall further still.

“Despite the recent market volatility, the early bird gets the bigger worm it seems when it comes to ISA investments.

“Many of us are not in the fortunate position to have enough money in the bank to be able to max-out the annual ISA on day one of the new tax year. But there are other ways to benefit from compound returns and still get the same tax benefits. Drip feeding your investments on a monthly basis helps to mitigate investment risk and smooth out the inevitable bumps in the market, buying fewer shares when prices are high and more when prices are low – a process known as pound-cost averaging.

“While you don’t have to invest your money straight away in an ISA, for end of the tax-year investors there can be a tendency to choose an investment at the last minute and think about it again twelve months later. This could leave you exposed to market timing issues or concentration risk.

“Alternatively, putting money in at the last minute could end up being left in cash that you never get around to investing.”

ISA contributions – millionaires do it differently!

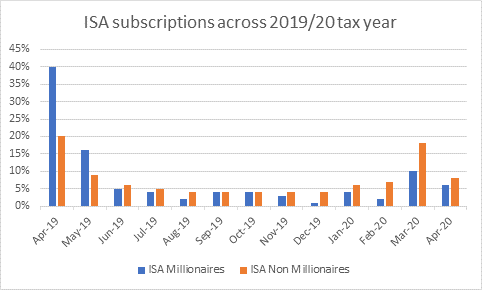

In terms of when our ISA investors funded their account, interactive investor’s ISA account holders tend to be early bird investors – especially among ISA millionaires while other ISA investors tend to be more last minute.

Total ii ISA subscriptions across 2019/20 tax year. April is new tax year from 6th – 30th.

Myron Jobson, Personal Finance Campaigner, interactive investor, says: “Our ISA millionaires are not resting on their laurels, with 66% of them still investing in their ISA every year. Those that are still investing tend to invest early and via lump sums, with the vast majority (88%) being in the fortunate position of having enough money to subscribe the full amount into their ISA and 93% of them investing lump sums.

“This year, more than ever, there are lots of calls on people’s cash and lots of uncertainty about the road ahead - but if you do have the ability to invest in your ISA then now might be a good time to do it. The other benefit of an ISA is that it comes with full accessibility.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.