How to invest during an election year

The top four things you need to know when you’re investing in an election year.

24th November 2023 10:09

by Theodora Lee Joseph from Finimize

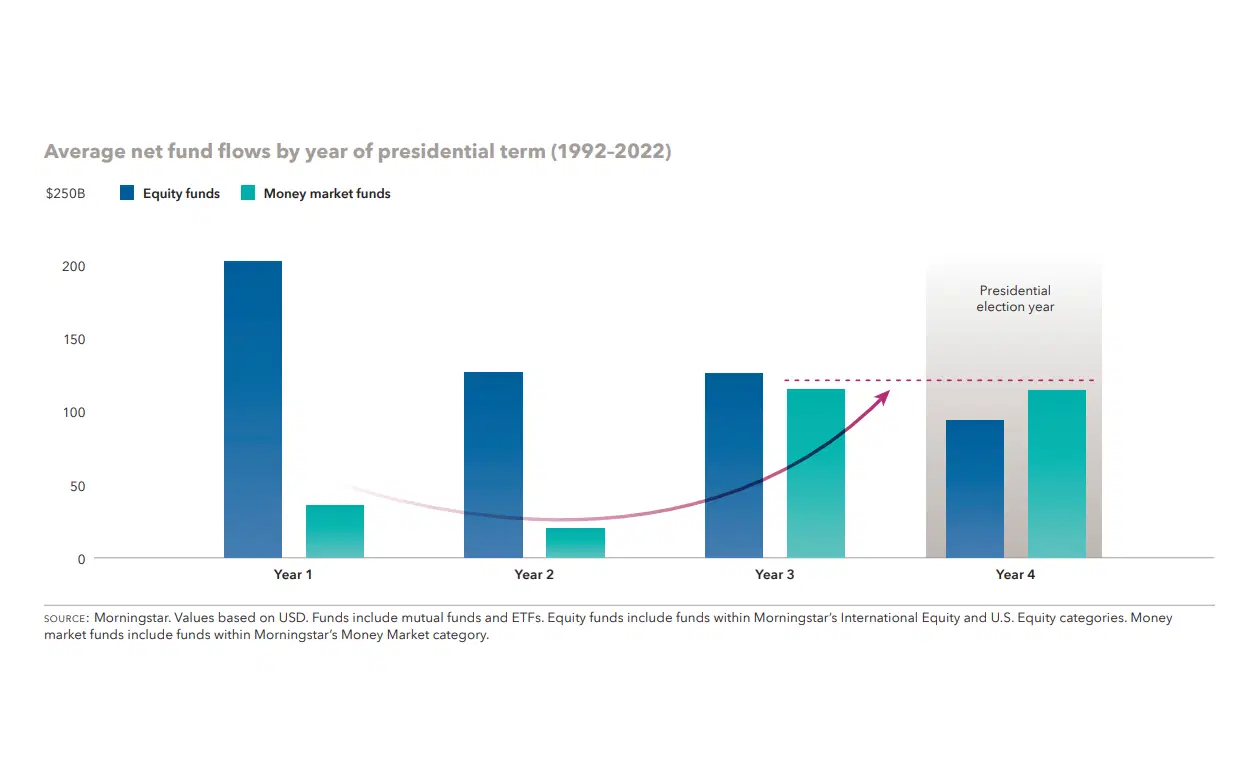

History shows many investors choose to park their money into low-risk investment vehicles like cash or money market funds ahead of elections.

Healthcare and energy sectors tend to experience more volatility in the years before and after an election.

The stock market typically performs better after an election than in the period leading up to it, but, regardless, US markets have consistently bounced back strongly regardless of the election outcome.

Some 40 national elections are on the calendar for next year, representing over 40% of the world’s population and 40% of the global economy. But the US presidential election is by far the most consequential for markets. Capital Group understands this better than most, as one of the world’s oldest and biggest investment houses. The firm recently published a deep dive into what happens to asset prices before and after Americans cast their ballots, and I’ve pulled out the top four things you need to know when you’re investing in an election year…

1. Cash is tempting, but it’s not always the best choice

Investing can be nerve-wracking when so much seems to be up in the air. After all, presidential campaigns draw attention to the country’s problems, and a candidate’s proposed solutions can often be radically different from the status quo. That’s undoubtedly why money market funds (MMFs) – which are akin to cash and traditionally one of the lowest-risk investment vehicles – tend to become more popular among investors ahead of elections. After the election dust settles, stocks typically get a boost and not just in the US – even international indexes catch the wave.

But cash or MMFs aren’t always the best choice. Take right now, for example: the Federal Reserve looks to be near the end of its long run of interest rate hikes, and when that’s the case, yields can take a nosedive. In other words, stashing away your cash could come with a reinvestment risk tag. For a safer investment option, consider bonds: they allow you to lock in better income for a longer stretch.

Sources: Capital Group, Morningstar.

2. Certain sectors see more volatility before and after elections

It would be handy if there were surefire sectors to invest in during an election year, but unfortunately, investing isn’t that straightforward. The impact on the economy and markets often boils down to proposed policies, and that’s why certain sectors, like healthcare and energy, tend to experience more volatility. And that makes sense: the major US parties have very different stances toward things like universal healthcare, domestic energy production, and the push for “green” energy sources.

Each election cycle introduces a fresh batch of candidates with their own policy agendas, and with the electorate split mostly down the middle, it can be tricky to predict the market’s potential winners and losers. But that doesn’t mean you should steer clear of a particular sector altogether. When the worry is that a new White House might wreck a sector, that’s usually blown out of proportion – giving you a chance to profit if you remain invested.

Range of one-year returns, in the year before an election (dark blue bars), the year after an election (medium blue bars), and the average (light blue dots) by S&P 500 sector (1992-2022). Sources: Capital Group, Refinitiv Datastream. Past performance is not a guide to future performance.

3. US markets have always bounced back strongly, regardless of who wins the election

It’s like a “thank goodness that’s over” sigh of relief: the stock market typically performs better after an election than it does in the period leading up to it. Since 1932, stocks have crawled up an average of less than 6% in the year before a presidential showdown, compared to the 8% gains they saw in non-election years. Bonds follow a similar vibe, pulling in around 6.5% leading up to elections, well shy of the usual 7.5%.

Despite all the uncertainties that come with an election year, the market’s rollercoaster ride is usually short-lived. When the votes are finally tallied, stocks typically go back to their usual upward groove. So a little patience often pays off for investors who ride out the waves. Since 1932, stocks have, on average, jumped 11.3% in the 12 months after the primaries wrap up (using May 31st as a marker), compared to a less impressive 5.8% over the same dates in non-election years.

S&P 500 index average cumulative returns since 1932, split by pre- and post-primaries. Sources: Capital Group, RIMES, Standard & Poor’s. Past performance is not a guide to future performance.

But let me take a step back here and point out that the US economy has consistently grown through all 46 presidencies to date. From a long-term perspective, elections have had essentially zero impact on long-term investment returns. What really counts for investors is sticking with it. Just to put things in perspective: if you’d dropped a grand into the S&P 500 when Franklin D. Roosevelt was in the Oval Office, it would have netted you over $19 million by June 30, 2023, through eight Democratic and seven Republican presidencies.

Growth of a hypothetical $1,000 investment in the S&P 500 from 1933, through various presidencies. Sources: Capital Group, RIMES, Standard & Poor’s. Past performance is not a guide to future performance.

4. In the end, the underlying economic trends matter most

Sure, things will be a bit volatile over the next year: if you set the time machine back to 1980, you’ll find that stocks have become pretty jittery leading up to every Election Day. And that makes the race seem hugely important.

S&P 500 returns (scaled to 100) around US presidential elections since 1980. Sources: Bloomberg, JP Morgan. Past performance is not a guide to future performance.

But, believe it or not, it’s not the candidates’ proposed policies that matter most to stocks, it’s the macro environment. And, yes, you could argue that policies do have an impact on the macro, but they often take years to materialize.

So it should be music to your ears that Goldman Sachs is whistling another happy tune for 2024, (just as it did for 2023). The investment bank sees positive income growth for US workers (as they benefit from easing inflation and a still-strong job market), a leveling out and eventual decline in interest rates, and better days ahead for the manufacturing sector. And stocks are bound to be cheered by that.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.