How have wealth preservation trusts fared over the past five years?

Four investment trusts that aim to protect and grow capital have delivered different returns, writes Sam Benstead.

9th October 2024 12:06

by Sam Benstead from interactive investor

The past five years have seen a global pandemic, a historic spike in inflation and interest rates, and conflict in Europe and the Middle East.

While global affairs are never quiet, and there’s always something for investors to worry about, this has certainly been a volatile period.

- Our Services: SIPP Account | Stocks & Shares ISA | What is a Managed ISA?

So, how then have investment trusts that bill themselves as “all-weather” wealth preservation and diversification vehicles faired over this period?

For context, the MSCI World index in sterling has risen 74% over this period and prices in the UK, measured by the UK consumer price index, have risen 24%. That’s an excellent return from simply tracking global markets and also a big rise in prices that eat into investors “real” returns.

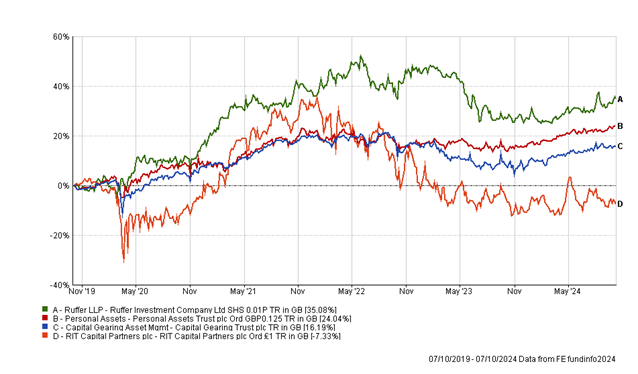

In contrast, the four largest “wealth preservation” trusts - Ruffer Investment Company, Personal Assets, Capital Gearing and RIT Capital Partners - returned in share price terms 35%, 24%, 16% and -7%.

This means that while Personal Assets and Ruffer kept pace with inflation, Capital Gearing and RIT delivered negative “real” returns. Looking at share price performance below, it shows that Personal Assets has given investors the smoothest ride, while Ruffer’s performance turned in April 2023.

RIT delivered strong returns coming out of the pandemic, but suffered when interest rates began to rise at the end of 2021.

Meanwhile, Capital Gearing struggled in 2022 but has steadily risen over the past 12 months.

We run through each trust’s performance and how they invest today.

Past performance is not a guide to future performance.

Ruffer’s up-and-down performance explained

How did Ruffer achieve the best return? A number of portfolio decisions are behind its successful run – while also recently hurting performance.

While Ruffer was quick to forecast rising interest rates and successfully used derivatives to balance out the risk that its inflation-linked bond portfolio would fall in value, the fund group did not see inflation falling as quickly as it did and paid a high cost to bet that the economy would keep getting worse.

It admitted mistakes after recording its worst-ever year in 2023, when its shares dropped more than 10% during a strong period for global equities.

- Ruffer admits ‘mistakes’ as it records worst year ever

- Baillie Gifford investment trust to merge with sister fund

The largest cost to the portfolio that year were the credit protections detracting over 3% as, despite credit conditions tightening significantly, market borrowing costs fell – meaning assets held to guard against stress in the corporate bond market were not required.

The other main detractor was the Japanese yen, which Ruffer held in anticipation of the removal of the zero-interest rate policy in Japan, as well as for its protective characteristics in market crises, something which worked well for the trust in 2008.

Looking ahead, it positioned for a recovery in Chinese shares, with iShares MSCI China A Ucits ETF its largest position, at 3.2% of the fund, alongside a 1.3% position in Alibaba. This would have boosted the trust’s net asset value (NAV) recently, with domestic Chinese shares rallying more than 30% on the back of increasing government stimulus.

It is also using short-dated bonds to reduce volatility and give an income to investors, alongside 6% in gold which has performed well this year.

Inflation-linked bonds are another important tool Ruffer used to protect against rising prices and deliver a steady income stream to investors.

- 10 hottest ISA shares, funds and trusts: week ended 27 September 2024

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Personal Assets’ golden touch

Managed by Sebastian Lyon, Personal Assets says its goal is to “protect and increase (in that order)” the value of shareholders’ funds per share over the long term.

Like Ruffer and RIT, it takes a multi-asset approach to investing in order to take advantage of growth opportunities, as well as using tools to protect investors.

The fund’s 12% allocation to gold has been a powerful contributor to returns this year-to-date, with 2% of the fund’s performance attributable to gold.

Gold has risen to more than $2,600 (£1985) an ounce, linked to falling interest rates and conflict in the Middle East.

Personal Assets also invests a lot in inflation-linked bonds, with 31.4% in US index-linkers and 3.4% in UK inflation-linked gilts. Lyon says that its US inflation-linked bonds are returning 2% above the inflation rate currently.

Short-term bonds also feature, and will help reduce the volatility of the trust, meaning that the largest peak-to-trough drop in the past 15 years has been just an 11.9% share price decline.

Equities, at 29% of the portfolio, are centred around “high-quality” companies such as Visa, Nestle, Diageo and Microsoft. This has helped drive returns for shareholders.

| Trust | 1-year return (%) | 3-year return (%) | 5-yr return (%) | discount/premium (%) |

| Personal Assets | 9.1 | 4.5 | 24 | -1 |

| Ruffer Investment Company | 6.1 | 0.6 | 35.1 | -6 |

| Capital Gearing | 8.3 | -0.3 | 16.2 | -2 |

| RIT Capital Partners | -0.7 | -24.4 | -7.3 | -29 |

Source: FE FundInfo, 8 October 2024. Past performance is not a guide to future performance.

Capital Gearing’s big bond bet

Peter Spiller’s Capital Gearing trust has endured a difficult run, losing investors money in 2022 and 2023.

The trust’s positions in real estate and Japanese assets hurt performance due to rising interest rates and a depreciating yen. It was also pessimistic about equity markets and expected higher inflation for longer, which meant it lost out to more bullish peers. A very low allocation to gold has also not been helpful for returns. Currently, the fund has just 1% in gold.

The largest allocations are to inflation-linked bonds and equities, which make up about one-third of the portfolio each. Another 27% is in conventional bonds.

- Why is China’s stock market soaring, and will it last?

- Terry Smith vs Nick Train: who is right on Diageo

Spiller prefers to invest in funds for his equity positions, such as iShares MSCI Japan ESG Screened (3.4% of the portfolio) and Vanguard FTSE 100 ETF (2.6%). He buys bonds directly, and likes UK and US index-linked instruments.

If Spiller is right that inflation will be higher for longer than markets anticipate, which looks increasingly unlikely as it is back around the 2% central bank target in the UK, then index-linked bonds could be an excellent long-run portfolio hedge due to the extra return kick that inflation delivers for them.

Rising interest rates could scupper this position, however, as index-linked bonds have a high sensitivity to interest rates due to their long maturity periods. Rising interest rates is what caused them to fall so much in value in 2022.

Nevertheless, if the Bank of England or US Federal Reserve deem that inflation is beaten, and interest rates continue to fall, then the price of index-linked bonds could rise, as could the prices of conventional bonds. At more than 50% in fixed income, this is definitely a defensive portfolio.

What’s gone wrong at RIT Capital Partners?

By the far the worst-performing wealth preservation trust over the past five years has been RIT Capital Partners.

While the share price dropped 6%, the NAV of the trust actually rose 32%. This means that a wide discount to NAV of around -30% opened up.

While investment trusts generally have seen discounts widen, it has been those that have been heavily invested in unlisted assets that have seen the biggest moves.

This has negatively affected RIT Capital Partners, which has one-third invested in unlisted investments, via third-party funds and direct positions. The funds are generally skewed towards growth investments, such as venture capital by the likes of Thrive and Iconiq.

- Three investments that thrive after the Fed’s first rate cut

- Terry Smith: two reasons why I haven’t bought Nvidia

These are higher-risk funds investing in early stage businesses with lots of potential. The problem for RIT is that investors have been sceptical about the true value of these underlying positions, which has played a part in the trust’s widening discount. Meanwhile, a lack of exposure to the giant US tech shares has hurt performance.

However, there are changes afoot, with the trust now being managed by Maggie Fanari, who was appointed CEO of Rothschild Capital Management, which manages the investment trust, earlier this year.

Fanari has increased the allocation to public shares, particularly small-cap companies, and has also worked to improve visibility of the trust to help close its discount, such as by revamping the website and increasing communications to shareholders. The board has also been buying back shares, worth 7% of the share capital in 2023.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.