How active fund managers can take advantage of passive boom

The popularity of passives has helped create a potential value opportunity for contrarian investors.

6th September 2019 08:57

by Tom Bailey from interactive investor

The growth in popularity of passive has helped create a potential value opportunity for more contrarian investors.

Over the past decade, passive investing has soared in popularity.

This growth, however, is a "bubble", according to a recent report from Michael Burry, the US hedge fund manager best known for his bet against the US housing market in the build up to the 2008 crash, chronicled in the book and film The Big Short.

In comments to Bloomberg, he noted:

"The bubble in passive investing through ETFs and index funds as well as the trend to very large size among asset managers has orphaned smaller value-type securities globally."

Burry's main point, however, was that growth in popularity of passive has helped create a potential value opportunity for more contrarian investors.

The argument is that with most index funds tracking indices that are weighted on market cap, while at the same time many active funds have favoured large cap growth stocks in recent years.

As a result, small cap "value type" stocks have become neglected creating a potential opportunity for active managers. "There is all this opportunity, but so few active managers looking to take advantage," he noted.

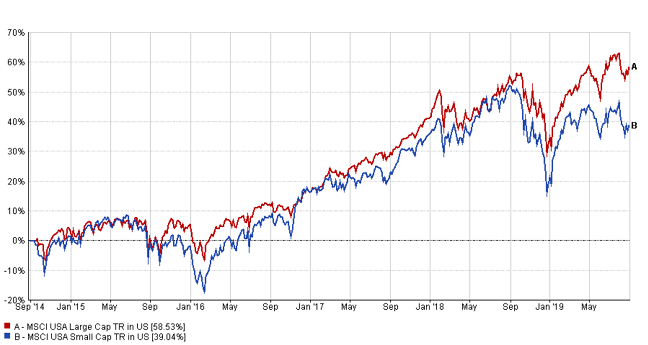

The point itself is not new. The underperformance of value stocks over the past decade has been widely documented. More recently, small cap stocks have started to underperform. For example, the US MSCI US Small Cap index has had roughly the same returns as the MSCI US Large Cap index over the past decade. But as the chart below shows, over the past five years large cap stocks have beaten smaller cap.

Similarly, Orbis recently released a research note showing that using an equal weighted index, the average global stock is down over 10% since January 2018, while the 50 largest US stocks are collectively in the positive over the same period.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.