Have AIM stocks just become attractive again?

26th May 2023 15:47

by Andrew Hore from interactive investor

A regular survey of smaller companies and their advisors can provide a good indication of the mood on AIM. Award-winning AIM writer Andrew Hore discusses the latest revelations and what they mean for investors.

AIM has been in the doldrums for more than 18 months, and a recovery between the autumn and early February has now completely unwound.

There is a dearth of new admissions, and more companies, like Applied Graphene Materials, are taking the decision to leave AIM because they cannot raise the cash they require, or do not think it is worth maintaining the quotation, such as Mirada (LSE:MIRA). The number of AIM companies is just above 800, but it will soon dip below that number, with more set to leave and few new companies replacing them.

- Invest with ii: Share Dealing with ii | Open a Stocks & Shares ISA | Our Investment Accounts

That is the lowest number of companies since early 2004, although the current market capitalisation is more than £90 billion, which is around five times the level 19 years ago. New admissions have raised £37.5 million of new money this year.

More worrying is the lack of cash being raised by existing companies on AIM. Last year, £2.23 billion was raised, which is the lowest amount since 2003 – although 2012 and 2013 were not much higher. In the first four months of this year the figure is £516.7 million. Just over £580 million was raised in the fourth quarter of 2022.

When companies can raise cash, many can only raise it at a highly discounted share price. Antibody discovery company Fusion Antibodies (LSE:FAB) raised £1.67 million at 5p a share, when the share price ended the previous day at 37.5p.

Automotive interior components supplier CT Automotive (LSE:CTA) raised £7.6 million at 34p a share when the market price before the announcement was 49p. The December 2021 placing price was 147p.

These are just two examples, and disappointing trading has affected share price performance, but it is not unusual for share issues of smaller companies to be heavily discounted. This is particularly true when the market is weak.

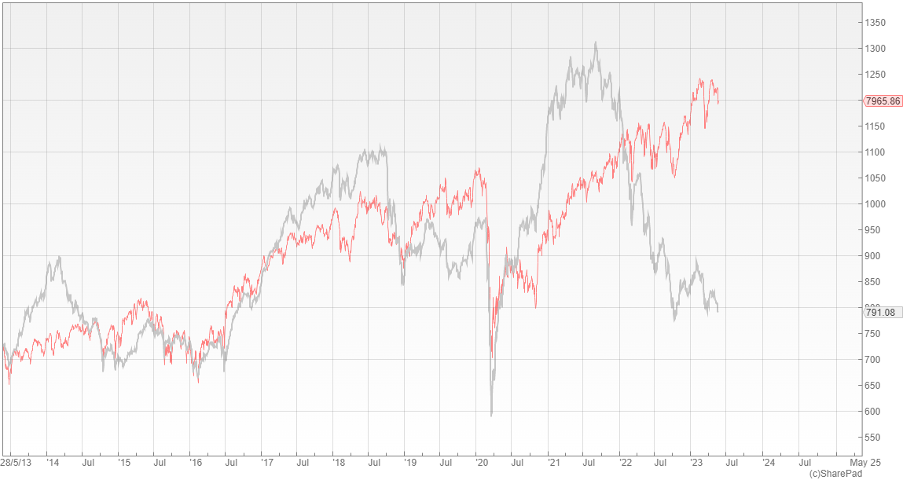

FTSE AIM All-Share index versus FTSE 100 Total Return index: 10-year chart

Source: SharePad. FTSE AIM All-Share index (grey) FTSE 100 Total Return index (red). Past performance is not a guide to future performance.

The consequences of this lack of activity can be seen in the merger of FinnCap (LSE:FCAP) and Cenkos (LSE:CNKS), the two advisers with the most AIM broking clients, and the takeover of Numis Corp (LSE:NUM) by Deutsche Bank. Back in 2012, after a weak 2011, there were also broking mergers with Collins Stewart and Arbuthnot being taken over and N+1 Brewin and Singer merging.

The main AIM market maker is Winterflood, and its trading levels remain subdued. This reflects the decline in liquidity of AIM, although trading levels are still higher than prior to 2020.

Sentiment index gives hope for AIM

There are signs that sentiment is improving. The latest Quoted Companies Alliance and YouGov Small and Mid-cap Sentiment Index was published earlier in May. This is the 30th edition of the index, which is published twice a year.

The survey was undertaken during April. There were 77 small and mid-cap company directors that answered the questions, plus 17 advisory companies, which is a range of businesses including institutional investors and accountants, plus one stockbroker and one corporate financier.

The number of companies and advisers is much lower than for the previous editions, although in June 2019 the number of companies was 78. The lowest number of advisers was 21 in April 2022.

Not all the views are positive. One in seven of the companies is likely to consider leaving the stock market. They are concerned about liquidity and disproportionate levels of regulation.

However, the core question is how optimistic or pessimistic do you fell about the UK economy over the coming 12 months? 0 is very pessimistic, while 50 is neutral and above that figure are levels of optimism.

The previous survey’s figure for the companies was 33.1, which is the second most pessimistic level in the history of the survey. The latest figure is 50.3, which is the first time it has been above 50 since October 2021. That earlier figure represented a decline following a sharp recovery six months earlier amid optimism about the economy coming out of Covid lockdowns. Prior to that there had not been a figure above 50 since 2017.

The advisers remain slightly pessimistic, with the figure rising from 35.4 to 45.9. However, historically the trend of the figures is similar to the companies, just slightly higher or lower.

Companies tend to be optimistic about their own prospects, with a rise in the figure from 60.2 to 67.2. The figure has never been below 50. Mean expected turnover growth is expected to be 16.6%. In contrast, advisers tend to be more pessimistic about business prospects, but this figure has also improved, from 40.8 to 47.6.

For the first time ever, less than 50% of companies (45%) are seeking to raise money. This may reflect the problems in getting additional funding and the high share price discounts when fundraisings are successful. Only 45% of those seeking to raise money intend to issue shares, with bank and quoted debt nearly as likely to be used.

However, the companies are slightly more optimistic about their ability to issue shares, with the figure out of ten rising from 5.5 to 5.8. Private equity is thought to be more difficult to obtain but the figure has improved from 3.3 to 3.9.

Mergers and acquisitions

Many of the companies surveyed are concerned that they could be the subject of a bid approach in the next 12 months. One-third of companies felt more vulnerable to takeover.

The companies are keen to make acquisitions, but 50% believe that finance could be a problem compared with one-third of advisers. Two-thirds of advisers believe that regulation and political uncertainty are potential problems.

There have already been private equity and international firms targeting AIM companies. The acquisition activity is an indication that there are attractive ratings for some AIM companies. Sun European Partners acquired M&A adviser K3 Capital Group for £272 million and AdEPT Technology was acquired by a private equity backed Wavenet for £50.3 million. The bid for energy efficiency and compliance services provider Sureserve by Cap10 Bidco is ongoing.

Crestchic was acquired by privately owned Aggreko and corporate and consumer redemption products provider Appreciate was bought by fully listed PayPoint (LSE:PAY). All these companies are profitable, and the deals were at significant premiums to the prior market capitalisation.

According to Shore Capital, the premiums for smaller company bids in April ranged from 32% to 72%. These bids put cash back into the market and this will need to be reinvested at some point.

There are 57% of the companies and 65% of the advisers that believe that smaller companies are undervalued. One-third of the companies are more concerned about being bid for than they were 12 months ago, while 11% are less concerned about this. This view is likely to be skewed by the share price performance, with reduced market valuations making the companies feel more vulnerable.

- Insider: multiple share purchases after small-cap names new CEO

- Six speculative UK share ideas for 2023

- 26 small-cap and AIM share picks for 2023

Nearly two-thirds of advisers believe that UK PLC valuations will reach higher levels over the next 12 months, but only one-third of the companies.

The performance of AIM in 2020 was an anomaly because it recovered faster than the FTSE 100 index. There is normally a lag with smaller companies following the recovery of larger companies, which tend to be more liquid. The Numis Smaller Companies Index, which includes smaller companies on the Main Market, is also lagging the performance of larger companies.

It is dangerous to say this, but it appears that the major decline in AIM performance has happened. It has fallen by 4.9% this year, compared with a 1.5% rise by the FTSE 100, which includes major beneficiaries of high oil prices and rising interest rates in a way that AIM does not.

There is still disappointing news from some companies, but there are also positive trading statements and upgrades. One of the triggers of an improvement in smaller company performance in the past has been a perception that interest rates are getting near their peak. As trading conditions stabilise investor confidence will return.

Loss-making technology and other companies with promise, but no delivery yet, remain out of favour. There will eventually be a return of interest in these opportunities, but probably not in the short-term.

It is difficult to assess whether AIM is at the bottom yet and there will continue to be disappointing trading statements, but this is a good time to be seeking out value in the market. Focus should be on cash generative companies on modest ratings that can prosper independently with the added potential of being snapped up by a bidder.

Andrew Hore is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.