GRANOLAS: The new acronym for Europe’s superstar stocks

A handful of stocks with strong balance sheets, low volatility growth and good dividend yields have em…

1st May 2020 12:43

by Tom Bailey from interactive investor

A handful of stocks with strong balance sheets, low volatility growth and good dividend yields have emerged as Europe’s post-financial crisis winners. They may also be the winners of the next market cycle, says Goldman Sachs.

The past decade saw large cap US tech stocks consistently outperform the rest of the market. Anyone with a high weighting towards the likes of Facebook, Apple, Amazon, Netflix and Alphabet (Google) would have outperformed in an already strong bull market. As a result, they earned the collective moniker 'Faang stocks', an acronym for the names of the five companies.

When it comes to European stocks, however, Goldman Sachs, in a new research note, says the so-called GRANOLAS have been the stars. The new acronym stands for GlaxoSmithKline, Roche Holding, ASML, Nestlé, Novartis, Novo Nordisk, L’Oréal, LVMH, AstraZeneca, SAP and Sanofi.

- Invest with ii: Most-traded US Stocks | Buy International Shares | Super 60 Investment Ideas

The past decade has been characterised by low interest rates, slow economic growth and weak earnings growth. Broadly, this has benefited large cap growth tech stocks such as the Faangs.

However, notes Goldman Sachs: “Europe lacks growth companies in general, and in the Technology sector in particular.” Instead, GRANOLAS, all companies with relatively strong balance sheets, low volatility growth and good dividend yields, emerged as Europe’s post-financial crisis winners.

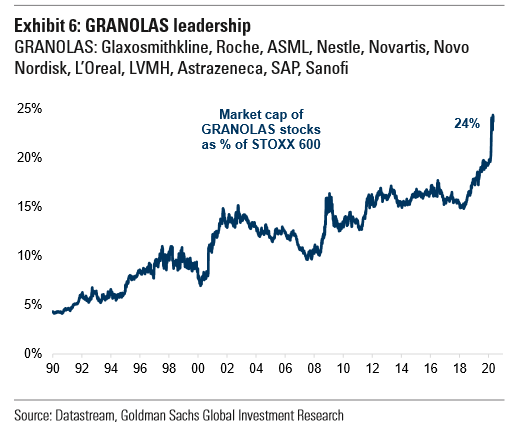

Goldman Sachs points out that in 2010 a cluster of oil, banks and telecom companies were still among the largest in Europe’s Stoxx 600 index. Ten years later, however, GRANOLAS dominate the market, with their collective market cap account for 24% of the index. “This shift was a function of the lower interest rate environment and higher risk aversion that have characterised the post-global financial crisis world,” says Goldman Sachs.

Don’t expect this trend to change any time soon, says Goldman Sachs. With their ability to grow their earnings in a low economic growth world, their stable dividend payments and healthy balance sheets, Goldman Sachs argues that GRANOLAS should continue to outperform in the next market cycle.

Goldman Sachs says: “We think the leaders of the forthcoming cycle will be companies that are able to generate earnings growth, sustainable dividend payouts and have healthy balance sheets. The GRANOLAS stocks may not all do well, but together we think they offer some quality: growth, stability and income.”

These qualities will likely still be prized by investors assuming Europe and other advanced economies remain characterised by slow economic growth, weak earnings growth and low interest rates.

The research note points out that the Stoxx 600 is not projected to see earnings per share (EPS) return to its 2019 level until 2022, according to consensus estimates. In contrast, the consensus estimate for GRANOLAS is for EPS to be up by 30% from their 2019 peak by 2022. This would be a continuation of the past decade’s trend, with the Stoxx 600 earnings still below their 2007 peak, while GRANOLAS have seen their earnings up by over 100%.

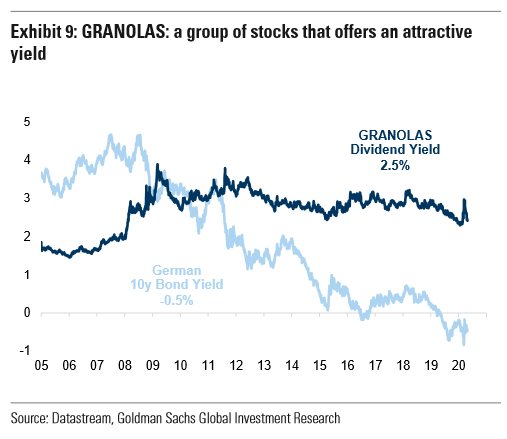

GRANOLAS also offer comparatively attractive dividends, with the collective yield of the stocks at 2.5%. With bond yields so low, this makes them attractive to income seeking investors.

Goldman Sachs says: “Their dividends should be sustainable and continue to grow over the long run. Indeed, we find that their payout ratio is around 50%, and they generally have a strong balance sheet.”

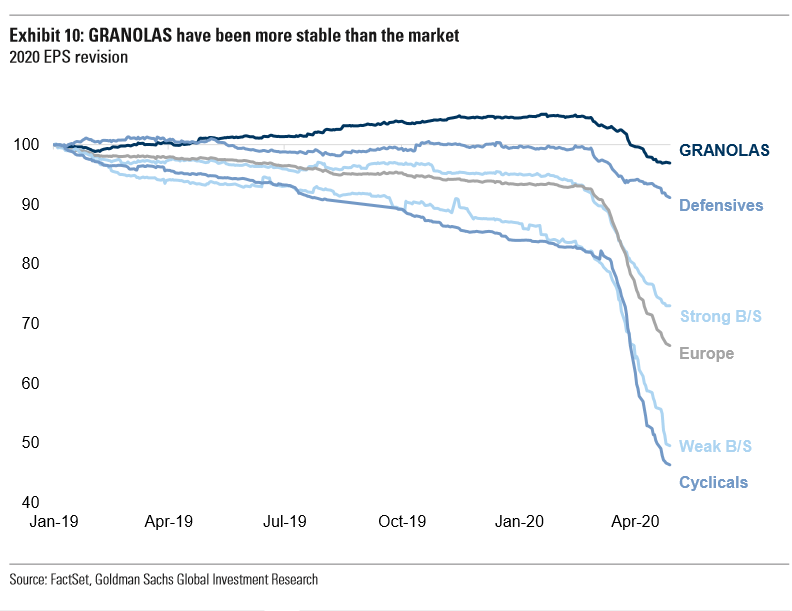

In terms of earnings stability, GRANOLAS appear much more defensive than the rest of the market. Year-to-date, the EPS of the Stoxx 600 index has been revised down 30% while GRANOLAS’ EPS have been revised down just 7%.

“We think this is a function of their size and their sectors. Indeed, all these companies are in healthcare, tech or consumer goods, three relatively stable industries. We would also note that the GRANOLAS are less volatile than the market or other growth companies,” notes Goldman Sachs.

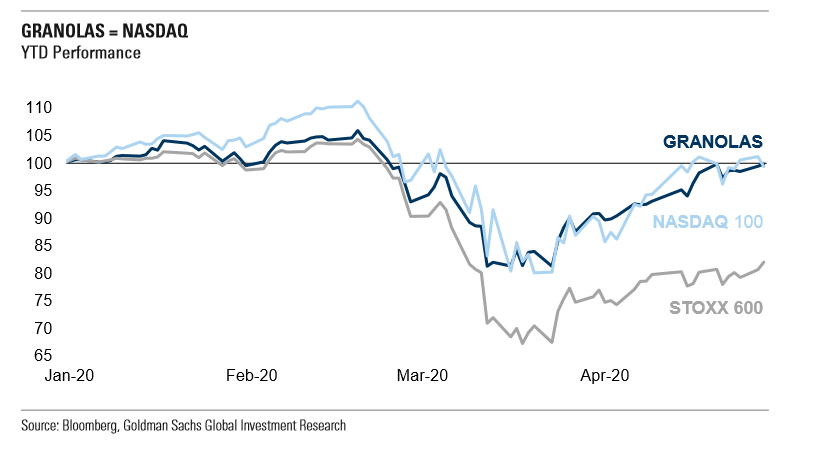

So far in the coronavirus sell-off the GRANOLAS have held up relatively well. As the table below shows, they have collectively outperformed the Stoxx 600 index and provided roughly similar performance to the Nasdaq year-to-date.

The risks of GRANOLAS

However, while Goldman Sachs says it expects the GRANOLAS to continue to broadly perform well in the next market cycle, the stocks are not without their risks.

The research note points out that the stocks collectively trade on a price-to-earnings ratio of 20.6x, giving them a 35% premium to the rest of the market. Goldman Sachs notes: “This is not unusual for defensive/growth companies but investors could question the high premium if markets recover.”

Another risk is a return to higher interest rates and bond yields. Part of the attraction of GRANOLAS over the past decade has been their relatively generous yields compared to negative or very low yielding bonds across Europe. “A shift in this paradigm could turn the tide,” says Goldman Sachs.

Three GRANOLAS, Roche, L’Oréal and Nestlé, were recently cited by Canaccord Genuity as stocks likely to perform better should the economy see an 'L-shaped' recession.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.