Gold investing: what, why and how to invest

The yellow metal is more expensive than ever before but there are still very good reasons to own gold in your investment portfolio. Analyst John Ficenec explains why and lists some options.

19th March 2025 12:03

by John Ficenec from interactive investor

Investors shouldn’t be fearful of gold as prices reach an all-time high. Now more than ever the precious metal is needed in your portfolio as the global economy slows, stock markets run out of steam and tensions are rising.

The reasons for holding gold are simple, if you think we are heading for a recession or a slowdown then it makes sense to hold some insurance. If you don’t know what’s going to happen then you should hold some gold to protect value as cash is devalued.

- Learn with ii: How to become an ISA millionaire | ISA Investment Ideas | Top ISA Funds

Given global conflicts, economic struggles and an uncertain future, the price of gold has some very sound fundamentals that mean the current price shouldn’t concern investors at all.

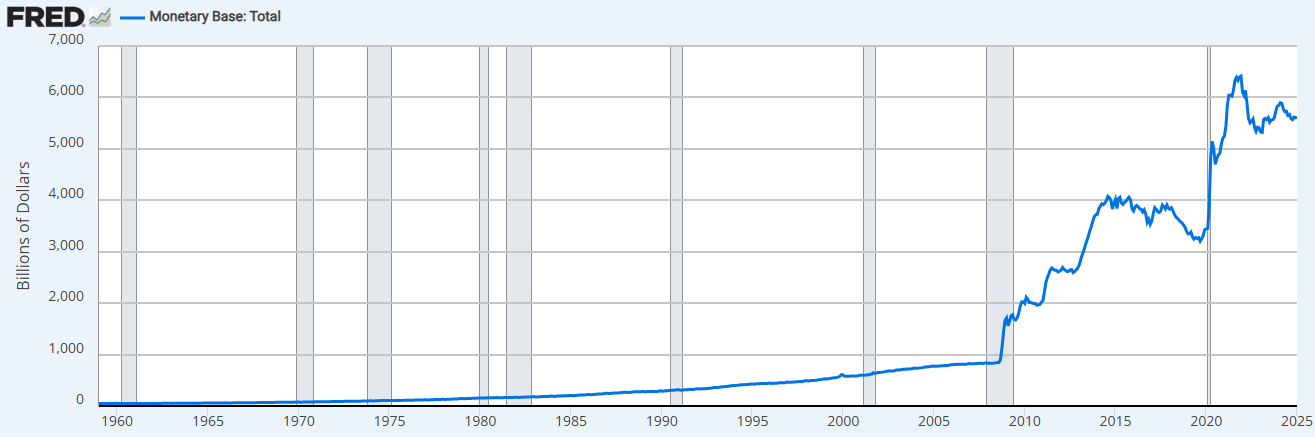

Monetary madness

We have to quickly jump back to 2008 to understand where gold prices are today and why they have every reason to keep on rising. Before 2008, the price of gold largely drifted sideways for a quarter of a century. Gold was so boring that Gordon Brown, as UK chancellor at the time, decided to sell off half our reserves, almost 400 tonnes, in the early 2000s, but little did he know the gold price was about to explode.

The great financial crisis of 2008 rocked global markets to their core and as investors sought a flight to safety the price of gold jumped around 20% that year, but the real action was still to come. The only solution to the crisis was combined government monetary intervention, so world leaders met, and the printing presses were turned on.

Source: TradingView. Past performance is not a guide to future performance.

Taking the world’s largest economy, the US, as an example, the total money supply or monetary base tracked by the Federal Reserve Bank of St. Louis started 2008 at $830 billion (see chart below). A little over three years later it had tripled to $2.6 trillion, meanwhile interest rates had been cut from 4%, down to 0.15%. This playbook was replicated around the world and gold responded in kind by rising over 100%, from $880 an ounce at the end of 2008, to over $1,600 in mid-2011.

By 2013 the then US Treasury Secretary Ben Bernanke had decided the economy had recovered enough and said he intended to turn off the printing presses and raise interest rates, which sparked the so-called Taper Tantrum as markets came off monetary life support. As the money supply contracted, gold responded by dropping some 25% from around $1,600 in early 2013 to end 2018 in the $1,200 region.

- The Analyst: the benefits of owning commodities in your portfolio

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Barely two years later in early 2020 the US economy dipped into recession again, and the printing presses were turned back on, with the money supply almost doubling from $3.4 trillion in January 2020 to $6.4 trillion at the end of 2021. Again, interest rates were cut from around 1.5% down to 0.05%. Gold jumped again from around $1,400 at the start of 2020, to $1,800 by the end of 2021. You’ll notice a pattern emerging here, the government response is always the same, print money and slash interest rates, and gold’s response is always the same.

Source: Board of Governors of the Federal Reserve System (US) via FRED®. Shaded areas indicate US recessions.

Trade war trouble

So that brings us up to date, and more recently it is US President Donald Trump’s trade war that has caused the gold price to reach record highs. The protectionist policy of introducing import tariffs of up to 20% on products such as coal, steel and consumer goods coming from China, Mexica, Canada and Europe has resulted in fears that these price increases will simply be passed on to consumers. That’ll spark inflation and nudge a slowing US economy into recession.

These tariffs haven’t been taken lying down, with China, the EU and Canada all responding in kind with retaliatory tariffs on US goods. If prices for goods are arbitrarily increased around the world, then the money in your pocket is worth less and people will search for safe havens.

- How investors can hedge against Trump’s trade wars

- Trump dump: biggest rotation out of US stocks ever

The gold price started 2024 at around $2,000 then steadily rose to end the year around $3,000 after Trump won the US election and rumoured tariffs became a reality.

Gold is as gold does

Gold was around for thousands of years before the dollar, yuan, euro and pound, and it will likely be around for thousands of years after. As a medium of exchange, it is almost without parallel; you can take a gold coin to pretty much anywhere in the world and receive goods and services in return for it.

Gold is also incredibly rare and has been prized by human civilisation for more than 6,000 years. The World Gold Council’s most recent estimates show that some 216,000 tonnes of gold have been mined throughout history. All that gold would fit within a cube measuring just 22 metres on each side or, put another way, if you stacked all that gold on the centre court at Wimbledon it would stand just over 10 metres high. If you wanted to go all Auric Goldfinger and relieve the US Federal Reserve of its 8,100 tonnes, it would take just five double decker buses to get it out of there and then one 747 to fly it out of the country.

- Are commodities the key to a smoother ride?

- DIY Investor Diary: I invest so I don't have to worry about money

It is this rarity when combined with devaluation of global currency that drives prices. We used to have solid silver coins in the UK before the 1920s, then the silver content was halved, before switching to copper and nickel in 1947.

The devaluing of currency is nothing new and has only accelerated since the printing presses went into overdrive in 2008. If you rapidly devalue a currency then a store of value such as gold, which has a finite amount and is highly prized, simply rises. The World Gold Council estimates some 55,000 tonnes are still in the ground, but these reserves are increasingly dangerous, difficult and expensive to extract.

Geopolitical tension on the rise

The concerted effort that allowed the global economy to recover from the 2008 financial crisis, has more recently gone into reverse. Russia, China, India and Turkey have all dramatically increased gold buying as they seek to move to a global economy that doesn’t rely on the US dollar.

Conflict in the Middle East, Ukraine and simmering tension over the future of Taiwan have all put stress on the world economy and pushed investors to the safety of gold.

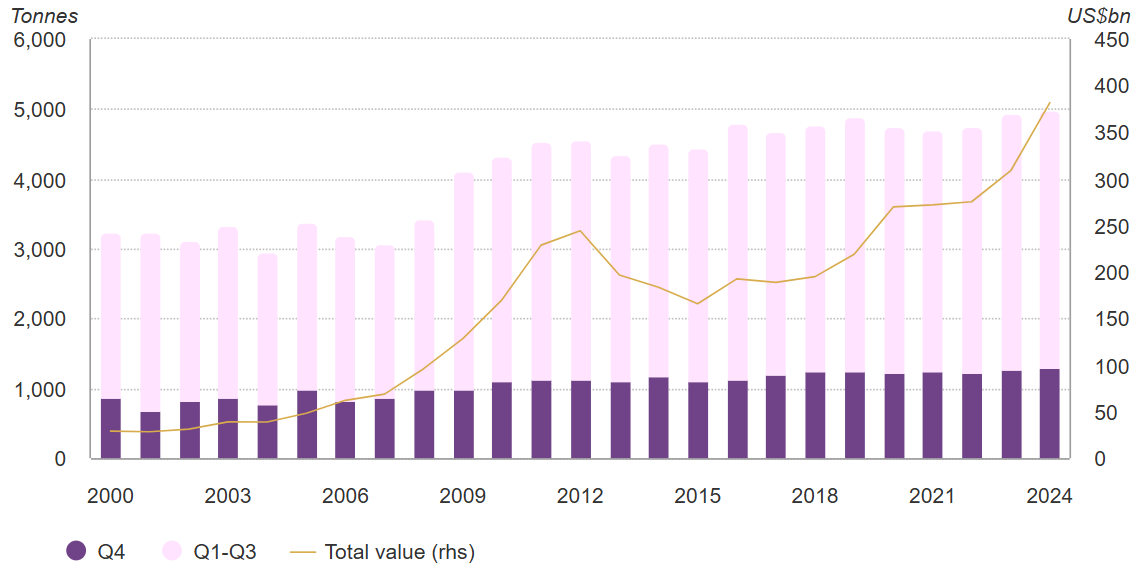

It is for this very reason that central banks have accelerated their buying of gold, with purchases exceeding 1,000 tonnes for the third year in a row. Buying increased significantly during the last three months of 2024, reaching 333 tonnes and bringing the annual total for central banks to 1,045 tonnes, according to World Gold Council figures. Only last month China initiated a pilot programme to allow insurance companies to purchase gold, which could unlock an additional $27 billion in buying power.

Gold demand at record levels for Q4 and full year

Quarterly gold demand in volume, tonnes, and value, US$bn*

Sources: ICE Benchmark Administration, Metals Focus, World Gold Council. *Data to 31 December 2024.

Gold as an investment

On the face of it, gold is a terrible investment. It pays no interest, generates no income, makes no profit, and no growth. But there are very good reasons why every investor should hold gold. The first rule of investing is preservation of capital, and in that respect there are fewer better options. From the pharaoh’s tombs, through the Viking hordes, to today, gold has been the store of value of choice. For this very reason, experts suggest every investor should hold around 5% to 10% of their total portfolio value in gold.

- Watch our video: Gold: what the mining experts say

- Three reasons why 2025 could be another glittering year for gold

Gold also has a low correlation to other asset classes, so it offers protection when markets crash. It is this insurance against the unknown that has allowed it to deliver steady capital gains.

Investment demand for gold hit a four-year high last year, driven by a revival in exchange-traded fund (ETF) demand, which accelerated in the second half of the year, according to World Gold Council figures.

Alternatives lose lustre

The alternative stores of value that investors can turn to have also been losing their lustre recently. As the interest rate cycle turned, with rate cuts in the UK and US last year, holding gold has become more attractive. The return offered by holding government bonds, often seen as the safest investment, has fallen as rates are cut. The interest offered on your bank savings account has also gone down.

The main reserve currency in the world - the US dollar - has also been falling in value as concerns about a slowing economy and Trump’s economic policy shake confidence. The returns on the stock market are also looking shaky. Big Tech companies have wobbled in recent months and there are fears that the two-year US bull market is running out of steam. So that said, how can investors best get exposure to gold?

How to buy gold

Gold specialist funds or an exchange-traded commodity (ETC) offer exposure to gold.

ETCs track the price of a single commodity, or a basket of commodities. For a gold ETC, the aim is to provide a return in line with the gold price, minus its fund fee, which is typically very low. Therefore, an ETC offers a low-cost way to invest directly in gold without having to pay for storage or security. Options include iShares Physical Gold ETC GBP (LSE:SGLN), Invesco Physical Gold ETC GBP (LSE:SGLP), WisdomTree Physical Swiss Gold ETC GBP (LSE:SGBX) and Royal Mint Rspnsbly Srcd Physcl Gld ETC GBP (LSE:RMAP). There is also VanEck Gold Miners ETF GBP (LSE:GDGB), which buys gold mining companies.

iShares Physical Gold ETC is on the interactive investor Super 60 list of investment ideas. The currency hedged version means movements in the pound/dollar exchange rate do not affect performance.

There are also leveraged gold and silver ETFs, but these products are high risk and can easily incur huge losses for investors if the market goes the wrong way.

Active funds that have large positions in gold – those managed by fund managers that attempt to beat a comparable index – include BlackRock World Mining Trust Ord (LSE:BRWM), Jupiter Gold & Silver I GBP Acc and WS Amati Strategic Metals B Acc fund.

For a broad spread of commodities, WisdomTree Enhanced Commodity ETF - USD Acc GBP (LSE:WCOB) is one of ii’s Super 60 investment ideas.

Fund | One-year return (%) | Three-year return (%) | Five-year return (%) |

iShares Physical Gold ETC | 35.6 | 55.1 | 79.1 |

Invesco Physical Gold ETC | 35.6 | 55.1 | 79.1 |

WisdomTree Physical Gold ETC | 35.2 | 53.8 | 76.8 |

Royal Mind Responsibly Sourced Physical Gold ETC | 35.4 | 54.5 | 78.2 |

VanEck Gold Miners ETF | 45.2 | 23.1 | 76 |

BlackRock World Mining Trust | 0.5 | -18.6 | 149 |

Jupiter Gold & Silver fund | 62.8 | 26.7 | 157.4 |

Amati Strategic Metals fund | 24.5 | -25.6 | * |

WisdomTree Enhanced Commodity ETF | 6.4 | -3.5 | 69.9 |

Source: Trustnet on 18 March 2025. All returns are for non-hedged versions. *No five-year track record. Past performance is not a guide to future performance.

If you’re confident enough to pick individual gold mining stocks yourself, there are plenty of options available on the UK stock market. These are not recommendations but do give you an idea of what investment options are available. As always, please do your own research.

In the FTSE 100 index, there's Endeavour Mining (LSE:EDV), one of the world's leading gold producers and the largest in West Africa. Fresnillo (LSE:FRES) is the world’s leading silver producer and the biggest producer of gold in Mexico. In the FTSE 250, there's Hochschild Mining (LSE:HOC), which has been working in the Americas for over 100 years. It produces gold from mines in Peru, Argentina and Brazil.

- ii view: shareholder returns shine at silver miner Fresnillo

- How to invest like the best: Warren Buffett

Further down the scale you can find small-cap mining companies, some already producing gold from mines around the world and others in the exploration phase. These are clearly much higher risk. Caledonia Mining Corp (LSE:CMCL) is producing gold via a large stake in the Blanket mine in south-west Zimbabwe, while Greatland Gold (LSE:GGP) owns the Telfer gold-copper mine operations in Australia, the Havieron development project, plus several exploration projects across Western Australia.

Buying shares in gold companies carries additional risk given the nature of the industry. Each mine has different economics, size of deposit, cost of production and mine life. There’s also geographical risk, where possible local or regional conflicts can flare up, and where navigating processes, laws and local customs in some countries can make it harder to get a mine off the ground let alone to profitability. For explorers, it can take many years from identifying a deposit to getting any gold out of the ground and generating an income.

For investors who want to get their hands on the yellow metal and own physical gold, there are established dealers such as ATS Bullion, BullionByPost and Chards, which will send your bars and coins through the post.

John Ficenec is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.