Global funds at risk of a damaging double whammy

The prospect of a declining dollar and the market falling out of form will hit investors in global funds.

20th October 2020 13:11

by Andrew Pitts from interactive investor

The prospect of a declining dollar and the US market falling out of form will hurt investors in global funds, as well as those with more direct exposure to the region via US funds.

One of the chief attractions of investing in a global equities fund is that it provides broad exposure to the world’s stock markets – or so one might justifiably believe.

What investors might not realise is the supersized US influence on how these funds perform. It is not just because of America’s market leadership role, embodied in phrases such as “Don’t fight the Fed” (which refers to the generally supportive and bullish policies of the US Federal Reserve) or the opposite, such as “when America sneezes, the world catches a cold”.

Most global equity funds have a very high weighting to the US. Analysis from FE Analytics, the fund data provider, shows that the average open-ended global equity fund – of which there are 353 – has 51% of its assets invested in North America. The much-smaller group of 16 investment trusts have much less riding on the fortunes of the US, with the average weighing standing at 37%. But trusts have more exposure to the UK versus funds, at nearly 18% versus 7.9%.

Among funds, the weighting to North America has increased from 45.7% three years ago, chiefly at the expense of the UK, which has decreased from 10.1%.

- The ETF that has almost doubled in the last six months

- Trust tips: adventurous and conservative picks outperform

The US market has been the place to be

That mirrors the different fortunes of both markets – while the US has been going gangbusters, the UK has languished. A representative index tracker, Fidelity UK index, is in the red by 3.3% over three years to end September, while Vanguard US Equity Index, a fund that tracks the entire US market, has gained 45%. Investing in hot sectors such as tech and biotechnology has yielded even better results: the Invesco EQQQ Nasdaq 100 (LSE:EQQQ) exchange traded fund has returned more than double the gain from the wider US market.

Passive, index-tracking global funds are even more highly exposed to the US than actively managed global equity funds. Fully 63% of the MSCI World index is represented by US stocks. What might surprise you is that just five US tech giants – Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Facebook (NASDAQ:FB) and Alphabet (NASDAQ:GOOGL) – account for 14.2% of the MSCI World index.

Leaving aside US influence for a moment, investors should also bear in mind that Asia and emerging markets are not well represented: just 7% on average in open-ended funds and around 11% in investment trusts. So, for example, investors in global funds will experience little, if any, participation in the 26% return racked up by the average fund in the 40-strong China/Greater China sector over the past six months, not to mention the 124% average gain over five years.

For many people, a global equity fund is their first and, for some, only investment and most will miss out on the direct growth opportunities that undoubtedly exist in Asia and beyond. China is the world’s second-largest economy, should one need reminding.

This is even more pertinent in the age of Covid-19. Economically important Asian countries – China, South Korea, Singapore and Taiwan to name just a few – have been far more effective at controlling the pandemic in their respective populations than western developed nations. That will undoubtedly result in big disparities in economic growth between the two blocs in the medium term, which could reasonably be expected to result in superior returns from Asia and its emerging markets.

Currency swings have worked in global investors’ favour

For global investors, high exposure to US assets, and by association the dollar, has in recent years received something of an artificial boost. Over the past five years – and particularly since the 2016 Brexit referendum – returns from overseas have been immensely flattered by the currency effect. Sterling has been particularly weak against a basket of currencies over that period, while the US dollar has been strong, which increases the returns made from overseas investments when expressed in sterling terms.

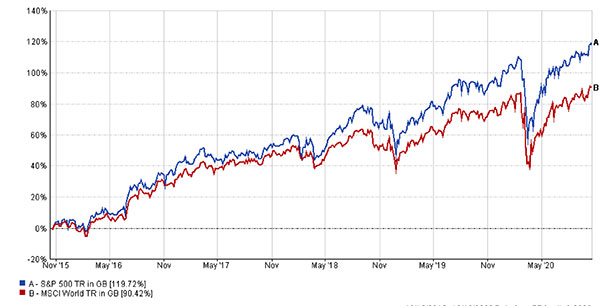

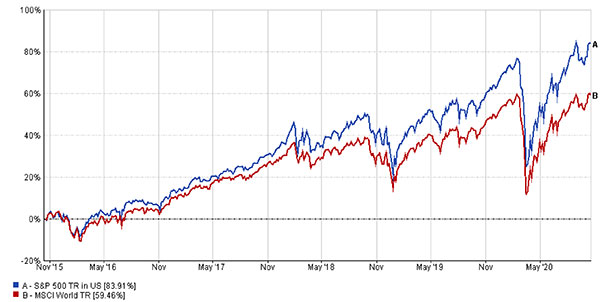

Five-year returns to 18 October from the MSCI World index illustrate this point: in local currency terms (ie, the aggregated returns from developed country indices) it has gained 59.5%. But in sterling terms, investments made five years ago are up 90.4%. So the currency effect has added up to 30 percentage points to returns over the period, a sizeable uplift for venturing beyond Britain’s shores.

How strong dollar vs pound has benefited UK investors

US investor ‘local’ returns lower than UK investor returns

Source: FE Analytics

It is quite possible that this beneficial currency effect will continue to favour venturing overseas, particularly if sterling weakens further.

But a potentially more worrying scenario lurks and one that could hit investors in the US even harder than those in global funds. Rather than a reversal in sterling’s fortunes, where a recovering pound depresses the value of investments made overseas, the chief threat is a rapid fall in the dollar exchange rate.

Respected economist bearish on dollar

Respected Yale economist and market veteran Stephen Roach forecasts that the dollar could fall by as much as a third next year. That is a lofty claim – particularly as the perceived wisdom is that in times of economic stress and uncertainty, investors flock to the dollar. True, but other safe havens also exist: Japanese yen, Swiss francs and gold, to name just a few.

Roach’s theory is that an unprecedented collapse in the US’s domestic net savings rate makes it impossible to internally fund economic growth via massive fiscal boosts and the burgeoning current account deficit (its transactions with the rest of the world). Instead, the US must look to borrow more from overseas investors, particularly from countries with higher net savings rates.

These investors would normally be rewarded with competitive rates of interest. But the US Federal Reserve has said that interest rates will remain near zero for several years. Roach points out that the other avenue for attracting overseas savings is via a currency adjustment – and that does not mean making dollars more expensive for foreigners to buy.

History indicates that the conditions that might lead to a crash in the dollar today are far worse than in the not-so-distant past. Writing in the Financial Times, Roach says: “The dollar index fell 33% in real terms both in the 1970s and the mid-1980s, and another 28% from 2002 to 2011. During those three periods, the net domestic saving rate averaged 4.9% (versus -1.2% today) and the current account deficit was -2.5% of gross domestic product (versus -3.5 per cent today).”

A potential crash in the dollar is not the only danger facing global investors. One of the reasons why US equities have continued to soar, led by Big Tech, is because of “Tina” (there is no alternative).

US tax rises and more regulation will be bad news for shares

Whether this situation endures will depend largely on the outcome of next month’s US presidential election. Should Joe Biden win and also secure a Democrat majority in both houses of Congress, increased regulation and higher taxes will surely follow – which is bad news for shares and particularly giant internet growth stocks. It would also mean a bigger stimulus package than Republicans are willing to countenance – at least $2.2 trillion – $400 billion more than what Republicans are offering.

Whatever the outcome, these vast sums will still need financing. That is leading to an increase in long-term government bond yields, with bonds also being sold off on expectations of a robust economic recovery (when bond prices fall, yields rise). Importantly, that is not going to be so great for Big Tech and other growth-focused stocks.

These stocks have been the main beneficiaries of Tina, but rising Treasury bond yields mean an alternative is available to recycle profits. Not so long ago, early in the year, 10-year bonds were yielding 2% rather than today’s 0.6%. It would not take much of a swing in sentiment to see them back at 2% before too long.

The upshot is that investors with high exposure to the US are facing a damaging double whammy of a falling dollar and a weaker stock market. Global funds that are highly weighted to the US, particularly to the tech giants, can reasonably be expected to fall further than those that are more evenly distributed across regions.

Taking some profits from US-focused stocks and funds that have done well since the markets began to rebound in late March is one strategy and is something that I have executed among some of my own holdings.

Seeking to ensure that portfolios are well diversified across regions and countries – particularly to Asia and Europe – is another. interactive investor customers can easily get a snapshot of where their assets are invested by using the Morningstar portfolio x-ray tool: you may be surprised at what it reveals.

- Top-performing fund, investment trust and ETF data: October 2020

- Coming soon: more fund manager videos. Click here to subscribe

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Should investors return home?

Comparatively speaking, the UK market is attractively valued on a price/earnings (PE) basis. But UK stocks have been largely shunned by foreign and domestic investors alike. Data from the Investment Association shows that since the start of 2016 to the end of August, private investors withdrew a net £14 billion from UK-focused open-ended funds.

Analysts as stockbroker Stifel point out: “While there is clearly some significant doubt about the 'E' or earnings number, in the UK the FTSE All-Share index is currently on a PE ratio of 17.5x and the FTSE 250 index on a 15.1x ratio. This is significantly less than the S&P 500, which has a PE of 27.7x.”

Some fund management groups are seeking to exploit these low valuations with new investment trust launches, focused on small to medium-sized UK companies. Arguably there are enough of these already. Tepid demand is apparent in the average 10% discount of the 25 trusts focused on UK smaller companies, with some discounts approaching 30%. The 12 trusts in the UK all companies sector trade on an average 9% discount.

Stifel highlights the attractions of established trusts that are trading on historically wide discounts such as Mercantile (LSE:MRC)(focused on mid-cap stocks) and Fidelity Special Values (LSE:FSV) (focused on recovery stocks).

The currency exchange effect has helped to float all boats that venture beyond the UK’s shores, particularly across the north Atlantic. That is where the big storms are now brewing.

The author was editor of Money Observer between 1998 and 2015.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.