Global funds not piling into ‘cheap’ UK market

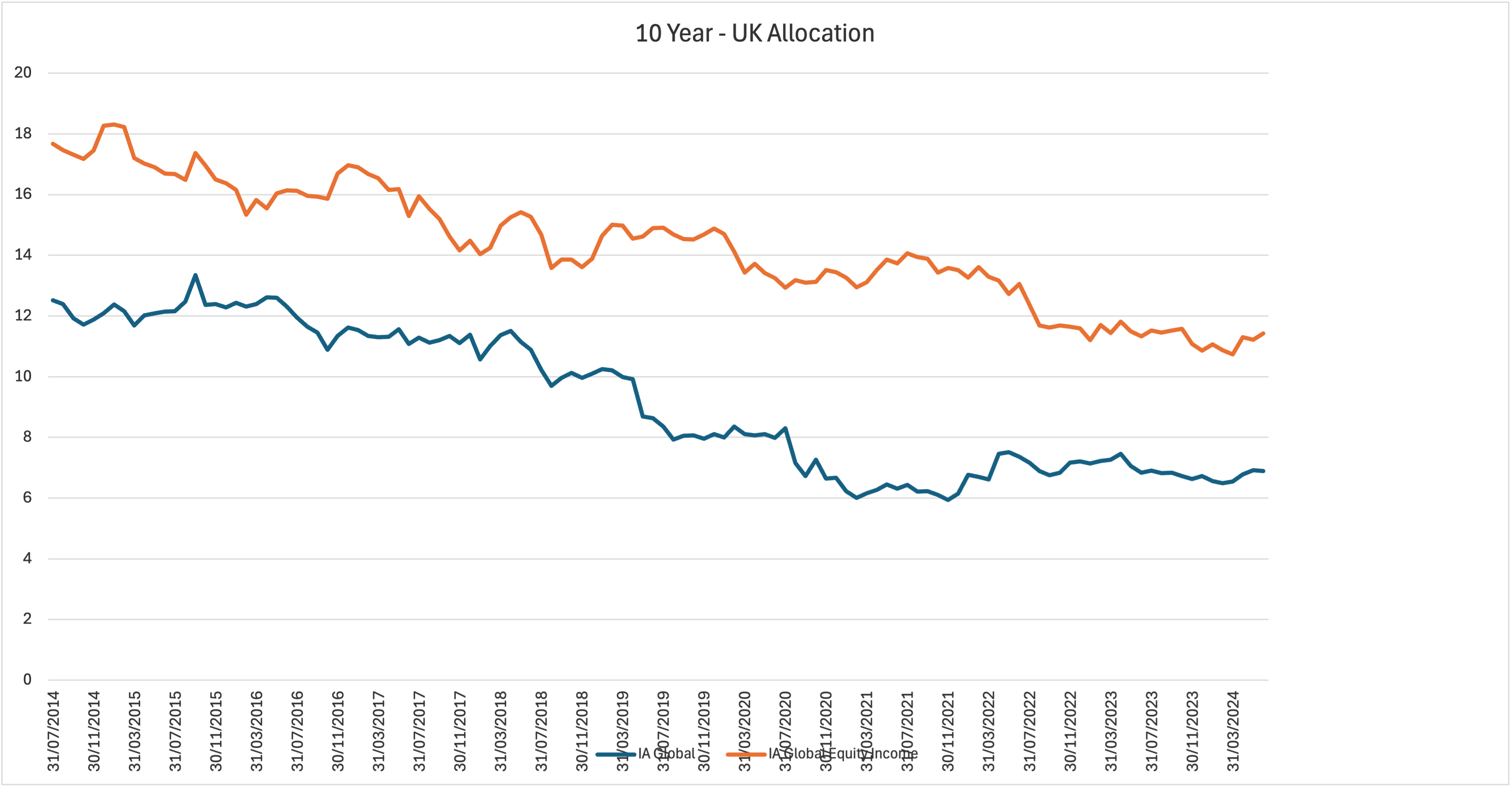

This chart shows that global fund managers have not been making a big move to back Britain.

23rd July 2024 09:15

by Kyle Caldwell from interactive investor

While plenty of column inches have been dedicated to how cheap the UK stock market is versus its history and other regions, it appears global fund managers have not been making a big move to back Britain.

As the chart below from Morningstar shows, the average UK weighting for the global equity and global equity income fund sectors has broadly remained the same over the past couple of years.

As at the end of June, global funds typically held 6.9%, while those with an income mandate had an average allocation of 11.4%. The higher weighting for global equity income funds reflects the high-yield opportunities in the UK market, as well as its rich dividend heritage.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Top ISA Funds

The chart also shows how allocations to the UK have reduced over the past decade. Global equity funds typically held 12.5% in the UK a decade ago, while global equity income funds had an average position of 17.7%.

The data contrasts with the latest Bank of America survey, which revealed an uptick in professional investor interest for the UK market.

Source: Morningstar. Blue line is Global fund sector. Yellow line is Global Equity Income fund sector.

Some global funds deliberately avoid having any exposure to the UK. This is on the grounds that many investors have home bias in their portfolios, so a global fund avoiding the UK offers diversification on a country level.

However, most global funds are able to invest in the UK, so the fact that weightings towards the country have remained broadly the same over the past couple of years shows that, on average, global fund managers are not viewing the UK as a screaming buy.

Brian Kersmanc, manager of GQG Partners Global Equityfund, holds just 3% in the UK. In a recent video with interactive investor, he explained: “There are names that we deem high quality in the UK landscape. However…there’s more interesting names, with better fundamentals from a bottom-up basis [and] with attractive valuations, in other places right now. [But this] doesn’t mean we can’t own things in the UK.”

- GQG Partners Global Equity: there's no reason for us to exist without performance

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

However, a fund that is overweight the UK, with a weighting of 14.7%, is investment trust Bankers (LSE:BNKR). In an interview we published in early April, its manager Alex Crooke described the UK stock market as being “under-researched, under-owned and unloved”.

Crooke added: “[The UK] is unloved. But there is an election this year, so we should have five years of reasonable certainty [over] whoever is going to govern the country. I think we’re seeing the low point of growth and we should see recovery, as one hopes the Bank of England starts cutting rates.”

- Bankers: why we are overweight the UK and underweight the US

- UK dividends hit record quarterly high, but 2024 outlook cut

While global fund managers are, on average, lukewarm towards the UK, various stock pickers focusing on the region have been pointing out that there are plenty of tailwinds for the UK market to have a sustained period of strong performance.

Among the reasons to be positive is the expected stability following Labour’s landslide victory earlier this month, the pick-up in M&A activity, the rate of inflation cooling to 2%, and the prospect of interest rate cuts, the first of which may happen next month.

Nick Shenton, manager of Artemis Income fund, says that another sign of how cheap valuations are across the UK market is companies increasingly buying back their own shares.

In an interview with interactive investor, Shenton said: “Companies themselves are saying, well, if you won't buy our shares, UK public, we'll buy them ourselves. Over 60% of the portfolio by value is bought-back shares in the past year. And we're on that ticket. If we're patient shareholders, we think we'll end up owning the businesses through the golden share because all the other shares will have been bought back, so something has to change. But the interesting thing is, it is changing. We can see it in the market. We can see and feel it.”

- Artemis Income: why UK bank share prices should be higher

- Where to invest in Q3 2024? Four experts have their say

Shenton named three UK shares that look unjustifiably cheap: easyJet (LSE:EZJ), SSP Group (LSE:SSPG) and Informa (LSE:INF).

In terms of putting figures on how cheap the UK market is, Charles Luke, manager of Murray Income (LSE:MUT), an investment trust, recently told our On The Money Podcast: “If you compare the markets across different regions and adjust for sector differences, so you’re comparing apples with apples, the UK is nearly 30% cheaper than the US and around 7% or so cheaper than Europe. And the sectors where there’s the greatest difference [in] valuations compared to the US are energy, financials, real estate and utilities. And that difference in those sectors is 35% to 40%.

“Arguably, there are some reasons why US companies should perhaps be a little bit more expensive, such as having access to a larger market with greater economies of scale. But it really seems to me that those valuation discrepancies are just too large at the moment.”

He named Rentokil Initial (LSE:RTO), National Grid (LSE:NG.), Coca-Cola Europacific Partners (LSE:CCEP) and RS Group (LSE:RS1) as shares that stand out in terms of their low valuations.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.