FW Thorpe shares rated 8 out of 10

Competition is hotting up, but profitability and value make this share a good long-term investment.

15th November 2019 15:45

by Richard Beddard from interactive investor

Competition is hotting up, but profitability and value make this share a good long-term investment.

If it were not for the fact that FW Thorpe (LSE:TFW) had different chairmen in 2013 and 2019, you could be forgiven for wondering whether the current incumbent, Mike Allcock, had used the 2013 chairman's statement as a template for the 2019 annual report.

"It was a game of two halves," he wrote, like his predecessor Andrew Thorpe in 2013. That year Thorlux, the company's biggest business by far, experienced a hangover from a lull in orders in the previous financial year, and profit fell 10% even though demand had picked up again well before the financial year was over.

In 2019, the company also experienced a substantial decline in demand in its first quarter, and, although demand quickly normalised leaving the company with a healthy order book by June, adjusted profit fell 9% due to higher costs, some relating to the closure of a factory, some to a temporary decline in efficiency because the company had to ramp up production to meet returning demand, and some to a "slight" squeeze in profit margins.

Stiffening competitive headwinds

The decline in profitability in 2013 was a blip. Over the last seven years, revenue has grown at a compound annual growth rate of 10%, and profit, diminished by the decline in 2019, has grown 8%. Twenty-nineteen may also be a blip. Only one of the factors Thorpe references in its relatively poor result that might have long-term significance is the squeeze in profit margins, which could mean competition in the lighting industry is heating up.

Many of FW Thorpe's competitors are having a tougher time of it as industry spends less on new lighting projects due to fears of economic trouble ahead, while public sector spending is subdued. Although there are brighter spots like healthcare and logistics, with more companies chasing less business it would be surprising if firms were not competing on price.

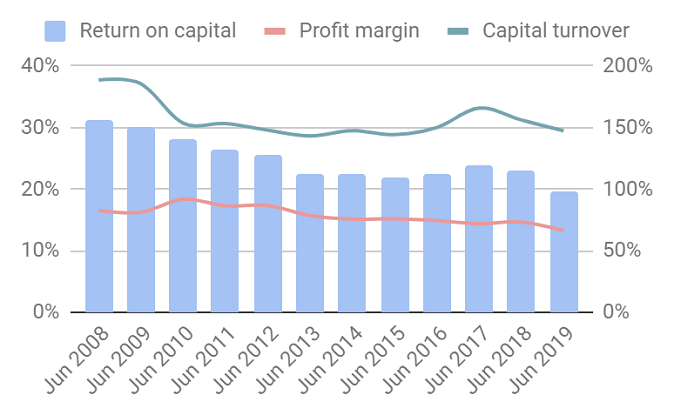

Even so, the fittest should survive and ultimately gain market share, and that is what appears to be happening. Currently, FW Thorpe believes it is gaining share, and, in 2019, it earned a return on capital of 20%, just 2% below the long-term average.

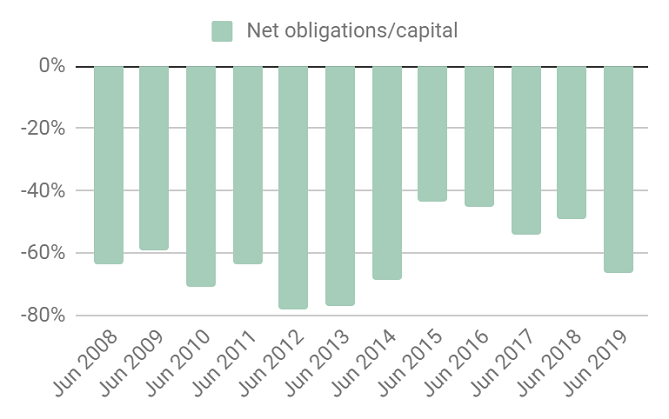

It is sitting on a large cash pile, so the company is about as far from floundering as a porpoise gliding through the ocean. It may not be leaping, but it's not going hungry either.

Avoiding the race to the bottom

FW Thorpe's strategy is to avoid the race to the lowest price by providing the best value over the lifetime of a lighting system (10 years or more). It has built its reputation on convenience and reliability by reducing the cost of spares, maintenance, and installation, and also efficiency, lowering energy costs through the adoption of LEDs, which now account for 90% of sales, and smart controls that, for example, switch lights off when no people are present.

But the easy efficiency gains have been made. LED lighting systems are 70% more efficient than fluorescent, which means future gains will be less significant, and, although there are still fluorescent systems to be replaced, interest in retrofitting LED systems into buildings to make quick savings has peaked. Work may also be harder to come by because companies brought forward the replacement of lighting systems to benefit from the new technology.

To stimulate demand and stay competitive, FW Thorpe is focusing innovation on controls now: presence detection, automated emergency lighting testing, and tuning colour temperatures to vary lighting naturally throughout the day. A New Flex System "brings the outside in" by mounting very thin lighting on the ceiling grid, and incorporating gently lit cloudscapes where the tiles would normally be:

Because lighting is ubiquitous, the company is also extending its utility into completely new domains, monitoring air quality and warehouse doors for example.

This is how FW Thorpe scores:

Does FW Thorpe make good money?

Yes, take a look at profitability:

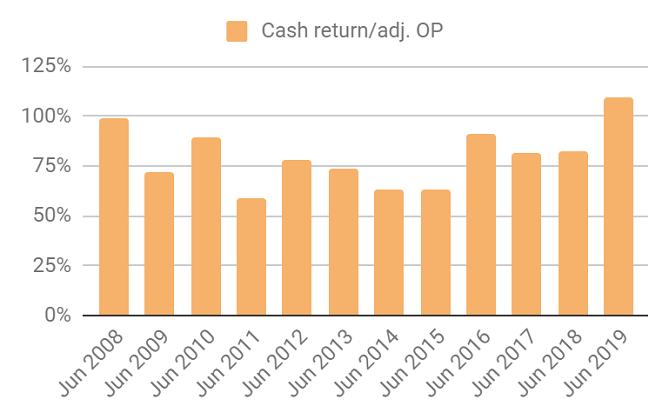

Cash conversion:

And its negative gearing:

Score: 2

What could prevent it from growing profitably?

Historically, FW Thorpe has emerged from downturns in a stronger competitive position than it entered them because of its strong finances, quality products, and enduring relationships with end customers like JLR.

So far, it has adopted new wireless and LED technologies without skipping a beat. Heightened competition and the return to a more normal replacement cycle after the rush to convert to LED are likely to impact growth, although Thorpe says product life cycles are shortening due to the faster pace of technological change.

The company is also seeking to expand abroad, in Europe. It has factories in Holland, and an investment in a Spanish manufacturer. While these, and its relatively new but homegrown road and tunnel subsidiary, are less profitable than the mothership, they are growing. As they grow, they may become more profitable.

Overseas expansion is not a one-way street though. The company warns of powerful new entrants in its risk report, European companies including world leader Signify (formerly Philips Lighting) extending their footprints in the UK.

Score: 1

How will it overcome these challenges?

FW Thorpe's strategic pillars are a focus on quality and advanced technology to differentiate products, growing the customer base by introducing UK products to Europe and products from its new Dutch subsidiary Famostar into the UK, and developing employees through apprenticeships and training. Generally, it sells direct to end customers. The strategy has generally served it well.

FW Thorpe is circumspect about acquisitions and does not appear to have overpaid. In recent years it has increased its provision for earn-outs that will be paid because of the good performance of acquisitions, and, in 2019, it evaluated several new opportunities, but chose not to act. Any acquisition, it says, must be non-competing and complementary.

Score: 2

Will we all benefit?

The similarities between the current chairman and his predecessor may be a reflection of the fact that Mike Allcock, who is also joint chief executive, has had a long apprenticeship. He joined FW Thorpe in 1984 as a trainee and took over from Andrew Thorpe, the grandson of the founder last year. Without naming them, Allcock says with evident satisfaction that the board of Thorlux, the biggest of FW Thorpe's subsidiaries, has two new members this year. One joined as an apprentice and the other as a trainee.

One can see perhaps, how its successful culture is being passed on from one generation to another under the stewardship of Andrew and his brother Ian, who remain as non-executive directors and substantial shareholders. They own 46% of the company between them.

FW Thorpe communicates well with investors through the annual report, which is devoid of accounting trickery. It says, "customers come to us for peace of mind", and, historically at least, shareholders also have had little to worry about.

Score: 2

Are the shares cheap?

They are not too expensive. A share price of 280p values the enterprise at about £325 million, 19 times adjusted profit in 2019. The earnings yield is 5%.

Score: 1

A score of 8/10 means despite the stiffening competitive headwinds I think FW Thorpe is a good long-term investment.

Richard owns shares in FW Thorpe.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.