Funds and sectors we use to protect our portfolios

Saltydog Investor reveals how it invests when markets are volatile and falling.

11th September 2023 14:15

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

As well as supplying regular performance data and market commentary, Saltydog Investor also runs a couple of demonstration portfolios to show how the information that we provide can be used.

It is generally accepted that when investing there is usually a trade-off between risk and reward. The least volatile, “safest”, investments should never go down by too much but are also unlikely to ever give spectacular returns. On the other hand, the investments that can give the greatest returns when things are going well are the ones that could also make the largest losses when the tide turns.

- Invest with ii: Top Investment Funds | Index Tracker Funds | FTSE Tracker Funds

Our portfolios are designed to be at the more cautious end of the risk spectrum and so we limit the amount that we are allowed to invest in the more volatile funds. Furthermore, we will invest in them only if they have been providing better returns than less volatile funds in recent weeks.

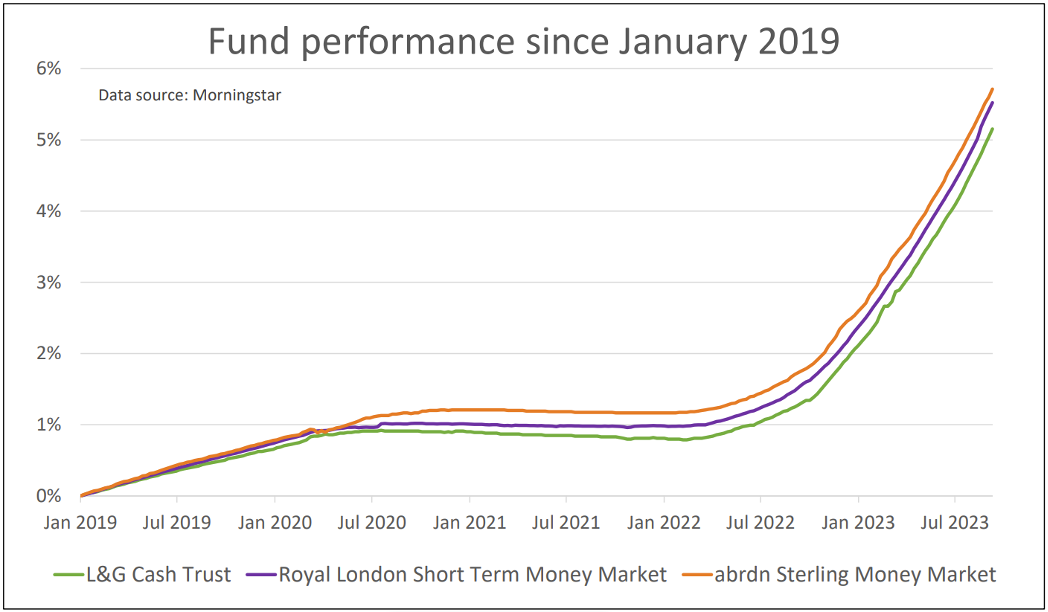

In the past, the least-volatile sectors have been Standard Money Market and Short Term Money Market, so we have put these into our “Safe Haven” group.

There is no requirement for us to invest in these funds and we tend to use them only when we are looking for somewhere to hold our money while we wait for more favourable market conditions. Unfortunately, that has been the case for some time. We started investing in them in October 2022 and they are currently our largest holdings. We now hold the Royal London Short Term Money Market fund, abrdn Sterling Money Market, and the L&G Cash Trust fund.

- Fund sales booming, but sustainable strategies given thumbs down

- BlackRock to cut fund fees as assets grow

The good news is that having earned next to nothing throughout 2022, the returns have gone up in recent months. Last month, the Royal London Short Term Money Market rose 52%. If it keeps on going at its current rate, then that works out at an annual return of over 6%.

Past performance is not a guide to future performance.

The next group of funds, based on their likely volatility, are from the £ Corporate Bond, £ High Yield, £ Strategic Bond, Mixed Investment, and Targeted Absolute Return sectors. These make up the Saltydog “Slow Ahead” group. In the past, this is where we have found the funds that have made up the bulk of our portfolios.

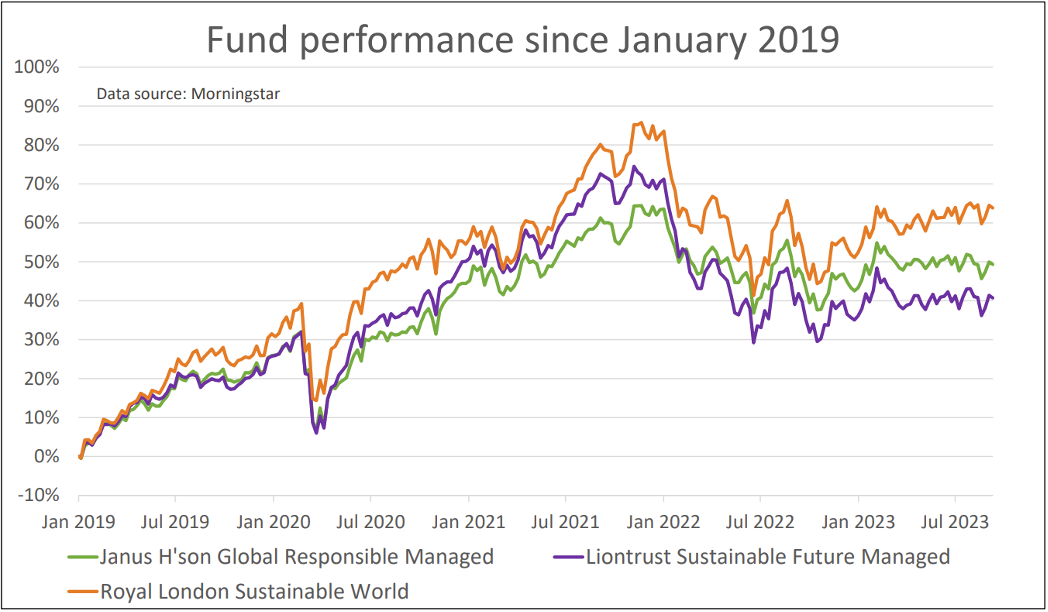

As an example, funds such as Janus Henderson Global Responsible Managed, Liontrust Sust Future Managed, and Royal London Sustainable World, from the Mixed Investment 40-85% Shares sector, have regularly featured in our portfolios. Most notably in the year leading up to the coronavirus crash in March 2020, and then from April 2020 through until early 2022.

Past performance is not a guide to future performance.

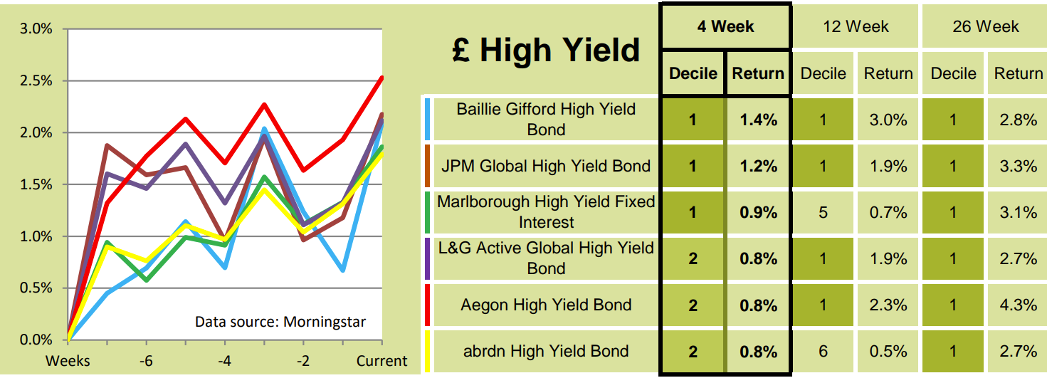

Unfortunately, most sectors in the “Slow Ahead” group are struggling at the moment. Only one, £ High Yield, rose in August.

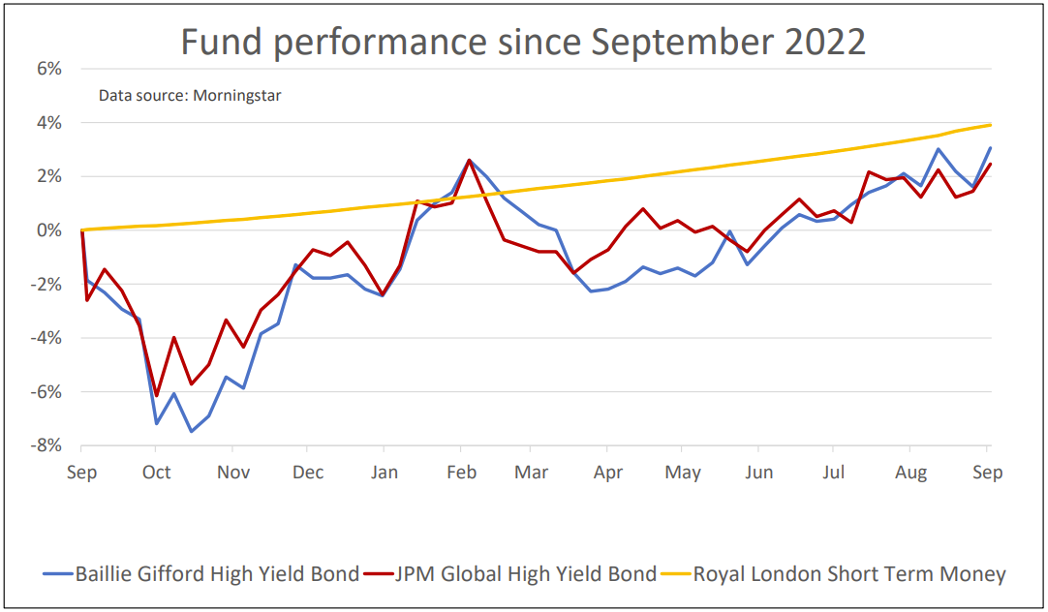

Last week, we had a look at two of the leading funds, JPM Global High Yield Bond and Baillie Gifford High Yield Bond, that featured at the top of our four-week data table. They were both in decile one over four, 12 and 26 weeks and we considered adding them to our portfolios.

Past performance is not a guide to future performance.

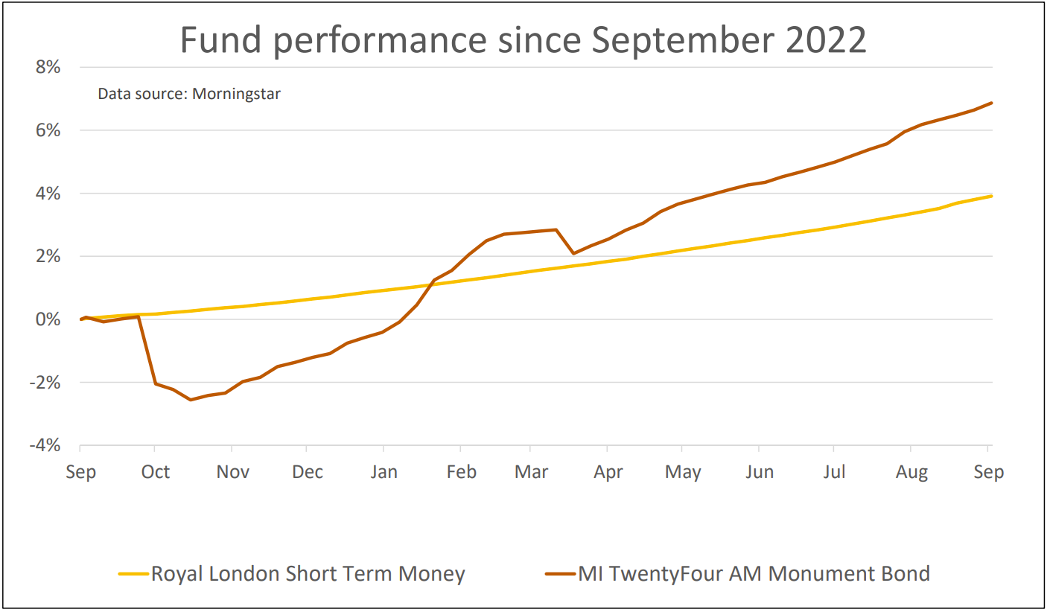

In the end, we decided to wait a little longer. From the eight-week graph shown above, you can see that they have been fairly erratic over the past couple of months. If you look over the last year, then you can see that they have not done as well as the Royal London Short Term Money Market fund that we are already holding, and that they have been much more volatile.

Past performance is not a guide to future performance.

For the time being we are happy to play it safe.

Our next largest holding, after the Money Market funds, is the MI TwentyFour AM Monument Bond that we went into earlier this year. It may be more volatile than the Royal London Short Term Money Market fund, but over the past six months it has been less volatile than 90% of the funds we monitor and has been making steady progress. It certainly still looks more appealing than the £ High Yield funds.

Past performance is not a guide to future performance.

We do have some exposure to the North America, Technology, and Indian sectors, which are much more volatile, but they account for only a relatively small proportion of our overall portfolio values.

At the moment, we have over 75% in cash or the Money Market funds and, until we see a general improvement in overall sector performance, that is how it is going to stay.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.