Fund Spotlight: Scottish Mortgage Investment Trust

The ii Research Team offers an update and view on one of the UK’s most popular investment trusts that applies a patient approach to finding the world’s most visionary companies.

16th November 2023 09:01

by ii Research Team from interactive investor

This £9.75 billion FTSE 100 listed trustneeds no introduction to many investors, as it has for the past couple of years consistently been the most-popular investment trust among interactive investor customers. The global trust offers a unique and long-term approach to investing in future winners, as well as exposure to operationally strong and growing businesses that aren’t accessible via any exchange listing.

- Invest with ii: ii Super 60 Investments | Transfer an Investment Account | Free Regular Investing

Scottish Mortgage Investment Trust (LSE:SMT), managed by Tom Slater and Lawrence Burns, is a strategy which aims for capital appreciation by investing for the long term in best-in-class growth companies. Management’s philosophy behind stock selection is one of identifying drivers of change, and investing in a select number of visionary names that they believe are poised to capitalise on these sea changes. With such a lofty goal to fulfil, management are unconstrained in where and how they invest. Leveraging the strength of Baillie Gifford’s vast research function, the trust also embodies the patient and long-term approach to stewardship that the house is known for.

What does the trust invest in?

The portfolio comprises a relatively select 99 holdings, considering its global remit. 47 companies are publicly listed, with the balance being unlisted. As above, the focus on disruptive companies in areas fuelled by structural growth drivers and the inclusion of private companies means the portfolio looks little like its FTSE All World benchmark.

Consumer discretionary (38%), Technology (27%) and Healthcare (11%) names dominate the portfolio at nearly 80% of assets, versus 3%, 24% and 11% for benchmark. Geographically, the trust favours the US (55%), which is quite commensurate with index, while other country allocations, most notably a great overweight to China (13%) versus index (3%), diverge to greater degrees.

To find these winning companies, regardless of where they are in their growth journey, management can allocate 30% of the portfolio to private companies. The thesis is not one of early stage venture capitalism, rather that companies are choosing to stay unlisted for longer, with much growth manifesting prior to listing. The portfolio’s unlisted names are, by and large, sizeable companies, six of which have valuations well in excess of $10 billion, such as Epic Games, Bytedance, SpaceX. This private allocation is a liberty afforded by the closed-ended trust structure.

Outlook and themes

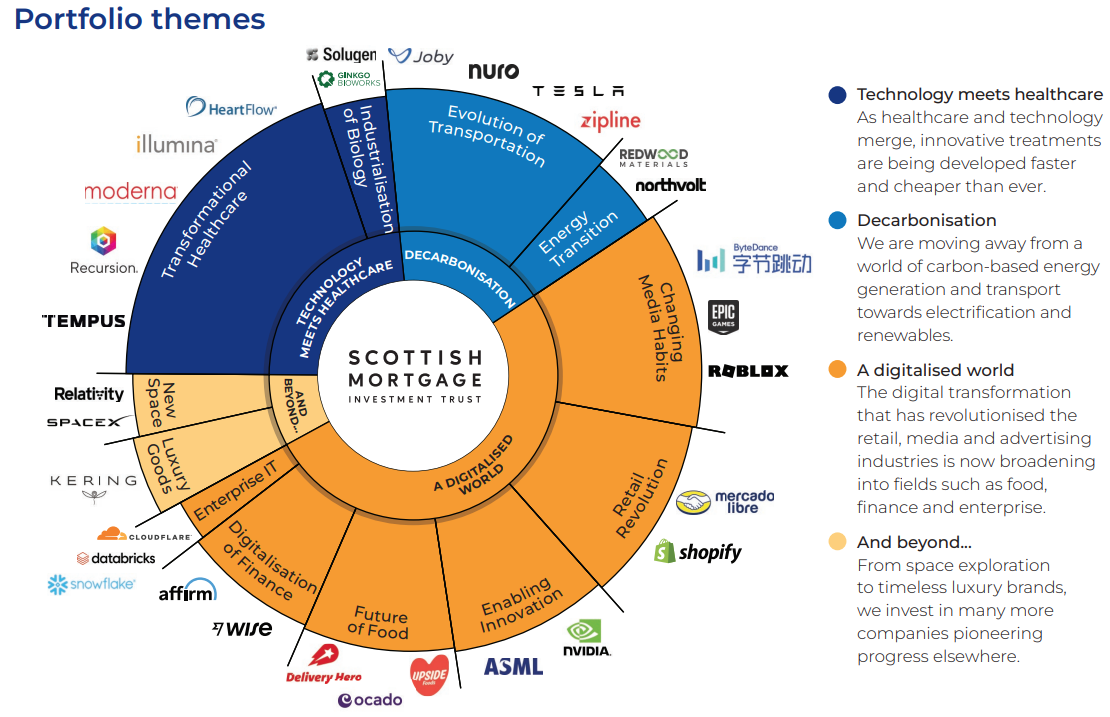

The trust considers the portfolio by theme (“Technology meets Healthcare”, “Decarbonisation”, “Digitalised World” and “Beyond”) in which sit more granular sub-themes. One sub-theme captured in the portfolio and driving markets this year is Artificial Intelligence. Companies with exposure to AI have enjoyed great returns since the start of 2023, buoying markets despite a broad rise in developed market base rates. Investors might query why Scottish Mortgage has yet to capitalise on these AI winners, given that the trust has a negative NAV return (-1.5%) over the year-to-date period.

- Scottish Mortgage: expect volatility – it’s essential to our success

- Nvidia and Scottish Mortgage hit by ban on chip sales to China

In light of the AI excitement, management highlight that they’re in the early stage of the transformation. NVIDIA (NASDAQ:NVDA) (5%) and ASML Holding NV (EURONEXT:ASML) (7.3%) are high-conviction positions, and indeed have aided performance over the past year. As key players in the supply chain of chips powering AI systems, whichever incarnation of AI manifests as practical and profitable, they are set to benefit. The process of training foundational AI models is, given its expense and technological requirements, confined to those large tech platforms, to which SMT has some exposure (Amazon.com Inc (NASDAQ:AMZN), at 4.2%). However, per the disruptive thesis of the trust more broadly, management hold out for those nimble new entrants that have scope to become the long-term beneficiaries of the technology as it develops and embeds itself.

Source: Scottish Mortgage Interim Financial Report, 30 September 2023.

How the portfolio has changed

While the team favour a low turnover and long-term bets on themes and companies, they retain a keen focus on operational performance and company management. Should these deteriorate, no matter how compelling the corporate story, positions will be cut, as has been the case recently with gene-sequencing company Illumina (NASDAQ:ILMN), given missteps in the company’s execution.

At a broader level, the team recently reevaluated their position on China. There’s terrific upside afforded by China’s domination of the EV supply chain amid other innovative industries. SMT retain exposure via disruptive names such as NIO (NYSE:NIO) (EV manufacturer) and recently added PDD Holdings Inc ADR (NASDAQ:PDD) (an innovative e-commerce platform). However, the team have raised the bar for Chinese investment, given the deteriorating US-China relationship and unpredictability of state intervention.

How has the fund performed?

Scottish Mortgage biases strongly towards growth companies and longer duration assets, where rewards to investors are positioned a long way in the future. This future value is discounted back to give a current valuation, and thus valuation is contingent on the market discount rate. Valuations can become greatly diverged from the companies’ asset bases and low discount rates generally will bolster higher valuations. When in 2022 central banks began to raise base rates to fight inflation, these growth companies saw great falls in valuations, and the portfolio of SMT was hit hard.

Investment | 01/11/2022 - 31/10/2023 | 01/11/2021 - 31/10/2022 | 01/11/2020 - 31/10/2021 | 01/11/2019 - 31/10/2020 | 01/11/2018 - 31/10/2019 |

Scottish Mortgage Ord | -11.4 | -51.3 | 51.4 | 97.8 | 5.5 |

FTSE All World Index | 5.0 | -4.6 | 29.4 | 4.7 | 11.1 |

Global AIC Sector | -1.4 | -20.2 | 26.1 | 5.5 | 6.8 |

Source: Morningstar - Market Return (GBP) to 31/10/2023.

2022 marked the greatest calendar year drawdown for SMT in over 20 years. The trust lost -39% and -46% on a NAV and share price basis respectively. Throughout 2023, the trust has lost investors -10% versus a benchmark return of circa 6%. A particular driver of underperformance was healthcare names, namely Moderna (NASDAQ:MRNA), Vir Biotechnology Inc (NASDAQ:VIR) and Illumina.

Further, broad market uncertainty and anxiety regarding unlisted assets has manifested as a discount to NAV – a trend across many funds holding private assets. The trust which, prior to 2022 tended to trade close to NAV saw its discount widen through 2022 to a depth of circa -22% in the first six months of 2023. This effect exacerbated losses to investors, however the current discount of circa 16% does mean that buyers now pay a lesser price for the assets than the price assigned by the market.

- Jeff Prestridge: cash is king but equities will prevail

- DIY Investor Diary: how my ISA and SIPP are invested differently

Accordingly, in spite of a stunning return of over 110% in 2020, amid a growth-friendly market environment, on a share price basis over three years the trust has lost money (-13%), while benchmark returned an annualised 9.5%. However, the trust still boasts a strong long-term track record. Over 10 and 15 years on a share price basis, the trust outperforms convincingly (with annualised returns of 13.2% and 17.8% respectively) versus benchmark (9.9% and11.1%). Investments in now household names, such as Tesla (NASDAQ:TSLA), Netflix (NASDAQ:NFLX) and Amazon have been stunning examples of long-term winning picks, driving these returns.

Why do we recommend this fund?

As management admit, smooth returns and exceptional outperformance are mutually exclusive. The speculative aspect to investing in future winners means that short-term returns can and have been extreme, both to the up and downside and the trust often displays volatility over twice that of its benchmark.

Aside from changes in the underlying portfolio’s valuation, the movement of the discount and use of a moderate amount of leverage adds to the “adventurous” nature of the trust and it should be held for a minimum of five years. The ultimate success of these companies ought not be a product of current macroeconomic trends, but rather of structural changes across industries and thus, prospective investors will have to look through the noise of short-term volatility.

Overall, this unique and high active share approach has proven its ability to create substantial alpha and pick companies at the helm of transformative themes. The ongoing charge per the most recent factsheet of 0.34% is competitive given this differentiated portfolio and unlisted exposure, while the discount of circa 16% provides a seldom-seen opportunity. Given the trust’s strong long-term track record and solid approach to identifying winning companies and transitional themes, it holds a place as an Adventurous Global Equities option on ii’s Super 60 investment ideas' list. Please find further information on the trust here.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.