This fund continues to shine in a crisis

In need of a safe haven fund, Saltydog analyst has achieved impressive results with an old favourite.

26th May 2020 10:25

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

In need of a safe haven fund, Saltydog analyst has achieved impressive results with an old favourite.

Earlier this year, just as markets started to head south, we sold most of the investments in our two demonstration portfolios.

The only fund that we kept was Investec Global Gold in our more adventurous portfolio, the ‘Ocean Liner’.

In September 2018, Investec announced its intention to demerge and separately list the Investec Asset Management business. This has now taken place and the company has been renamed Ninety One.

The funds have changed their names to reflect this, but the management, objectives, risk profiles, and costs remain the same. Investec Global Gold is now called Ninety One Global Gold.

In the past, gold bullion and gold funds have performed well when the world's economies have been under great stress. Examples include after the Great Depression, the end of the Vietnam War, and the 2008/9 global financial crash, when the value of gold, and gold funds, soared to new highs.

The present coronavirus pandemic will surely rate alongside these previous catastrophes, so we should perhaps expect a similar performance from these funds.

The Ninety One Global Gold fund is an old favourite. We held it for seven months in 2016, between February and August, and it went up by over 100%.

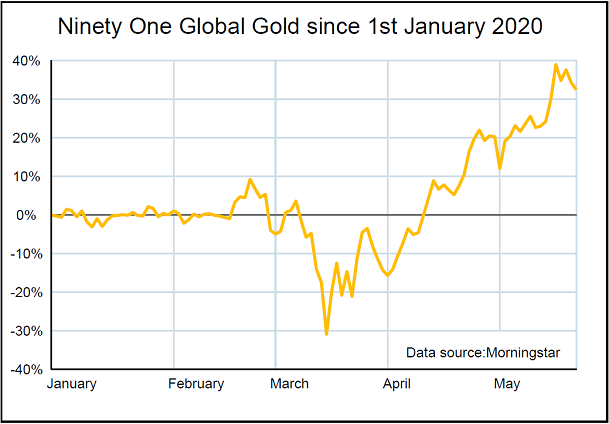

After a relatively quiet start to 2020, it suddenly started to pick up in the middle of February.

We bought it on 27 February and felt confident that if coronavirus spread, then it would do well as investors headed for safety. We could not have been more wrong.

After the first week our investment was down more than 9%. Fortunately, it only accounted for 1.6% of the total portfolio value. It then rallied for a week before the downhill trend continued. Within a few weeks it had fallen by 25%.

It is hard to understand why it did so badly, but the most plausible explanation that I have heard is that as global equities plummeted, one of the few things that retained its value was gold.

After a good run it was just about the only thing that traders and hedge funds could sell and make a profit. They went on a selling spree, to cover stock losses and margin calls, forcing the price of gold to collapse.

Since then it has recovered well and gone back up to highs that we have not seen since 2010.

In April we increased our holding and it is now showing a gain of over 20%. Not bad for three months.

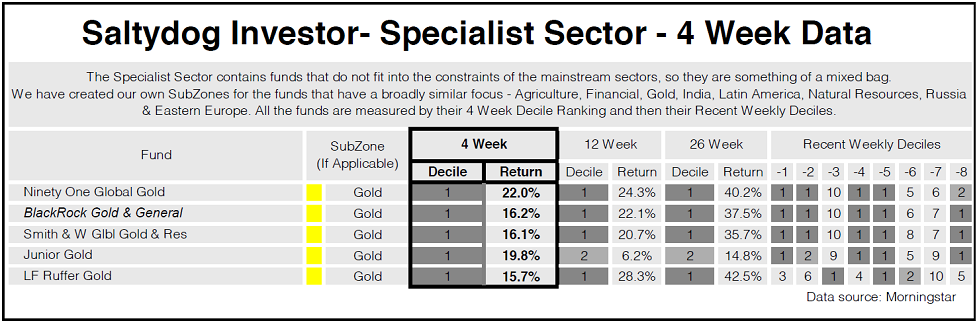

There are five ‘gold’ funds that we monitor in the Specialist sector and last week they were all at the top of our four-week performance table.

We have recently added the Ninety One Global Gold fund to our more cautious ‘Tugboat’ portfolio.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.