FTSE for Friday: will bank rescues save FTSE 100?

17th March 2023 07:50

by Alistair Strang from Trends and Targets

It will take a brave trader who keeps large positions open over the weekend. Independent analyst Alistair Strang studies the possible impact this may have on the blue-chip index.

We shall not be surprised if Friday ends with some reversals, if only due to concern over potential bad news breaking over the weekend. While the Swiss Central Bank has “saved” Credit Suisse and First Republic Bank saved by a coalition of major banks, considerable effort is obviously going in to inhibit a domino effect in the banking sector.

However, it will be interesting to see how many traders opt to close positions on Friday rather than risk a wipe-out on Monday, due to a new cause for panic.

- Invest with ii: Open an ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

We’ve some doubts about this for Friday as it feels like the FTSE 100 may again experience some recovery.

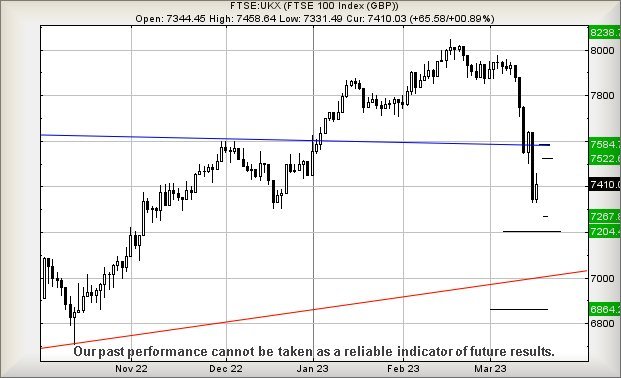

Closing Thursday at 7,410 points, it need only lurch above 7,460 to hopefully trigger recovery to 7,522 points with secondary, if bettered, a more encouraging 7,584 points. This secondary ambition is quite a big deal, giving the FTSE the impetus to potentially regain the Blue downtrend and point at happy days ahead.

The required stop loss is rather wide, calculating at 7,377 points.

If everything intends to go wrong, below 7,330 points looks catastrophic as this risks triggering reversal to 7,267 points with secondary, if broken, at 7,204 points and a limp bounce, maybe…

Have a good weekend.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.