FTSE for Friday: the stormy weather is not over

Markets are volatile and it's difficult to identify a clear pivot point. Independent analyst Alistair Strang explains what this means and what investors might expect to happen.

11th April 2025 07:47

by Alistair Strang from Trends and Targets

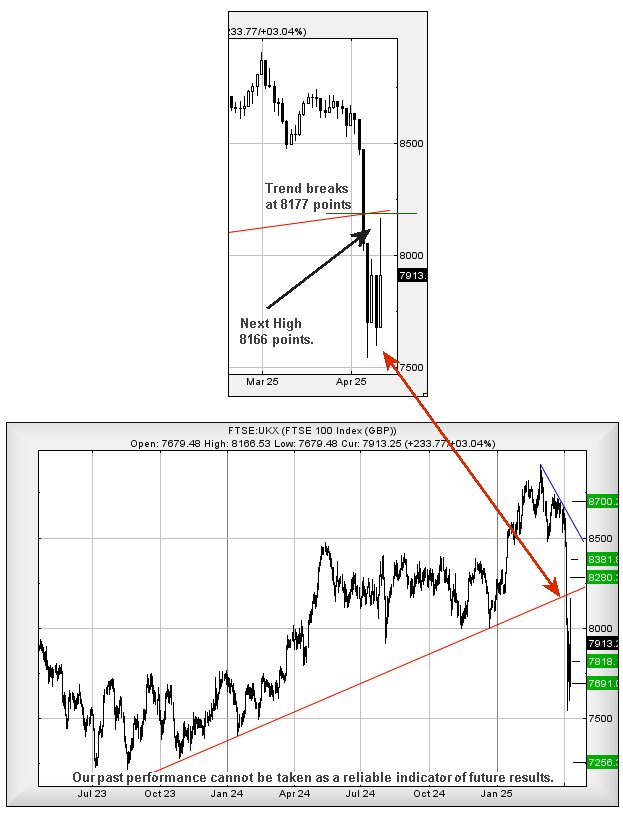

One of our pet things is to monitor the levels of trend breaks as, essentially, when a price exceeds any trend break level, there’s a good chance the trend break was an error and there’s a reasonable chance things shall proceed in the direction of the preceding trend.

In the case of the FTSE 100, the index has exhibited an almost perfect enactment of our theory, as shown on the chart extract. In other words, as the index has failed to exceed 8,177 points, we’d recommend holding off on the party poppers as things could still go very wrong!

- Invest with ii: Open a Stocks & Shares ISA | Top ISA Funds | Transfer your ISA to ii

Market movements in the last week have been of such magnitude we’re struggling with the mental leap, where we’ve been conditioned to expect minimal index movements on a daily basis, whereas the last week has seen the FTSE wander around in a 600-point bandwidth. There’s no clear point where we can accuse the FTSE of having a pivot point, a fairly common creation where a volatile market will invent an imaginary point that the price oscillates above and below.

By looking at minute by minute movements over the last four days, if the market knew what it was doing, we’d expect to see repeat visits to the 7,850 mid-point level. This has not been happening, so we’re not convinced the stormy weather is over.

From a near-term perspective, trigger levels for real movements appear fairly distant, due to the index range in the last week. Apparently, below 7,864 points risks promoting reversal to an initial 7,816 with our secondary, if broken, at 7,691 points. Neither target level is particularly interesting, given the games of the last week, but does afford a fairly tight stop loss level at 7,914 points.

Our alternate scenario, if things intend to turn positive, calculates with a wide trigger at 8,060 points as this works out with an ambition at 8,280 points with secondary, if beaten, at 8,381 points.

Have a good weekend.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.