FTSE for Friday: new forecasts for Bitcoin and FTSE 100

14th April 2023 08:15

by Alistair Strang from Trends and Targets

Bitcoin feels like it’s on the edge of doing something clever, reckons independent analyst Alistair Strang, who reveals his software's latest price predictions. It's also looking good for the UK's blue-chip index.

As we go into the weekend with new snow on the mountains in Argyll, our lawn is finally cut, there’s reason for optimism. And, of course, some puzzlement. The FTSE 100 is looking capable of tracing new highs, Bitcoin looks like it’s about to enter a recovery phase, even gold looks like it’s about to attempt new levels above $2,100.

Our puzzlement comes from conventional wisdom, essentially if the markets are tanking, smart money is supposed to head elsewhere like gold or Bitcoin. But the markets, while certainly lacking flamboyant gestures, continue to exhibit gains on almost a daily basis. Firstly, we want to examine Bitcoin as it feels like it’s on the edge of doing something clever.

- Learn more: SIPP Portfolio Ideas | How SIPPs Work | Transfer a SIPP

Currently, it appears Bitcoin (trading around 30,300 USD at time of writing) need only exceed $30,575 to apparently trigger a gain in the direction of $33,186, a fairly useful little jump. Our secondary, however, is of special interest as should this initial target be exceeded, we are calculating $47,938 as a secondary, a price level not seen for 12 months.

Visually, it makes a lot of sense but do pay attention to the initial target as it “really” needs to be exceeded to better a funny batch of movements last year, making a strong lift to our $47k level a viable proposition.

For everything to go wrong for Bitcoin, it needs below $23,500 to spoil the party.

Source: Trends and Targets. Past performance is not a guide to future performance.

FTSE for Friday

We’re a little hacked off about the UK AIM market once again riding second fiddle to the FTSE. It's made a series of pretty useless movements rather than exhibit the very real strength shown when it enacted pandemic recovery, quite literally leaving the FTSE 100 in the dust.

However, movements since the start of 2022 almost felt the junior exchange was facing payback for its temerity, and only now are there slight signs things may be improving. But we need to see the AIM above 900 points (currently 825 points) to start thinking happy thoughts again.

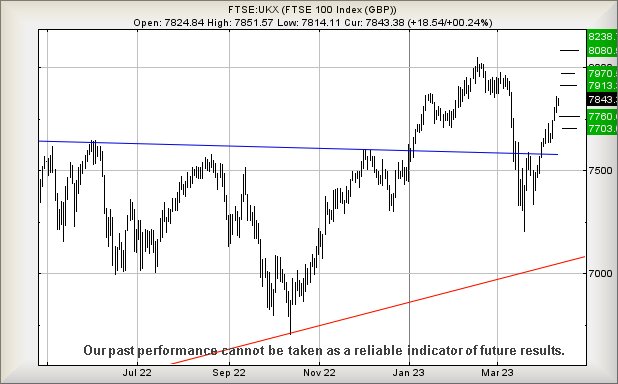

As for the FTSE 100, it’s looking very much like the index is planning another forage into the land of higher highs.

Currently, above 7,862 points should hopefully trigger gains to an initial 7,913 points with secondary, if bettered, at 7,970, a price level where the visuals suggest hesitation is possible.

However, were it not for the previous stall at this level at the start of March, our secondary would work out at 8,080 points. But, in this instance, our software is probably taking the wiser stance.

Market gains recently are proving slow and steady, making us wonder what shall be required to see days of 100+ point movements return.

Our alternate scenario requires the FTSE to slither below 7,808 points, risking a slight reversal cycle to an initial 7,760 with secondary, if broken, at 7,703 points and hopefully yet another bounce.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.