Election poll 2024: which policies do investors value most?

The economy, pensions and tax are front and centre ahead of the general election. ii’s personal finance editor reveals the issues that matter most to you.

25th June 2024 09:14

by Craig Rickman from interactive investor

Whether it’s how to manage the economy, strike the balance between taxation and spending, or control immigration, many of us have ideas about how the country should be run.

While we don’t have the power to make decisions about these key topics ourselves (and frankly, who would want to?) we can collectively choose who is tasked with them. The political party that aligns closest with our views is the one that gets our vote.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

As the clock ticks down to the general election, we wanted to find out which policies are most important to investors, so we ran a couple of polls to find out.

Rather than ask respondents to select multiple answers, we asked them to choose the one that matters most to them.

Let’s examine the responses to each question and unpack how they may have informed investor thinking.

1. “Which issue will have the biggest impact on the way you vote?”

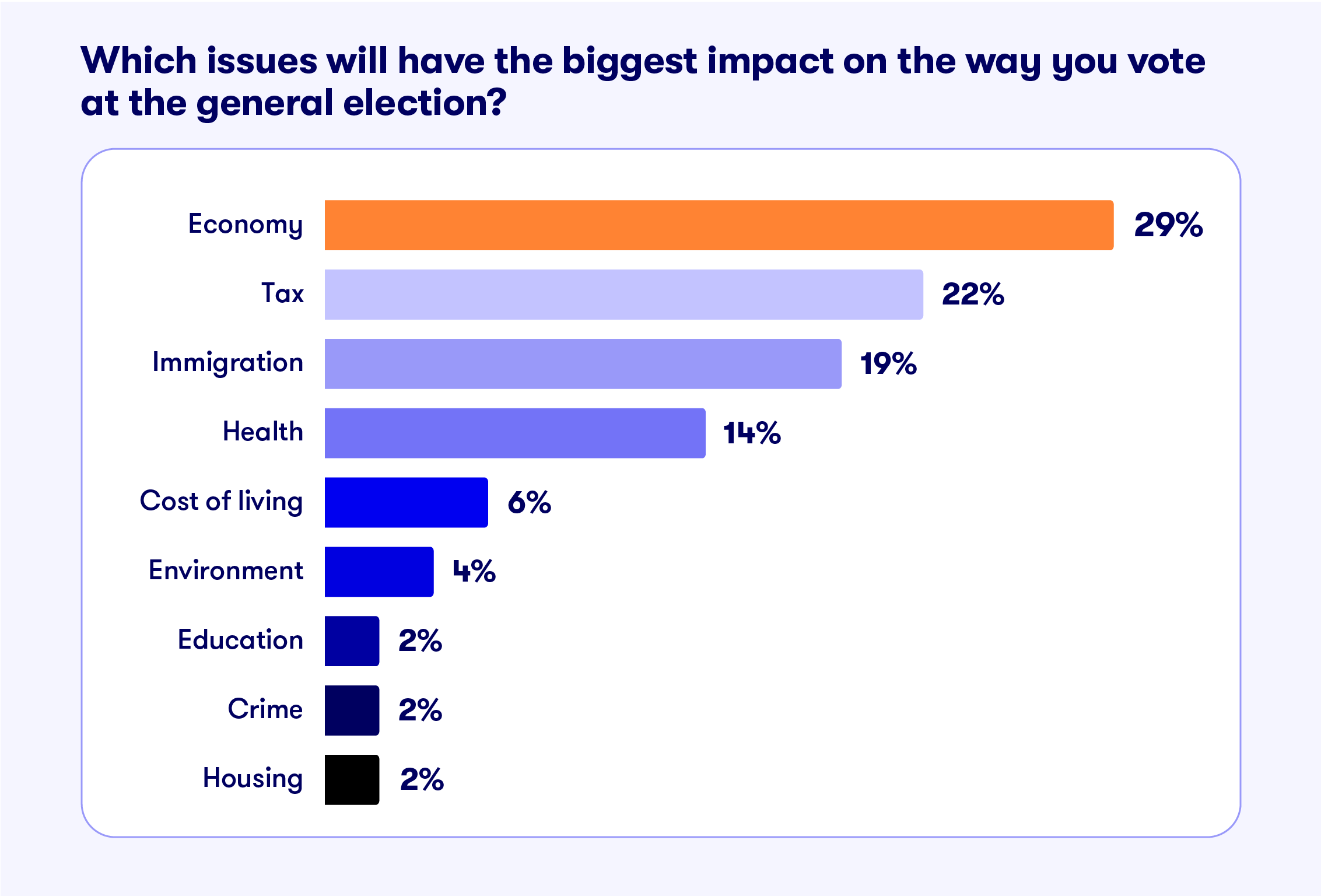

There were nine options to choose from here, with the results unearthing some clear winners.

Some 57% believed that financial issues rank highest for this election, though some areas of the landscape are clearly more important than others. Almost a third (29%) put the economy highest, and some 22% chose tax.

Both the economy and taxation are key battlegrounds ahead of polling day. The development that inflation hit the Bank of England’s 2% target in May was timely news for the current government. No doubt Rishi Sunak will make a play of this key milestone during his election campaign.

Revitalising the UK’s sluggish economy, which is only 0.6% bigger than this time last year, is next on the agenda, whoever wins power.

When it comes to personal taxes, Labour and the Tories have contrasting ideas. Sunak has committed to giveaways over the next parliament, but Starmer doesn’t believe the money is there.

- Election manifestos 2024: the impact on your personal finances

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Meanwhile, addressing the rising cost of living (6%) ranked fairly low with investors. This could be for two reasons. First, as noted above, inflation is now at target level, so the worst of the saga is behind us. Second, respondents may have felt the effects of rising costs less than others, particularly if they’re mortgage free.

Investors also flagged Immigration and Health as their main policy concern, gathering 19% and 14% of the vote, respectively, whereas Education, Crime and Housing received just 2% each.

2. “What finance policy is most important to you?”

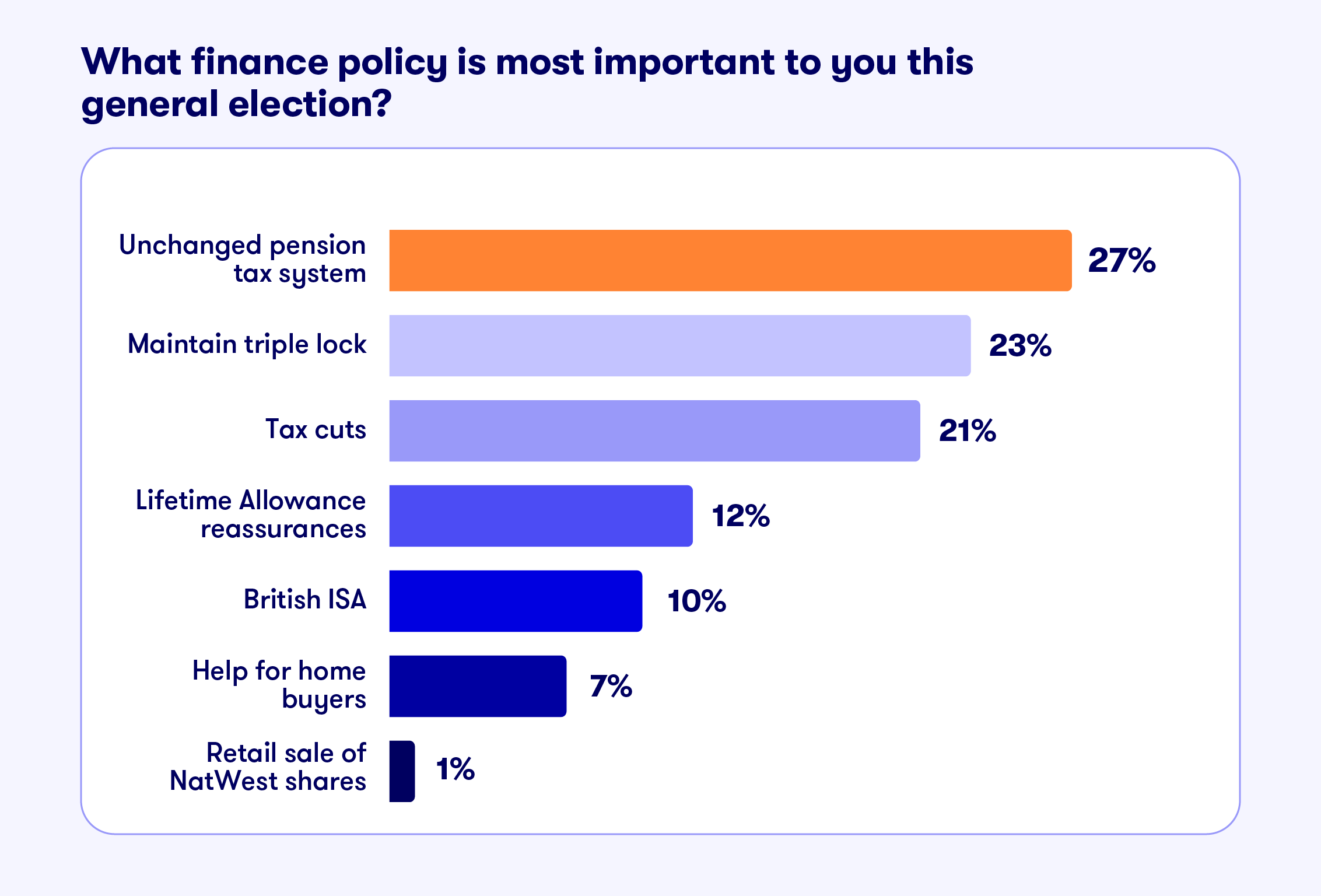

The most popular answer to this question was to keep the pension tax system unchanged, a policy the Tory Party has pledged with its Pension Tax Guarantee.

Consistency in the pension tax regime is clearly important to investors. The landscape has seen significant upheaval in the past two decades, notably concerning tax-free limits.

The various annual allowances – standard annual, money purchase annual, and taper – were all made more generous in April 2023 but had been frequently tinkered with over the years.

Being confident that the goalposts won’t move is vital for savers to plan their retirements effectively. This includes making the most of the tax-free pension allowances and having clarity about the upfront tax breaks available.

- How to invest ahead of the general election

- How to plan your finances as you approach 75

- When paying your state pension into a personal pension makes sense

Maintaining the state pension triple lock was the second most popular policy – no eyebrows raised there given its importance to support retirement outgoings. In a boost to retirees, both major parties have committed to the policy for next parliament.

Tax cuts also ranked high with investors (21%). Further reductions to national insurance (NI) are on the cards should Rishi Sunak win next month, but with both parties promising to keep tax thresholds frozen, any cuts to headline rates may be offset by more people tripping into higher tax bands.

The lifetime allowance (LTA) was officially scrapped in April this year, but there were fears it may return should Labour secure victory next month.

But Keir Starmer has backtracked on the idea, for now at least, allowing savers to continue filling up their pension pots and investing wisely without the worry that a tax-free lifetime will be reinstalled after 4 July.

And lastly, the British ISA didn’t make it into either party’s manifesto but 10% of investors feel it’s the most important policy, while 7% believe help for homebuyers ranks top.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.