Election countdown: what’s the deal with personal taxes, really?

As the fight for 10 Downing Street reaches the final round, Craig Rickman digs into what the next Parliament really might hold for our tax bills.

1st July 2024 12:10

by Craig Rickman from interactive investor

Personal taxes are a key battleground for Rishi Sunak and Keir Starmer as general election polling day edges closer.

In two fierce live TV debates, the prime minister accused his rival of planning to hike annual household tax bills by £2,000, claiming these costings were supported by independent Treasury officials.

Labour leader Starmer vehemently rebuffed the claim, describing it as “absolute garbage” and “nonsense”.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

Squarely in the middle of this political rock-chucking are taxpayers, who will each have their own take on whether Sunak’s claims are credible or hogwash. Voters have had a couple of weeks to digest the main parties’ manifestos, and if we’re likely to pay more tax in future years, we want to know roughly how much.

Both Sunak and Starmer have assured voters that headline rates of income tax, VAT, corporation tax and national insurance (NI) won’t be jacked up over the next Parliament. The Tories have in fact promised further reductions to NI to boost workers’ incomes.

However, a leading think tank is unconvinced with either party’s tax pledges, asserting that voters have not been furnished with the full details. It says: “In line with their unwillingness to face up to the real challenges, neither main party makes any serious new proposals to increase taxes. Consistent with their conspiracy of silence, both are keeping entirely silent about their commitment to a £10 billion a year tax rise through a further three years of freezes to personal tax allowances and thresholds.”

This is the damning assessment issued by Paul Johnson, director at the Institute of Fiscal Studies (IFS).

As Johnson notes, no matter who gets the keys to 10 Downing Street, our tax bills will still rise over the next Parliament, even if headline rates stay put.

This is due to a tax-raising tactic known as fiscal drag, and its effects are punitive. Tax thresholds have been frozen since 2021 and will remain so until 2028. This has pulled 4.4 million people into the tax net in the past four years – a staggering figure. Meanwhile, millions more have tripped into the 40% and 45% tax bands.

- Election poll 2024: which policies do investors value most?

- Election manifestos 2024: the impact on your personal finances

In an article for The Times, published in May, Johnson laid bare just how lucrative fiscal drag is for the government. He said: “Simply by holding these thresholds constant in cash terms, the government is implementing one of the biggest tax rises in a generation.”

Johnson added that alongside increases to corporation tax and feeble economic growth, the tax burden is set to reach its highest level in peacetime. “It will settle at three or four percentage points above where it has been for decades. That is a huge change, a tax rise in the order of £100 billion,” Johnson said.

He also questioned whether tax giveaways are actually feasible right now. “Usually chancellors can find goodies worth a few billion when elections heave into view. But any tax cut almost certainly will have to be reversed pretty swiftly once the election is safely out of the way.”

How would the reforms affect your annual finances based on your household situation?

Whatever happens with personal taxes over the next Parliament, and whoever secures power, the effects will not be felt equally across society.

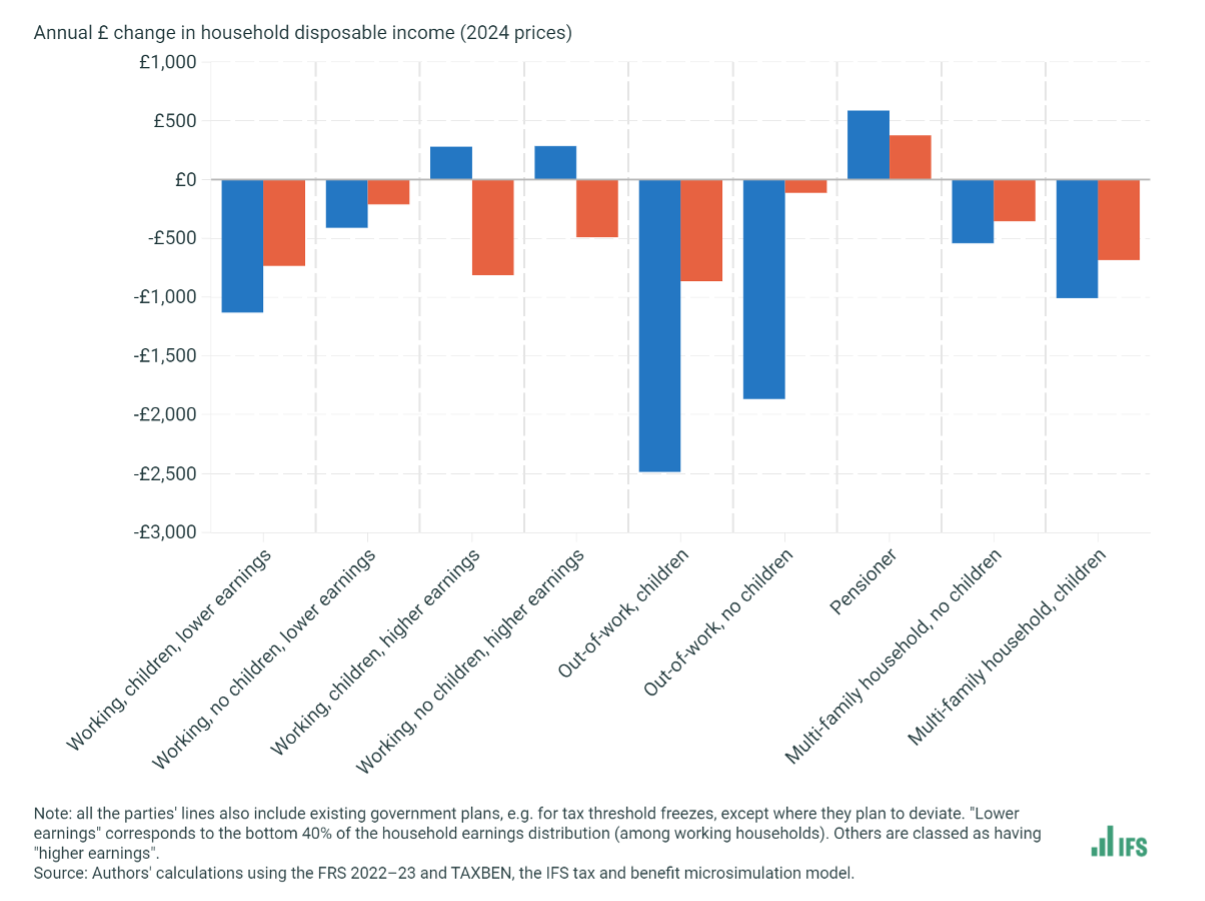

The chart below shows IFS calculations setting out how certain groups will be impacted in pounds and pence under Labour (red) and the Tories (blue).

The results here paint a reasonably clear picture. If you’re a pensioner, you should be marginally better off under either main party, while households with higher earnings should be a few quid up every year under the Tories. But everyone else is set to be worse off, mainly owing to, you guessed it, fiscal drag.

But despite what the above chart indicates, the situation for retirees is far from milk and honey. New figures from HMRC show that the number of pensioners paying income tax has rocketed to 8.51 million over the past year. This represents a 10% uptick from the 7.85 million in 2023-23.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- How to invest ahead of the general election

One of Sunak’s flagship manifesto promises, the triple lock plus, aims to flatten the future trajectory here. The policy will increase pensioners’ personal tax-free allowance in line with the state pension, which uprates annually by the higher of inflation, wages or 2.5%.

Labour, however, refused to commit to anything similar but, like the Tories, has pledged to maintain the triple lock.

Are wealth taxes up for grabs under Labour?

Reports surfaced last week that Labour has its sights set on inheritance tax (IHT) and capital gains tax (CGT) – two taxes strikingly omitted from the party’s manifesto. The document did promise to stamp out IHT relief on trusts for non-domiciled individuals, but this will only affect a small portion of the population.

Labour’s failure to rule out raids to IHT and CGT suggests the door is ajar for reform. One would hope any changes would seek to boost wealth, but given the state of the nation’s finances, this seems unlikely. Let’s look at what might happen to each of these taxes should Labour win later this week.

Capital gains tax

According to an article published in early June by TheGuardian, Labour members are urging Shadow Chancellor Rachel Reeves to hike CGT to fund public services.

CGT has been subject to some significant reform over the past few years, with annual receipts set to triple in the 10 years to 2026-27. As this article notes, CGT revenues are expected to rise faster than any other personal tax in percentage terms over the next few years.

The annual CGT exemption, the tax-free profit you can make every year selling assets, has been hacked from £12,300 to £3,000 since April 2022. This is hurting the gains of investors with money outside tax wrappers such as self-invested personal pensions (SIPP) and individual savings accounts (ISA).

In a rare giveaway at this year’s Spring Budget, the government did cut the top rate of CGT from 28% to 24% on sales of second homes, but this is still higher than the top rate of 20% that investors pay.

So, what shape could CGT reform take? The nuclear option is to equalise rates with income tax, something the government apparently weighed up in the recent past.

This would increase the minimum and top rates of CGT to 20% and 45%, respectively; a significant uptick if it came to pass. Some have argued this will make the tax system fairer, but wouldn’t be well received by investors, business owners and landlords. Reports reckon the move could generate £8 billion for the Treasury over the long term.

Elsewhere, there is one CGT loophole Labour may seek to close. As things stand, CGT is exempt on death, something that causes people to retain assets rather than realise gains, according to the IFS.

The Tory Party have reportedly claimed Labour wants to scrap this feature, raising the prospect of a double death tax on estates that exceed the tax-free limits.

Inheritance tax

That brings us neatly on to IHT, frequently voted Britain’s most-hated tax despite only one in 20 estates paying it.

Reports suggest Labour will shake up the IHT landscape if successful later this week, with a consultation launch pencilled in for autumn.

Calls to reform IHT stretch back many years. In the most enduring example of fiscal drag, the nil rate band, the tax-free IHT threshold, has been frozen at £325,000 since 2009.

The residence nil rate band, which gives some homeowners an extra £175,000, was introduced in April 2017. But the qualifying criteria is complex in parts – this allowance reduces by £1 every £2 an estate exceeds £2 million, and the home must be left to direct descendants.

As such, the tax-free IHT allowances are not particularly well understood, which may be resulting in estates paying more tax than perhaps necessary.

But anyone hoping any potential consultation will bring some much-needed simplification to the IHT landscape might be left disappointed. Reports indicate Labour will hone its focus on some reliefs, notably those afforded to farms and businesses, which could be watered down or even scrapped.

Investors could also feel the impact here, as qualifying AIM shares offer 100% IHT relief if held for two years under business relief rules.

This is all speculative, of course. Labour may be odds on to lead the country for the next five years, but there are no guarantees. And the party has given no indication about how wealth taxes might be shaken up.

Still, the subject of personal taxation, both hikes and cuts, whether overt or covert, will prove a big talking point throughout the coming Parliament.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.